Posted on 02/24/2024 5:59:01 AM PST by SpeedyInTexas

Imports include more than just energy products, and, in normal market pressure behaviors, fungible parts of trade "find their way" to where they are needed / wanted.

Some sources and quotes:

"The plan proposes a two-phase approach: Banning new gas contracts with Russian suppliers by the end of 2025 and phasing out all remaining imports by 2027. However, with fossil fuel flows still strong and intra-EU divisions widening, experts remain skeptical."Russian LNG imports rising — against the trend"

"The move comes amid a sharp uptick in Russian liquefied natural gas (LNG) imports into the EU. Although overall EU fossil fuel imports from Russia have fallen since the 2022 invasion of Ukraine, imports of Russian LNG and pipeline gas rose by 18% in 2024, according to the European statistics office Eurostat.

"The financial stakes are high: The EU spent €23 billion ($26 billion) on Russian fossil fuels in 2024, directly contributing to the Kremlin's war budget. The new roadmap is set to stop that.

"Pawel Czyzak, researcher at the UK-based energy think tank Ember, sees the EU Commission's latest plan as a push against a slowing political momentum towards Europe's independence from Russian oil and gas, which has been complicated since the beginning." more....

Source: Why the EU's push to cut Russian energy ties is so difficult

Deutsche Welle, 7 May 2025

"Since the beginning of the war, trade between the EU and Russia has drastically contracted due to EU sanctions and import restrictions on some products. Imports from Russia fell by 86% from the first quarter of 2022 through the first quarter of this year, according to the latest data from Eurostat.

"Imports of goods from Russia in the first quarter of 2025 totaled 8.74 billion euros ($10.11 billion), down from 30.58 billion euros four years earlier. Since January 2022, the EU has imported 297 billion euros' worth of Russian goods.

"The EU, however, continues to purchase oil, nickel, natural gas, fertilizer, iron and steel from Russia."

Source: Three years into war, US and Europe keep billions in trade with Russia Reuters, 8 August 2025.

"Russia's total Exports in 2021 were valued at US$492.31 Billion, according to the United Nations COMTRADE database on international trade. Russia's main export partners were: China, the Netherlands and Germany. The top three export commodities were: Mineral fuels, oils, distillation products; Commodities not specified according to kind and Pearls, precious stones, metals, coins. Total Imports were valued at US$293.50 Billion. In 2021, Russia had a trade surplus of US$198.82 Billion."

Source: Russia Exports By Country [ China at 14 percent; look at the surprise coming second at 8.6 percent, and third at 6.1 percent ]

The EU seems to be about 15 percent of the world's GDP, The US is estimated at about 26 percent. So together, less than half. There will be places to trade for any and all that want to trade, as the EU's past eighteen or nineteen sanctions sets seems to suggest.

We need be careful of deciding how we see trade and how we see using it wholly as a weapon, in a world wherein there are always alternatives escaping controls. Prices are always affected, meaning consumers are always affected. Consider:

"Which Countries Have Experienced the Steepest Rise in Energy Costs?"It is not just a matter of politics, but of individuals' and companies' wallets. How would you be doing with a 200 percent rise in your fuel bill?1. Estonia | Electricity: +323% | Gas: +559%

2. Netherlands | Electricity: +421% | Gas: +328%

3. Italy | Electricity: +211% | Gas: +329%

4. Austria | Electricity: +145% | Gas: +433%

5. Denmark | Electricity: +161% | Gas: +353%

European Energy Prices Increase up to 500% Compared to Pre-crisis Levels Green Match, 8 January 2025

The picture is far more complex than choosing a side for which to cheer, or a side to denigrate. "Supply and demand" is a real phenomenon washing over the entire world.

Or one can look at pictures of bombers, fighter jets and some analysis of maps and X and Telegram videos of destruction. Time perhaps for some new perspective?

“So yes, President Trump did do what he had threatened, and did it before the deadline. So far, it seems to be working, with Indian companies now substituting Russian oil supplies for other suppliers.”

My friend, no sanctions against India for buying RuZZian oil has gone into effect. Lets talk again at the end of the month. I’ll believe it when it happens...

“On Wednesday, Donald Trump doubled US tariffs on India to 50%, up from 25%, penalising Delhi for purchasing Russian oil - a move India called “unfair” and “unjustified”. The tariffs aim to cut Russia’s oil revenues and force Putin into a ceasefire. The new rate will come into effect in 21 days, so on 27 August.”

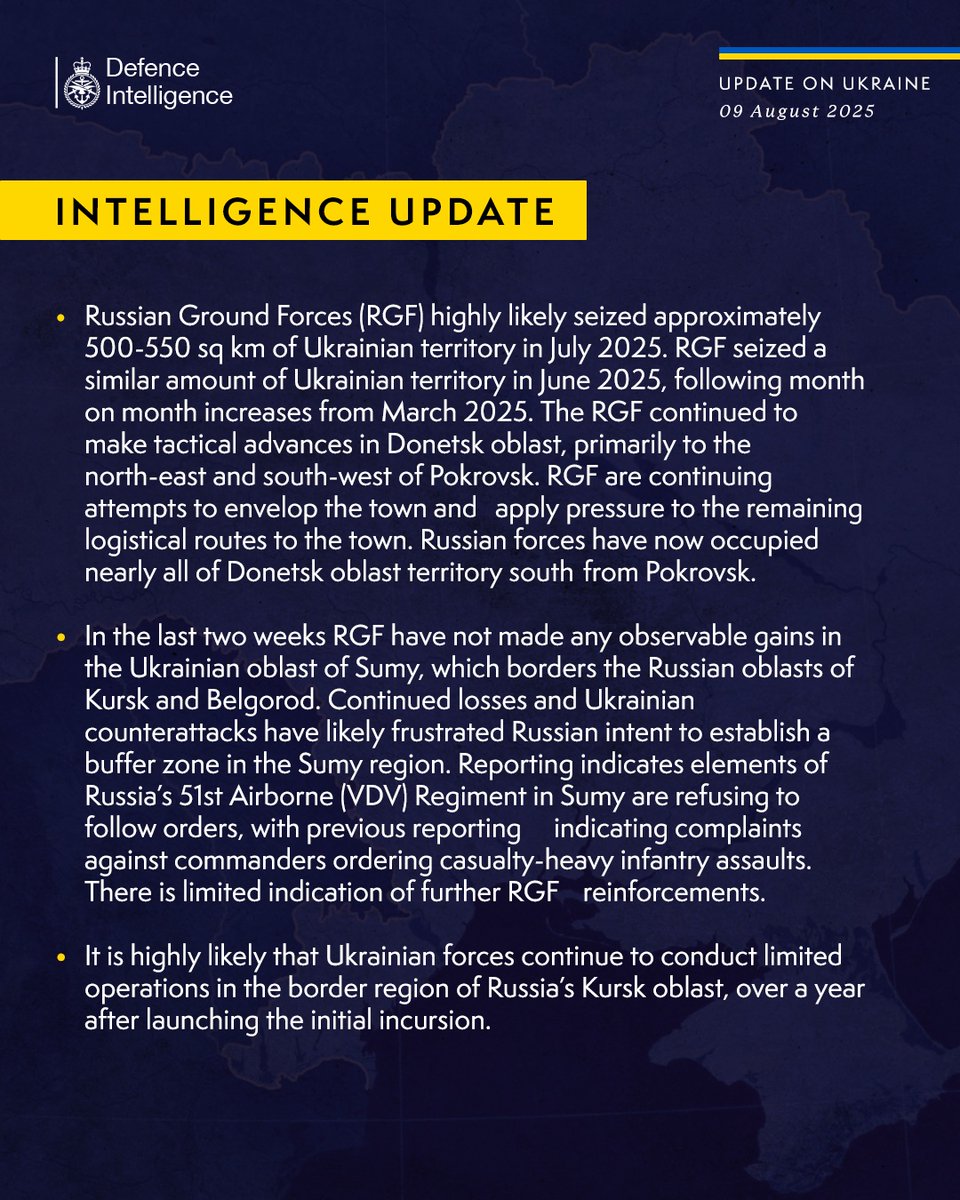

The Trump Administration has described Russian President Vladimir Putin's reported demands for a ceasefire in Ukraine in four different ways since August 6. The exact details of Putin's position remain unclear. German outlet BILD reported on August 9 that US Special Envoy for the Middle East Steve Witkoff misunderstood Putin's demand for Ukraine to withdraw from the remainder of Zaporizhia and Kherson oblasts, in addition to the remainder of Donetsk Oblast, as an offer for Russia to withdraw from occupied Zaporizhia and Kherson oblasts during the August 6 Putin-Witkoff meeting.[1] BILD reported that Witkoff also misunderstood Putin's proposal for an energy infrastructure and long-range strikes ceasefire, and that Witkoff interpreted Putin's offer as a general ceasefire that would curtail frontline military activity. The Wall Street Journal (WSJ) reported that European officials familiar with the conversation and call stated that US President Donald Trump, presumably after being briefed by Witkoff, told Ukrainian and European officials on August 6 that Putin would withdraw from occupied Zaporizhia and Kherson oblasts in exchange for Ukraine ceding unoccupied areas of Donetsk Oblast.[2] The officials told WSJ that Witkoff walked back Trump's statement during a call with European officials on August 7 and stated that Russia would “both withdraw and freeze” the frontline, presumably referring to Zaporizhia and Kherson oblasts. European officials reportedly asked Witkoff to further clarify Putin's demand during a call on August 8, and Witkoff stated that the “only offer” on the table was for Ukraine to unilaterally withdraw from Donetsk Oblast in exchange for a ceasefire. Ukrainian outlet Kyiv Independent reported that a source in Ukraine's Presidential Office briefed on the Putin-Witkoff meeting, presumably by Witkoff himself, stated that Putin also offered to withdraw from northeastern Kharkiv and Sumy oblasts as a “sign of goodwill” in exchange for Ukraine ceding the remainder of unoccupied Donetsk Oblast.[3] The source stated that Putin reportedly told Witkoff that Putin would be willing to freeze the frontline in Zaporizhia and Kherson oblasts. Bloomberg reported on August 8 that unnamed sources stated that Putin demanded that Ukraine withdraw from the entirety of Donetsk and Luhansk oblasts and concede occupied Crimea to Russia in exchange for freezing the frontline in Kherson and Zaporizhia oblasts and beginning negotiations on a ceasefire agreement.[4] It remains unclear, based on Western reporting, if Putin ever truly offered to withdraw from occupied Zaporizhia and Kherson oblasts. Ukrainian President Volodymyr Zelensky rejected Putin's demand.[5]

