Skip to comments.

The Income Tax in 1913

ZeugmaWeb.com ^

| 1/26/2012

| Zeugma

Posted on 01/26/2012 9:02:45 PM PST by zeugma

The 1913 Income Tax

|

In 1913 the 16th Amendment to the U.S. Constitution was ratified. It was a fairly short amendment, as such things go, weighing in at a whopping 30 words. It reads as follows:

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several states, and without regard to any census of enumeration.

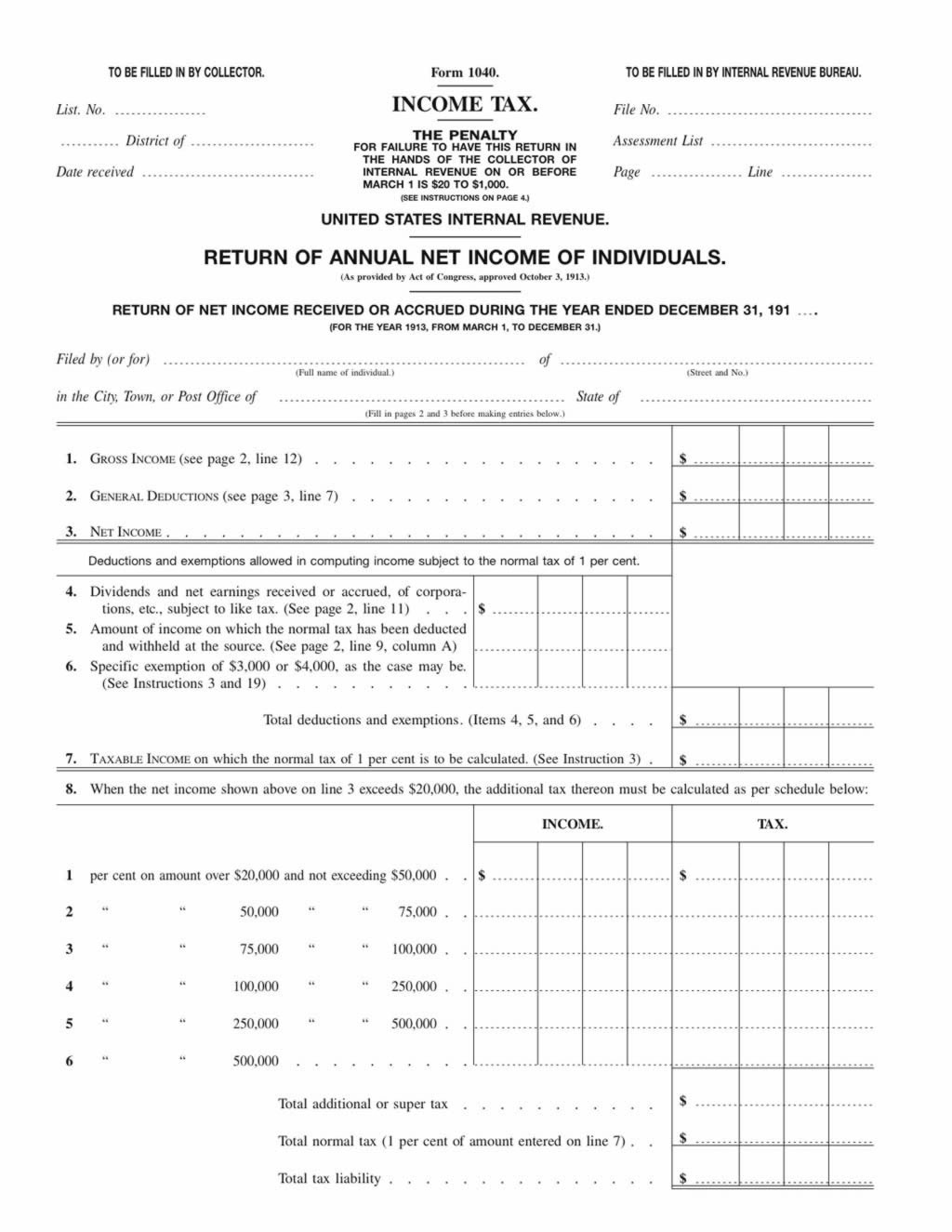

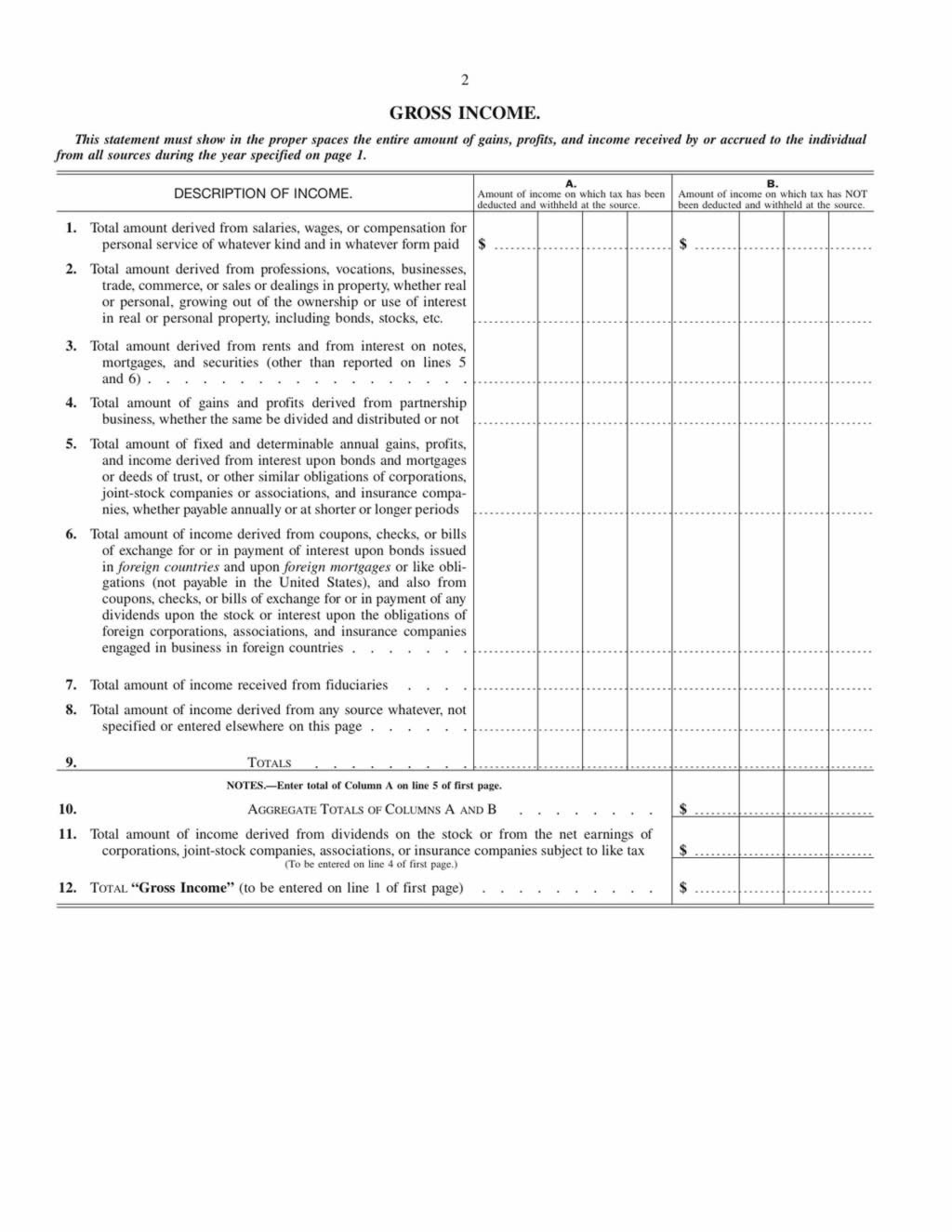

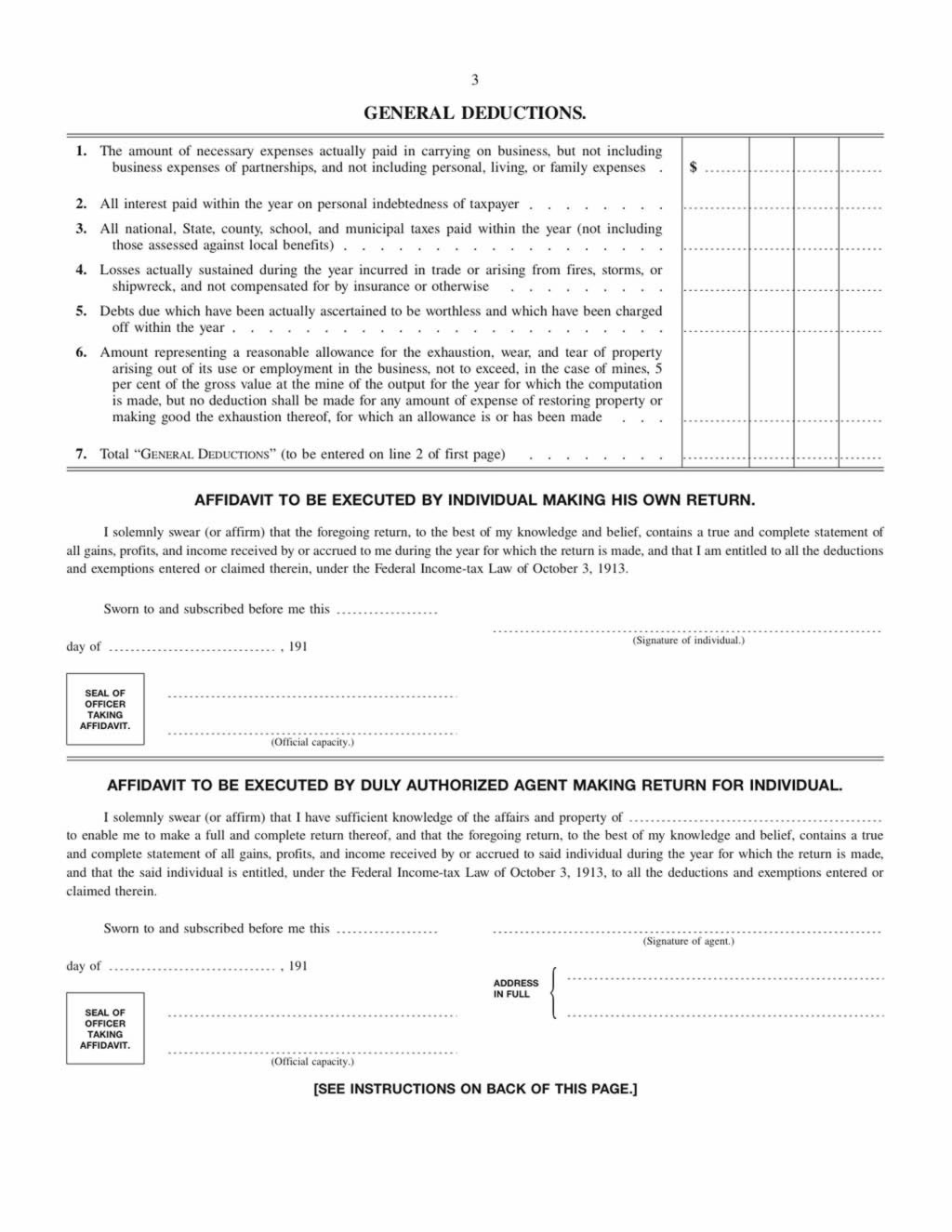

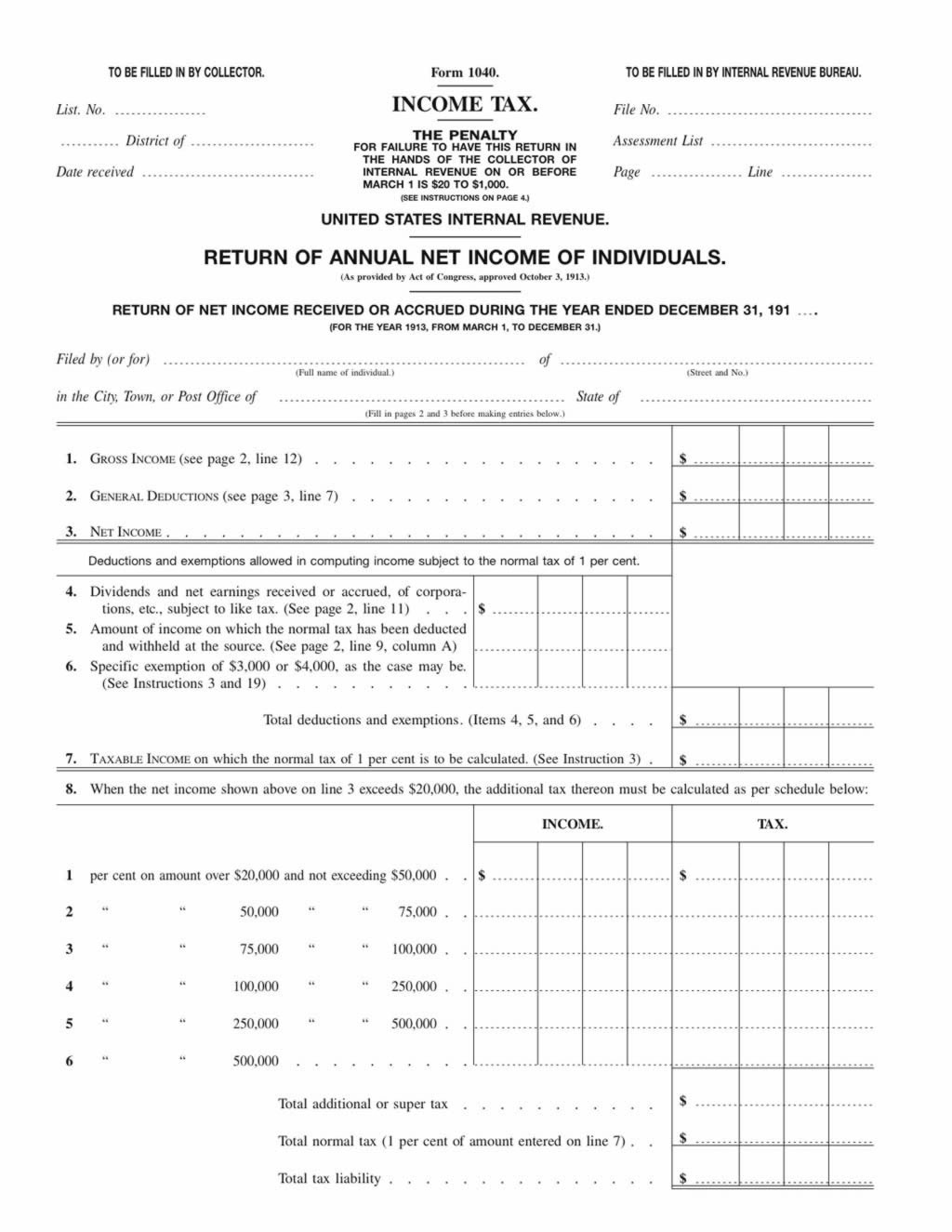

It was a simple little thing, with rather large consequences for the republic. Prior to the income tax being instituted, the United States government managed to fund itself with various excise taxes, and duties on imports. Afterwards, such taxes pale into insignificance to the revenue generated by the income tax. Those of us who actually pay taxes are familiar with the 1040 form. It was way back in 1913 that the IRS (Infernal Revenue Service) unvelied this form. The modern form (PDF) is a two page document that requires an instruction mantual that is 189 pages long. The 1913 form was actually longer, being three pages in length, however the instructions were printed on a single page of paper. Back in 1913, there were 6 tax brackets.Those making under $20,000 per year paid no tax. According to this inflation calculator, $20,000 in 1913 was equivalent to $435,543.79 in 2010. This first $20k was subtracted from your income so even if you made $30,000, you were only taxed on the last $10,000 of it. The rate was a whopping 1%. So, let's take that hypothetical person who made $30,000 in 1913. He would have paid $100 in taxes on it. If you run that through the above inflation calculator, you'll see that it would be equivalent to $2177.72 today. Well, that sounds like a lot of money until you consider that what that really means is that in today's dollars, someone would have to make $653,315.69 per year to pay that $2177.72 in income tax. How do you like them apples folks? |

