Posted on 07/07/2025 6:07:41 PM PDT by Angelino97

Are interest rates too high?

A lot of people think they are, and a growing chorus of voices is calling on Federal Reserve Chairman Jerome Powell to cut rates.

Are they right? Does the central bank need to step in, slash interest rates, and loosen monetary policy?

The honest answer to the question is that nobody really knows. However, from a historical perspective, interest rates are low, and monetary policy remains loose.

What Are Interest Rates?

Before we delve into whether the current interest rate environment is too high or too low, we need to understand exactly what an interest rate is.

Fundamentally, it is a price – the price of borrowing money.

Since interest rates are prices, they behave in the same way as any other price in a free market. As the demand for money increases, interest rates (the cost of money) tend to rise. When the demand for money wanes, rates fall. In other words, if left alone, interest rates will set themselves based on market activity.

When central planners intervene and "set" interest rates, it inevitably creates problems.

Think about it. Would you trust government central planners to set the price of tennis shoes? Or iPhones? Or automobiles? Imagine what would happen.

In fact, we don't have to imagine. We have countless examples of government price controls going haywire. Inevitably, we end up with shortages and/or overproduction.

For example, in 1971, President Richard Nixon implemented wage and price controls. It was a disaster. Price ceilings intended to hold costs down led to widespread shortages, particularly in meat, gasoline, and other essentials. Businesses weren't willing to sell at unprofitable prices.

Or consider the impact of minimum wage laws. These price floors also distort the market. They raise the pay of some workers, but it also lowers demand for workers more generally, leading to higher rates of unemployment.

The problems with price fixing are entirely predictable given that prices serve as signals in the economy. Distort the signals, distort the economy.

Economist Thomas Sowell explained the fundamental role of prices in his foundational book Basic Economics.

"Each consumer, producer, retailer, landlord, or worker makes individual transactions with other individuals on whatever terms are mutually agreeable. Prices convey those terms, not just to the particular individuals immediately involved but throughout the whole economic system – and indeed, throughout the world. If someone else somewhere else has a better product or a lower price for the same product, that fact gets conveyed and acted upon through prices, without any elected official or planning commission having to issue orders to consumers or producers – indeed faster than any planners could assemble the information on which to base their orders."

Generally, central planners have noble intentions. They want to eliminate some "unfairness" or right some perceived wrong. But in effect, they obliterate these important signals. This causes chaos and confusion. Inevitably, we end up with misallocations of resources. The economy becomes less efficient. Markets cease to function. As a whole, society becomes poorer.

In effect, government action distorts, and in some cases, obliterates the price system. As economist Ludwig von Mises explained, "prices are by definition determined by people's buying and selling or abstention from buying and selling. They must not be confused with fiats issued by governments or other agencies enforcing their orders by an apparatus of coercion and compulsion."

"Prices are a market phenomenon. They are generated by the market process and are the pith of the market economy. There is no such thing as prices outside the market. Prices cannot be constructed synthetically, as it were."

Given this history, why would you want these central planners trying to set one of the most important prices in the economy – the price of money?

The results are exactly what you would expect. Central bank interest rate manipulation has distorted the economy, incentivized unsustainable levels of debt, driven boom-bust cycles, and generally wrecked the operation of the economy.

Are Interest Rates Too High?

This brings us back to the original question. Now that we understand the nature of interest rates, it should be clear why we can't answer the question. Not even the brain-trust at the Fed can possess and process all the information necessary to accurately "set" any price, much less the price of money.

However, we can look back in time and see how the current interest rate environment compares with the past.

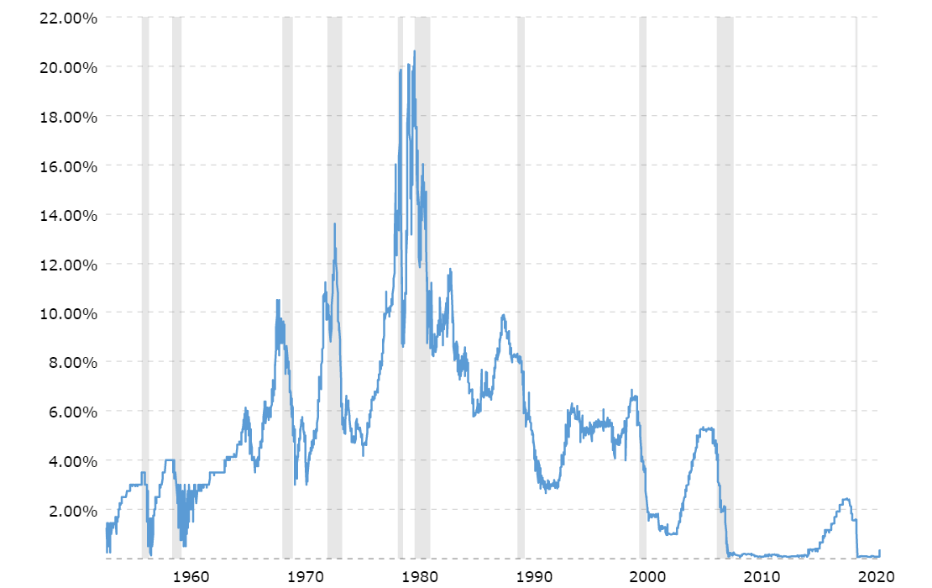

Historically, rates aren't high.

