Posted on 11/11/2017 7:41:56 AM PST by NaturalBornConservative

Point #1

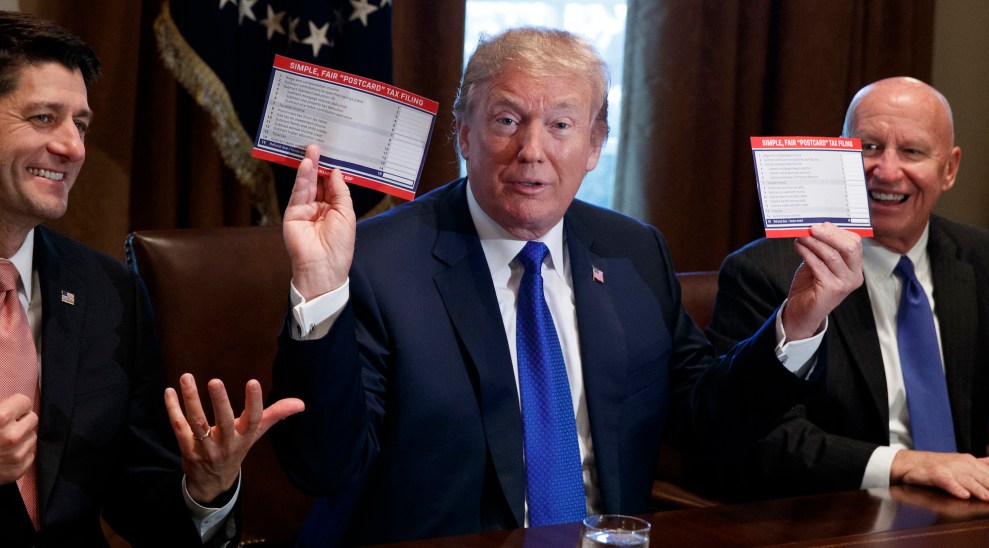

Like a broken record, Republican promotors of the Tax Cuts and Jobs Act insist that by raising the 2018 standard deduction for single filers from $6,500 to $12,200, for couples from $13,000 to $24,400, and by lowering selective tax rates, that their plan will usher in a huge tax cut for the middle-class. It, in fact, does no such thing.

Whenever challenged with the reality that their proposal will result in a tax increase on many of their constituents, they exclaim, “Yes, but we are doubling the standard deduction!” Yet, not one of them ever mentions that they are, simultaneously, repealing the personal exemption deduction of $4,150, per person.

In 2018, the standard deduction for single filers will be $6,500, and for married taxpayers filing jointly $13,000, while the personal exemption will be $4,150 (per person). That means a single non-itemizer would already have received $10,650 ($6,500 standard deduction + $4,150 personal exemption) of tax exempt income before the proposal, versus $12,200 after. And, a married couple, without children and not itemizing, would already have received $21,300 of tax exempt income before the proposal, versus $24,400 after.

For single filers, the difference between $12,200 and $10,650 isn’t double, it’s only $1,550. For married couples, the difference between $24,400 and $21,300 is a mere $3,100. This isn’t a doubling of the standard deduction. It is effectively an increase to the standard deduction of $1,550 for single filers and $3,100 for couples without children. So, please stop lying to us.

Furthermore, since this is income that would have been taxed at a rate of 10% before the proposal, the amount of taxes saved will be just $155 for singles, and $310 for couples without children. Those with at least one child will start out in the hole, and must rely on an expansion in tax credits just to get back to par.

Point #2

According to the Congressional Research Service, more than 50% of taxpayers with adjusted gross incomes of $50,000, or more, itemize their deductions. Those with $50,000 to $100,000 of adjusted gross income claim average itemized deductions of $19,187, while those with $100,000 to $200,000 in income claim an average of $25,598 (see table below).

So, more than half of taxpayers, who pay most of the income tax, itemize. And, the Republican bill seeks to eliminate their deductions for state and local taxes, real estate taxes, medical expenses and unreimbursed employee expenses. This won’t end well.

Among the deductions Republicans seek to disallow, according to the Congressional Research Service, on average, most itemizers with adjusted gross incomes of $50,000 to $100,000 stand to lose a least the following (see table above):

You might say that mortgage interest, real estate taxes and state and local taxes go hand in hand. But, that doesn’t mean one should discount the importance of deductions for medical and unreimbursed employee business expenses.

Almost everyone knows at least one infirm or elderly person that spends all or most of their income on medical care. This is not by choice. Denying them the ability to offset their income will force many into a tax liability where none previously existed.

Collecting taxes from the elderly and infirm, those with the least ability to pay, is of course detestable, but well within the spirit of this horrible bill. The same applies to sales persons and other employees who spend much of their time on the road and are not reimbursed for all the expenses they must incur to earn their pay.

Add the loss of deductions for the state and local taxes, and real estate taxes to the loss of the $4,150 (per person) personal exemption deduction, and single itemizers with adjusted gross incomes between $50,000 and $100,000 stand to lose total deductions of at least $10,523, while married itemizers (without children) lose $14,673.

Thus, under the Republican proposal, an average single itemizer with adjusted gross income between $50,000 and $100,000 stands to lose $10,523 in deductions, which equates to an $1,884 tax hike (at 17.9%). An average married couple (without children) in the same bracket will lose $14,673 in deductions, which equates to a $2,421 tax hike (at 16.5%).

Single itemizers with incomes between $100,000 to $200,000 will lose total deductions of $15,066, while married filers (without children) lose $19,216. Thus, an average single itemizer with adjusted gross income of $100,000 to $200,000 will see a $3,254 tax hike (at 21.6%), while a married couple in the same bracket will see their taxes rise by $3,728 (at 19.4%).

Losing the ability to deduct state and local taxes, real estate taxes, medical expenses and employee business expenses may impair a taxpayer’s ability to itemize at all. That’s because mortgage interest and charitable contributions, alone, for the majority, will not be enough to exceed the proposed $12,200 and $24,400 standard deduction. Thus, taxes will rise more on some taxpayers than others.

At this point, Republican lawmakers will say, “But, you have to look at the whole package. We are also lowering tax rates, and your boss is going to give you a $4,000, or more, pay raise.”

Expanding the 12% bracket to the first $45,000 of taxable income for single filers, to $90,000 for couples; and the 25% bracket to incomes of $200,000 and $260,000, respectively, doesn’t make up all the shortfall for those losing deductions. Although the average tax rate will drop by 1.2 percentage points on single filers, and 1.4 percentage points on couples, middle-class itemizers will at best break even. That’s because a greater amount of their income will be subject to income taxes. At worst, they are punished with a tax hike.

Apples to apples, if deductions were not being disallowed, the GOP’s proposed adjustment to the tax brackets would be a good thing. But, this isn’t apples to apples, it’s apples to applesauce. The GOP is telling more than 50% of middle-class taxpayers, who currently itemize their deductions, “We’re going to tax you on a greater amount of your income, but you’ll save money because we’re taxing it at a lower rate.”

Voilà! That explains why a majority, already carrying the burden of taxes, now face a Republican tax hike. Meanwhile, health insurance premiums continue to spin out of control, and if you’re fortunate enough to afford it, it will no longer be deductible. If this bill passes, you better hope that pay raise comes fast, otherwise the public will vote against every one of you in 2018.

The GOP’s tax reform proposal effectively raises the standard deduction by $1,550 for single filers, and by $3,100 for married couples without children, while lowering it for couples with at least one child. It takes away average deductions of $10,523 to $19,216 for more than half of middle-class taxpayers that itemized their deductions. The lowering of tax rates and expansion of tax credits are fancy mechanisms designed to mitigate a portion of the damage. This is not a tax cut, it’s a tax hike by design.

Another Way

To avoid raising taxes on the middle-class, the GOP could increase its proposed standard deduction on single filers from $12,200 to $21,800, and on couples from $24,400 to 43,600. That way, more than 50% of middle-class taxpayers won’t be punished. A move in this direction would promote simplicity and fairness. It would also be more in line with the original proposal that put DJT in the White House.

It looks like they went out of their way to figure out everything they could do to hurt the middle class and especially alienate most of the people who voted for Trump.

For those of you who think that all Californians are nut cases, there still are lots of middle and upper middle income conservatives living here, and I am one of them.

For folks in low or no state income tax states, if you itemize and think that either of these bills will not result in higher incomes taxes, then think again and try applying these proposed changes to your last year’s tax returns, both Federal and State.

Everyone will lose medical expenses, real property taxes, personal property taxes, sales taxes and some other tax deductions. Plus, if your state income taxes are calculated directly off of your Federal income tax form as is California’s, then your state itemized deductions will be significantly reduced, and your state income taxes will be significantly increased.

We need large and small business income tax reductions but we do not need this fraud of an individual tax increase for those of us middle and upper middle income earners.

If this thing passes, many, many people are going to be hurt. Badly.

All true.

What I would like to know is: where is Donald Trump?

Is he really going to screw us all?

I want to believe that, in the end, he won't go along with all of this - but it looks like he will.

They went out of their way to take take of their donors and the lobbyists.

/cdn.vox-cdn.com/uploads/chorus_image/image/57501545/3.22.3.0.jpg)

“This is not a tax cut, it’s a tax hike by design”

That’s what I’ve been saying since the House released their plan.

It’s a tax increase. And it’s coming from a Republican Congress.

The dirty rotten bastards.

I wonder if the Chamber has considered the affect this bill will have on consumer spending.

My household is going on a diet until these idiots figure this out.

True. Most states start with your federal AGI, then allow either federal itemized deductions, or a meager standard deduction (e.g. $2,300 for a single filer, $3,000 for a joint filer in Georgia). So, if after losing itemized deductions, you are forced to take the federal standard deduction, then you have to take the state standard deduction as well.

I will lose roughly $12K in itemized deductions making the federal standard deduction higher. And, if forced to use the federal standard deduction, then my state itemized deductions will go from $24K, and change, to the $2,300 Geordia standard deduction. That means I will owe $1,100 more in state taxes at 5% of $22K.

So, in my case, and many others I can name, I will be getting a federal and state tax hike. But, I'm sure Congress already thought about this. Right? Unless all 40 some-odd states with an income tax change their laws simultaneously, this hidden gem will negate any of the proclaimed tax savings Republicans in Congress are harping about.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.