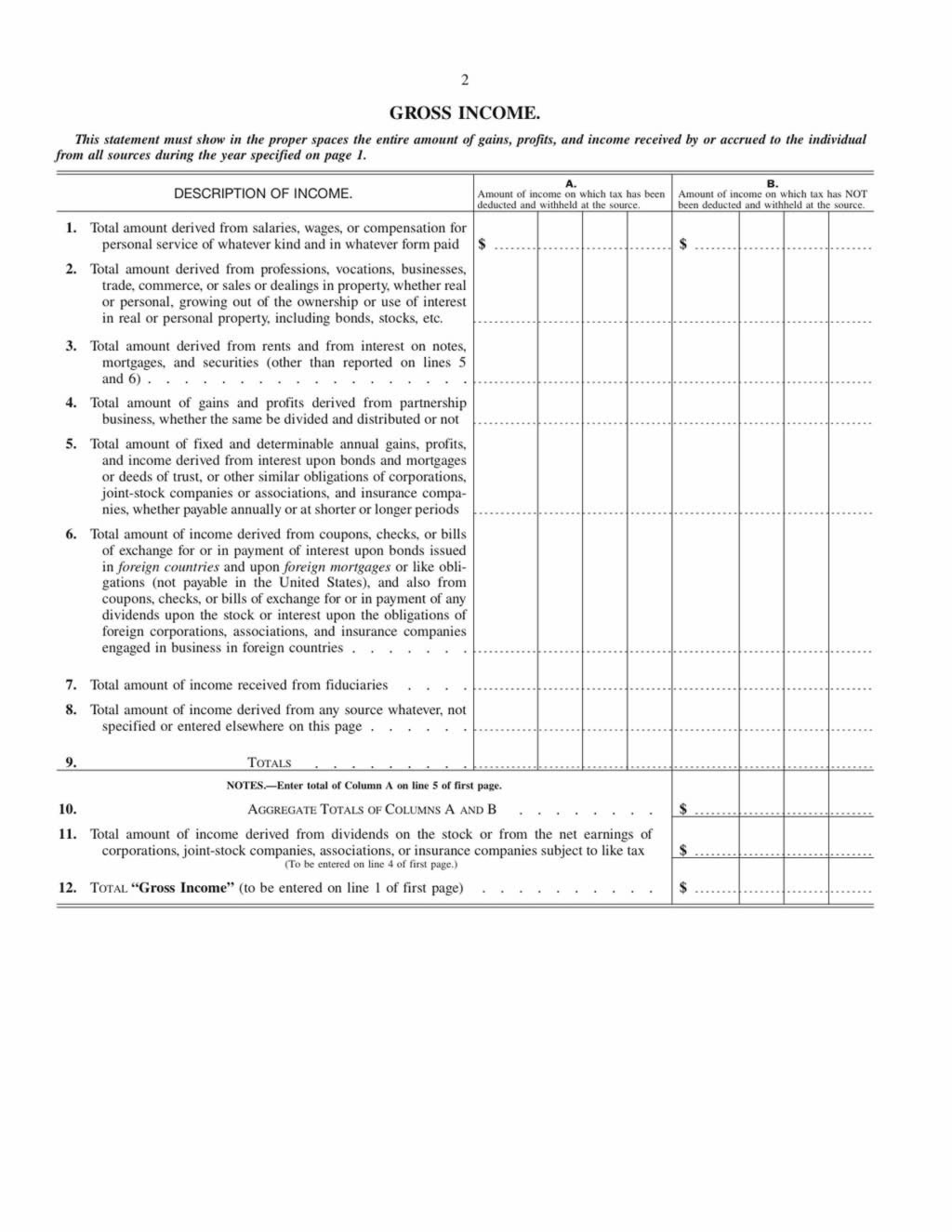

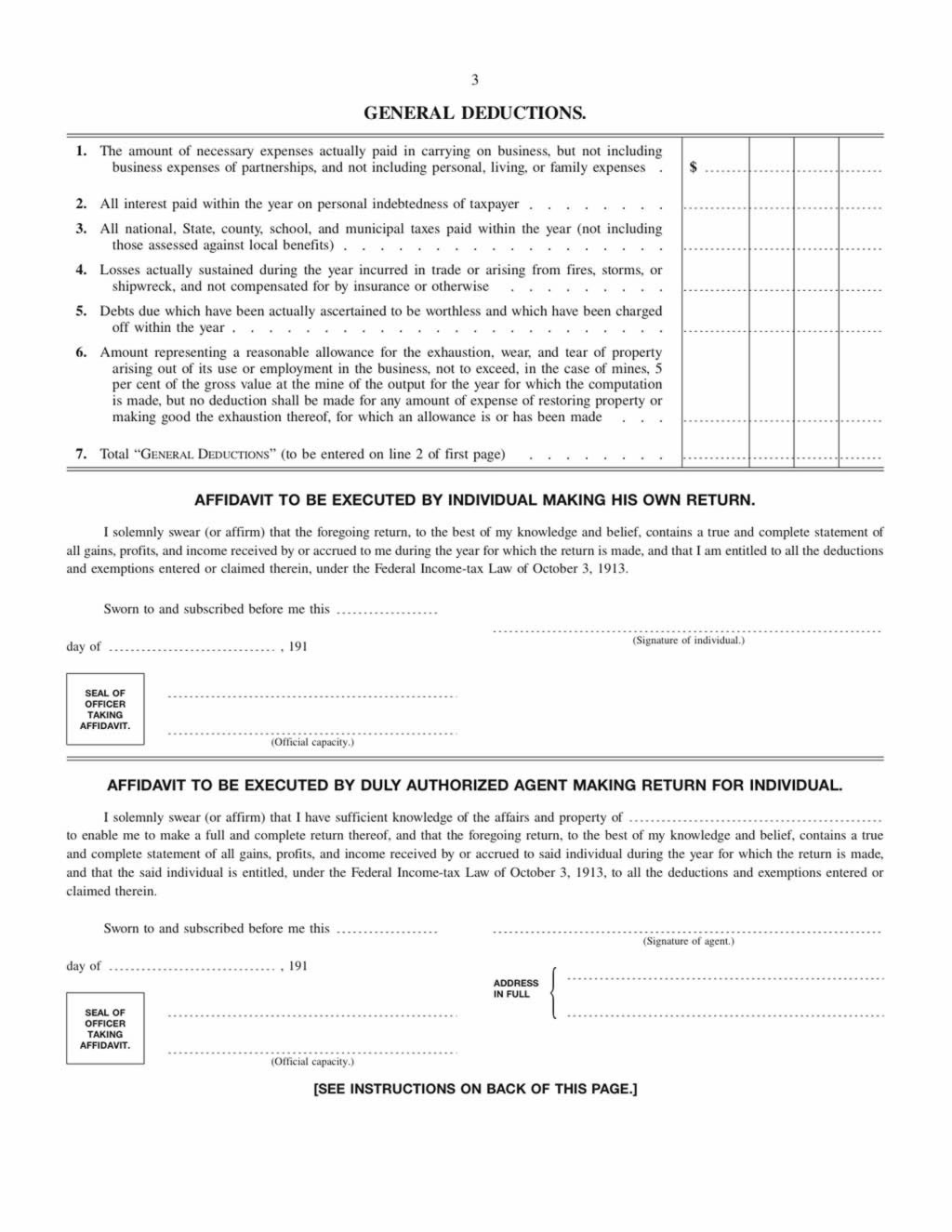

The four pages of the 1913 income tax form. Click on a page to see it full-sized.

TOPICS: Business/Economy; Government; History

KEYWORDS: 16thamendment; 1913; billofrights; godsgravesglyphs; incometax; theframers

I just posted this on my website and thought it might be of general interest to Freepers. The above post includes the entire page. I hope y'all enjoy it, and that it doesn't depress ya too much.

1

posted on

01/26/2012 9:02:48 PM PST

by

zeugma

To: zeugma

Interesting. My grandfather who was an attorney had a hand in writing the first income tax laws. In fact when Al Capone was first charged with income tax evasion my grandfather was briefly hired to represent Al.

2

posted on

01/26/2012 9:34:41 PM PST

by

UB355

(Slower traffic keep right)

To: zeugma

Even that is to complex.

3

posted on

01/26/2012 9:48:22 PM PST

by

mylife

(The Roar Of The Masses Could Be Farts)

To: zeugma

From newsmax.com...

The Tax Code: The Law That Never Was?You might undertake the effort to read the large 2 volume set if you haven't done so already.

I even had our library order it in special for me on an inter-library loan since it wasn't on the shelves.

4

posted on

01/26/2012 9:58:41 PM PST

by

philman_36

(Pride breakfasted with plenty, dined with poverty, and supped with infamy. Benjamin Franklin)

To: philman_36

I’m aware of that. In the original draft I said it was allegedly passed.

5

posted on

01/26/2012 10:31:16 PM PST

by

zeugma

(Those of us who work for a living are outnumbered by those who vote for a living.)

To: zeugma

In the original draft I said it was allegedly passed.I understand. Ridicule is hard to take.

Better to compromise your values and go with what's PC.

Don't take that last comment too harshly or personally, it wasn't meant to be.

I am of the opinion that the sitting POTUS was never qualified for the job to begin with, what with his purported Father never even having been a US citizen, so you can imagine what I've endured over the years.

I won't be PC. I eventually have to stand before God and I've already got enough on my plate for which I have to answer.

6

posted on

01/26/2012 10:46:02 PM PST

by

philman_36

(Pride breakfasted with plenty, dined with poverty, and supped with infamy. Benjamin Franklin)

To: mylife

Your response is 2014?

I know what might be said in answer to this; what the objections might be. But this is not the place to exhaust a controversy of this nature. I wish merely to observe here that this controversy over universal suffrage (as well as most other political questions) which agitates, excites, and overthrows nations, would lose nearly all of its importance if the law had always been what it ought to be. In fact, if law were restricted to protecting all persons, all liberties, and all properties; if law were nothing more than the organized combination of the individual’s right to self defense; if law were the obstacle, the check, the punisher of all oppression and plunder — is it likely that we citizens would then argue much about the extent of the franchise?

Under these circumstances, is it likely that the extent of the right to vote would endanger that supreme good, the public peace? Is it likely that the excluded classes would refuse to peaceably await the coming of their right to vote? Is it likely that those who had the right to vote would jealously defend their privilege? If the law were confined to its proper functions, everyone’s interest in the law would be the same. Is it not clear that, under these circumstances, those who voted could not inconvenience those who did not vote?

7

posted on

01/26/2012 11:01:00 PM PST

by

raygun

(http://bastiat.org/en/the_law DOT html)

To: zeugma

i wonder if anyone ever put the copies of amendment 16 that were shipped to each state side by side for comparison

it’s my understanding that the amendment was not the same in all states... invalidating it

8

posted on

01/27/2012 1:03:49 AM PST

by

sten

(fighting tyranny never goes out of style)

To: zeugma

Then there’s the problem of the 16th amendment’s ratification. Through an oversight, Ohio was never officially admitted to the Union until Eisenhower signed the admission papers in 1953 and marked it retroactive to 1803. The problem is that the Constitution does not allow ex post facto laws. This Ohio couldn’t be retroactively admitted and legally only joined the Union in 1953. Since it wasn’t a state in 1913, it’s ratification of the 16th amendment was null and void and thus Congress had no authority to enact an income tax.

9

posted on

01/27/2012 5:30:00 AM PST

by

BuffaloJack

(Defeat Obama. End Obama's War On Freedom.)

To: BuffaloJack

But one less state would have been a moot point since 6 more ratified it within a few weeks.

Ratification (by the requisite 36 states) was completed on February 3, 1913 with the ratification by Delaware. The amendment was subsequently ratified by the following states, bringing the total number of ratifying states to forty-two of the forty-eight then existing: (Or 41 of the 47 sans Ohio)

37. New Mexico (February 3, 1913)

38. Wyoming (February 3, 1913)

39. New Jersey (February 4, 1913)

40. Vermont (February 19, 1913)

41. Massachusetts (March 4, 1913)

42. New Hampshire (March 7, 1913), after rejecting the amendment on March 2, 1911

10

posted on

01/27/2012 5:44:32 AM PST

by

King Moonracer

(Bad lighting and cheap fabric, that's how you sell clothing.....)

To: zeugma

but you forgot to add a few things:

Today in 1895: Federal income tax ruled unconstitutional

April 8, 2010

Death and taxes and childbirth! There’s never a

convenient time for any of them! – Margaret Mitchell

As tax day fast approaches, it’s easy to forget that for most of our nation’s history, there was no federal income tax at all.

It wasn’t until 1894 that Congress gave us the first peacetime income tax as a popular way to fund the growing nation’s infrastructure needs. The law called for a flat 2% tax on all incomes above $4,000. The new tax affected less than 10 percent of the population, which probably explains its popularity.

But while the tax itself was relatively small, its political impact was huge. Thanks to the industrial revolution, wealth and power had become concentrated in the hands of a few individuals and corporations, and taxing the rich became a rallying cry for social activists and the growing Populist movement.

Of course, the folks with the money and power weren’t about to roll over, and in Pollock v. Farmers’ Loan and Trust Co., they argued that taxing real estate rental income was effectively a “direct tax” on property. This, the plaintiffs argued, violated a Constitutional provision that all direct taxes be apportioned among the states according to population. The case was quickly taken up on appeal by the U.S. Supreme Court.

On April 8, 1895, the Supreme Court declared that the federal income tax was unconstitutional, and the wealthy were off the hook…At least for a while. The Supreme Court’s unpopular decision eventually led to the ratification of the Sixteenth Amendment in 1913, which in no uncertain terms gave Uncle Sam the power to tax incomes “from whatever source derived.”

The quote from Margaret Mitchell (author of “Gone with the Wind”) can be found in Uncle Anthony’s Unabridged Analogies: Quotes & Proverbs for Lawyers and Lecturers, which is available at a 10% discount to Westlaw Insider readers. Check it out!

Print Share

This Post

3 Comments

Post a Comment

1.

Anthony Holt said: On June 12, 2010 | Reply

The Supreme Court is bound by the Constitution. In Article I, Section 8, the Constitution grants jurisdiction to the federal government to regulate three areas of commerce: “To regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes” – in other words, foreign commerce, interstate commerce, and Indian commerce.

The 16th Amendment, the income tax, has been the subject of many Supreme Court decisions. The IRS always cites to the Brushaber v. Union Pacific R.R. Co., 240 U.S. 1 (1916), to inform the public that the 16th Amendment was held to be constitutional by the Supreme Court. What the IRS doesn’t inform the public about Mr. Frank Brushaber, the central character in the Supreme Court case, is that he was a withholding agent for several foreign investors in the Union Pacific Railroad, acting as their fiduciary.

The Supreme Court, obviously being aware of all of the pertinent details, ruled in the Brushaber case that the federal government always had the power to tax income as an excise tax and, therefore, the 16th Amendment is constitutional.

The Supreme Court then ruled in the very next case it decided, Stanton v. Baltic Mining, 240 US 103 (1916), the following: “… that by the previous ruling it was settled that the provisions of the Sixteenth Amendment conferred no new power of taxation, but simply prohibited the previous complete and plenary power of income taxation possessed by Congress from the beginning from being taken out of the category of indirect taxation to which it inherently belonged and being placed in the category of direct taxation subject to apportionment by a consideration of the sources from which the income was derived…”. The ”previous ruling” cited in the Stanton decision was referring to the Brushaber decision.

A few years later the Supreme Court again ruled upon the 16th Amendment’s effect on the federal government’s power of taxation. In Peck & Co. v. Lowe, 247 US 165 (1918), the Supreme Court stated, in part: “The Sixteenth Amendment … does not extend the taxing power to new or excepted subjects …”.

The Supreme Court decisions above all inform everyone that no new power of taxation was granted to the federal government by the 16th Amendment. These decisions all inform everyone that the federal government always had the power to tax income from the beginning. Since no new power of taxation was granted to the federal government by the 16th Amendment and the federal government was held to always have had the power to tax income, then the revenue that’s being derived by the federal government from an income tax must come from one of the regulated commerce jurisdictions granted to the federal government by the Constitution – therefore, this revenue must come from foreign commerce, interstate commerce, or Indian commerce. After all, generating income is a commercial activity.

The Supreme Court ruled exactly that in Eisner v. Macomber, 252 U.S. 189 (1920), where the Court stated the following: “The 16th Amendment must be construed in connection with the taxing clauses of the original Constitution and the effect attributed to them before the Amendment was adopted.”.

By realizing that Mr. Frank Brushaber was a fiduciary for foreign investors in the Union Pacific Railroad, it becomes obvious that the revenue being derived by the federal government from the income tax must come from foreign commerce.

After the Brushaber and Stanton Supreme Court decisions were rendered, the Treasury Department issued its own decision, Treasury Decision 2313 (TD 2313). TD 2313 was issued to “collectors of internal revenue” and it stated that the Internal Revenue Form 1040 is to be used only by the fiduciary of a nonresident alien who has received interest from bonds and dividends on the stock of domestic (US) corporations on behalf of that nonresident alien. This Treasury Decision, which was based upon the Supreme Court decisions, confirms the foreign commerce nature of the income tax.

The statutes that make up the Internal Revenue Code must, therefore, be read in mind with the above Supreme Court decisions as well as the following Supreme Court decision:

“It is elementary law that every statute is to be read in the light of the Constitution. However broad and general its language, it cannot be interpreted as extending beyond those matters which it was within the constitutional power of the legislature to reach.” – McCullough v. Com of Virginia, 172 U.S. 102 (1898).

2.

3.

4. http://www.westlawinsider.com/today-in-legal-history/today-in-1895-federal-income-tax-ruled-unconstitutional/

Supreme court cases against the 16th amendment

http://usa-the-republic.com/revenue/true_history/Chap4.html

Chapter 4 of the TRUTH!

The TRUTH About Income!

In the last chapter we learned the truth about income tax. In this chapter we will learn the truth about the real definition of income itself! Nowhere in the Internal Revenue Code (IRC) is income defined.

So the big question becomes, what IS income? And did you have any that was taxable?

The word “income” is not defined in the Internal Revenue Code, as the court stated in U.S. v. Ballard 535 F.2d 400 at 404, but the Supreme Court has defined it for us in numerous cases.

Stratton’s Independence v. Howbert 231 U.S. 399 (1913) “As has been repeatedly remarked, the corporation tax act of 1909 was not intended to be and is not, in any proper sense, an income tax law. This court has decided in the Pollock Case that the income tax of 1894 amounted in effect to a direct tax upon property, and was invalid because not apportioned according to population, as prescribed by the Constitution. The act of 1909 avoided this difficulty by imposing not an income tax, but an excise tax upon the conduct of business in a corporate capacity, measuring, however, the amount of tax by the income of the corporation, . . .”

“As to what should be deemed “income” within the meaning of Sec. 38, it of course need not be such an income as would have been taxable as such, for at that time (the 16th amendment not having been as yet ratified) income was not taxable as such by Congress without apportionment according to population, and this tax was not apportioned. Evidently Congress adopted the income as the measure of the tax to be imposed with the respect to the doing of business in corporate form because it desired that the excise should be imposed, approximately at least, with regard to the amount of benefit presumably derived by such corporations from the current operations of the government.”

The Supreme Court defines “income tax”, as an excise tax “imposed with respect to the doing of business in corporate form”. If you are not engaged in any corporate activities then you are not liable for an “excise income tax.” This Supreme Court decision also states that Congress cannot tax an individual’s income directly. All direct taxes must be imposed on the states with apportionment. U.S. Constitution Art. 1 Sect 2. Cl. 3 and Sect 9 Cl. 4.

The above case applies to corporations, so if you are not a corporation, then the Corporation Excise tax does not apply to you. The important thing here is the clarification that the income tax is an excise tax, imposed upon the doing of business in corporate form. An the tax is determined by how much income is received. But WHAT is income? The Supreme Court again tells us:

Eisner vs. Macomber 252 U.S. 189 pg 205 (1920) The Sixteenth Amendment must be construed in connection with the taxing clauses of the original Constitution and the effect attributed to them before the Amendment was adopted. In Pollock v. Farmers’ Loan and Trust it was held that taxes upon rents and profits of real estate and upon returns from investments of personal property were in effect direct taxes upon the property from which the income arose, imposed by reason of ownership; and that Congress could not impose such taxes without apportioning them among the states according to population, as required by Art 1 Sect. 2 Cl. 3 and Sect. 9 Cl. 4 of the original Constitution.

Afterwards, and evidently in recognition of the limitations upon the taxing power of Congress thus determined, the Sixteenth Amendment was adopted: . . . As repeatedly held, this did not extend the taxing power to new subjects, but merely removed the necessity which might otherwise exist for an apportionment among the states of taxes laid on income. . . . it becomes essential to distinguish between what is and what is not “income’, as the term is there used;

After examining dictionaries in common use we find little to add to the succinct definition adopted in two cases arising under the Corporation (Excise) Tax Act of 1909 (Stratton’s Independence v. Howbert 231 US 399, 415; Doyle v. Mitchell Bros. Co. 247 US 179, 185)

“Income may be defined as the gain derived from capital, from labor, or from both combined”, provided it be understood to include profit gained through a sale or conversion of capital assets, to which it was applied in the Doyle case pp. 183, 185.

“Derived — from — capital”; — “the gain — derived — from — capital,” etc. Here we have the essential matter: not a gain accruing to capital, not a growth or increment of value in the investment; but a gain, a profit, something of exchangeable value proceeding from the property, severed from the capital however invested or employed, and coming in, being “derived,” that is, received or drawn by the recipient (the Taxpayer) for his separate use, benefit and disposal; — that is income derived from property. Nothing else answers the description.

That Congress has power to tax stockholders upon their property interests in the stock of corporations is beyond question; and that such interests might be valued in view of the condition of the company, including its accumulated and undivided profits, is equally clear. But this would be taxation of property because of ownership, and hence would require apportionment under the provisions of the Constitution, is settled beyond peradventure by previous decisions of this court.

Clearly, the definition of corporate income means a gain or profit received from an excise taxed activity. But does this same definition apply to individual income tax? To the Supreme Court again:

Merchants’ Loan & Trust Co. v. Smietanka 255 U.S. 509 (1921) “It is obvious that these decisions in principle rule the case at bar if the word “income” has the same meaning in the Income Tax Act of 1913 that it had in the Corporation Excise Tax Act of 1909, and that it has the same scope of meaning was in effect decided in Southern Pacific Co. v. Lowe 247 U.S. 330, 335, where it was assumed for the purposes of decision that there was no difference in its meaning as used in the act of 1909 and in the Income Tax Act of 1913. There can be no doubt that the word must be given the same meaning and content in the Income Tax Acts of 1916 and 1917 that it had in the act of 1913. When to this we add that in Eisner v. Macomber, supra, a case arising under the same Income Tax Act of 1916 which is here involved, the definition of “income” which was applied was adopted from Strattons’ Independence v. Howbert, arising under the Corporation Excise Tax Act of 1909, with the addition that it should include “profit gained through sale or conversion of capital assets,” there would seem to be no room to doubt that the word must be given the same meaning in all the Income Tax Acts of Congress that was given to it in the Corporation Excise Tax Act, and that what that meaning is has now become definitely settled by decisions of this Court.”

The word “income” has the same meaning in ALL the income tax acts of Congress. That meaning has been declared to be corporate profits and gains and has been definitely settled by the Supreme Court. So, did you have income that is taxable? Did you have a gain or profit from a corporate activity? Remember that the income tax is an excise tax on the doing of business in a corporate capacity. That is the ONLY way that you can receive taxable income, as legally defined by the Supreme Court.

If you relied on these never overturned Supreme Court rulings in your beliefs, does your reliance on these plain rulings constitute a frivolous position? The IRS says it does!

So, if you had NO corporate income tax liability for this year, you had zero “income” as legally defined by the U.S. Supreme Court. A corporation is NOT taxed on ALL its income, from whatever source. It is only taxed on it’s profit. If that is the case then why are YOU taxed on ALL your income from whatever source? You are also allowed to deduct SOME expenses. Does that mean that if you work for a corporation and you exchange 40 hours of your labor for $600, that you had $600 of profit, minus deductions? If a corporation exchanges $600 for 40 hours of your labor, did they also have a profit? NO! They can claim ALL your labor as a deductible operating expense. So why is it that why you exchange one property (your labor) for another property ($600) that in that exchange, you had a profit and the corporation had a deduction? Why is it a profit for you but not for the corporation? The answer is that it is not a profit for EITHER of you! And therefore it is not taxable income, as defined by the Supreme Court.

The Supreme Court has ruled:

Eisner vs. Macomber 252 U.S. 189 pg 205 (1920): “ The Sixteenth Amendment must be construed in connection with the taxing clauses of the original Constitution and the effect attributed to them before the Amendment was adopted. . . .taxes upon rents and profits of real estate and upon returns from investments of personal property (labor) were in effect direct taxes upon the property from which the income arose, . . . that Congress could not impose such taxes without apportioning them among the states”

The Supreme Court has plainly stated that an individual’s income cannot be taxed directly: But an individual’s income CAN be taxed with an excise tax, IF it was received in a corporate activity. More on this later.

Stratton’s Independence v. Howbert 231 U.S. 399 (1913) “As has been repeatedly remarked, the corporation tax act of 1909 was not intended to be and is not, in any proper sense, an income tax law.

Corporate “income” (profits and gains) CAN be taxed with an excise tax, but the income itself is not taxed because it is property. Therefore income tax is not on income, it is on profits. It is not an income tax law, it is a profits tax law. Are you engaged in, or did you receive income in connection with, any corporate activities? Receipts received from labor or private investments are not corporate “income” and therefore do not fall within the legal definition of “income” as defined by the Supreme Court.

SUMMARY

“Income” is legally defined as a corporate gain of profit in the Internal Revenue Code. Nowhere is there any different definition.

The definition of income used in the Corporate Excise Tax Act of 1909 is the same definition used in ALL the income tax statutes.

“Gross income” would then be the total income of a corporation, from all sources.

“Taxable income” would therefore be corporate gross income, minus allowable deductions. Also known as profit. If a corporation had no profit, then it had no taxable income. If you are an officer of a corporation, then you had individual income that is taxable.

Anytime the Internal Revenue Code mentions the word “income” it is talking about corporate income.

More info on this is in the chapter on the 16th Amendment.

11

posted on

01/27/2012 6:07:02 AM PST

by

phockthis

(http://www.supremelaw.org/fedzone11/index.htm ...)

To: mylife

I’d like to see that form, but with a 10% rate.

If the Govt can’t live off that 10%, then it needs to cut spending until it can, starting with all the unconstitutional entities. It’s waaaay passed time for some tough-love and cold-turkey.

To: philman_36

Actually, the reason I didn’t go with “allegedly” in the document I posted is because arguing that was not the purpose of the webpage. At some point in the future, I may flesh that out and link to it at that point.

13

posted on

01/27/2012 6:51:34 AM PST

by

zeugma

(Those of us who work for a living are outnumbered by those who vote for a living.)

To: zeugma

I stand corrected.

At some point in the future, I may flesh that out and link to it at that point.

I shall endeavor to keep an eye out for it.

14

posted on

01/27/2012 7:44:50 AM PST

by

philman_36

(Pride breakfasted with plenty, dined with poverty, and supped with infamy. Benjamin Franklin)

To: zeugma; Pharmboy

15

posted on

01/29/2012 11:10:50 AM PST

by

SunkenCiv

(FReep this FReepathon!)

To: zeugma

The entire concept of “income” taxes is abhorrent. That the fruit of a person’s labor or creativity is owed to the State is but a form of legalized slavery.

16

posted on

01/29/2012 11:14:23 AM PST

by

abb

("What ISN'T in the news is often more important than what IS." Ed Biersmith, 1942 -)

To: zeugma

17

posted on

01/29/2012 11:20:32 AM PST

by

skinkinthegrass

(kill all the terrorists, protect all the borders, punch all the liberals :^)

To: abb

That the fruit of a person’s labor or creativity is owed to the State is but a form of legalized slavery.Absolutely. That's an argument I've made many times.

18

posted on

01/29/2012 7:51:13 PM PST

by

zeugma

(Those of us who work for a living are outnumbered by those who vote for a living.)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson