Posted on 06/12/2024 11:06:25 AM PDT by Miami Rebel

“...but we certainly are not going to see pre pandemic prices in awhile.”

I agree. And the only way we would see them is with a severe recession.

Agreed. The Fed just basically said they’ll rate cut one more time to keep from deflating the bubble stock market before the election, then deflate away after that.

Yep and markets move on offhanded comments like that, by the Fed.

That’s what these “inflation is under control” nuts don’t get. You have to get ahead of inflation, not keep up with it.

We are entering stagflation and deflation.

The Fed could do something like to continue to tighten our monetary policy. But to do that, it will cause a severe recession similar to the Early 1980s recession. The Biden Administration is unwilling to pay the political price for that so we will continue to see high inflation (with continued deficit spending by the government)

The Biden administration has no power to alter Fed policy, nor does any other administration. Its only lever is fiscal policy, and with a split government the chances of fiscal discipline are nil.

Do you really believe that?

https://advisors.vanguard.com/insights/article/series/market-perspectives#projected-returns

Vanguard Market projections for the next 10 years.

This was published May 15. 2024

Vanguard is the largest mutual fund company in the world. They MAY know something about this subject.

Yes.

Almost every administration has advocated for easy money, including the Trump presidency, but the Fed tends to turn a deaf ear.

The only direct action that a President can take is to fire a governor for cause. This has never happened because the reality is that doing so would blow up the Fed’s credibility and lead to a run on the dollar.

The Vanguard Investment Strategy Group is a respectable one, but there are dozens upon dozens of economists making predictions every day of the year.

The fact that this team gets paid by Vanguard doesn’t give them any special insights or clout. Mericle at Goldman is pretty good, as is Sajjid Chinoy at JP Morgan.

The Federal Reserve left the fed funds target range steady at 5.25%-5.50% for a 7th consecutive meeting in June 2024, in line with forecasts. Policymakers do not expect it will be appropriate to reduce rates until they gained greater confidence that inflation is moving sustainably toward 2%. Meanwhile, the dot plot showed policymakers see only one rate cut this year and four reductions in 2025. Back in March, the Fed was seeing three cuts in 2024 and three in 2025. The Fed made no revisions to GDP growth projections and still sees the economy expanding 2.1% in 2024, 2% in 2025 and 2026.

Meanwhile, PCE inflation was revised higher for 2024 (2.6% vs 2.4% in the March projection) and next year (2.3% vs 2.2%) but was kept at 2% for 2026. Core PCE inflation was also revised up to 2.8% in 2024 (vs 2.6%) and 2025 (2.3% vs 2.2%) but was kept at 2% for 2026.

The unemployment rate is projected at 4% for 2024, the same as expected in March, but is seen slightly higher at 4.2% in 2025 (vs 4.1%).

My grocery bill for starters. I’m a professional consumer. Happy for your safe space. Bought a vehicle lately? A house? Tried to rent one? Tried to rent anything? These are things a professional investor should notice, if he hopes to a long and happy career.

Grocery prices are +2.2% year over year. (US Inflationcounter.com)

Used car prices -12.1% (Manheim Used Vehicle Value Index)

Nationally, between March 2023 and March 2024, rent prices have climbed by 0.77 percent, or $15, since one year prior. (rent.com)

You must be a very selective shopper.

see, again, you choose sources that suit you, and I guess that’s what makes you an expert professional investor.

but they have no basis in reality.

whatever you do, I recommend you hedge it. You’ll thank me one day.

Godspeed!

My prediction is a cut by August or September and it could be a 1/4 point or even a 1/8th point cut. Anything to juice the market.

They can’t, if rates go like Volker did then how would we pay the interest on the Debt , it would then eat up the entire budget.

Gas is down because people are not traveling.

How about we get a negative inflation rate?

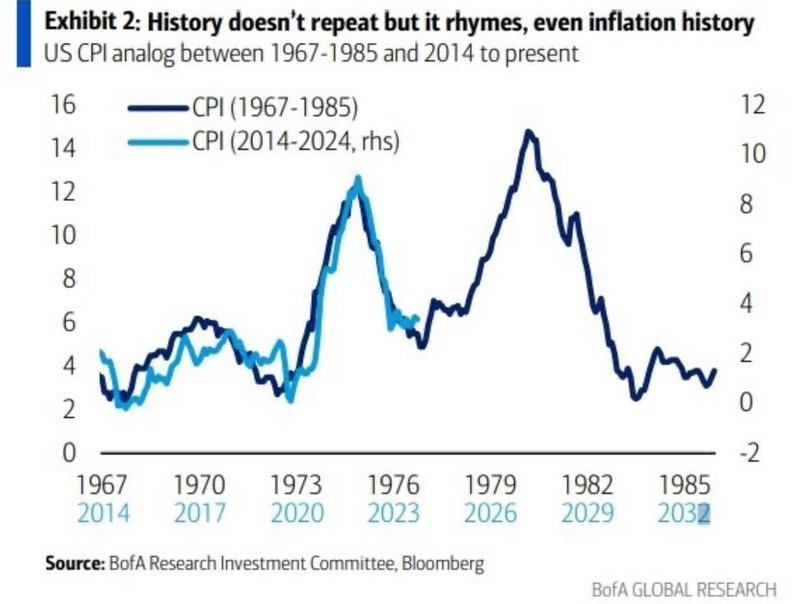

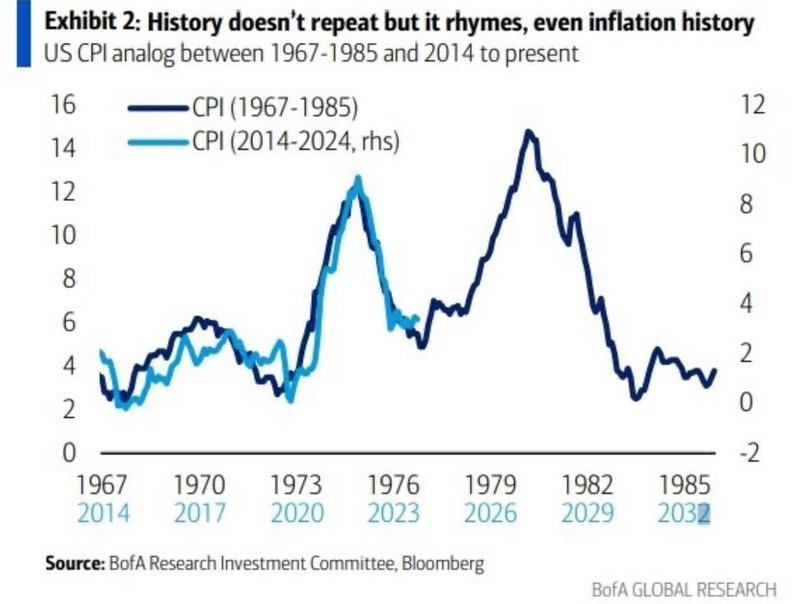

That’s quite an impressive chart!

But it misses the point: inflation has been trending down for over a year.

A cumulative CPI chart will ALWAYS show an upward trajectory barring an economic contraction. The direction of the chart is less important than the rate of incline, and since you’re obviously content to us usinflationcounter.com as a reliable reporter, then you should be in agreement with me that their 2.2% food inflation year-over-year is quite modest.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.