Posted on 07/05/2012 3:40:07 PM PDT by blam

Silver, Gold And The Coming Deflation

Commodities / Gold and Silver 2012

Jul 05, 2012 - 02:03 PM

By: Hubert Moolman

Historically gold has made its significant gains, relative to other assets (as well as nominally), not during inflation, but during deflation (Note: I am using the terms inflation and deflation very loosely in this case). These significant gold rallies historically occur when value flees instruments such as stocks and certain commodities.

Since the 1920s there have been three major gold rallies (1930s, 1970s and the current rally).

All three major gold rallies came after a significant top in the Dow and the Dow/Gold ratio (1929, 1966 and 1999). A great portion of the 1930s and 1970s rallies occurred when the Dow was falling significantly. In fact, the biggest rise in the gold price occurred when the Dow was falling or was trading closer to the bottom of its trading range during that period.

The current gold rally (since 2001) has mostly been during the time when the Dow has also been rising, with the exception of a short period in both 2002 and the end of 2008 to Feb 2009. The best of the current gold rally, since 2001, has been during a time when the Dow was rising as well.

With the Dow still relatively close to all-time highs; I believe the current gold rally has not yet had its best period - it is still to come, and will be during the time that the Dow is falling just like in the 1930s and 1970s. It is my believe that if gold goes on to rally from here, then we will have financial turmoil like there has never been. The word depression might not be adequate to describe what is coming. The Great Tribulation might be the proper term. More details on this in my next updates.

Gold/Silver Ratio Suggests Silver Will Outperform Gold

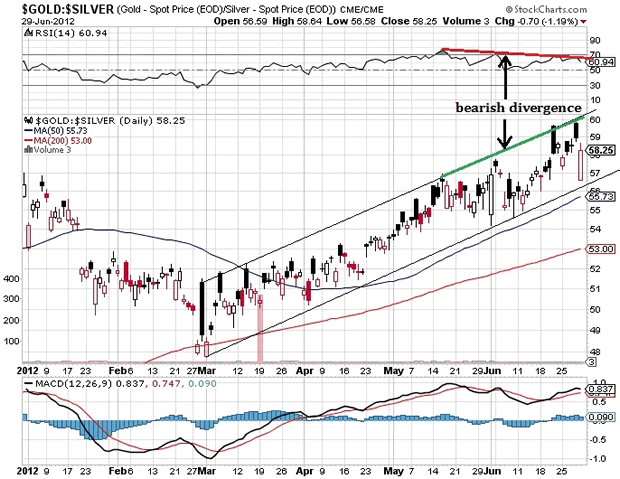

In my last update, I covered the Gold/Silver ratio, and explained why I think the Gold/Silver ratio will soon fall straight down. Below is a Gold/Silver ratio chart (from stockcharts.com), which shows some more evidence to suggest that it could indeed fall soon:

On the chart I have indicated a trading channel in which the ratio has been moving for the last four months. On Thursday, 28 June, it hit the top of that channel and was smacked down immediately. When price goes out of this channel, it could be a sign of where this ratio, as well as the gold and silver price is going.

More importantly, there is a bearish divergence, between the ratio and the RSI. The RSI has been making lower highs, whereas the ratio has been making higher highs. This could be a signal that the ratio will soon fall significantly, confirming higher prices for gold and silver.

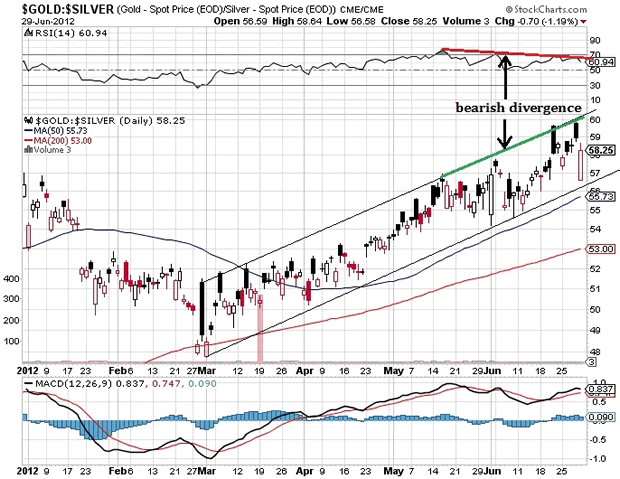

Below is a chart for gold (from fxstreet.com):

On the chart, I have indicated a big triangle. When the price moves out of this triangle, it is very likely to fall or rise very fast (a very long way). It really could go either way, and nobody can be 100% certain which way it will go.

However, before price makes a big move, there is almost certainly going to be signs and evidence of that big move. Based on the evidence that I have collected, analysing gold and silver, I am convinced that the big move will be higher.

I own SLW and THM. I think if Gold falls enough I should buy the physical but it is too high now.

Why not just buy silver eagles?

The price comparison per ounce of silver between the two is just not there.

Gold and silver are similar is someways but depending upon their actual value to industry vs their value to the economy, they fluctuate somewhat independent.

Therefor I buy equal values of BOTH and will sell only when it is prudent and when that (silver vs gold) is peaked or peaking.

The other will peak at another time but I am covered by keeping a balance at most time and purchasing for replacement when it is lower in the cycle.

The premium is too rich; with Morgans and other “junk” silver, your haircut is minimum.

If the author turns out to be prescient, and a drop in the G/S Ration occurs as growth in silver outpaced gold percentage-wise, it’ll be a great time to convert your silver to gold. Trying to catch a parabola is tough though; they happen so quickly.

I’ve been buying silver and gold coins, a lot more silver than gold, not because it’s an investment but I see it as my kids inheritance. I don’t know what the dollar will be like by the time they’re adults, or if we’ll have a completely different currency, but actual gold and silver will have SOME value, at the very least.

I don’t buy gold simply because I do not know of a gold equivalent to buying circulated peace/morgan dollars AKA “junk silver”.

Bottom line common sense and good insurance...not losing everything.

Silver is an industrial metal. Many uses.

Metals as a whole are nice to own.

Spot price on Copper is about $3.50 per pound.

Lead and copper both have many manufacturing uses.

And you can draw copper to make jackets for bullet and cast lead to form bullets. Very useful in unusual times.

I carry a silver 1964 Washington quarter in my billfold.

From time-to-time, when the situation is right,

I pull it out and pass it around to lecture about how

in 1964 that quarter was worth a gallon of gasoline,

and today it still is.

(It seems to be that soon we will be approaching buying two gallons of gasoline for one 1964 quarter)

After the general bond collapse and currency adjustment, we’ll see a great inflation in foreign products (imports) and extreme deflation in a few things made in America (especially labor).

why pay a numismatic premium over the spot price of silver?

unless you are building a collection of course or getting them dirt cheap... the meltdown value of a Morgan is less than $22

If you are interested in collecting Morgans, than go for the rare issues. If you are intersted in silver then go for Eagles or Maple leafs.... just a suggestion

BTW, I have bought some junk silver, especially dimes

What are your thoughts of purchasing land instead of gold and silver?

There are some great deals on land!

What are your thoughts of purchasing land instead of gold and silver?

There are some great deals on land!

Didn’t Soros do just that about a year ago?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.