The only element of Putin's reported position common to all reports is Putin's continued demand for Ukraine to withdraw from unoccupied areas of Donetsk Oblast — a major Ukrainian concession. Conceding to such a demand would force Ukraine to abandon its “fortress belt,” the main fortified defensive line in Donetsk Oblast since 2014 — with no guarantee that fighting will not resume.[6] Ukraine's fortress belt stymied Russian advances in Donetsk Oblast in 2014 and 2022 and is still impeding Russia's efforts to seize the remainder of Donetsk Oblast in 2025, as ISW has recently described. The fortress belt is a significant obstacle to Russia's current path of advance westward in Ukraine, and surrendering the remainder of Donetsk Oblast as the prerequisite of a ceasefire with no commitment to a final peace settlement would position Russian forces extremely well to renew their attacks on more favorable terms, having avoided a long and bloody struggle for the ground.[7]

Ukrainian and European officials reportedly presented a counterproposal to US officials on August 9 as European officials continue to issue statements of support for Ukraine's sovereignty and territorial integrity. WSJ reported on August 9 that Ukraine and European leaders proposed a counteroffer to Russian President Vladimir Putin's demands for Ukrainian territorial concessions as a precondition to ceasefire during a meeting with US Vice President JD Vance in the United Kingdom (UK) on August 9.[8] WSJ reported that the counteroffer stipulates that a full ceasefire in Ukraine must be implemented prior to territorial negotiations, in accordance with US President Donald Trump's previously articulated preferred timeline for an end to Russia's war against Ukraine.[9] WSJ reported that the counteroffer also states that territorial exchanges should be conducted in a reciprocal manner and that Ukraine must receive robust security guarantees in exchange for any Ukrainian territorial concessions to prevent future Russian aggression against Ukraine. WSJ reported that Finnish President Alexander Stubb presented the Ukrainian-European counterproposal to Trump during a phone call on August 9. European leaders, including UK Prime Minister Keir Starmer, French President Emmanuel Macron, Estonian Foreign Minister Margus Tsahkna, Lithuanian Foreign Minister Kęstutis Budrys, Latvian Foreign Minister Baiba Braze, and Romanian Foreign Minister Toiu Oana, expressed support for Ukraine's efforts to achieve a just and lasting resolution to Russia's war on August 9.[10]

Russian officials welcomed the announcement that US President Donald Trump and Russian President Vladimir Putin will meet in Alaska on August 15 and referenced Russian narratives about Russia's historical claims to Alaska. Russian Presidential Aide Yuriy Ushakov claimed that Alaska is a logical meeting place due to the fact that the United States and Russia are close neighbors across the Bering Strait and share economic interests in Alaska and the Arctic region.[11] Leading Russian negotiator and Russian Direct Investment Fund (RDIF) CEO Kirill Dmitriev, who attended the August 6 meeting between Russian President Vladimir Putin and US Special Envoy for the Middle East Steve Witkoff, described Alaska on August 9 as “a Russian-born American” and claimed that Alaska reflects the ties between the United States and Russia.[12] Dmitriev also noted Alaska's historic ties to the Russian Orthodox Church and Russia's past military and economic presence in Alaska.[13] Russian officials and state media have previously claimed that the United States should return Alaska to Russia. Russian Security Council Deputy Chairperson Dmitry Medvedev claimed in January 2024 that Russia has been waiting for the United States to return Alaska “any day” in response to a US Department of State statement to the contrary.[14] Russian TV hosts and propagandists Vladimir Solovyov and Olga Skabeyeva repeatedly claimed in 2024 that the United States should return Alaska to Russia.[15] Russian State Duma Chairperson Vyacheslav Volodin claimed in July 2022 that Russia would claim Alaska as its own if the United States froze foreign-based Russian assets.[16] Russian state media outlet RT claimed in October 2018 that Russia should demand Alaska back from the United States after the United States withdrew from the Intermediate-Range Nuclear Forces (INF) Treaty.[17]

Ukraine continues its long-range drone strike campaign against Russian military and defense industrial base (DIB) facilities. Ukraine's Security Service (SBU) reported on August 9 that it conducted a drone strike against a Russian Shahed drone warehouse in Kzyl Yul, Republic of Tatarstan and that the drone strike started a fire at the warehouse.[18] The SBU stated that Russia stored Shahed drones and related foreign-sourced components at the facility. Kzyl Yul is located roughly 43 kilometers from the Alabuga Special Economic Zone (SEZ) near Yelabuga, Republic of Tatarstan, where Russia has based a large-scale Shahed drone production facility.[19] Ukrainian outlets Suspilne and Militarnyi reported that sources within Ukraine's Main Military Intelligence Directorate (GUR) stated that GUR conducted a sabotage operation in Afipsky, Krasnodar Krai on August 8, causing two explosions near a checkpoint on the Russian 90th Anti-Aircraft Missile Brigade's (49th Combined Arms Army [CAA], Southern Military District [SMD]) base.[20]

https://www.understandingwar.org/backgrounder/russian-offensive-campaign-assessment-august-9-2025

Regarding Alaska as a choice, the Kamchatka Peninsula has a number of marine bases which include facilities for submarines among other military items. There have been comments here at FR regarding possible damage caused there by the huge earthquake and subsequent tsunamis. I believe commenters are waiting on visual satellite reports becoming available subsequent to this event. Also, they now have an active volcano which may or may not affect the installations.

Putin may have felt safer going to Alaska with it being closer to Russian military protection and action should Trump do something dangerous to his safety/freedom. Perhaps Trump just wants Putin to see how happy the Alaskans are to be Americans rather than Russians, and how much better the common Alaskan lives compared with the common Siberian.

100%

“no sanctions against India for buying RuZZian oil has gone into effect”

Quibbling.

The threat was that he would impose tariffs on the 8th. They have been imposed. They are currently part of every import calculation. Implementation time is normal for tariff changes.

Thank you for your attention to this matter.

2,000 Km drone strike into Russia, a new distance record.

Kyiv Independent (10Aug):

“Drones attacked an oil refinery in Saratov on Aug. 10, sparking a large fire and explosions, according to local reports.”

And separately:

“A Ukrainian drone attack on Aug. 10 struck the Lukoil-Ukhta oil refinery in Russia’s Komi Republic, about 2,000 kilometers (1,243 miles) from the Ukrainian border, a source in Ukraine’s military intelligence agency (HUR) told the Kyiv Independent....

...The attack marks Kyiv’s first confirmed drone strike in Russia’s northwestern Komi Republic.

Ukrainian drones hit the Lukoil-Ukhta refinery, which supplies Russian forces with fuel and lubricants, according to HUR. The refinery was targeted as part of a special operation by Ukraine’s military intelligence.

The drones struck a petroleum tank, causing it to spill, HUR said. The attack also damaged a gas and gas condensate processing plant that produces propane-butane and gasoline.

Local residents also report power outages and mobile internet outages in Ukhta.

Earlier in the evening, local Telegram channels reported a drone attack in Ukhta targeting the Lukoil refinery, which authorities evacuated. The independent Russian media outlet Novaya Gazeta also said that flights at the airport were temporarily suspended.

Rostislav Goldshteyn, the acting head of the Komi Republic, said on social media that workers at enterprises in the drones’ flight path were evacuated and that there were no casualties. He did not provide details on which enterprises were evacuated and did not mention an oil refinery in his post...

...The Lukoil plant specializes in processing blended crudes from oilfields in the Komi Republic, shipped to the facility via the Usa-Ukhta pipeline.”

I wonder if this is part of a Ukranian effort to freeze Russia this winter and severely damage Russia’s war effort. Are these oil refineries primarily for internal use or primarily for export? Would lack of heat spark an uprising of the people against this wasteful war which is now causing misery and destruction of basic services at home? I have seen no reports of civilian casualties caused by Ukraine bombing in Russia except of people working or living very close to such bombed military related facilities and buildings. Is that because Ukraine, unlike Putin, is avoiding targeting residential areas, or is Russia just hiding those figures from their own people and the world?

“Are these oil refineries primarily for internal use or primarily for export?”

Russia has a lot of refining capacity - 44 “mega” refineries, the largest class of refineries. Most are dual use, for domestic and export, but the proportion varies among them. Each is tailored to where it is - the type of local crude oil that is fed into them (more suitable for some kinds of refined products, vs. others). how close to export facilities they are (ports and pipelines), and what the local domestic demand is (urban, industrial, agricultural).

Refineries are somewhat specialized, so it is possible to target a subset of refineries (or certain parts of refineries) to target certain products (like aviation fuel, for example, or feedstocks for explosives). Likewise, targeting could be somewhat preferential for export products, vs. those for domestic use.

I can’t tell for sure what the targeting strategy is, but it seems to me like a mix of objectives. Damage anywhere puts some systemic pressure on Russia’s ability to restore their capacity generally - spare parts, expert’s time, money, etc.

Samolet is one of Russia's four listed developers and the second-largest in the Moscow Region. In October 2020 Samolet held an IPO on the Moscow Exchange. Since Russia's invasion of Ukraine, Samolet has maintained its bullish sales goals, believing that the market is materially undersupplied and keeping expectations of the average price increase at 10% annually. “We are sad to confirm that today, on August 10, entrepreneur and investor Mikhail Kenin passed away,” the company's statement said, offering condolences to his family and friends.

The company described Kenin as “one of those people who leave their mark on the earth… a rare person, gifted with natural talents, an excellent organiser and successful entrepreneur… ready to take risks and make difficult decisions.” It credited him with creating the country's largest development firm. Kenin held a 31.6% stake in the company, sharing control with co-owner Pavel Golubkov. He was reportedly trying to sell his stake in November, CPD Ukraine reported. Amid sharply rising interest rates and cuts in mortgage subsidies, Samolet’s sales dropped 44% in Q3 2024.

As followed by bne IntelliNews, in 2024, Samolet raised concerns over high-profile shareholders fleeing the company and the poor performance of its bonds. Samolet’s net debt rose by 46% y/y to a record RUB291bn. The net debt/EBITDA ratio increased from 2.8x to 3.5x at the end of 2024. Renaissance Capital analysts wrote at the time that Samolet’s IFRS results for 2024 were negative, stressing that the amount of interest paid (as per the cash flow statement) rose 2.8-fold to RUB41bn. “Given the deteriorating sales performance in 1Q25, the company's creditworthiness remains low. This figure is likely to rise further this year, driven both by higher average interest rates on obligations and by significant debt load growth,” RenCap analysts warned.

In December 2024, the developer held an Investor Day, which failed to address the debt load and the outlook on the company's bonds. At the beginning of 2025, Samolet announced a buyback programme of 16% of its bonds, which somewhat calmed the market.

https://www.intellinews.com/largest-shareholder-of-russia-s-samolet-group-mikhail-kenin-dies-at-57-395446/

Seems SMLT Samolet company rather has problems for last few years. Its stock is in strong bear market since Sept. 2021

https://x.com/SongMun67/status/1954641401167151485

The Defense Ministry has been instructed to assess what is needed to mobilize one and a half million people

Philosopher Alexandr Dugin reported this information to us, citing his acquaintances in the ministry and the Kremlin.

“My calls for a total mobilization (Alexandr Gelyevich has long been talking about the need to mobilize several million people into the army , - ed.) seem to have been heard. I know for sure that the Defense Ministry has begun to calculate how many people need to be recruited in order to finally completely liberate the DPR (I consider it regrettable that we have been struggling for so long to liberate one region) and to complete a number of other tasks. And not only in Ukraine. Now the military is studying what needs to be done to immediately replenish the army by 1.5 million people, they have been clearly instructed to do so,” the philosopher said.

The Defense Ministry is reluctant to comment on this information. Only a few sources admitted that the ministry “is making different calculations.”

