Posted on 07/07/2025 6:07:41 PM PDT by Angelino97

Yes, but then again the dollar is going to be worthless after the printing the trillions to fund the BBB.

“Yes, but then again the dollar is going to be worthless after the printing the trillions to fund the BBB.”

Why are you posting democratic talking points?

Inflation kills. It’s damage is permanent.

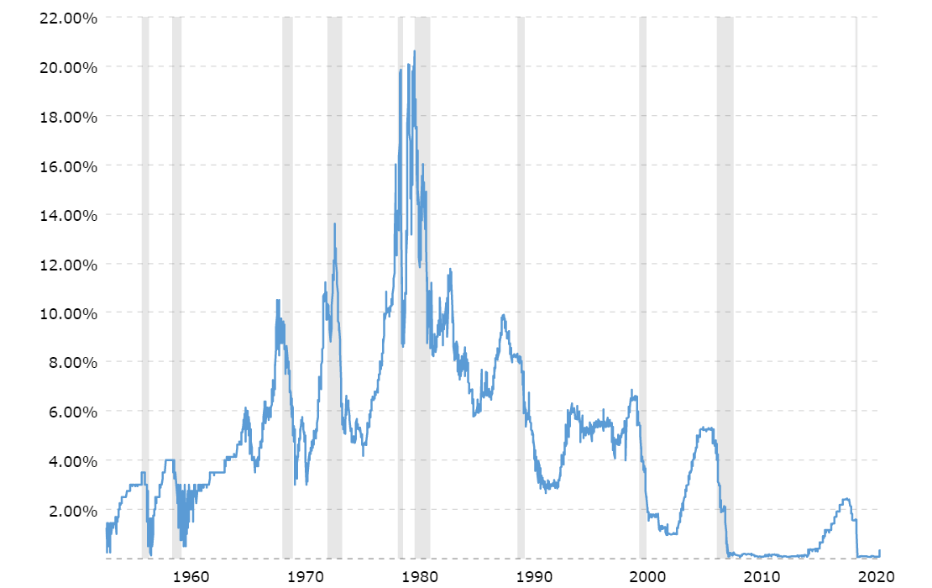

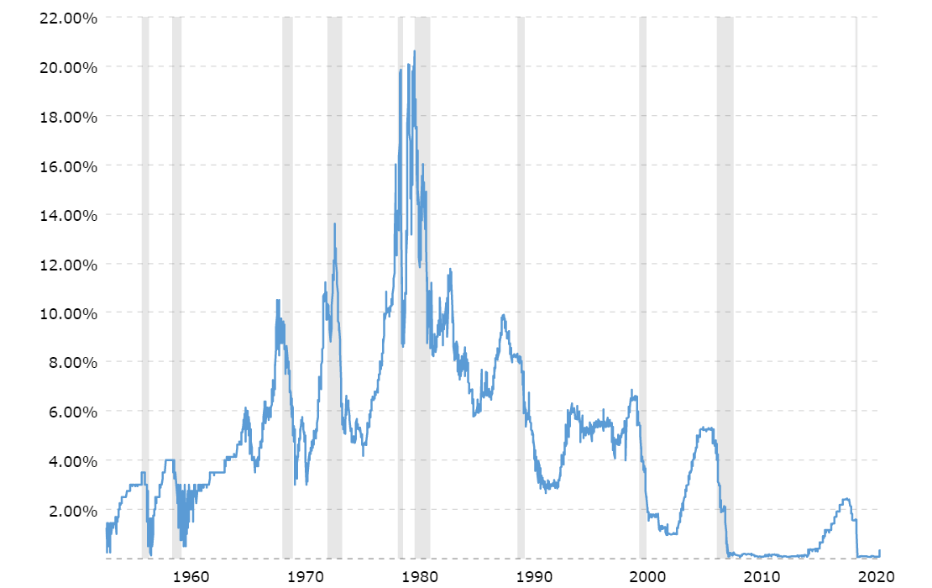

The purpose of raising rates is to prevent an over-heating economy from causing inflation-producing shortages. If you know that the cause of inflation is not an over-heating economy, why would you raise interest rates? The Fed’s failure to recognize temporary, transient causes for inflation resulted in recessions in 1982, 1991 and 2001. (Also, the Fed refused to see a developing crisis in 2007; forcing banks to make bad loans in order to be able to make good loans certainly made this recession far, far worse.)

Kiplinger: The Magic Mortgage Rate Number to Tip the Housing Market

“Are interest rates too high?”

Maybe, depends on what level of unemployment and inflation you want.

No.

Interest rates should be 3% above inflation.

And the Inflation Target should be Zer0.

The deep state wants us to believe inflation means “an increase in prices.” Wrong, inflation is an increase in the money supply thanks to the Federal Reserve, which is not “federal” and is not “reserve.” Printing the fiat money is the cause of inflation—an increase of prices. Compare our current dollar to the Dollar when the “Fed” was created in 1913. ‘Nuff said but there is so much more. The Fed owns this country, 36 trillion debt will never be paid back, ever. Just a matter of time before the United States is bankrupt.

In your mind

“And the Inflation Target should be Zer0.”

Never happen, that’s crazy. That’s a recipe for a no-growth economy in recession more than not.

The paper debt instruments of 1913 are the same paper debt instruments of today.

Seeking to lower rates solely to make massive amounts of debt have cheaper servicing is a complete slap in face to older Americans who are seeking to survive on fixed-rate assets instead of the gambling casino of the equities market.

Every spike was during a Republican presidency?

The lines on your graph are a bit blurred. But my recollection, is that interest rates zoomed very high during the Carter years. Interest rates were very high in 1980, when Carter was president. Carter was a Democrat.

The graph is a bit muddled, but it appears there was a spike in 1968 when Johnson was president. Johnson also was a Democrat.

The target rate will always be at least 2%.

In a debt-based monetary system, going to zero runs a very real risk of a deflationary cycle, which can sometimes feed on itself.

Carter was president in 1980.

The market sets the rates.

They went up today.

The Fed has a lot to say about it, but money goes where its best treated.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.