.

Who says? They are pretty high now historically

So much money has been printed in recent years that everything is supposedly wildly inflated and will move to things that truly hold value. I’ve seen on a podcast or two where it’s talked about how the only way to deal with the debt is to inflate away the dollar. If that happens, metals seem like a safe haven.

Who says? All those companies selling gold.

Buying gold now may be contrary to the investment adage, " Buy low, sell high". Another thing about buying physical gold is that the moment you buy an oz you will lose money if you attempt to sell it the same day. Also, you may have additional storage & insurance expenses with physical gold. Also, unlike some stocks & stock funds, gold doesn't generate any dividends.

I apply Buffett's advice and invest in low fee S&P 500 fund that reinvests dividends for the long term and brokered CDs, Treasuries and high-grade bonds short-term. It's not a sexy get rich approach but it lets me sleep well.

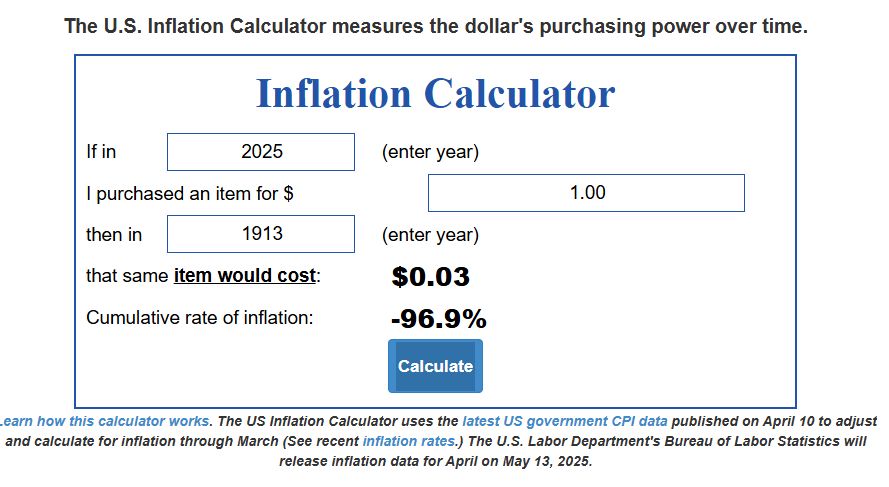

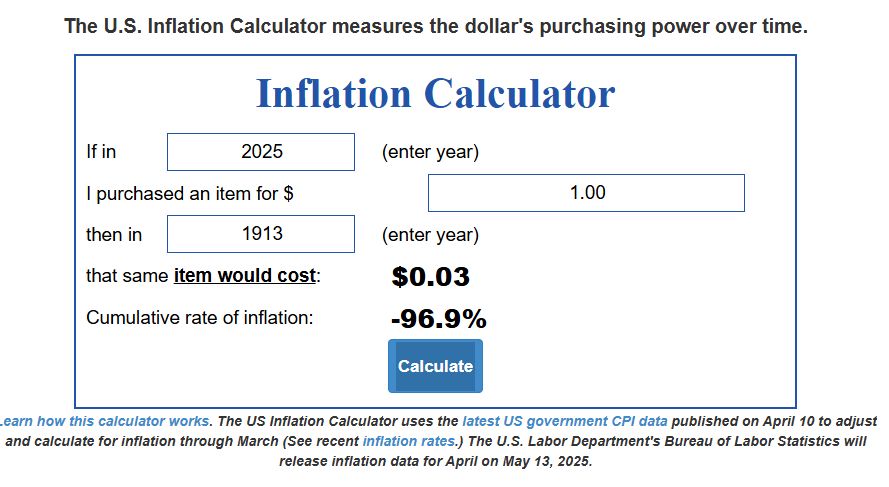

To be technically accurate the value of dollar can sink lower. And it will.

The conspiracy theorists tell us gold and silver prices are artificially suppressed by the cabal.

(note the fact that the label “conspiracy theory” generally means it’s true)

.