Posted on 03/10/2020 11:57:29 AM PDT by Oldeconomybuyer

DUBAI/MOSCOW - Saudi Arabia said on Tuesday it would boost its oil supplies to a record high in April, raising the stakes in a standoff with Russia and effectively rebuffing Moscow’s suggestion for new talks.

The clash of oil titans Saudi Arabia and Russia sparked a 25% slump in crude prices on Monday, triggering panic selling on Wall Street and other equity markets that have already been badly hit by the impact of the coronavirus outbreak.

Oil prices LCOc1 recovered some ground on Tuesday, but were still 40% down on the start of the year.

U.S. President Donald Trump spoke with Saudi Crown Prince Mohammed bin Salman in a call on Monday to discuss global energy markets, the White House said on Tuesday.

Russia’s Energy Ministry also called for a meeting with Russian oil firms on Wednesday to discuss future cooperation with OPEC, two sources told Reuters.

But Saudi Energy Minister Prince Abdulaziz bin Salman appeared to rebuff the suggestion.

“I fail to see the wisdom for holding meetings in May-June that would only demonstrate our failure in attending to what we should have done in a crisis like this and taking the necessary measures,” he told Reuters.

(Excerpt) Read more at reuters.com ...

There are proxies - XOM, BP, CVX, RDS, etc

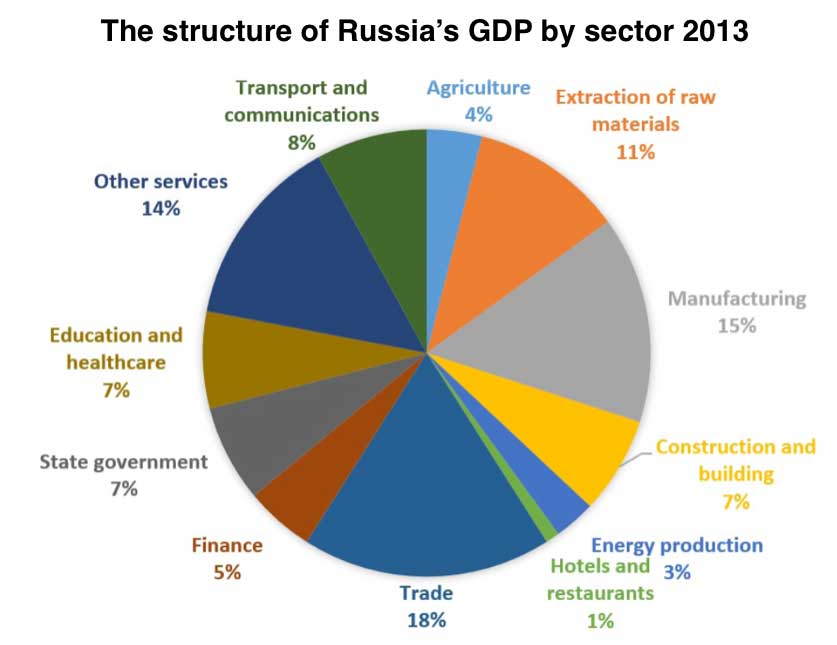

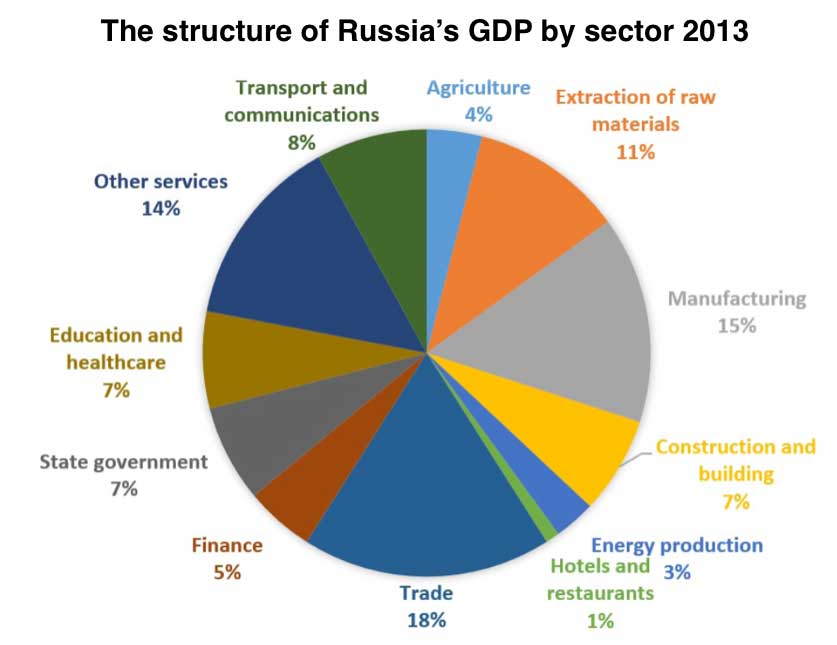

Oil exports are about 50% of Russian GDP, and a much higher percent of their government operating revenue. If they F with the Saudi’s, Putin loses.

If you don’t produce but you do consume, you like oil price wars, as long as there is supply. And that’s the whole point of this one, more supply.

Some American states will take advantage of the low prices to raise their gas taxes, the price increase that only grows over time.

There are other sectors of the economy that would benefit. Kind of a mixed bag.

“...and the oil terminal at Dhahran is one of the most modern in the world.”

Damn shame if something were to happen to it...

Got it. Then POTUS could tailor his message for different states. For Texas, e.g., it’s important to address major layoffs and small frackers potentially going bankrupt.

TX electoral votes won’t go to the Rats, but just a few seats in the House might make the difference between keeping Pelousi as Speaker or sending her to pasture.

My understanding is there is tons of dormant oil in Saudi Arabia they haven’t even bothered to put wells on.

[US frackers now have a production cost of $27 a barrel. ]

Mutual weakening would be the best possible outcome and we may very well get that.

[Russia wants to hurt a vital sector of the U.S. economy in an election year.]