“This does not mean that tomorrow we will go to Kiev, Odessa or, say, some European country. Russia simply needs to have a plan for any eventuality. So, excuse me, you won't hear any sensations in my answer. And in general, we first need to completely liberate the DPR, and only then think about new offensives,” a high-ranking interlocutor in the Ministry of Defense emphasized.

Russian Purchasing Managers Index (PMI) turned strongly negative (47) for June and July.

Business confidence has also hit lows (around zero, which is neutral), not seen since the 2023 shift to a wartime economy in Russia; in May, June and July. Apparently, the Government stimulus has run its course, and can no longer achieve growth effects.

IMF has downgraded its forecasts for Russian GDP, as well as some retroactive downward revisions.

The United States and Ukraine's European allies agree that Europe, not the United States, will fund further military and security assistance to Ukraine. US Vice President JD Vance gave an interview to Fox News on August 10 and reiterated the Trump Administration's consistent position that the United States will no longer directly fund the Ukrainian military effort, but that Europe can continue to buy weapons from US manufacturers for Ukraine and Europe's own defensive needs.[1] North Atlantic Treaty Organization (NATO) Secretary General Mark Rutte stated in an interview with Face the Nation published on August 10 that the “floodgate” of lethal aid packages to Ukraine opened after US President Donald Trump met with Rutte on July 14 and that Canada and European NATO allies will continue to fund weapons for Ukraine.[2] Rutte stated that these deliveries are in addition to Europe's investments in European and Ukrainian defense industrial facilities and that there will be additional European aid package announcements in the coming weeks. Western outlets reported on August 7 that NATO allies, the European Parliament, and several international banks — including US JP Morgan Chase, German Commerzbank, and Canadian RBC Capital Markets — are backing the new Bank for Defense, Security, and Resilience (DSRB), an international bank that will specialize in lending to NATO and allied countries for defense procurement.[3] Western media reported that the DSRB will help NATO states reach their goal of committing five percent of gross domestic product (GDP) to defense spending and that more than 40 unspecified countries are expected to become shareholders. UK Chancellor of the Exchequer Rachel Reeves and UK Defense Secretary John Healy endorsed the DSRB.[4] The DSRB announcement signals NATO allies’ commitment to increasing defense spending, and European NATO members will likely leverage the bank to sustain investments in Ukraine's defense industrial base (DIB), to launch further joint production initiatives with Ukraine, and to fund defense production intended for Ukraine and NATO allies’ own stocks.

US President Donald Trump is reportedly considering a trilateral meeting with Russian President Vladimir Putin and Ukrainian President Volodymyr Zelensky during the August 15 summit in Alaska. Reuters reported on August 9, citing sources in the White House, that Trump is open to holding a trilateral summit in Alaska with Zelensky and Putin but that the White House is currently preparing for a bilateral meeting between Trump and Putin.[5] CNN and NBC reported on August 10, citing senior US officials and sources familiar with the matter, that the White House has not ruled out the possibility of inviting Zelensky to Alaska.[6] One of the sources noted that any meeting with Zelensky would likely occur after the Trump-Putin meeting. Vance told Fox News on August 10 that the United States is trying to schedule a trilateral meeting between Putin, Trump, and Zelensky in order to negotiate an end to the war.[7] Vance stated that Putin's refusal to meet with Zelensky has been one of the most significant impediments to the peace process.

The Kremlin is attempting to use the upcoming Alaska summit to divide the United States from Europe rather than engage in meaningful peace efforts. Russian Security Council Deputy Chairperson Dmitry Medvedev claimed on August 10 on both his English and Russian language Telegram accounts that Europe is trying to prevent the United States from helping to stop the war in Ukraine.[8] Russian Liberal Democratic Party (LDPR) Head Leonid Slutsky claimed on August 9 that European countries are pursuing an anti-Russian policy and trying to prevent a quick peace settlement in Ukraine.[9] Russian political scientist Sergei Markov told the Washington Post on August 10 that Russia's main interest in the Alaska summit is to portray Ukraine and Europe rather than Russia as the obstacles to peace in Ukraine.[10] Markov stated that Russia refuses to take any steps backward and that the only compromise that Russia is willing to consider is halting military efforts to seize Odesa and Kharkiv oblasts and Kherson and Zaporizhzhia cities. Markov expressed hope that Trump will realize that Zelensky is the main reason for Russia's war in Ukraine and that European leaders are the second reason for the war, rather than Russia.

European and Ukrainian officials, including Zelensky, have consistently demonstrated their willingness to promote and engage in good faith negotiations and impose substantive ceasefire agreements to progress the peace initiative, which Russia has consistently rejected in pursuit of incremental battlefield gains and additional concessions from Ukraine and the West.[11] The Kremlin has long attempted to weaken cohesion between the United States, Europe, and Ukraine as part of a wider campaign to deter further Western support to Ukraine and distract from Russia's intransigence regarding the peace process and unwillingness to compromise on Putin's original war demands.[12] ISW continues to assess that Russia remains unwilling to compromise on its long-standing war aims of preventing Ukraine from joining NATO, regime change in Ukraine in favor of a pro-Russian proxy government, and Ukraine's demilitarization - all of which would ensure Ukraine's full capitulation - and that Russia will very likely violate and weaponize any future ceasefire agreements in Ukraine while blaming Ukraine for the violations as it repeatedly did in Spring 2025.[13]

Ukraine's European allies continue to signal their support for Ukraine and US-led peace efforts ahead of the Alaska summit. French President Emmanuel Macron, Italian Prime Minister Giorgia Meloni, German Chancellor Friedrich Merz, Polish Prime Minister Donald Tusk, UK Prime Minister Keir Starmer, Finnish President Alexander Stubb, and European Commission President Ursula von der Leyen published a joint statement on August 9 expressing support for US-led peace efforts and calling for Ukrainian and European involvement in future peace negotiations.[14] The European leaders called for a ceasefire or reduction of hostilities before negotiations begin and stated that the current frontline should be the starting point for negotiations. The leaders also called for robust and credible security guarantees that protect Ukraine's sovereignty and territorial integrity. The leaders expressed their commitment to the principle that international borders cannot be changed by force and reiterated that Russia's invasion of Ukraine violates the UN Charter, the Helsinki Act, and the Budapest Memorandum, among other Russian international agreements.

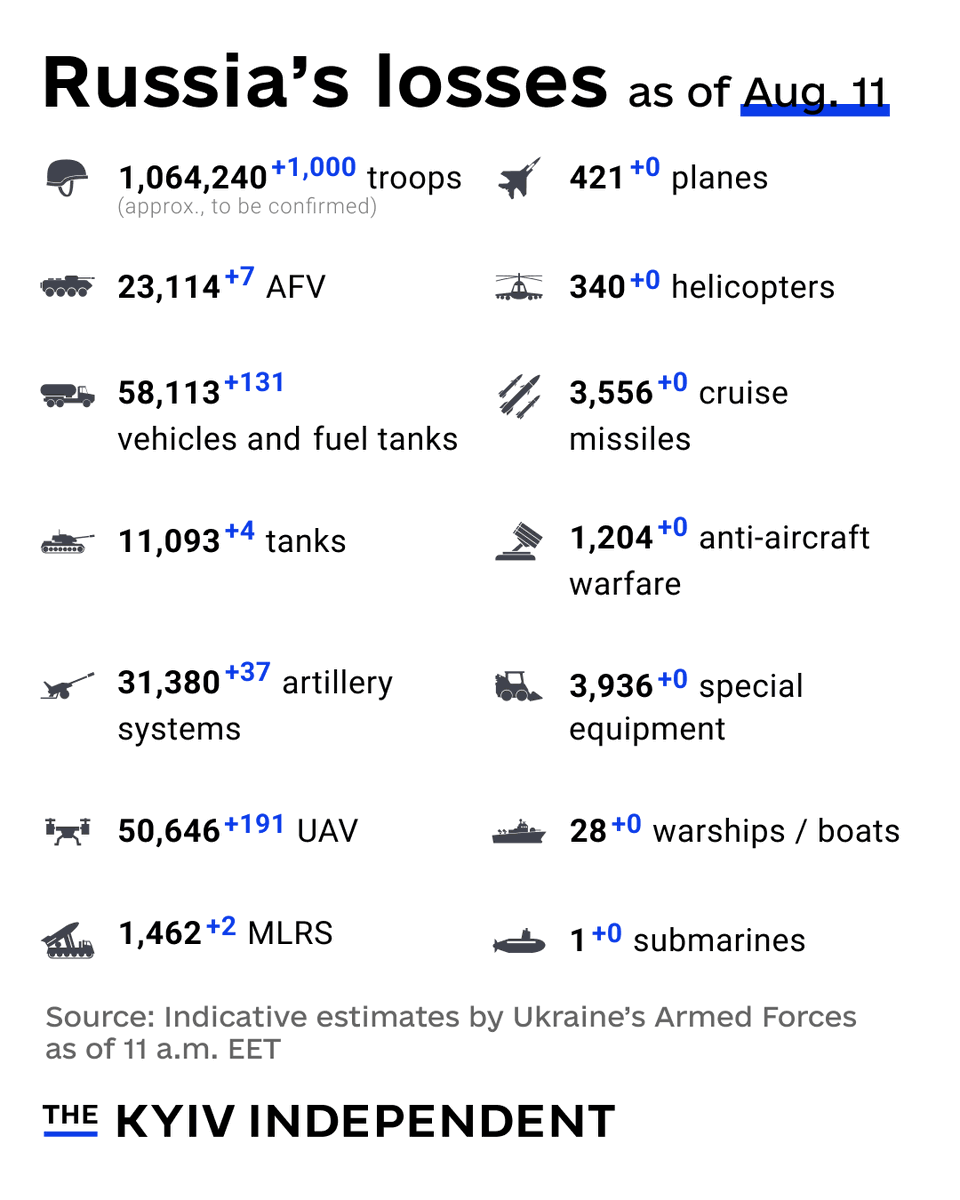

Russian tank losses appear to be declining as Russian forces continue to deprioritize mechanized assaults across the frontline, indicating that the Russian command recognizes that it cannot protect vehicles from Ukrainian drone strike capabilities on the frontline and near rear. An intelligence focused open source that tracks Russian vehicle losses in Ukraine reported on August 10 that the rate of Russian tank losses continues to decline and reached its lowest levels of the war in June and July 2025.[15] The source stated that it has visually confirmed 22 Russian tank losses in June 2025 and 19 Russian tank losses in July 2025, down from 116 confirmed tank losses in June 2024 and 97 confirmed tank losses in July 2024.[16] The source indicated that Russian tank loss rates began to decrease in December 2024, which is consistent with the Russian military command's theater-wide shift from costly mechanized assaults toward gradual, creeping infantry assaults.[17] The source stated that Russian T-62 and T-90 loss rates remain consistent, T-72 loss rates have declined in proportion to the overall decline of Russian tank losses, and T-80 tank loss rates have significantly declined.[18] Russia has likely exhausted much or all of its stockpiles of T-80 tanks and is likely conserving existing stores and stockpiling newer tank models while depleting stores of other tanks and armored vehicles, including the older T-62. Russian forces have conducted relatively few but costly mechanized assaults in Ukraine thus far in 2025 due to the effectiveness of Ukrainian drone strikes against armored vehicles, instead prioritizing infantry-led assaults and assaults on expendable motorcycles and other light vehicles.[19] Russian forces have been using armored vehicles to transport infantry to forward positions for infantry assaults, constraining Russian advances to foot pace and preventing Russia from using mechanized maneuver warfare to exploit breakthroughs and achieve operationally significant advances.[20] It remains unclear why Russia continues to invest significantly in tank and armored vehicle development and production while Russian forces are largely unable to field these vehicles for their intended purposes, as Ukrainian forces maintain the ability to inflict high frontline and near rear armored vehicle losses with drone reconnaissance and strikes.[21] Russia may be preparing for the eventuality that Russian forces will become able to counter Ukrainian drone operations well enough to be able to field armored vehicles and restore at least some maneuver to the battlefield, but ISW has observed no indications of Russian technological advances in this direction.

Ukrainian drone manufacturers have developed a new drone capable of intercepting higher-speed Russian drones. Representatives of the Ukrainian drone manufacturer Besomar told Ukrainian outlet Militarnyi on August 10 that Besomar developed a reusable interceptor drone that is capable of downing Russian drones at speeds up to 200 kilometers per hour, including Geran-type long-range strike drones.[31] The interceptor drone is equipped with a shotgun and an automated firing system that can hold between two and four shots. The interceptor drone is also equipped with a digital communications system with a frequency response that allows the drone to approach its target unnoticed by the Russian drone's evasion systems. The drone can fire manually or automatically due to a sensor in the nose of the drone that the drone operator can activate to initiate a shot when a target enters the drone's range.

https://www.understandingwar.org/backgrounder/russian-offensive-campaign-assessment-august-10-2025

“ Markov expressed hope that Trump will realize that Zelensky is the main reason for Russia’s war in Ukraine and that European leaders are the second reason for the war, rather than Russia.”

Russian Mir

After your home is invaded, the authorities blame you and arrest you for fighting back against the criminals😎

I just love how Dizzy learns a new word and then proceeds to beat it to death, as if ppl will think he's smart. But we don't. We know he's just being his Dizzy self.

Funny how 🍈 loves to project just like his comrades. Hence why he is The 🍈.

Russia projects they are the victims , 🍈 projects that all who disagree with him are idiots.

Russian Mir is fascinating

What air defense doink😎

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.