Skip to comments.

100 Years Ago: Why Bankers Created the Fed

The Mises Daily ^

| 12/23/2013

| Christopher Westley

Posted on 12/23/2013 3:22:13 PM PST by BfloGuy

It is little wonder that early Democrats garnered such popular support and would demand Andrew Jackson end America’s experiment with central banking. Jackson called it “dangerous to the liberty of the American people because it represented a fantastic centralization of economic and political power under private control.”

It’s hard to believe that guy who said that is now on the $20 bill.

Jackson also warned that the Bank of the United States was “a vast electioneering engine” that could “control the Government and change its character.” These sentiments were echoed by Roger Taney, Jackson’s Treasury Secretary, who talked of the Bank's “corrupting influence” and ability to “influence elections.” (The Whigs would later get revenge on this future chief justice when Abraham Lincoln, in response to a written opinion with which he disagreed, issued his arrest warrant.)

But the courtship between the political classes and their cronies would continue in the decades following Lincoln’s assassination. Those politically well-connected groups that benefited from early central banking continued to benefit from government finance, especially off of “internal improvements,” which is the nineteenth-century term for pork. National banking would appear during the War Between the States, setting in place a banking system in which individual banks would be chartered by the federal government. The government itself would use regulations backed by a new armed U.S. Treasury police force to encourage the banks’ inflation and protect them from the market penalties that inflation would otherwise bring them, such as the loss of specie and the occurrence of bank runs.

The boom and bust cycle, explained by the Austrian School in such detail, became worse and worse in the period leading up to 1913. And with the rise of Progressive Era spending on war and welfare, and with the pressure on banks to inflate to finance this activity, the boom and bust cycles worsened even more. If there was one saving grace about this period it would be that banks were forced to internalize their losses. When banks faced runs on their currencies, private financiers would bail them out. But this arrangement didn’t last, so when the losses grew, those financiers would secretly organize to reintroduce central banking to America, thus engineering an urgent need for a new “lender of last resort.” The result was the Federal Reserve.

This was the implicit socialization of the banking industry in the United States. People called the Federal Reserve Act the Currency Bill, because it was to create a bureaucracy that would assume the currency-creating duties of member banks.

It was like the Patriot Act, in that both were centralizing bills that were written years in advance by people who were waiting for the appropriate political environment in which to introduce them. It was like our current health care bills, in which cartelized firms in private industry wrote chunks of the legislation behind closed doors long before they were introduced in Congress.

It was unnecessary. If banks were simply held to similar standards as other more efficient industries were held to — the rule of law at the very least — then far fewer fraudulent banks would ever come about. There were market institutions that would penalize those banks that over-issued currencies, brought about bank runs, and financial crises. As Mises would later write:

What is needed to prevent further credit expansion is to place the banking business under the general rules of commercial and civil laws compelling each individual and firm to fulfill all obligations in full compliance with the terms of contract.

The bill was passed fairly easily, in part because the Democrats had a larger majority in both Houses than they do today. There were significant differences that were resolved in conference, with one compromise resulting in the requirement that only 40 percent of the gold reserve back the new currency. So instead of a 1-to-1 relationship between gold and currency issued — a ratio that defined sound market banking since the time of Renaissance Italy — the new Federal Reserve notes would be inflated, by law, at a ratio of 1-to-2.5.

The bill that was first drawn up at Jekyll Island was signed by Woodrow Wilson in the Oval Office shortly after the Senate approved it. At one point during the signing ceremony, as he reached for a gold pen to finish signing the bill, he jokingly declared “I’m drawing on the gold reserve.”

Truer words were never spoken.

Central banks always result in feeding those forces that centralize and expand the nation-state. The Fed’s policies in the 1920s, so well documented by Rothbard, would provoke the Great Depression, which, in the end, wrenched political power from cities and state governments to the swampland in Washington. Today people take seriously the claim that there can be a viable federal solution to every problem thanks to the money printed up by the Fed, while each decade has seen a larger proportion of the population become dependent on its inflation.

And yet Andrew Jackson’s beliefs about the perniciousness of the Second Bank of the United States are just as applicable to the Federal Reserve today.

Here’s to hoping we’ll see Jackson’s hawkish nose and unkempt hair on a gold-backed, privately issued currency in the not–too-distant future.

TOPICS: Business/Economy; Constitution/Conservatism; Government; News/Current Events

KEYWORDS: andrewjackson; anniversary; battleofneworleans; dredscott; falseflagops; fed; federalreserve; fff; inflation; johnnyhorton; kkk; klan; oldhickory; randsconcerntrolls; rogertaney; sideshow

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120, 121-139 last

To: khelus

Consider it repeated (and true)

121

posted on

12/28/2013 12:35:25 PM PST

by

LS

('Castles made of sand, fall in the sea . . . eventually.' Hendrix)

To: PieterCasparzen

it's really the dishonesty at fault, not the system, per seOf course, it is. But a system which separates us by hundreds or thousands of miles from our representatives is one to always be suspicious of.

122

posted on

12/28/2013 2:29:58 PM PST

by

BfloGuy

( Even the opponents of Socialism are dominated by socialist ideas.)

To: PieterCasparzen

But here we get into whether we want the GOZ currency actually to have ounces of gold sitting in a vault, enough to back every paper or electronic ounce. If we do want that “backing” gold in a vault, at today’s dollar price of gold, there is nowhere near enough gold available to the US Treasury to back the GOZ currency that would translate to the USD that is now in paper or electronic form.

Though I prefer to be a purist, partial backing would be better than none. It is the ability to exchange dollars for gold when one fears that too much paper currency is being issued that enforces the gold standard.

I understand that isn't a perfect system and, really, I've no interest tonight in getting into a discussing of 100% reserve vs. fractional reserve banking. It can be fascinating, but we're so far down the inflation curve that fractional reserve would serve us well.

123

posted on

12/28/2013 2:44:37 PM PST

by

BfloGuy

( Even the opponents of Socialism are dominated by socialist ideas.)

To: khelus

124

posted on

12/28/2013 5:21:47 PM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: khelus; plainshame; expat_panama

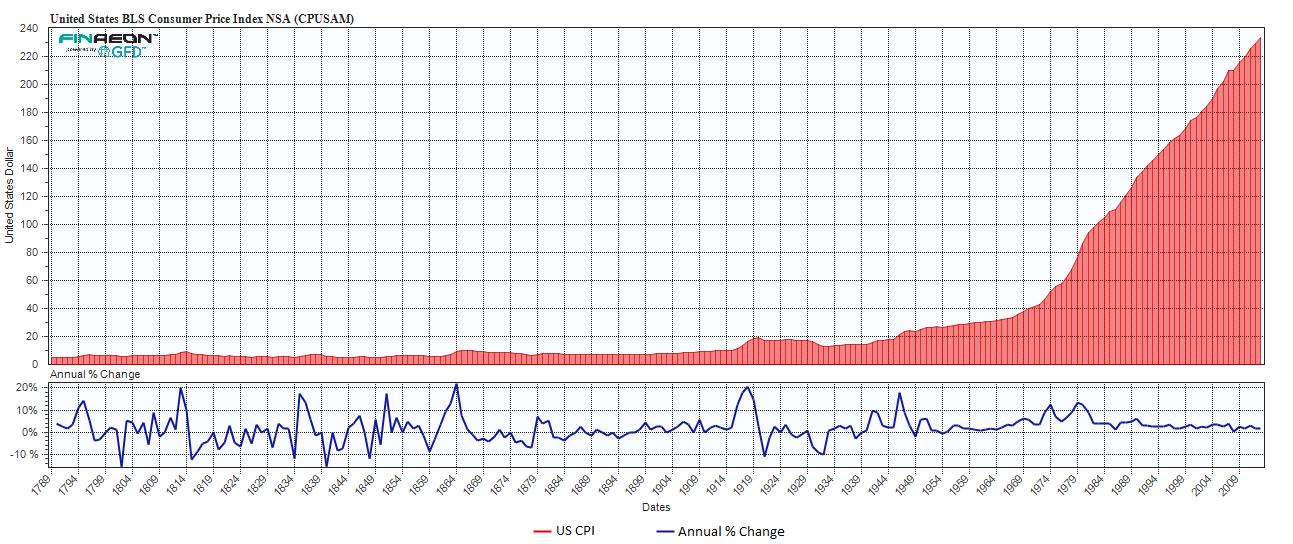

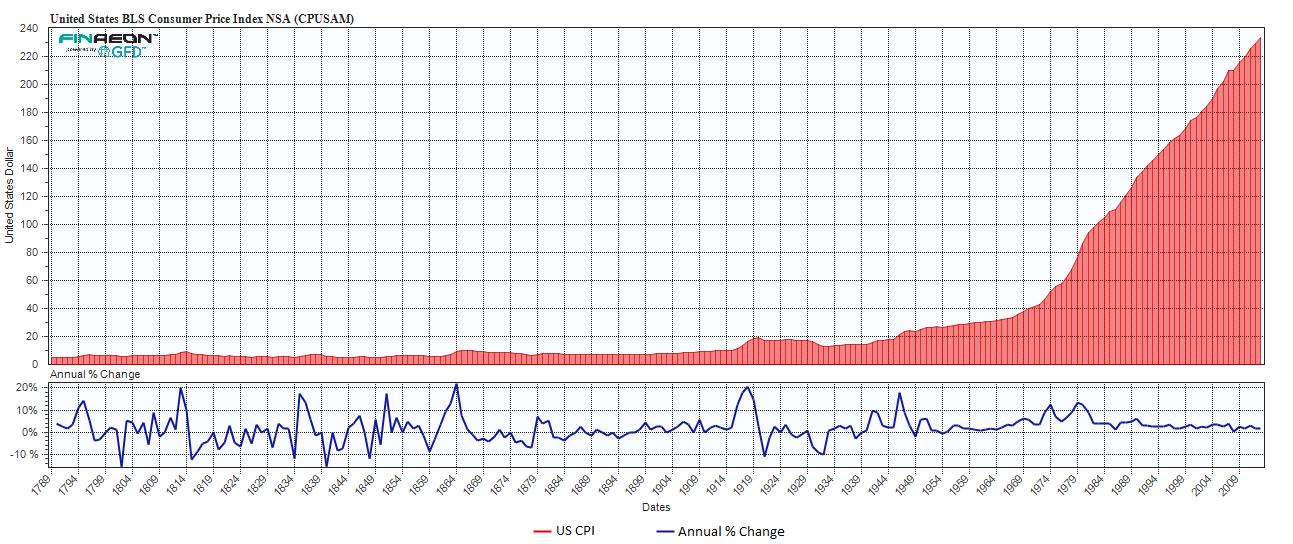

Try an inflation graph from 1913 to 2012 and compare it from 1791 to 1912.People will be horrified!

yup pretty much a straight line until 1912.

LOL! The up and down swings were much, much worse before 1912.

125

posted on

12/28/2013 5:24:06 PM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Toddsterpatriot

You must have been looking at the wrong graph that a drunk drew then.

To: Toddsterpatriot

To: BfloGuy

Though I prefer to be a purist, partial backing would be better than none. It is the ability to exchange dollars for gold when one fears that too much paper currency is being issued that enforces the gold standard.

One can always exchange dollars by buying something.

People exchanging dollars for gold won't put any pressure on the financial elites when they create too many dollars. The elites control both dollar creation and the gold market, and they can invest in either at any time - and in advance of market moves. To wit, Soros was into gold prior to the run-up and exited just before the peak, when the retail customer was being whipped up into a frenzy of gold buying. Of course, he's just one, there certainly are many others that are tied in closely with new world order.

A gold or other precious metal standard does nothing to prevent money creation of such a large scale that it causes inflation. This is because those in control who desire to create more money will simply reduce the purity of the metal used for backing. It actually happened to the Spanish empire and was written about contemporaneously by Juan de Mariana. Strangely, economists of the Austrian school have written about this and are quite well aware of it. They obviously then know that a "gold standard" is no guard against excessive money printing.

One of de Mariana's works, "A Treatise on the Alteration of Money", is available online as a downloadable PDF...

"The Political Economy of Juan de Mariana" is available for free as a downloadable PDF from google books (you just have to click on the "gear" on the far top right, under the sign in button to see the option to download the PDF. You might have to allow cookies, at least temporarily, I'm not sure). It appears to have be republished by the Ludwig Von Mises Institute in 2008.

Corrupt financial elites are the source of continual problems, changing currencies won't affect that situation.

128

posted on

12/28/2013 5:48:02 PM PST

by

PieterCasparzen

(We have to fix things ourselves)

To: plainshame

Thanks, but I already know that we had wide price swings, up and down, before the Fed was created.

129

posted on

12/28/2013 5:51:12 PM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Toddsterpatriot

To: plainshame

http://www.ritholtz.com/blog/wp-content/uploads/2013/08/2.jpg

LOL! You first.

131

posted on

12/28/2013 10:42:22 PM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Toddsterpatriot; plainshame; khelus

Try an inflation graph from 1913 to 2012 and compare it from 1791 to 1912.People will be horrified!yup pretty much a straight line until 1912.

http://www.ritholtz.com/blog/wp-content/uploads/2013/08/2.jpg

Ritholtz got a few things right with his graph--

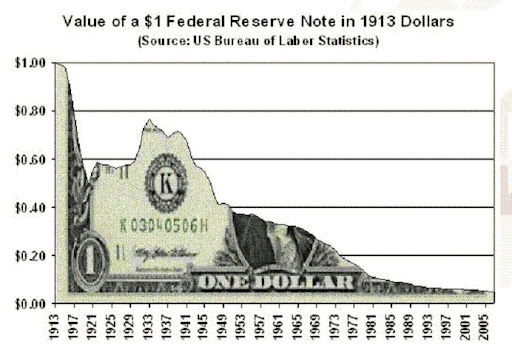

--but I got two problems with it. One is that when he got his numbers from http://www.measuringworth.com/uscpi/, he left out from 1775 to 1791 which included the wildest swings. The other is that people that know how to use money are more concerned with what prices will be next year than what they'll be in the next century --they want to pay off loans and feed their families (duh!). Here's the same graph corrected to show all years and with the emphasis on purchasing power:

To: GeronL

Re:

That is what they call “stability”

Try an inflation graph from 1913 to 2012 and compare it from 1791 to 1912.People will be horrified

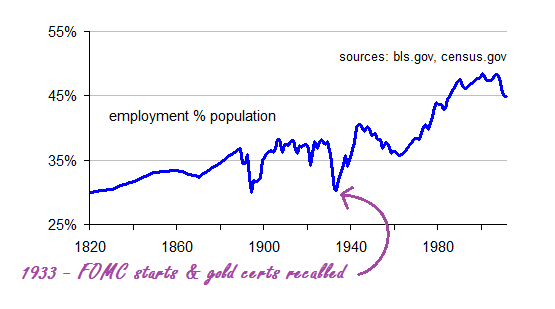

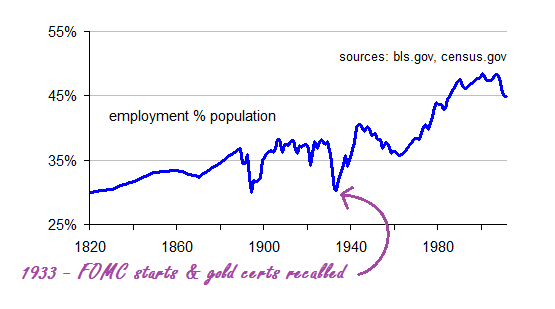

I found two more interesting charts for you both.

133

posted on

12/29/2013 10:22:36 AM PST

by

khelus

To: khelus

Prices up 11% one year and down 10% the next give an average change of 0%. Would that be okay?

134

posted on

12/29/2013 11:27:46 AM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Toddsterpatriot; plainshame; khelus

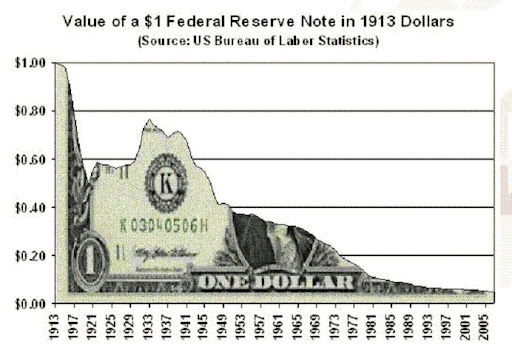

Prices up 11% one year and down 10% the next give an average change of 0%. Would that be okay?There are people who've never tried to earn a living in the real world who actually think the wild fluctuations over months doesn't matter, and that the change from one century to the next does. But even the long term cpi change didn't begin until 1933 when gold certificates were recalled and the FOMC took over. We all know that this was the big change that put paid to the gold insanity, but not as many people are familiar with how the employment picture changed after 1933:

To: expat_panama

The US dollar has lost 95.8% of it’s value since 1913.Math doesn’t lie.

To: PieterCasparzen

One can always exchange dollars by buying something. That is beside the point.

Under the classical gold system, banks held their reserves in gold. When dollar-users suspected that too many had been issued, they could present their dollars at the teller's window and receive their equivalent in gold.

This had the effect of drawing down the bank's reserves thus decreasing their ability to pyramid loans from it and also served as a warning to the bank's officers that the public was growing skeptical of their performance.

This was the crucial component to the gold standard's working as well as it did. The ersatz gold standards adopted in Europe after WWI did not allow citizens the ability to exchange their currency for gold and failed miserably.

To this day, many still blame the gold standard for the Depression in Europe but it really wasn't one.

This is because those in control who desire to create more money will simply reduce the purity of the metal used for backing.

Another reason for gold as currency. Tampering with its purity is very easy to determine. That kings got away with it several centuries ago is a testament only to the lack of education and economic understanding of their subjects.

Corrupt financial elites are the source of continual problems, changing currencies won't affect that situation.