As you can see from the chart, the Federal Reserve funds rate peaked just above the level of the 2006 peak. (You'll also want to note the steep decline in rates beginning in 2006, long before the 2008 financial crisis and Great Recession.)

You'll note a general downward ratchet effect in rates over time. Each interest rate peak preceding a bust gets lower as the economy has become more addicted to easy money.

In effect, the economy needs bigger doses of the easy money drug to reinflate the bubble each time through the cycle.

The most notable aspect of the chart is the nearly 10 years of zero percent interest rates following the 2008 financial crisis. This is the real outlier. However, we have millions of people working in the financial sphere who have never experienced a "normal" interest rate environment during their careers. They imagine that zero is closer to the norm than five-and-a-half percent.

The current low-interest-rate environment (from a historical perspective) becomes even more apparent if you look at the real yield (inflation-adjusted) on the 10-year U.S. Treasury.

Keep in mind, the central bank has far less control over rates on the long end of the curve. Supply and demand have a bigger impact on these rates. But even as the demand for U.S. debt has sagged, Treasury yields are still low from a historical standpoint.

The bottom line is that monetary policy remains historically loose. The Chicago Fed National Financial Conditions Index reflects this reality. As of the week ending June 27, the NFCI stood at -0.50. A negative number reflects historically loose financial conditions.

When Too Loose Is Too Tight

While interest rates remain historically low, they may be too high for the current economic environment.

Year after year of zero percent rates since 2008 has incentivized staggering levels of debt. Debt-burdened economies don't perform well in high-interest rate environments.

Furthermore, an economy addicted to the easy money drug needs bigger and bigger fixes to maintain the high. This is why we've seen more extreme monetary policy during each subsequent economic downturn.

Given the economic environment, it makes sense that President Trump and many others want rate cuts. While rates are historically on the loose side, they may well be too tight for current conditions.

However, we find inflation lurking on the other side of the coin.

Low interest rates are inherently inflationary. They incentivize borrowing. Given the fractional reserve nature of the banking system, new loans mean new money injected into the economy. This is, by definition, inflation.

In fact, the money supply has been increasing for over a year. Again, this is inflation.

So, Powell & Company isn't wrong to be concerned about cutting rates too fast. It could lead to another bout of price inflation.

The Fed's inaction is exactly what you would expect given the Catch-22 it finds itself in. It simultaneously needs to cut rates to prop up the easy money-addicted economy and hold rates steady (or even raise them) to keep inflation at bay.

The bottom line is that Federal Reserve monetary malfeasance has completely distorted the economy. The central bank has squeezed itself between a rock and a hard place. The reality is that there isn't a good choice between economic malaise and inflation.

The question is what path with they take?

Yes, but then again the dollar is going to be worthless after the printing the trillions to fund the BBB.

“Yes, but then again the dollar is going to be worthless after the printing the trillions to fund the BBB.”

Why are you posting democratic talking points?

Inflation kills. It’s damage is permanent.

The purpose of raising rates is to prevent an over-heating economy from causing inflation-producing shortages. If you know that the cause of inflation is not an over-heating economy, why would you raise interest rates? The Fed’s failure to recognize temporary, transient causes for inflation resulted in recessions in 1982, 1991 and 2001. (Also, the Fed refused to see a developing crisis in 2007; forcing banks to make bad loans in order to be able to make good loans certainly made this recession far, far worse.)

Kiplinger: The Magic Mortgage Rate Number to Tip the Housing Market

“Are interest rates too high?”

Maybe, depends on what level of unemployment and inflation you want.

No.

Interest rates should be 3% above inflation.

And the Inflation Target should be Zer0.

The deep state wants us to believe inflation means “an increase in prices.” Wrong, inflation is an increase in the money supply thanks to the Federal Reserve, which is not “federal” and is not “reserve.” Printing the fiat money is the cause of inflation—an increase of prices. Compare our current dollar to the Dollar when the “Fed” was created in 1913. ‘Nuff said but there is so much more. The Fed owns this country, 36 trillion debt will never be paid back, ever. Just a matter of time before the United States is bankrupt.

In your mind

“And the Inflation Target should be Zer0.”

Never happen, that’s crazy. That’s a recipe for a no-growth economy in recession more than not.

The paper debt instruments of 1913 are the same paper debt instruments of today.

Seeking to lower rates solely to make massive amounts of debt have cheaper servicing is a complete slap in face to older Americans who are seeking to survive on fixed-rate assets instead of the gambling casino of the equities market.

Every spike was during a Republican presidency?

The lines on your graph are a bit blurred. But my recollection, is that interest rates zoomed very high during the Carter years. Interest rates were very high in 1980, when Carter was president. Carter was a Democrat.

The graph is a bit muddled, but it appears there was a spike in 1968 when Johnson was president. Johnson also was a Democrat.

The target rate will always be at least 2%.

In a debt-based monetary system, going to zero runs a very real risk of a deflationary cycle, which can sometimes feed on itself.

Carter was president in 1980.

The market sets the rates.

They went up today.

The Fed has a lot to say about it, but money goes where its best treated.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.