Both the Russians and the Saudis will come back to the table. Neither can take a 50% oil revenue reduction for very long. Saudi Arabia has far more staying power than Russia, though - (1) its sovereign wealth fund is 7x Russia’s, (2) it has 1/4 the population, i.e. fewer mouths clamoring for a share of the oil revenues and (3) Russian oil, at $20 per barrel in production cost, costs twice as much to pump as Saudi oil.

https://en.wikipedia.org/wiki/List_of_countries_by_sovereign_wealth_funds

MBS is right - the Russian ability to survive $25 oil for any length of is minuscule. Before the price war, oil prices were at $45, yielding $25 a barrel in revenues for the Russians. At a price of $25, the Russians would get $5 a barrel in revenues. How will the Russians plug the 80% decline in revenues?

Whereas the Saudi drop, while serious, is far smaller - $45 - $10 (production cost) yields $35 per barrel pre-price war. Post price war, they get $25-$10 = $15 per barrel. That’s still a 60% drop in revenues, but it’s a lot better that Russia’s 80% decline. And as noted above, the Saudis have a bigger war chest and a smaller population over which to spread the oil revenues.

A passage from the origin of your chart:

During the 15 years of Putin’s prosperity, the Russian state has expanded its economic presence significantly. The secondary economy of services, manufacturing and the public sector has evolved on the back of the hydrocarbon boom. The data on the growth of the state and its relationship to petrol income is clear: in 2005, the Russian budget was balanced at 20 dollars per barrel, in 2013, the budget was balanced at 102 per barrel dollars. Today, the welfare of many people directly depends on the federal budget and regional transfers and subsidies. In 2004 16.4 million of people were employed in the state sector, today 20 million workers (or 28 percent of the total workforce) are employed in the state sector. This number is higher than the number of people who were employed in the government sector of the Soviet Union. Sustaining and funding this secondary economy is the biggest and most immediate economic challenge facing the Russian authorities amidst the unfolding crisis caused by the collapse of oil revenues.]

Yep, that you have cited is one of many opinions. Everybody interprets facts according to own bias. For me the facts are important and the opinions not so much. Also it is not 2013 now and not only the already miniscule role of oil in total Russian economy reduced but also its role in government budget too.

I wonder what would be the same graphic for the Saudis.

[Also it is not 2013 now and not only the already miniscule role of oil in total Russian economy reduced but also its role in government budget too.]

https://www.statista.com/statistics/1028682/russia-federal-budget-oil-and-gas-revenue/

That’s about 1/3 of the 2020 budget of $329b

https://www.rbth.com/business/331534-russian-budget-2020

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.