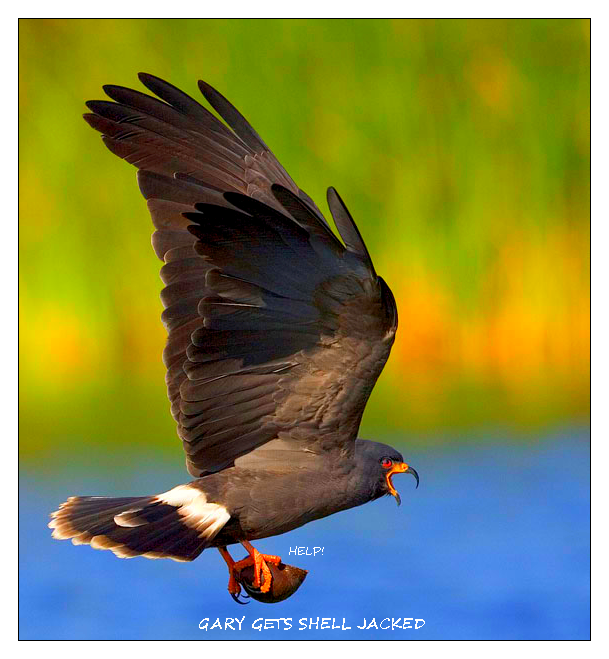

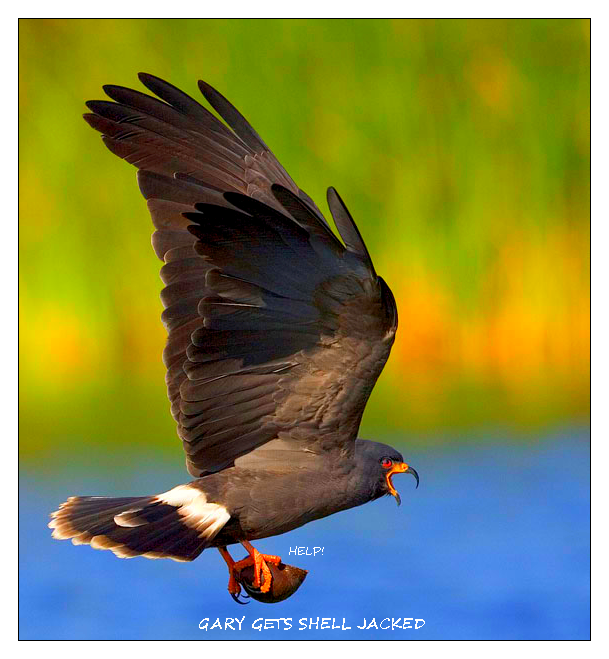

Click the Pic Thank you, JoeProBono

Gary is in Terrible Danger!

Follow the Exciting Adventures of Gary the Snail!

Abolish FReepathons -- Go Monthly

If you sign up, a sponsor will donate $10

Posted on 11/10/2011 1:57:26 PM PST by SeekAndFind

With interest rates on its sovereign debt surging well above seven per cent, there is a rising risk that Italy may soon lose market access. Given that it is too-big-to-fail but also too-big-to-save, this could lead to a forced restructuring of its public debt of €1,900bn. That would partially address its “stock” problem of large and unsustainable debt but it would not resolve its “flow” problem, a large current account deficit, lack of external competitiveness and a worsening plunge in gross domestic product and economic activity.

To resolve the latter, Italy may, like other periphery countries, need to exit the monetary union and go back to a national currency, thus triggering an effective break-up of the eurozone.

Until recently the argument was being made that Italy and Spain, unlike the clearly insolvent Greece, were illiquid but solvent given austerity and reforms. But once a country that is illiquid loses its market credibility, it takes time – usually a year or so – to restore such credibility with appropriate policy actions. Therefore unless there is a lender of last resort that can buy the sovereign debt while credibility is not yet restored, an illiquid but solvent sovereign may turn out insolvent. In this scenario sceptical investors will push the sovereign spreads to a level where it either loses access to the markets or where the debt dynamic becomes unsustainable.

So Italy and other illiquid, but solvent, sovereigns need a “big bazooka” to prevent the self-fulfilling bad equilibrium of a run on the public debt. The trouble is, however, that there is no credible lender of last resort in the eurozone.

(Excerpt) Read more at blogs.ft.com ...

I guess Bush cut taxes on Italy’s millionaires also. The Bush tax cuts. That’s the only explanation.

I'm pretty sure they'll NOT get the German people to sign up for that.

Hmmmm...rest assured that when they get back to that Lira, and the cost of travel to Italy drops, I’ll be planning a trip.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.