No monetary system can work to the benefit of the individual if his leaders are corrupt. There are some who are not. If one of those someday gains power, I hope he will push to reinstate hard money for the reasons I've stated.

137

posted on

12/29/2013 2:39:37 PM PST

by

BfloGuy

( Even the opponents of Socialism are dominated by socialist ideas.)

To: plainshame

The US dollar has lost 95.8% of it’s value since 1913.Math doesn’t lie.

Facts are such inconvenient things they are to be avoided both by Al Gore and those who have swallowed global communism's faux conservative message about 'free trade' and the 'stability' brought about by the Fed.

138

posted on

12/30/2013 6:55:05 AM PST

by

khelus

To: BfloGuy

One can always exchange dollars by buying something.

That is beside the point.

Under the classical gold system, banks held their reserves in gold. When dollar-users suspected that too many had been issued, they could present their dollars at the teller's window and receive their equivalent in gold.

There's not enough gold to make that possible any more. Let alone the fact that modern banks have enough difficulty coming up with cash when withdrawals are made. Fractional reserve introduces the risk of not being able to meet withdrawal requests on demand deposit accounts - but it allows the banks to use demand deposits as leverage (i.e., they are investing part of them and generating profits) so the practice was instituted by our banking friends despite the risks of bank insolvency. Somewhere around 2,000 banks have failed in the past few years, and the top 10 or so - one would think the strongest - received bailout loans from the government. Notice how it was not the Federal Reserve that bailed out the banks in its own Federal Reserve System, it was the taxpayer, via the Treasury. Requiring banks to keep gold as reserves would only complicate and exacerbate all our problems. If there was truly a popular demand for redeemable gold certificates - banks would be offering them. Then again, they'd be competing with all the existing sellers of gold and gold funds, and they'd be exposing themselves to the risk of fluctuations in the price of gold.

This had the effect of drawing down the bank's reserves thus decreasing their ability to pyramid loans from it and also served as a warning to the bank's officers that the public was growing skeptical of their performance.

"pyramid" is not an accounting term. I assume you mean use the same gold that "backs" the private money issued as collateral to borrow. That gold would already pledged as collateral to "back" the "private money", so the same gold would be pledged twice as collateral, which is fraudulent.

Perhaps you're describing a "fractional-reserve" banking where the reserves are held in gold. Again, if the price of gold drops, additional physical gold would have to be posted to the reserve. This would be simply introducing another variable in the banking business model, one that would add risk while doing very little to improve the either real or perceived solvency of banks.

This was the crucial component to the gold standard's working as well as it did.

Today we tend to think that the "old days", the glory days of, say, the 1800's were economic "smooth sailing" due to the gold standard, or at least inflation was very low and very consistent. Neither of these is true, they were ecnomoically chaotic times, due mostly to the machinations of financial elites.

This is because those in control who desire to create more money will simply reduce the purity of the metal used for backing.

Another reason for gold as currency. Tampering with its purity is very easy to determine. That kings got away with it several centuries ago is a testament only to the lack of education and economic understanding of their subjects.

I'm not talking about tampering, I'm talking about official government policy, i.e., a dictate that the currency is being devalued. The whole US government right now issues all sorts of dictates that are forced on the citizens of the US, some with popular political support after propagandizing, others they just shove down their throat by issuing policy changes and cue the news media to NOT report the changes. A few people in the know may howl with objections - but these changes are simply forced into law. Subjects or citizens, the public is, for the most part, stuck with its ruling elites and is ruled by them. And usually when they finally have "had enough" and there is a revolution, the elites are 10 steps ahead of them and have their operatives well-placed within its leadership.

Corrupt financial elites are the source of continual problems, changing currencies won't affect that situation.

No monetary system can work to the benefit of the individual if his leaders are corrupt. There are some who are not.

A single politician, i.e., 1 President, working against the Congress can't do much. Congress has to be in on the plan at least enough to get bills passed, the Judiciary needs to uphold the laws made. There needs to be quite a bit of popular support or Congress and the President won't do squat.

In truth, the citizenry is pitted against the ruling financial elites who run education, the news and entertainment media, the capital markets, the foundations, the intelligence agency leadership, Congress, the Executive Branch leadership (spans Presidents, a la Zbigniew Brzezinski, "advising" from Carter - and still at it), etc., and thus exert tremendous control behind the scenes (since the major news networks refuse to mention this corruption).

The ruling financial elites, through their foundations and lobbying organizations (both left and right), are the ones that "craft" legislation.

139

posted on

12/30/2013 9:21:45 AM PST

by

PieterCasparzen

(We have to fix things ourselves)

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120, 121-139 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson