Skip to comments.

Lowest Core PCE in History; "Flation" Perspective

Townhall.com ^

| June 2, 2013

| Mike Shedlock

Posted on 06/02/2013 3:55:03 AM PDT by Kaslin

Doug Short at Advisor Perspectives has a pair of interesting reports on price inflation as measured by the CPE and PCI.

Please consider PCE Price Index Update: Sorry Fed, The Disinflationary Trend Continues.

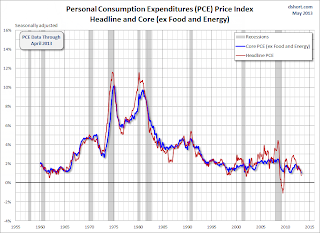

The latest Headline PCE price index year-over-year (YoY) rate of 0.74% is a decrease from last month's adjusted 1.01%. The Core PCE index of 1.05% is decrease from the previous month's adjusted 1.17%. It is the lowest Core PCE ever recorded; the previous all-time low was 1.06% in March 1963, fifty years ago.

The continuing disinflationary trend in core PCE (the blue line in the charts below) must be troubling to the Fed. After years of ZIRP and waves of QE, this closely watched indicator has been consistently moving in the wrong direction for over a year. It has contracted month-over-month for ten of the last 13 months since its interim high of 1.96% in March of 2012 and is now approaching half that YoY rate.

The first chart shows the monthly year-over-year change in the personal consumption expenditures (PCE) price index since 2000. I've also included an overlay of the Core PCE (less Food and Energy) price index, which is Fed's preferred indicator for gauging inflation. I've highlighted 2 to 2.5 percent range. Two percent had generally been understood to be the Fed's target for core inflation. However, the December 12 FOMC meeting raised the inflation ceiling to 2.5% for the next year or two while their accommodative measures (low FFR and quantitative easing) are in place.

click on chart for sharper image

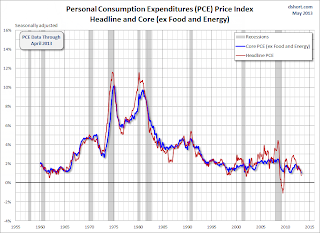

For a long-term perspective, here are the same two metrics spanning five decades.

click on chart for sharper image

Inquiring minds may also wish to consider Two Measures of Inflation: Core PCE at Its All-Time Low

"Flation" Perspective

Inflation, deflation, and disinflation are all in the eyes of the beholder, and all depend on the definition. Still I expect another round of deflation possibly with prices but more importantly with credit, my preferred measure of "flation".

Regardless of how one measures "flation", the hyperinflationists missed the boat by a mile.

TOPICS: Business/Economy; Culture/Society; Editorial

KEYWORDS: core; deflation; economy; inflation; mikeshedlock

Navigation: use the links below to view more comments.

first 1-20, 21 next last

1

posted on

06/02/2013 3:55:03 AM PDT

by

Kaslin

To: Kaslin

How about explaining? IS this a predictor of anything?

2

posted on

06/02/2013 4:06:29 AM PDT

by

nikos1121

To: Kaslin

Yeah, I’ve noticed food getting cheaper.

Wait. No I haven’t.

3

posted on

06/02/2013 4:08:39 AM PDT

by

MrB

(The difference between a Humanist and a Satanist - the latter admits whom he's working for)

To: Kaslin

As usual, the grocery stores don't seem to have gotten the memo. Just look at your weekly food expenditures charted over the past year to get a different answer.

4

posted on

06/02/2013 4:13:29 AM PDT

by

Truth29

To: Kaslin

The price I pay for everything I buy has gone up by no less than 3-5% a year for the past 4 years.

5

posted on

06/02/2013 4:18:35 AM PDT

by

Beagle8U

(Free Republic -- One stop shopping ....... It's the Conservative Super WalMart for news .)

To: Truth29

“As usual, the grocery stores don’t seem to have gotten the memo.”

I think the price deflation they’re scared of would only occur to banks and large financial institutions. The Golden Gate bridge, the Empire State building both came in way under budget because of deflation. That was probably bad for any financial institutions involved as they’d have made less money or lost money. As another example, if the price of homes drops due to deflation people tend to bail on them and leave the banks with an asset that the bank must discount (lose money on) to get rid of. Multiply this across thousands of financial instruments and the impact to financial institutions is quite large. (No bonuses!) But to the individual, deflation is great. Obama has more than tripled the money supply since 2008 to prevent deflation. The result for you and me is high gas prices and higher food prices.

To: Kaslin

Since 2009:

- Health insurance: up 50%

- Car Insurance: up 20%

- Food up: 20 to 30%

- Fuel: up 100%

Yep, no inflation. Nothing to see here move along.

7

posted on

06/02/2013 4:32:20 AM PDT

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: MrB

Exactly. If the idiot professors that do all the equation would just walk into a supermarket or visit a gas pump they’d find out they are more accurate predictors or indicators of future trends.

To: nikos1121

Outside of food and gas expenditures, the US consumer is tapped out, discretionary spending on average is back to the levels of the early sixties, which was prior to the widespread adoption of credit cards. Wage growth is anemic at best and wages are even declining for some, so that’s another hit to discretionary spending, the money’s just not there. Retailers have no pricing power at all because demand is flat to declining. That’s one angle, and it applies to a significant segment of the population, so there’s one facet of economic weakness.

Some are still doing reasonably well, though, and this group appears to have put the brakes on discretionary spending in a major way. Food and gas expenditures still eat into budgets even in households with healthy income and the continued ability to spent for discretionary items, so demand softens.

There seems to be something anticipatory going on there, too, I’d call it a fear element. In my own circle that would be the dawning realization that another big increase in household “overhead” is looming in 2014, health insurance premiums. I’ve been warned by my accountant to expect it to more than double. That’s several hundred to over a thousand a month for most households. Of course they’re clamping down. So, another facet would be the Obamacare recession-within-a-recession, compounding an already tenuous situation.

Add on top of all this the effect of wildly expqnded government assistance on the demand end for food and gas, and goverment stimulus on the supply end in the form of commodities speculation, and the two continue to increase independent of normal pricing pressures, they’re unhinged from the day to day reality of actual demand that is not being somehow artificially induced.

So, in short, the stuff you’re forced to buy keeps getting more expensive, so the stuff you’re not forced to buy languishes more and more over time because income is stagnant to declining, basically, for private sector working poor to middle class.

To: RegulatorCountry

Spot on analysis.

Why aren't you being published instead of these over-analyzing graph tweakers?

10

posted on

06/02/2013 5:05:23 AM PDT

by

Aevery_Freeman

(We say "low-information" but we mean "low-intelligence")

To: Kaslin

Core PCE makes as much sense as ice hockey without skates and sticks. Why calculate a meaningless number, other than political?

Bread and circuses to the masses. Let them eat cake. Tanks, there are no tanks approaching Baghdad.

11

posted on

06/02/2013 5:11:17 AM PDT

by

NTHockey

(Rules of engagement #1: Take no prisoners)

To: Kaslin

But are we comparing apples with oranges? When did they start discounting cost because the product was ‘better’. That is relatively recent, I think.

12

posted on

06/02/2013 5:31:17 AM PDT

by

expat2

To: RegulatorCountry

Yes, we have inflation and deflation at the same time, depending on which spending you are talking about.

13

posted on

06/02/2013 5:34:33 AM PDT

by

expat2

To: expat2

The “hedonic adjustment” has been in there for quite a long time. Its official term from th1 1960’s is “the Hedonic Quality Adjustment Method”.

14

posted on

06/02/2013 6:00:07 AM PDT

by

jiggyboy

(Ten percent of poll respondents are either lying or insane)

To: Aevery_Freeman

Most of the pundits frequently cited on FR have some motivation to publish other than merely attempting an accurate, basic observation of actual conditions. For instance, Karl Denninger, less popular now than a few years back, is a “short.” His hair is always on fire about one thing or another, panic, panic!!! You can sort of tell what he's shorting by what he's trashing.

“Mish” Shedlock, formerly a rival of Denninger, appears to have now jumped on the QE gravy train and is not so subtly begging for more.

Precious metals “commentary” has devolved to the point of sheer goldbuggery masquerading as analysis with charts and graphs and wacked out quasi-official sounding theories, as if it's some sort of long term investment when it never has been, it's a safe haven in times of uncertainty and economic turmoil. Just a cursory look at the early eighties would tell the tale, so they don't go there.

Then, you have the more established commentary, which at times can appear completely in the bag for Obama. Actually, it is completely in the bag.

No room there for basic observations with no “angle.” It gets shouted down.

To: Kaslin

the hyperinflationists missed the boat by a mileThe "hyperinflationists" never predicted a date on which hyper-inflation would begin. They only warned that all the money Bernanke created has set the table for it.

16

posted on

06/02/2013 6:25:05 AM PDT

by

BfloGuy

(Don't try to explain yourself to liberals; you're not the jackass-whisperer.)

To: expat2

If people can stop buying it, prices are flat to declining. If people can’t stop buying it, prices are being bid up further and further by money manufactured out of thin air, on both the supply and the demand end of the equation.

The impact of this stimulus has been effectively limited to the top and the bottom of the economy, in ways that are not being measured, intentionally or not. There is benefit to understating inflation, cost of living adjustments to Social Security primarily.

The middle is bearing the cost now and will in the future, but is not receiving the benefit.

To: jiggyboy

I didn’t realize it was that old. However, I can’t help wondering if its weighting hasn’t been increased since the 60’s.

18

posted on

06/02/2013 7:13:24 AM PDT

by

expat2

To: expat2

Good point. It might be that they haven’t jiggled the equation, but the changes, i.e., “improvements”, have become so much bigger that that’s what changes the equation.

The most obvious example would be changes in electronics. Year to year in the 1960’s, there was black and white to color, manual to remote, size of screen (bigger), and size of console (smaller). That’s not twice the functionality. Now you have a computer that has twice as much RAM, twice as much disk space, and twice the speed every 18 months, and that is going to make it look like it costs half (or would it be one eighth?) as much.

19

posted on

06/02/2013 7:23:36 AM PDT

by

jiggyboy

(Ten percent of poll respondents are either lying or insane)

To: RegulatorCountry

"The middle is bearing the cost now and will in the future, but is not receiving the benefit. "

Don't neglect that the "middle" is also the center of gravity of the Makers carrying the rest of the country on both taxes and wealth production (not that they get a large fraction of that).

20

posted on

06/02/2013 6:04:40 PM PDT

by

Paladin2

(;-))

Navigation: use the links below to view more comments.

first 1-20, 21 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson