Posted on 09/22/2009 6:56:25 AM PDT by SeekAndFind

The 1930s has become the sole object lesson for today's monetary policy. Over the past 12 months, the Federal Reserve has increased the monetary base (bank reserves plus currency in circulation) by well over 100%. While currency in circulation has grown slightly, there's been an impressive 17-fold increase in bank reserves. The federal-funds target rate now stands at an all-time low range of zero to 25 basis points, with the 91-day Treasury bill yield equally low. All this has been done to avoid a liquidity crisis and a repeat of the mistakes that led to the Great Depression.

Even with this huge increase in the monetary base, Fed Chairman Ben Bernanke has reiterated his goal not to repeat the mistakes made back in the 1930s by tightening credit too soon, which he says would send the economy back into recession. The strong correlation between soaring unemployment and falling consumer prices in the early 1930s leads Mr. Bernanke to conclude that tight money caused both. To prevent a double dip, super easy monetary policy is the key.

While Fed policy was undoubtedly important, it was not the primary cause of the Great Depression or the economy's relapse in 1937. The Smoot-Hawley tariff of June 1930 was the catalyst that got the whole process going. It was the largest single increase in taxes on trade during peacetime and precipitated massive retaliation by foreign governments on U.S. products. Huge federal and state tax increases in 1932 followed the initial decline in the economy thus doubling down on the impact of Smoot-Hawley. There were additional large tax increases in 1936 and 1937 that were the proximate cause of the economy's relapse in 1937.

(Excerpt) Read more at online.wsj.com ...

* In 1930-31, during the Hoover administration and in the midst of an economic collapse, there was a very slight increase in tax rates on personal income at both the lowest and highest brackets.

* The corporate tax rate was also slightly increased to 12% from 11%.

* 1932 the lowest personal income tax rate was raised to 4% from less than one-half of 1% while the highest rate was raised to 63% from 25%. (That's not a misprint!)

* The corporate rate was raised to 13.75% from 12%.

* All sorts of Federal excise taxes too numerous to list were raised as well.

* The highest inheritance tax rate was also raised in 1932 to 45% from 20% and the gift tax was reinstituted with the highest rate set at 33.5%.

* In 1934, the highest estate tax rate was raised to 60% from 45%

* Taxes raised again to 70% in 1935.

* The highest gift tax rate was raised to 45% in 1934 from 33.5% in 1933

* Raised again to 52.5% in 1935.

* The highest corporate tax rate was raised to 15% in 1936 with a surtax on undistributed profits up to 27%.

* 1936 the highest personal income tax rate was raised yet again to 79% from 63%—a stifling 216% increase in four years.

* 1937 a 1% employer and a 1% employee tax was placed on all wages up to $3,000.

* 1933, the federal government (not the Federal Reserve) declared a bank holiday prohibiting banks from paying out gold or dealing in foreign exchange. An executive order made it illegal for anyone to "hoard" gold and forced everyone to turn in their gold and gold certificates to the government at an exchange value of $20.67 per ounce of gold in return for paper currency and bank deposits. All gold clauses in contracts private and public were declared null and void and by the end of January 1934 the price of gold, most of which had been confiscated by the government, was raised to $35 per ounce. In other words, in less than one year the government confiscated as much gold as it could at $20.67 an ounce and then devalued the dollar in terms of gold by almost 60%.

* The 1933-34 devaluation of the dollar caused the money supply to grow by over 60% from April 1933 to March 1937.

* RESULT : CPI from early 1933 through mid-1937 rose by about 15% in spite of double-digit unemployment.

KEY QUOTATION TO REMEMBER :

Treasury Secretary, Henry Morgenthau, angry at the Keynesian spenders, confided to his diary May 1939:

“We have tried spending money. We are spending more than we have ever spent before and it does not work. And I have just one interest, and now if I am wrong somebody else can have my job. I want to see this country prosper. I want to see people get a job. I want to see people get enough to eat. We have never made good on our promises. I say after eight years of this administration, we have just as much unemployment as when we started. And enormous debt to boot.”

bookmark

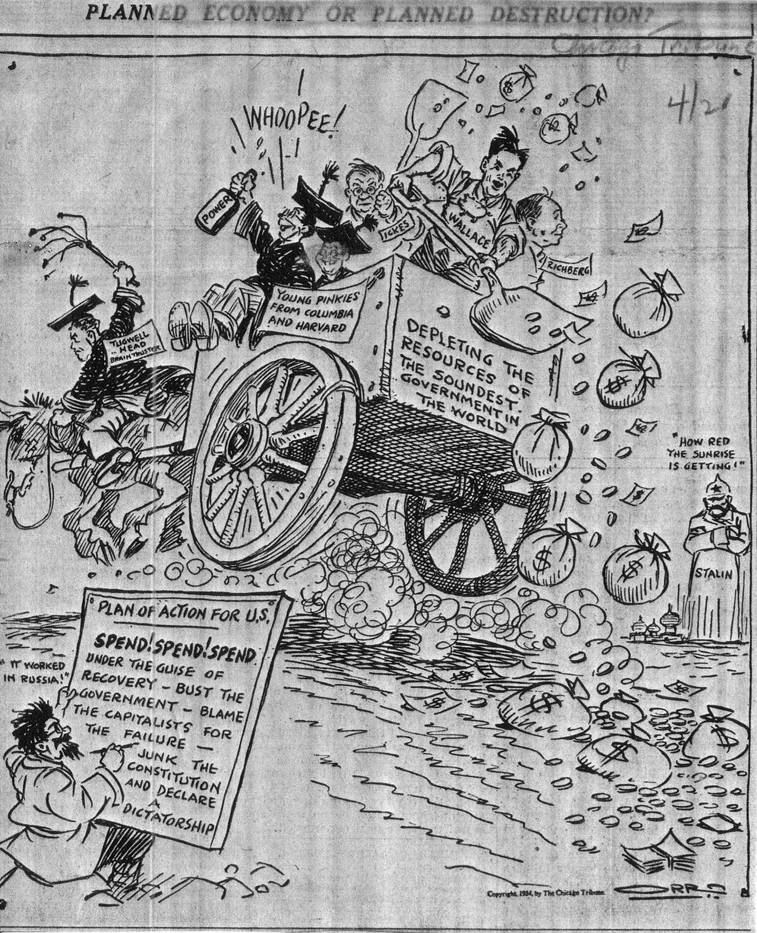

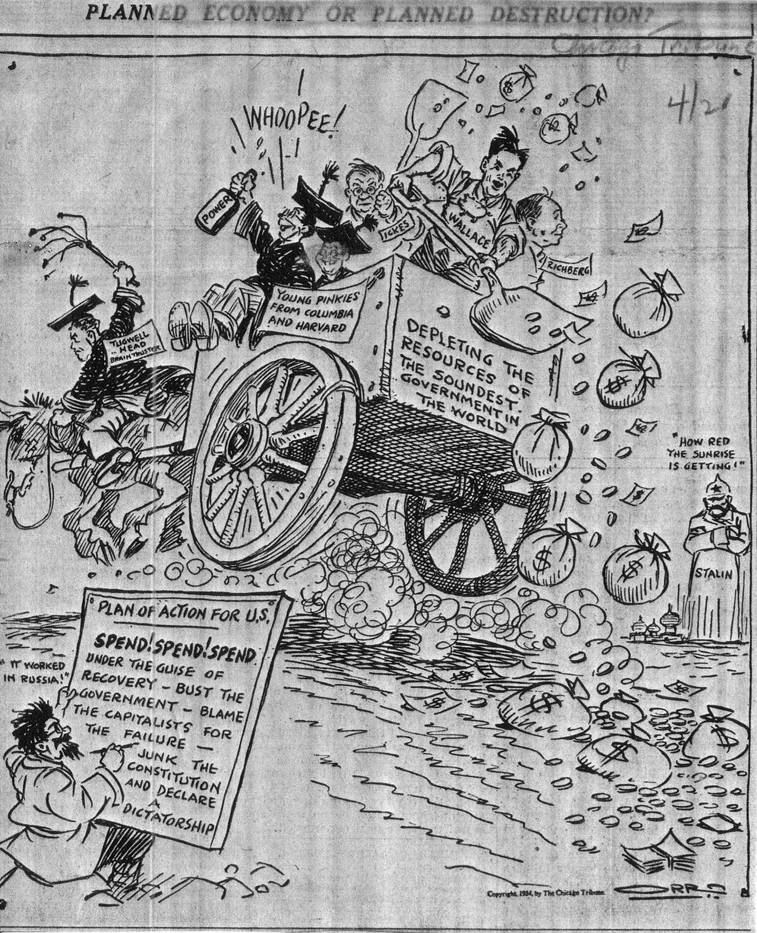

Do you know the year of that cartoon?

Good article thanks for posting.

1934

Thanks!

I’m going to put that on my FReeper Profile if you don’t mind.

I believe the author Arther Laffler still owes Peter Schiff a penny and an apology. Which is to say that he has some large blind spots in his understanding of economics.

Would you please explain that further?

I’m just a mom, not an economist.

Oh ... I get it now. The “stimulus” was really just to stage cash in the banks in case of a run. I guess I’m gettin’ slow in my old age?

Those who do not learn from History are condemned to repeat it (and typically make up 51% of the turnout in any given election cycle)

RE: Would you please explain that further?

I’m just a mom, not an economist.

According to this site :

http://www.xdtalk.com/forums/political-view/88644-peter-schiff-vs-arthur-laffer.html

Art Laffer and Peter Schiff debated in 2006 regarding the future of the US economy. Laffer was the optimist, Schiff the pessimist. At that time, the economy was in good shape, housing was going up and unemployment less than 5%.

Schiff turned out to be right and Laffer wrong. Schiff predicted with remarkable accuracy the meltdown we are now having.

Schiff, by the way, was an advisor for Ron Paul.

Here is his article describing their debate entitled :

PETER SCHIFF vs ART LAFFER

http://www.financialsense.com/fsu/editorials/schiff/2006/0901.html

Thanks!

Thanks so much for that post. Schiff was so right with very specific and concrete reasons. Laffer was so wrong with vague generalities and faulty reasoning. That was extremely informative.

Peter Schiff is running fot the Senate in CT.

The 1935 Wagner Act resulted in rapid unionization of heavy industries.

Overhead costs to companies went up overnight without an increase in receipts. It helped cause the 1937 “depression within the Great Depression.”

Also, going off the gold standard stole hundreds of billions of dollars from bondholders. FDR was an economic madman.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.