Skip to comments.

The Laffer Curve and Limits to Class Warfare Tax Policy

Townhall.com ^

| September 21, 2014

| Daniel J. Mitchell

Posted on 09/21/2014 11:29:08 AM PDT by Kaslin

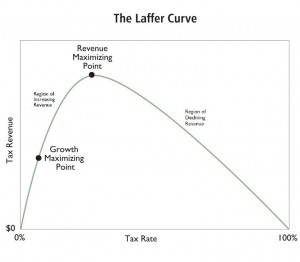

I’m a big advocate of the Laffer Curve.

Simply stated, it’s absurdly inaccurate to think that taxpayers and the economy are insensitive to changes in tax policy.

Yet bureaucracies such as the Joint Committee on Taxation basically assume that the economy will be unaffected and that tax revenues will jump dramatically if tax rates are boosted by, say, 100 percent.

In the real world, however, big changes in tax policy can and will lead to changes in taxable income. In other words, incentives matter. If the government punishes you more for earning more income, you will figure out ways to reduce the amount of money you report on your tax return.

In the real world, however, big changes in tax policy can and will lead to changes in taxable income. In other words, incentives matter. If the government punishes you more for earning more income, you will figure out ways to reduce the amount of money you report on your tax return.

This sometimes means that people will choose to be less productive. Why bust your derrière, after all, if government confiscates a big chunk of your additional earnings? Why make the sacrifice to set aside some of your income when the government imposes extra layers of tax on saving and investment? And why allocate your money on the basis of economic efficiency when you can reduce your taxable income by dumping your investments into something like municipal bonds that escape the extra layers of tax?

Or people can decide to hide some of the money they earn from the grasping claws of the IRS. Contractors can work off the books. Workers can take wages under the table. Business owners can overstate their expenses in order to reduce taxable income.

To reiterate, people respond to incentives. And that means you can’t estimate what will happen to tax revenues simply by looking at changes in tax rates. You also need to look at what’s happening to the amount of income people are willing to both earn and report.

Which is why I’m interested in some new research from two Canadian economists, one from the University of Toronto and one from the University of British Columbia. They looked at how rich people in Canada responded when their tax rates were altered.

Here are some excerpts from the study, published by the National Bureau of Economic Research.

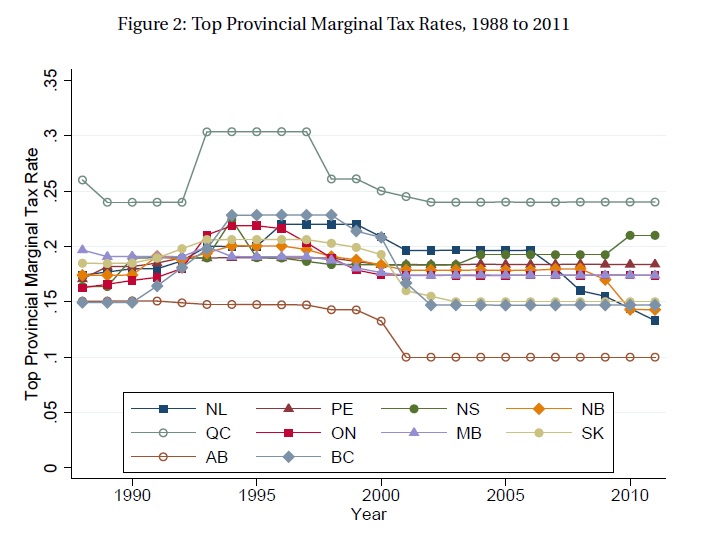

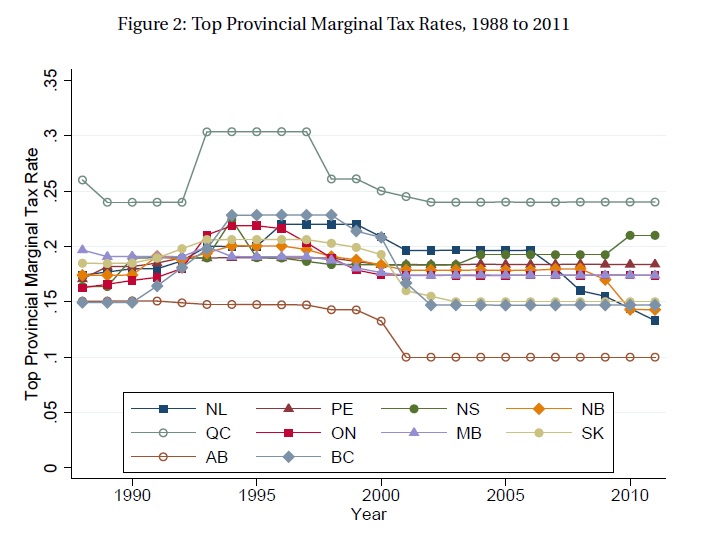

In this paper we estimate the elasticity of reported income using the sub-national variation across Canadian provinces. …Comparing across provinces and through time, we find that elasticities are large for incomes at the top of the income distribution…  The provincial tax rates for high earners vary strongly across the country, ranging from a low of 10 percent in Alberta to a high of 25.75 in Quebec. …at the top of the income distribution…these taxpayers have access to substantial financial advice that may facilitate tax avoidance. …We pay particular attention to the categories for $250,000 and those that report income between $150,000 and $250,000 as that income range is the closest to the P99 cutoff on which we focus.

The provincial tax rates for high earners vary strongly across the country, ranging from a low of 10 percent in Alberta to a high of 25.75 in Quebec. …at the top of the income distribution…these taxpayers have access to substantial financial advice that may facilitate tax avoidance. …We pay particular attention to the categories for $250,000 and those that report income between $150,000 and $250,000 as that income range is the closest to the P99 cutoff on which we focus.

Interestingly, the economists state that upper-income taxpayers should be less sensitive to tax rates today because less of their income is from investments.

…the source of incomes among those at the top has shifted substantially over the last half century from capital income toward earned income. All else equal, this change would tend to make income shifting or tax avoidance more difficult now than in earlier times.

Yet their results suggest that the taxable income of highly productive Canadians (those with incomes in the top 1 percent or the top 1/10th of 1 percent) is very sensitive to changes in tax rates.

The third column has the results for the bottom nine tenths of the top one percent, P99 to P99.9. Here, the estimate is a positive and significant 0.364. Finally, the top P99.9 percentile group shows an elasticity of 1.451, which is highly significant and large. …our estimate of 0.689 for P99 is high, and 1.451 for P99.9 very high.

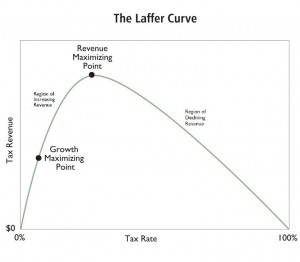

And because rich people can raise or lower their taxable income in response to changing tax rates, this has big Laffer Curve implications.

According to the research, the revenue-maximizing tax rate for the top 1 percent is 44.4 percent and the revenue-maximizing tax rate for the even more successful top 1/10th of 1 percent is 27.5 percent!

The magnitude of our estimates can be put into context by calculating the revenue-maximizing tax rate t*, which is the rate corresponding to the peak of the so-called ‘Laffer Curve’. At this point, an incrementally higher rate will raise no further net revenue as the mechanical effect of the tax increase will be completely offset by the behavioural response of lower taxable income. …Plugging a = 1.81 and e = 0.689 into equation (8) yields an estimate for t* of 44.4 percent. In Figure 1, four provinces have a top marginal tax rate for 2013 under 44.4 percent and six provinces are higher. Using the P99.9 estimate of 1.451, the revenue maximizing tax rate t* would be only 27.5 percent. If true, this would suggest all provinces could increase revenue by lowering the tax rate for those in income group P99.9.

By the way, you read correctly, the revenue-maximizing tax rate for the super rich is lower than the revenue-maximizing tax rate for the regular rich.

This almost certainly is because very rich taxpayers get a greater share of their income from business and investment sources, and thus have more control over the timing, level, and composition of their earnings. Which means they can more easily suppress their income when tax rates go up and increase their income when tax rates fall.

That’s certainly what we see in the U.S. data and I assume Canadians aren’t that different.

But now it’s time for a big caveat.

I don’t want to maximize revenue for the government. Not from the top 1/10th of 1 percent. Not from the top 1 percent. I don’t want to maximize the amount of revenue coming from any taxpayers. If tax rates are near the revenue-maximizing point, it implies a huge loss of private output per additional dollar collected by government.

As I’ve repeatedly argued, we want to be at the growth-maximizing point on the Laffer Curve. And that’s the level of tax necessary to finance the few legitimate functions of government.

As I’ve repeatedly argued, we want to be at the growth-maximizing point on the Laffer Curve. And that’s the level of tax necessary to finance the few legitimate functions of government.

That being said, the point of this blog post is to show that Obama, Krugman, and the rest of the class-warfare crowd are extremely misguided when they urge confiscatory tax rates on the rich.

Unless, of course, their goal is to punish success rather than to raise revenue.

P.S. Check out the IRS data from the 1980s on what happened to tax revenue from the rich when Reagan dropped the top tax rate from 70 percent to 28 percent.

I’ve used this information in plenty of debates and I’ve never run across a statist who has a good response.

P.P.S. I also think this polling data from certified public accountants is very persuasive.

I don’t know about you, but I suspect CPAs have a much better real-world understanding of the impact of tax policy than the bureaucrats at the Joint Committee on Taxation.

TOPICS: Business/Economy; Culture/Society; Editorial; Government

KEYWORDS: arthurlaffer; artlaffer; laffercurve; punkmonetarist; punkmonetarists

1

posted on

09/21/2014 11:29:08 AM PDT

by

Kaslin

To: Kaslin

The provision to have access to your financial information via Obamacare makes a lot more sense if the Feds are trying to monitor how much more they can squeeze you for...just enough so you can eat a meal a day, afford a car so you can work, and your Obamacare biill

To: Kaslin

3

posted on

09/21/2014 11:47:43 AM PDT

by

EEGator

To: Kaslin

I’m a big advocate of the Laffer Curve.

The Laffer curve is simply a restatement of the mean value of derivatives on a smooth differentiable curve. If the derivative is positive at one end, and negative at the other end, there HAS to be at least one place somewhere at an intermediate value of the independent variable where the derivative is zero, which identifies a local extrema on the interval. Being an advocate of a mathematical theorem is a no-brainer.

4

posted on

09/21/2014 11:52:52 AM PDT

by

SpaceBar

To: Kaslin

One argument I've always heard against the Laffer Curve by leftists is that people won't quit working just because the government is taking more money. They even go so far as to claim that people will work harder in order to get the same after tax income to maintain their lifestyle and use as evidence that the first year after a tax rate increase will often result in a total tax revenue increase. However, the Laffer Curve is more about longer term investment than tax returns next year. Did Laffer do any studies on this where the long term Laffer Curve would have a peak at a much lower rate than the short term curve? And the Rahn Curve for growth maximization referenced by the author will peak at an even lower tax rate than either a short or long term Laffer Curve. Also, I believe a tax curve maximizing personal freedom would have an even lower peak rate than that.

5

posted on

09/21/2014 12:13:37 PM PDT

by

KarlInOhio

(The IRS: either criminally irresponsible in backup procedures or criminally responsible of coverup.)

To: SpaceBar

The writer wants to use the curve as a policy tool, not just worship the obvious relationship shown by the curve.

The writer did miss the most powerful example of using lower tax rates to raise revenue and business velocity significantly. When the capital gains tax is lowered, many investors use the opportunity to sell when they would otherwise hold (or in the case of real estate, use tax-deferred exchanges). The resultant sales raise revenue from each investor from zero (if prop not sold) to whatever rate has been set. This also causes consumption and job growth as new owners tend to spend to improve properties. Also, properties

being readied for sale often get improvements at that time.

Also, sales generate idle cash which is used for new investments, or deposited in banks where it is loaned to others so they can do or grow businesses.

The old ripple effect.

6

posted on

09/21/2014 1:09:56 PM PDT

by

SaxxonWoods

(....Let It Burn...)

To: KarlInOhio

From the article:I don’t want to maximize revenue for the government. Not from the top 1/10th of 1 percent. Not from the top 1 percent. I don’t want to maximize the amount of revenue coming from any taxpayers. If tax rates are near the revenue-maximizing point, it implies a huge loss of private output per additional dollar collected by government.

the Rahn Curve for growth maximization referenced by the author will peak at an even lower tax rate than either a short or long term Laffer Curve. Also, I believe a tax curve maximizing personal freedom would have an even lower peak rate than that. I confess that I have never seen a discussion of the Rahn Curve, and would like a link to an exposition of it . . .

7

posted on

09/21/2014 2:04:22 PM PDT

by

conservatism_IS_compassion

("Liberalism” is a conspiracy against the public by wire-service journalism.)

To: Kaslin

The important point to note about the Laffer Curve is that Conservatives must not fall for the trap it lays for them. We are tempted to want to tweak the tax rate so as to optimize government revenues.

Government exists not to be able to extract the maximum amount of money from its citizens but to achieve the maximum amount of liberty for them. This is the Liberty Curve, where zero government has no liberty due to anarchy and complete government intrusion has no liberty due to tyranny and coercion.

We must strive to use government for its intended purpose, to secure the blessings of liberty for all citizens.

Look up “Rahn Curve”

To: theBuckwheat

“Rahn Curve” Video Shows Government Is Far Too Big

By DANIEL J. MITCHELL

There is considerable academic research on the growth-maximizing level of government spending. Based on a good bit of research, I’m fairly confident that Cato’s Richard Rahn was the first to popularize this concept, so we are going to make him famous (sort of like Art Laffer) in this new video explaining that there is a spending version of the Laffer Curve and that it shows how government is far too large and that this means less prosperity.

http://www.cato.org/blog/rahn-curve-video-shows-government-far-too-big

Also:

New Study from Swedish Economists Allows Us to Quantify the Cost of the Bush-Obama Spending Binge

By DANIEL J. MITCHELL

...

For all intents and purposes, all this research shows that developed nations are on the downward-sloping portion of the Rahn Curve. Named after my Cato colleague Richard Rahn and explained in the video below, the Rahn Curve is sort of a spending version of the Laffer Curve.

It shows that growth is maximized by small governments that focus on core “public goods” like rule of law and protection of property rights. But when governments expand beyond a certain growth-maximizing level (the research says about 20 percent of GDP, by I explain in the video why the right number is probably much smaller), the result is slower growth and less prosperity...

http://www.cato.org/blog/new-study-swedish-economists-allows-us-quantify-cost-bush-obama-spending-binge

To: Kaslin

During the Depression, top tax rates were above 90%. So instead of building a factory and creating jobs, investors put their money into stamp collections, Swiss Bank accounts and other non-productive tax shelters.

Hence the worst year of the Depression was 1937.

We are being given the innovative policies of the 1930s — with similar results.

10

posted on

09/21/2014 2:29:30 PM PDT

by

walford

(https://www.facebook.com/wralford [feel free to friend me] @wralford on Twitter)

To: theBuckwheat

11

posted on

09/21/2014 2:29:57 PM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Kaslin

The Left has never cared about maximizing economic growth or even maximizing tax revenues. When will conservatives stop thinking that Leftists have good intentions but lack sufficient knowledge or good sense.

The Leftists are composed of 3 primary factions economically. There are the exempt super-rich (not the 1%, but the .001%) that are exempt from income taxes because they can shelter their income via off shore corporations, foundations, and various other complex tax shelter schemes not available to medium and small business owners. They also get the government contracts, and special immunity from legislation (0-care, carbon emissions). There is the parasitic government worker class (teachers, bureaucrats, municipal & state workers) that receive overly generous tax free benefits such as pensions & healthcare, and are relatively less affected by higher taxes paid by those making more than $200k. More government means more work & job security. Then there is the welfare class that receives food stamps, EITC, healthcare etc.

The Left needs to destroy their enemy, AKA the productive & innovative sector, to retain political power. Deprive small and medium business of income, and you can destroy their means to fund candidates. Put people out of work, or into part time employment, and you gain more welfare constituents, and those that depend on government programs.

12

posted on

09/21/2014 2:42:17 PM PDT

by

grumpygresh

(Democrats delenda est. New US economy: Fascism on top, Socialism on the bottom.)

To: AdmSmith; AnonymousConservative; Berosus; bigheadfred; Bockscar; cardinal4; ColdOne; ...

13

posted on

09/21/2014 2:44:39 PM PDT

by

SunkenCiv

(https://secure.freerepublic.com/donate/)

To: walford

Swiss bank accounts are a no go today. But rare artifacts such as stamps can function as a covert store of value unlike PMs, jewels and the like which are easily recognized for their value by SWAT raiders, highway patrol cops, customs, TSA, and various other neo-Gestapo agents in the land of the free.

14

posted on

09/21/2014 2:50:11 PM PDT

by

grumpygresh

(Democrats delenda est. New US economy: Fascism on top, Socialism on the bottom.)

To: KarlInOhio

I WILL.

I DO and I DID.

25% is enough. I’ve hit my limit already.

“use as evidence that the first year after a tax rate increase will often result in a total tax revenue increase.”

What a stupid observation. Typical libtard logic.

“I am the President of the United States. No one should make more than I do.” Obama

It’s amazing to think that a country like ours is headed by someone who says he hates others’ wealth and appears to try to destroy it.

16

posted on

09/21/2014 4:26:59 PM PDT

by

combat_boots

(The Lion of Judah cometh. Hallelujah. Gloria Patri, Filio et Spiritui Sancto!)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

In the real world, however, big changes in tax policy can and will lead to changes in taxable income. In other words, incentives matter. If the government punishes you more for earning more income, you will figure out ways to reduce the amount of money you report on your tax return.

In the real world, however, big changes in tax policy can and will lead to changes in taxable income. In other words, incentives matter. If the government punishes you more for earning more income, you will figure out ways to reduce the amount of money you report on your tax return.