To: eastexsteve

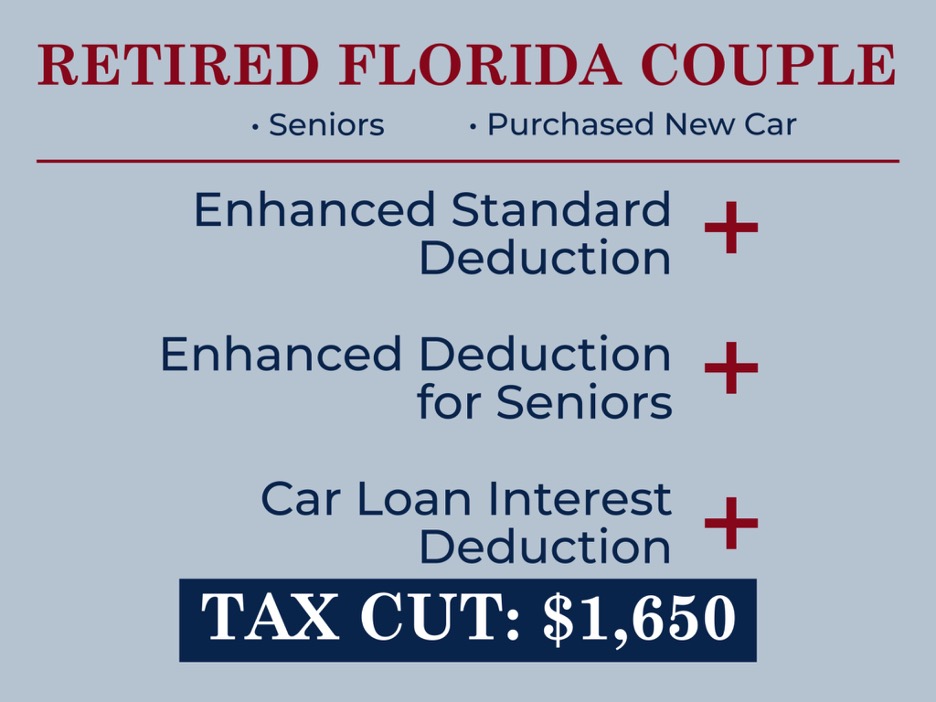

a $1,650 tax cut???So you eliminate $4,000 from your taxable income. If you are in the 20% tax bracket that means you save The 20% you would have paid on $4,000 or $800. Where are they getting a tax cut of twice that?

5 posted on

06/12/2025 1:08:14 PM PDT by

1Old Pro

To: 1Old Pro

The $4000 deduction is *per* senior. The $1650 quote was for a senior *couple* in Florida.

8 posted on

06/12/2025 1:11:12 PM PDT by

CatOwner

(Don't expect anyone, even conservatives, to have your back when the SHTF in 2021 and beyond.)

To: 1Old Pro

Married filing joint would double that.

19 posted on

06/12/2025 1:20:19 PM PDT by

Fido969

To: 1Old Pro

It's for a COUPLE, and includes extending the old tax cuts and purchasing a new car and deducting the interest. They don't show the math.

22 posted on

06/12/2025 1:24:35 PM PDT by

ETCM

(“There is no security, no safety, in the appeasement of evil.” — Ronald Reagan)

To: 1Old Pro

“Where are they getting a tax cut of twice that?”

Put on your glasses! It says “couple” would receive.

38 posted on

06/12/2025 1:45:16 PM PDT by

TexasGator

(1.//1-1.'I'11-.1.'1'11\1I11111111111.1'11.'11/'~~'111./.)

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson