Skip to comments.

Six GOP Senators Send Up Warning Flares On House Tax-Reform Bill

Hotair ^

| 11/07/2017

| Ed Morrissey

Posted on 11/07/2017 7:56:57 AM PST by SeekAndFind

I don’t want to say I told you so, but … you know. After taking a look at the House Republican version of tax reform, their counterparts in the Senate plan to basically ignore it and write their own version. Six Senate Republicans have expressed serious reservations about the direction and details of the plan, which prompts questions again about GOP preparation for another major agenda item.

And gosh, it all sounds so familiar, The Hill notes:

The House GOP tax-reform package has put Senate Republicans in a tough spot, much like the House-passed ObamaCare repeal bill did earlier this year. …

At least a half-dozen Senate Republicans have already raised concerns about various proposals in the tax measure, setting the stage for arduous negotiations in the upper chamber.

They might just skip over all the arguments over the House proposal and go directly to writing their own version:

Senate GOP leaders have assured their colleagues that the Senate Finance Committee will write its own bill and urged them to withhold judgment on the House measure.

“They’ve told us the House bill is just a shell and we’ll have our own bill. They’ve asked to hold off on commenting and to not pick it apart,” said a Republican senator summarizing the instructions that Senate Majority Leader Mitch McConnell (R-Ky.) gave during a Thursday lunch meeting.

That takes another page from ObamaCare, but from its passage rather than the futile efforts to repeal it earlier this year. According to Article I, Section 7 of the Constitution, “all bills for raising revenue shall originate in the House of Representatives[.]” Nancy Pelosi and Harry Reid got around that by hollowing out the House bill and passing a Senate version of the Affordable Care Act, which prompted an unsuccessful lawsuit from House Republicans over the origination clause. If you can’t beat ’em, join ’em.

So there are lots of opportunities for déjà vu in the tax reform effort, but mainly from earlier this year. Politico predicts that even writing their own bill might prove difficult for Senate Republicans, especially given the need to meet the requirements of reconciliation:

Some of the differences will be rooted in budget constraints that bar Senate Republicans from adding to the federal debt after 10 years under the filibuster-proof process they’re following, known as reconciliation. That’s likely to be a major consideration when it comes to permanently cutting the corporate tax rate to 20 percent, as the House wants to do.

Cutting the tax that deeply comes with an estimated $1.5 trillion price tag. House Ways and Means Republicans — who will start formally working on their legislation in committee on Monday — achieved that permanent reduction with offsets that include delaying their plan to eliminate the estate tax, ending a couple of family-related tax benefits and sunsetting more generous business write-offs after five years. …

Sens. Bob Corker (R-Tenn.) and Susan Collins (R-Maine) have raised budget concerns, and there’s less GOP angst about the estate tax in the Senate than in the House. Both Collins and Sen. Mike Rounds (R-S.D.) have said it should remain.

In addition, Sens. Marco Rubio (R-Fla.) and Mike Lee (R-Utah) want to boost the child tax credit much more than the House bill does. And Sens. John McCain (R-Ariz.), Jeff Flake (R-Ariz.) and Rand Paul (R-Ky.) simply appear difficult to predict.

None of this was tough to predict. The question this prompts is why House and Senate Republicans didn’t work more closely together to produce a joint effort in the first place. We will mark the one-year anniversary of the 2016 election this week, meaning that the GOP had almost exactly a full year to prepare a comprehensive tax bill that would garner enough approval within the caucus to succeed. Instead, as I noted in my column two weeks ago, it still appears that no one has quarterbacked this properly at all.

Unless all of this déjà vu comes to a sudden end soon, get ready for another disaster.

TOPICS: Business/Economy; Culture/Society; Front Page News; Government

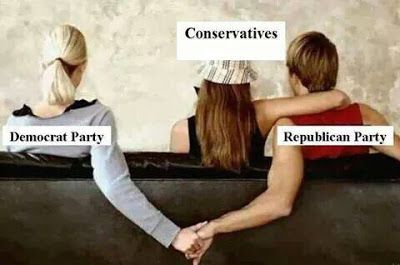

KEYWORDS: gop; pos; senate; tax; taxcuts; taxes; taxreform; uniparty

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-44 next last

To: KC_Lion

Yeabut...

...only if we had ample opportunity to shoot first.

21

posted on

11/07/2017 9:13:35 AM PST

by

HKMk23

(You ask how to fight an idea? Well, I'll tell you how: with another idea!)

To: SeekAndFind

President Trump is showing the Republican party how to win but individual Republican egos will not allow them to join the president and work for the American people.

Too sad and what a missed opportunity.

22

posted on

11/07/2017 9:25:46 AM PST

by

The Deplorable Miss Lemon

(If illegals are here to do the jobs Americans won't do why are so many on welfare?)

To: SeekAndFind

We’re effectively down to 51, with Rand on the disabled list for a while.

23

posted on

11/07/2017 9:55:25 AM PST

by

TBP

(Progressives lack compassion and tolerance. Their self-aggrandizement is all that matters.)

To: apillar

“Personally I think there is such a loony #NeverTrump wing of the Republican party, especially in the Senate, that some members are more than willing to even sacrifice their own seats and hand both houses of congress to the democrats in 2018 in the hopes that democrat will, “do the dirty work” they are afraid to do and seriously attempt to impeach and remove Trump or, baring that, simply stop Trump’s agenda cold, including all court nominations so he has nothing to run on it 2020.”

Well, you had a Republican ex-President vote for the Dem candidate for President, so your scenario is not at all far-fetched.

Oh, and all of them, including 41, should be strung up.

24

posted on

11/07/2017 9:56:44 AM PST

by

Ancesthntr

("The right to buy weapons is the right to be free." A. E. van Vogt)

To: SeekAndFind

There will be no tax cuts with this Congress. We need more conservatives. And we need to get rid of Ryan and McConnell.

To: SeekAndFind

It’s not that they don’t work together, it’s that they do and the target is the Trump agenda. Hasn’t that been clear from day one? Folks, tax reform isn’t happening, the only question is who is going to be the Senator to kill it? John McCain, Lisa M and Collins because it’s not bi-partisan or Rand Paul, Corker and Flake because it adds to the deficit or McCain, Flake and Corker because, “Trump!”? The only reason why the Repukes may hold Congress is because of the Dems talking about Impeachment. If they threw that away the Repukes would get thoroughly defeated and I would cheer. Then Trump can negotiate with the Dems. He wouldn’t get everything but he would get somethings and that would be better than the Repukes. As it stands, the best chance is do replace any Repukes who are up for re-election in 2018 with hardcore Trump supporters because believe me, if the same batch get in they’ll be the new people who constantly criticize Trump. They’re just not doing it now because they’ve got an election coming up.

To: SeekAndFind

There seems to be broad based agreement among Republican's in the House & Senate to cut Corporate Tax Rates to 20% and it seems to me were a simple bill introduced in both the House & Senate to do just that, it'd pass.

So why don't the House & Senate start there and work on properly reforming the Income Tax (or replacing it all together) later?

I mean c'mon already they're making this much harder than it needs to be jamming Corporate and Personal Income Tax "reform" together in the same bill.

27

posted on

11/07/2017 10:24:46 AM PST

by

usconservative

(When The Ballot Box No Longer Counts, The Ammunition Box Does. (What's In Your Ammo Box?))

To: headstamp 2; All

28

posted on

11/07/2017 10:30:17 AM PST

by

musicman

(The future is just a collection of successive nows.)

To: headstamp 2

29

posted on

11/07/2017 10:41:16 AM PST

by

Caipirabob

(Communists...Socialists...Fascists & AntiFa...Democrats...Traitors... Who can tell the difference?)

To: Georgia Girl 2

This isn’t tax reform. This is moving some numbers around so that some people’s taxes go up and others have their taxes go down.

Real reform is impossible for a number of reasons. The two biggest are 1. they failed to repeal Obamacare and 2. they have to pass this via reconciliation.

30

posted on

11/07/2017 10:41:38 AM PST

by

WVMnteer

To: usconservative

You can’t pass it via reconciliation. A huge corporate tax cut has to be revenue neutral.

31

posted on

11/07/2017 10:42:54 AM PST

by

WVMnteer

To: SeekAndFind

I do not know if this is a good tax bill. I defer to folks like Rand Paul and Mike Lee on these kinds of things. Let’s not group principled opposition to a bill with flat-out obstruction, which is what McCain, Flake, Corker and Collins are likely to do.

At the end of the day, keep in mind that the inflation tax, caused by Fed destruction of our currency, and deficit spending, will do far more harm to all of us, than a few % in income tax. I do not know how we can avoid instituting tariffs on imports at our current spending levels, in order to balance the budget. We know there is no intention to even cut a nickel of govt spending!

32

posted on

11/07/2017 11:12:55 AM PST

by

SecAmndmt

(Arm yourselves!)

To: TTFlyer

33

posted on

11/07/2017 11:13:04 AM PST

by

shove_it

(Huxley, Orwell and Rand warned us of Obama's America)

To: SecAmndmt

The Business Side of this tax plan is OK ( Other than the Small Businesses for some reason, are not getting the same cuts as the big corporations, but they get a cut nonetheless ).

The INDIVIDUAL tax plan is CONVOLUTED and filled with so many fine prints that the more I study it, the more I dislike it.

To: Windflier

We do need another Tea Party....except instead of throwing tea into the harbor this time it will be Congressmen and Senators.

35

posted on

11/07/2017 11:57:41 AM PST

by

Red in Blue PA

(Fascism and socialism are cousins. They both disarm their citizens.)

To: Red in Blue PA

We do need another Tea Party....except instead of throwing tea into the harbor this time it will be Congressmen and Senators. MAGA!!

36

posted on

11/07/2017 2:37:00 PM PST

by

Windflier

(Pitchforks and torches ripen on the vine. Left too long, they become black rifles.)

To: Lurkinanloomin

Wow, you called it. Finding out so many with R by their name were really Democrats has been a bitter pill for us.

To: SeekAndFind; All

>

According to Article I, Section 7 of the Constitution, “all bills for raising revenue shall originate in the House of Representatives[.]” Nancy Pelosi and Harry Reid got around that by hollowing out the House bill and passing a Senate version of the Affordable Care Act, which prompted an unsuccessful lawsuit from House Republicans over the origination clause.

>

The ‘logic’, of which, I can never hope to understand: If the House passes a bill and the Senate GUTS said bill and replaces the verbiage that original bill ceases to exist.

IOW, if anyone in the REAL world had done the same w/ any other bill/contract, they’d be in Club Fed. faster than Skelator mixing her meds.

38

posted on

11/07/2017 4:41:09 PM PST

by

i_robot73

("A man chooses. A slave obeys." - Andrew Ryan)

To: SeekAndFind

The GOP will pass a tax reform bill this year. The best tax policy for our economy is broad tax rate cuts that generate broad incentives for work, education, and investment for all Americans. Special tax breaks for homeowners and state income taxes generate narrow incentives to buy houses and increase state government spending, but they don’t build incentives that generate strong economic growth and job growth in the national economy. Home renters get taxed more to subsidize home buyers, while people in FL and PA get taxed more to pay for big federal tax breaks for Silcon Valley billionaires who get to deduct millions in state income taxes. Why should people outside of CA and NY have to pay more federal taxes to subsidize vast, overstaffed state government bureaucracies working on unnecessary programs in California and New York? The answer of course, is they shouldn’t have to subsidize state and local government spending in other states. So that’s what the House bill is trying to do. It’s trying to generate broad incentives for economic growth that benefit all Americans in all states, which is best for our economy in the long run. It’s the starting point for negotiations.

But of course that kind of bill would be costly to some people who own expensive homes and pay lots of state income taxes in states like CA,NY, and TX. So to get the votes to pass a tax reform bill, the House GOP is going to have to keep a certain amount of specific tax breaks in the final bill that passes and is signed by President Trump. Most likely, this will end in a compromise bill that limits the amount of federal tax deductions for state income taxes and home mortgage interest, but doesn’t eliminate either deduction completely. I think the limits will end up being fairly high—something like a $70,000 limit on the state income tax deduction and a $50,000 limit on the home mortgage interest deduction. Then we won’t have middle class people subsidizing huge state tax deductions for Silicon Valley billionaires and professional athletes, but everyone in the middle class will retain all of their current federal tax deductions and get a big cut in tax rates. People with incomes in the millions in high-tax states will pay more taxes, but there will be no political cost for that tax increase, and if a few GOP reps from those places vote against the bill, so be it. It will still pass and provide big benefits for the vast majority of Americans.

39

posted on

11/08/2017 6:00:15 AM PST

by

socialism_stinX

(Not only does socialism stink, but when given enough time it wrecks any national economy.)

To: apillar

I don't think The Swamp understands.

The Uniparty is going to get removed before President Trump gets removed.

40

posted on

11/08/2017 6:02:09 AM PST

by

kiryandil

(Never pick a fight with an angry beehive)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-44 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson