Posted on 10/30/2017 9:54:57 AM PDT by NaturalBornConservative

According to White House Press Secretary, Sarah Sanders, “Very few people itemize. I think it’s around 20% of people that actually itemize. Those things will be offset by other tax credits that are part of this plan…”

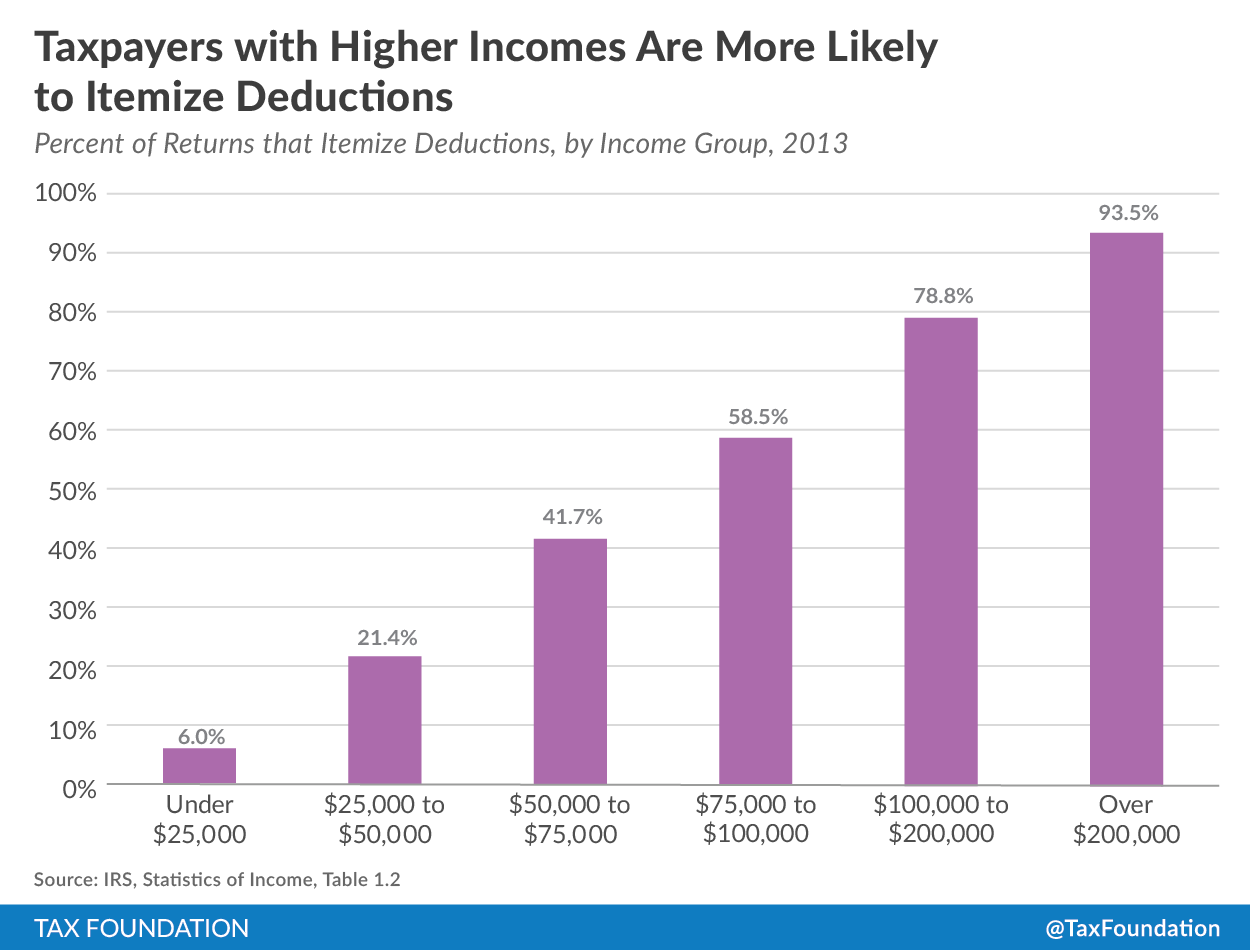

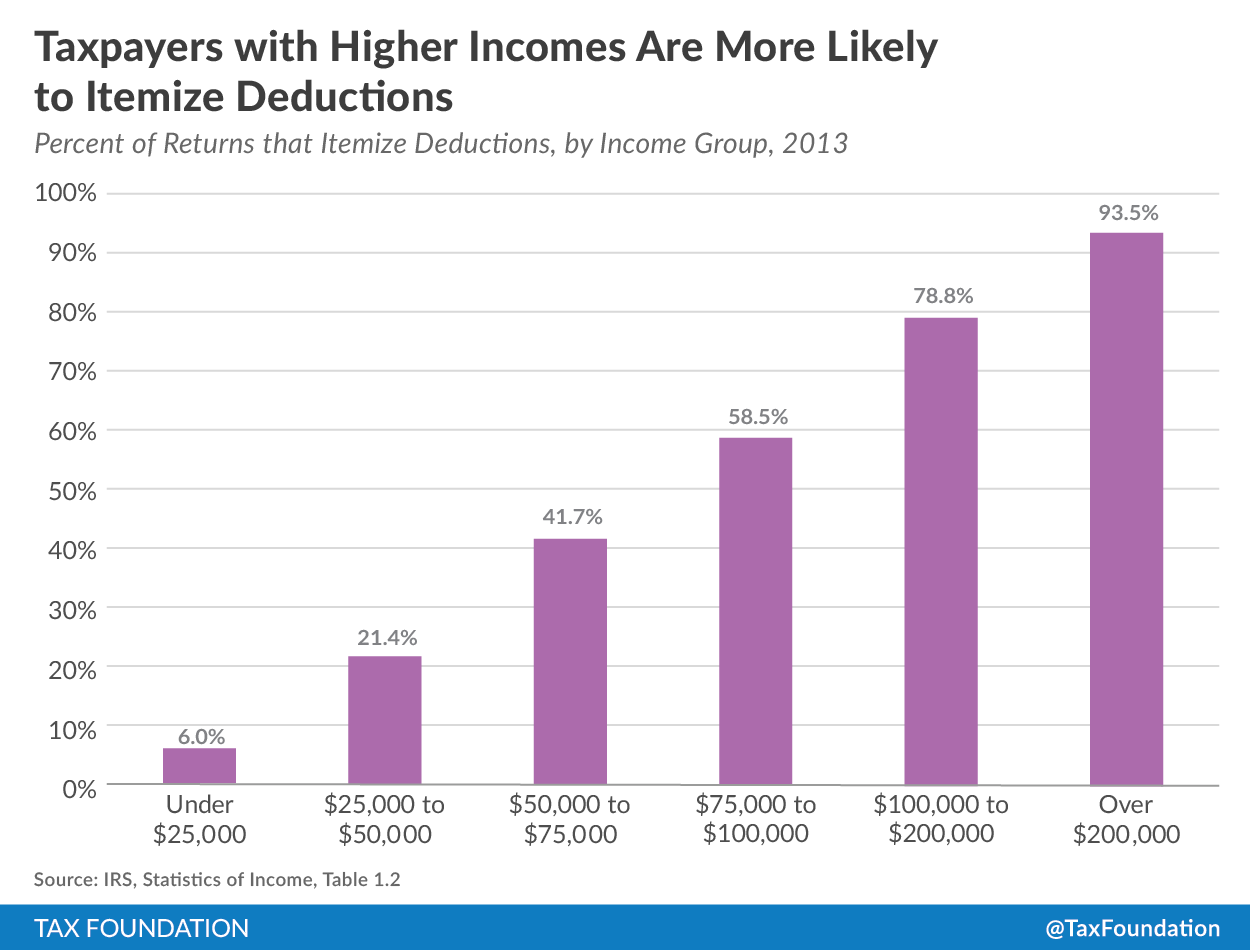

Ms. Sanders would be correct, if she was referring to households earning less than $50,000 per year, a figure which barely skirts the middle-class. However, as you can see in the chart below, 41.7% of households earning between $50,000 and $75,000 itemize. The figure jumps to 58.5% for those earning $75,000 to $100,000, and rises to 78.8% for those earning between $100,000 to $200,000.

On average, 30.1% of taxpayers itemize. A figure which comprises roughly 44,000,000 households. This is something neither the White House nor Congress should take lightly. Any effort to reform the tax code should at least begin with the facts.

The Republican tax reform plan proposes to eliminate the $4,050 (per person) personal exemption, and limit a household’s ability to itemize deductions, replacing both concepts with a higher standard deduction. The proposed standard deduction is $12,000 for single filers, and $24,000 for married couples.

In tax year 2016, the standard deduction and personal exemption(s) combined were $10,350 (6,300 + 4,050) for single filers, and $20,700 (12,600 + 8,100) for married couples. Keep in mind that taxpayers able to claim dependents were allowed additional personal exemptions of $4,050 for each. Dependents include children and in many cases elderly parents.

Under the Republican framework, single taxpayers, who currently do not have enough deductions to itemize, and are not claiming dependents, will receive an extra $1,650 (12,000 – 10,350) of tax free income. Since this income was previously taxed at 10%, their savings under the Republican plan are a mere $165.

Married taxpayers filing jointly, who currently do not have enough deductions to itemize, and are not claiming dependents, will receive an extra $3,300 (24,000 – 20,700) of tax free income. Since this income was previously taxed at 10%, their savings under the Republican plan are a mere $330.

The Republican framework further eliminates the 10%, 15%, 28% and 33% tax brackets. Commencing at 12%, the new framework then jumps to 25%, then 35% and potentially up to 39.6%. We don’t yet know where each bracket will end, but we do know that the plan represents a 20% tax hike at the lowest level. Not good.

Actually, in raising the bottom tax rate from 10% to 12%, the Republican plan takes back all of the initial tax savings, placing both single filers and couples in the red. Thus, for non-itemizers, the premise of a higher standard deduction combined with the elimination of the personal exemption results in less than nothing in terms of a tax cut.

Furthermore, married and single non-itemizers with dependent parents or children turn out to be big losers. So, if the framework does nothing for non-itemizers, what will it do for those that currently itemize? I’ll use myself as an example.

For tax year 2016 I filed as Single with no dependents, had itemized deductions of just over $20,000, and claimed a personal exemption of $4,050. Rounding it off, my total deductions were $24,000. That means my taxable income was computed as total income minus $24,000. That’s where the tax brackets kick in.

Of the $20,000 I claimed in itemized deductions, around $6,000 was mortgage interest, $9,000 were employee business expenses (which don’t appear to be part of the discussion), and the remainder were real estate and state and local income taxes.

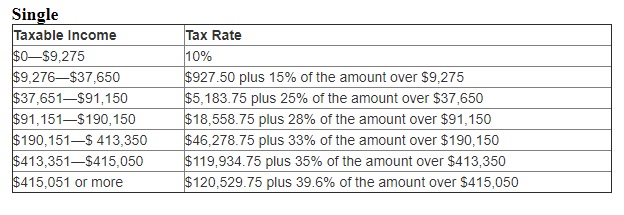

Being single in 2016 meant the first $9,275 of taxable income (i.e. income above my deductions of $24,000) was taxed at 10%, the next $28,374 at 15%, and the next $53,499 at 25% (see table above).

Moving forward, instead of being allowed to claim my usual itemized deductions and personal exemption of roughly $24,000, the Republican framework will limit me to a new standard deduction of $12,000 (for single filers). Thus, $12,000 of my income that was previously un-taxed will now be subject to a 12% income tax.

So, where $12,000 of my income wasn’t previously taxed, the Republican plan taxes it at 12%, thereby increasing the government’s coffers by an extra $1,440. And, this is just the starting point.

Where the next $9,275 of my income was previously taxed at 10%, the Republican plan taxes it at a rate of 12%, favoring the government by an additional $186. So far, the government is ahead by $1,626. Will an adjustment in the tax brackets make up for my shortfall?

Now, where my next $28,374 of income was previously taxed at 15%, it will presumably be taxed at 12%, assuming the new 12% bracket covers at least the first $49,649 of taxable income (12,000 + 9,275 + 28,374). Compare this to the chart above. If correct, this saves me $851 in taxes (3% of 28,374). Yet, the government is still ahead by $775. If the bracket isn't extended, I am forced even further into the abyss.

In fact, to break even the 12% tax bracket must be extended to $55,611, for a single person in my shoes (49,649 + (775 / (.25 – .12))). But, since the Republican framework is billed as a big beautiful tax cut, not just a crafty way to simplify the code, at the expense of the middle-class, the 12% bracket must be extended further for me to realize an actual reduction in taxes.

To receive a modest tax cut of $1,440, the 12% tax bracket must apply to taxable income of $0 to $66,688. That’s what it will take for me to lose my current itemized deductions and personal exemption, and wind up with a modest tax cut. It may take more, or less for you, but you get the gist.

Yet, according to the White House, the average American family will receive a $4,000 tax cut. For a taxpayer in my shoes to receive a $4,000 tax cut, the 12% bracket for single individuals must be extended to taxable income of up to $86,380.

So, my new benchmarks for the Republican plan are as follows (yours may differ). If the 12% bracket, for single individuals, ends at $55,611 or less, then the bill is garbage. If the bracket extends to the first $66,688 of taxable income, then it’s alright. And, if the 12% bracket for single filers applies to taxable incomes of up to $86,380, then I'm all in.

Tax brackets for married individuals filing jointly should be roughly double the single brackets. That means the 12% bracket for married couples should apply to taxable income of no less than $111,222 to break even, $133,376 for a modest tax cut, and more optimally to $172,760 to be in line with the administration's rhetoric.

If you think the Republican middle-class tax hike will be made up for by tax credits, first know that refundable tax credits are not in line with Republican principles. The refundable child tax credit, earned income tax credit, and education tax credit are wealth redistribution mechanisms, favoring special interests, supported by liberals and socialists, and should be abolished under a true Republican administration.

Leaving refundable tax credits in the tax code lends nothing towards simplification, or fairness. As I have long advocated, it is enough not to owe any income taxes at all, that should be as good as it gets. Going beyond this, into the realm of refundable tax credits, only leads to government dependence and unnecessary red ink.

To sum it up, if the 12% tax bracket doesn’t apply to taxable incomes of at least $66,688 for single individuals, and $133,376 for married couples, then the Republican tax plan is little more than a sham, favoring special interests, and will end up confiscating and redistributing even more wealth from the middle-class than it does today.

Alternative Plan:

As an alternative, Republicans could simply raise the standard deduction as proposed, keep the deduction for personal exemptions, maintain the current framework for itemizing, and lower tax rates starting from the bottom up. Add to this a business tax cut and you’ve got something that makes sense.

References:

Tax Foundation: Who Itemizes Deductions?

And around and around we go simply rearranging the deck chairs.

Careful, according to the Social Justice Warriors on Free Republic, only those “rich people” in California and New York get screwed by this plan.

They are likely to call you a whiner if you don’t agree with their hateful, and stupid, gibberish.

It lacks enough Republicans with the cajones to vote for it.

And what about charitable deductions? Eliminating them as a write off will destroy their ability to collect any donations.

And besides, they’re tired of “subsidizing” us anyway lol

“It lacks enough Republicans with the cajones to vote for it. “

I actually consider it a positive that Republicans may not vote for a TAX HIKE!

Charitable deductions remain.

But they are going after 401k limits, Mortgage Deduction and SALT deductions.

MASSIVE TAX HIKE ON THE MIDDLE CLASS!

Steve Forbes had a simple “post card” Form 1040. 20 some years ago. Simplify the process. Revenues will rise from such reform. Then cut the tax rate...

Is it really fair to post the whole article? You rob the author of most of the site traffic that would be generated by interested parties who want more info. That said great article & thanks for posting.

A year ago I was sure Steve Forbes would be a key part of President Trump’s economic team.

He would have been a great Veep, imo.

Don't snicker that is about enough for a cup of coffee every two weeks.

Noted.

This idiotic bill will raise taxes on the upper middle class. It is a ryan brady scam to help fund their donors big tax cut. Brady is a slimeball as traitorous as ryan. Both should be hanging from trees.

Actually, because they are also raising the bottom tax rate from 10% to 12%, that $165 of savings turns into a $20 tax hike.

LOL — If you’re not against the elimination of tax subsidies but think the elimination/reduction of subsidies is a good thing then you’re a Social Justice Warrior in your mind? Wow!

>

Steve Forbes had a simple “post card” Form 1040. 20 some years ago. Simplify the process. Revenues will rise from such reform. Then cut the tax rate...

>

There are those of us whom believe Fedzilla steals ENOUGH of our property. Two of the biggest CONS I can think of: 1) Still involuntary 2) Still doesn’t cover 100% of the public (use govt, PAY for govt).

No 16th and a NRST (nat. retail sales tax), the ONLY way to go.

I as well. Disappointed S. Forbes not given a greater role in the Trump Admin. At least in an advisory capacity. Oh well, there is still 7 years...//

Not opposed to the NRST. However, we just can’t get there from here. Would take years to explain it to most. We need tax reform now.

Subsidies?

Who is getting a subsidy?

These are called deductions so that people can pay less tax to the Feds.

You take those deductions away and they pay more tax.

Ergo, TAX INCREASE.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.