The New York Times has gained insider information on the current advertising revenue for the social media platform Twitter. [Article Here] Ignoring the nonsense narrative engineering and just focusing on the data itself, the revenue side for Twitter is half what we previously estimated. This makes the overlay for decisions on platform content even more stark.

*****

New York Times Gains Insider Information on Twitter Revenue, Expanded Financials Look Worse Than Former Estimates

June 5, 2023 | Sundance | 215 Comments

According to the data, ad revenue for the month of April was a lackluster $88 million. That’s a pace of just over $1 billion a year. With a pre-Musk operating expense of $4.5 billion, and pre-Musk revenue at $4 billion cited by the Twitter owner as the backdrop, here’s the outlook.

Assuming post Musk labor cost reductions saved $500 million, a decline in revenue to $1 billion/yr would be a $3.0 billion deficit, to wit you would need to add the $1.5 billion in debt service as part of the investor buyout structure.

That puts Twitter into a $4.5 billion loss ballpark per year.

This is the high end of what Musk previously estimated in public statements. Now we see why.

(New York Times) – Twitter’s U.S. advertising revenue for the five weeks from April 1 to the first week of May was $88 million, down 59 percent from a year earlier, according to an internal presentation obtained by The New York Times. (read more)

$1 billion per year in advertising revenue is a whopping 75% loss from the claimed $4 billion in revenue before the Musk purchase. Perhaps the Fidelity estimate of company value at $15 billion is closer to reality.

If the value of Twitter has dropped to the $15 billion level, that means almost all of the $30 billion in personal equity Musk put into the company has been lost.

Current investor debt is $12.5 billion, with $1.5 billion in debt service/yr. A valuation of $15 billion would only leave Musk with around $2.5 billion in equity position. If the valuation is accurate, Musk personally would have lost around $27.5 billion in this Twitter platform purchase.

The last time I outlined the Twitter financial position, several people took exception to the data as shared. However, the data is from Elon Musk himself, and I will again post the video at the bottom of the article.

Revenue is now Elon Musk’s #1 priority. All other platform decisions are going through the prism of financial viability.

Twitter CEO Elon Musk has provided some convincing commentary about his willingness to forgo revenue in order to retain “free speech.” However, more recently he has qualified that outlook by saying, “Freedom of speech is not the same as freedom of reach.” Musk noting Twitter will block, remove, censor, shadow ban, deboost, downrank and stop content from amplifying based on the determination of those in charge of Twitter content.

This controlled “freedom of reach” perspective, which is really shadow-banning in practice, is generally accepted and now admitted. Against this backdrop, it becomes important to understand the priorities of the platform to understand the guidelines of the platform. Within this context the financials are key to understanding what elements are included within “approved content.” {GO DEEP}

Twitter is now a private company, therefore understanding the financials of Twitter is a little more challenging than when they were required to post their financial statements publicly. However, Elon Musk gave an interview with the Babylon Bee yesterday and revealed some of the internal financial challenges. [VIDEO HERE] I am going to summarize the status of the Twitter financial position according to what Musk himself revealed.

♦ Twitter was initially purchased by Musk and his investors for around $44 billion. The company now estimates its value around $20 billion. Last week, the mutual funds giant Fidelity, which owns shares in Twitter, valued the company at $15 billion. Bottom line, Musk grossly overpaid.

♦ Musk put roughly $30 billions of his own net worth into the purchase and financed the rest.

♦ Current outstanding debt on the financing for the purchase is around $12.5 billion. Per Musk statement.

♦ Current debt service, interest on the loans (from investors), is roughly $1.5 billion/yr. $120.5 million per month for debt service. Per Musk statement.

♦ Previous revenue (when public) was roughly $4 billion/yr. Twitter was generally breaking even.

♦ Advertising revenue, as a result of changes in industry in combination with concerns about Twitter, are “half” what they were during the acquisition phase, per Musk statement. That puts current advertising revenue around

$2 billion/yr. Per NYT report that’s now $1 billion/yr.♦ Per conversation, current status of Twitter is -$3 billion/yr and could be as high as -$4 to 5 billion/yr.

The NYT revenue leak now makes the top side of this scale make sense. If $4 billion in revenue was generally the breakeven point (before acquisition), and now they have $2 billion $1 billion in revenue and $1.5 billion in additional debt service [as they trim operational costs (including labor) to offset].

♦ For the bottom line to be an operational loss of $3 to $5 billion (est) per year, Twitter is generally losing around $300 million per month.

♦ There is only so much Tesla stock Musk can sell to support Twitter. He has limits. Per conversation.

♦ Twitter has around $1 billion in liquid cash available. Per conversation. With a burn rate of $300+ million a month.

Twitter is in locked contracts with AWS and Google cloud services through 2025 at roughly $300 million per year for both [AWS $100 million, Goog $200 million].

Twitter Blue subscriptions are around 180,000 users, paying $11/mo. That’s around $2 million a month; pittance in comparison to what he needs.

There’s your prism for platform content!

Elon Musk needs revenue desperately.

Twitter urgently needs advertising revenue.

Without revenue or acquisition of another platform (with assets) to offset the current status of Twitter, it is only a matter of time before some form of bankruptcy.

[Note, Twitter investors are backstopped with Tesla/SpaceX as collateral against default.]

The tightrope… Elon Musk must appease the Google advertising control agents and adhere to content rules and regulation (DEI etc.) in order to maximize his revenue. That’s where Linda Yaccarino comes in as a critical player.

Bottom line, Musk has to make decisions through one prism, THE ECONOMICS. Musk’s decision-making, pro freedom or not, is constrained by this financial dependency. Hence, a lot of the platform censorship elements remain (including some personnel) and now the outreach to appoint Google/WEF approved Linda Yaccarino in an effort to enhance the revenue.

Musk discusses the financials:

When you are perplexed about Musk decision making…. THERE’S YOUR ANSWER.

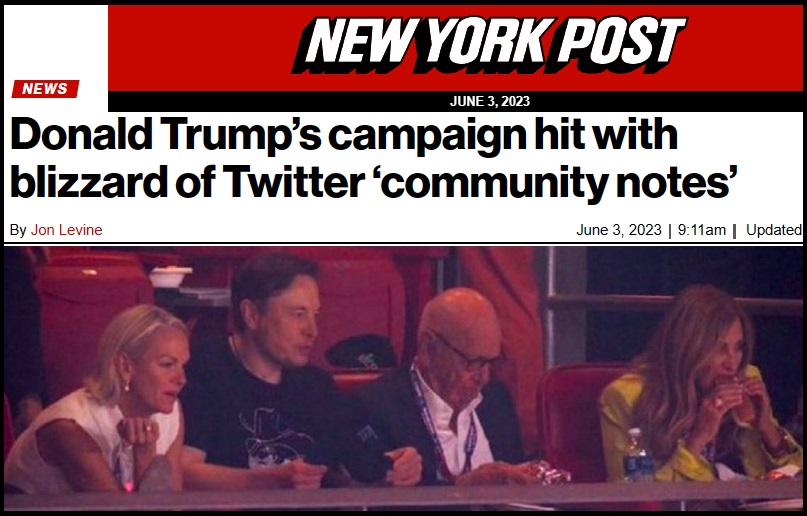

The recent relationship between Elon Musk and the Rupert Murdoch media enterprise, now makes even more sense.