Biden's intellectually facile words on the corporate minimum tax From CNN's Daniel Dale

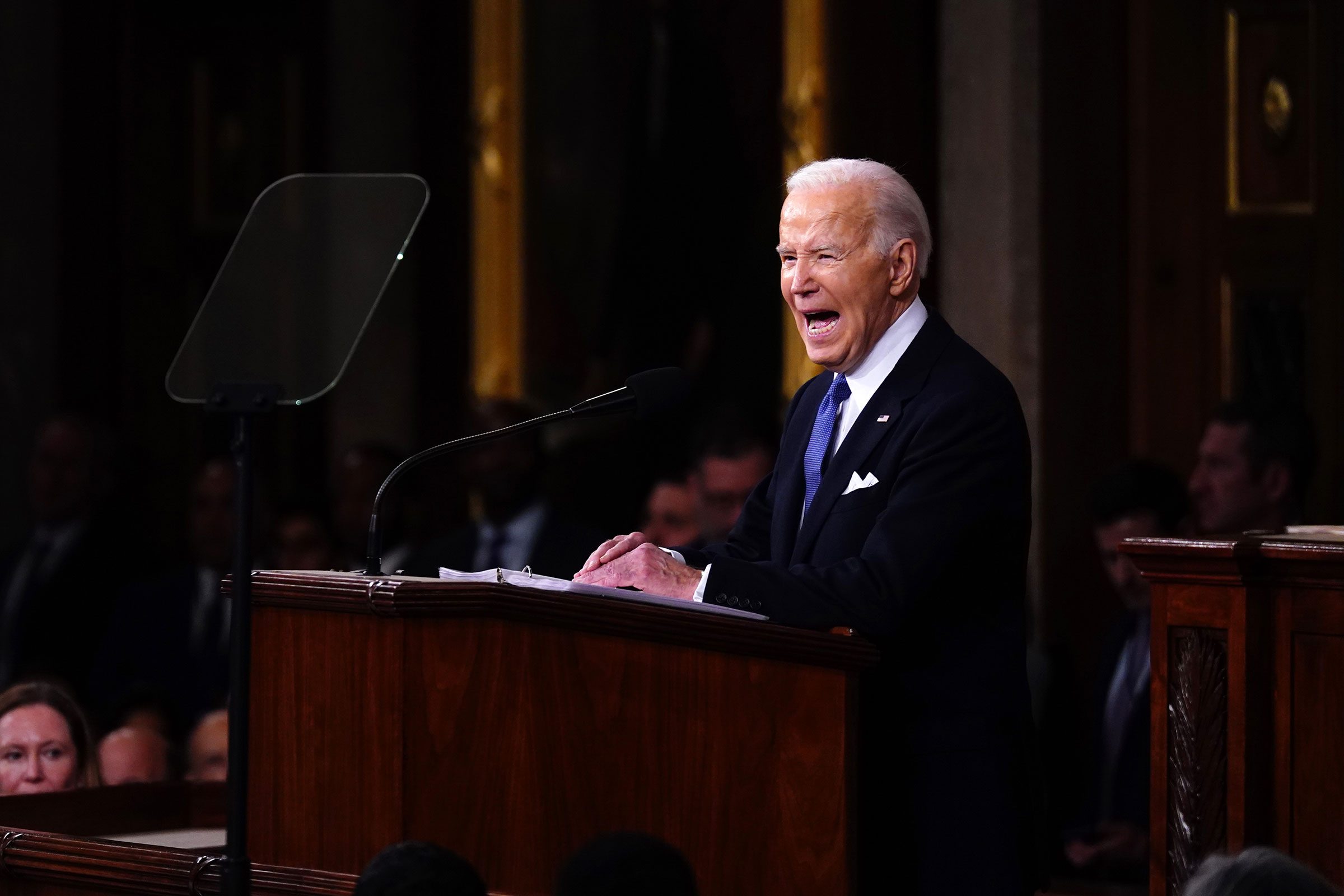

Joe Biden whines as he delivers the annual State of the Union address before a joint session of Congress in the House chamber on March 7.

During his State of the Union address, President Joe Biden cited a 2021 report from the Institute on Taxation and Economic Policy think tank that found that 55 of the country’s largest corporations had made $40 billion in profit in their previous fiscal year but not paid any federal corporate income taxes.

He said, “Remember in 2020, 55 of the biggest companies in America made $40 billion and paid zero in federal income taxes. Zero. Not anymore. Thanks to the law I wrote and we signed, big companies have to pay a minimum of 15%.”

Facts First: Biden’s “not anymore” claim is false, an exaggeration. While his 15% corporate minimum tax will reduce the number of big companies that don’t pay any federal taxes, it’s not true that “not anymore” will any big company – such as the ones on the list of 55 companies Biden mentioned – ever do so. That’s because the minimum tax, on the “book income” companies report to investors, only applies to companies with at least $1 billion in average annual income. According to the Institute on Taxation and Economic Policy, only 14 of the companies on its list of 55 non-payers reported having US pre-tax income of at least $1 billion.

In other words, there will still be some large and profitable corporations paying no federal income tax despite the existence of the tax. The exact number is not known.

Matthew Gardner, a senior fellow at the Institute on Taxation and Economic Policy, told CNN in 2022 that the new tax is “an important step forward from the status quo” and that it would raise substantial revenue. But he also said: “I wouldn’t want to assert that the minimum tax will end the phenomenon of zero-tax profitable corporations. A more accurate phrasing would be to say that the minimum tax will 'help' ensure that 'the most profitable' corporations pay at least some federal income tax.”