First off, none of those countries has a debt GDP ratio as out of whack as ours, which means their currencies are are far more stable. we are basically dead broke and still borrowing. Quality jobs are being lost and being replaced by low-wage parttime jobs. The treasury intake can't begin to match the outlay. If you could borrow yourself to richness, I would be infinitely wealthy, and the banks would be imploding. Oh that's right, they are starting to do just that aren't they.

Moody’s stated two primary reasons for downgrading the outlook:

Debt affordability — rising interest rates have caused the cost of financing the debt to rapidly increase. Furthermore, without policies in place to address the underlying drivers of the debt, Moody’s anticipates that federal deficits will remain very large.

Political polarization — which will complicate the ability of policymakers to enact solutions to the nation’s fiscal challenges. Moody’s mentioned recent examples of polarization leading to an inability to govern such as the struggle of House Republicans to elect a speaker, threats of a partial government shutdown, and the political impasse around the debt ceiling debate in June.

When S&P lowered the sovereign credit rating for the United States more than a decade ago, it noted weakening “effectiveness, stability, and predictability of American policymaking and political institutions” as well as an insufficient fiscal stabilization plan for the medium-term. The recent downgrade from Fitch Ratings cited the nation’s high and rising debt, the lack of a plan to address the drivers of that debt, and the erosion of good governance.

Sovereign credit ratings assess the capacity and willingness that a borrower will default on its debt obligations. Now, all three major rating agencies have lowered their ratings or outlook for U.S. debt. These serious and credible warnings should send a strong message to policymakers about the need to address America’s unsustainable fiscal path.

Fitch Ratings recently downgraded the U.S. long-term credit rating from its top mark of AAA to AA+, marking the second time in history that a major credit-rating agency downgraded the United States. The first time was by Standard & Poor’s (S&P) in 2011.

Fitch cited multiple reasons for the decision, including:

The nation’s high and rising national debt

The lack of a plan to address the major drivers of the debt

The erosion of good governance

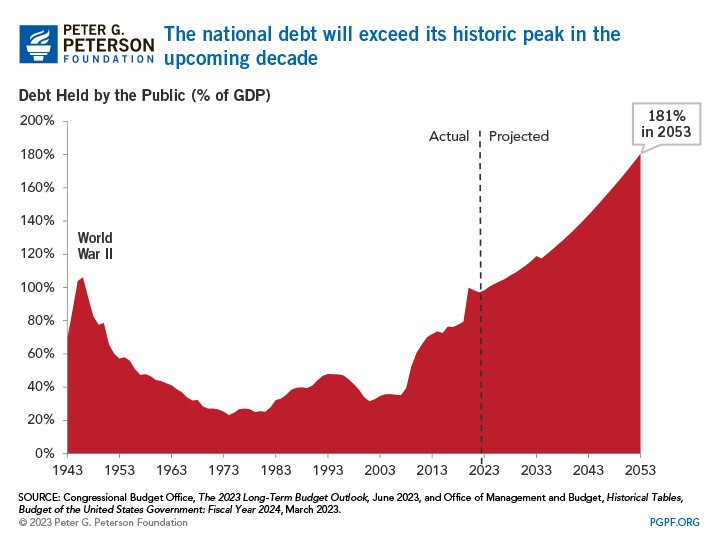

The level and trajectory of federal debt is a central reason for Fitch’s downgrade. At nearly 100 percent of gross domestic product (GDP), the U.S. debt-to-GDP ratio is significantly higher than that of most other AAA-rated countries. According to projections from the Congressional Budget Office, the nation’s debt will soon exceed its all-time high relative to GDP and skyrocket to 181 percent in 2053.

You also ignored that the US dollar is under attack as being the world's reserve currency, and the BRICs nations have already succeeded in removing the dollar as the currency that must be used to purchase oil needs. It's a hop, skip, and a jump before the reserve currency status is taken away as well.

We are still strong because of our reserve currency status, along with the fact that we have historically had the most robust economy of the world. The latter is no longer the case after the Bush, Obama, & now Biden years, and like I said the reserve currency status is no longer a question of if, but when.

Just so you are aware, the about sources are from 2023, and it has only gotten worse. The following is also from 2023:

Why plunging tax receipts are raising fears about the debt ceiling