He is celebrating the market going nuts in anticipation of the corporates getting their tax break on the backs of middle and upper middle class taxpayers.

The flawed assumption of this entire enterprise is that by giving the corporations a massive tax break from 35% to 20%, they will "reinvest" that money.

Maybe some of it - but I believe most corporations will simply use it to buy back their own stock (as they have historically done).

The Goldman Sachs snake oil agents who wormed their way into the White House did their job.

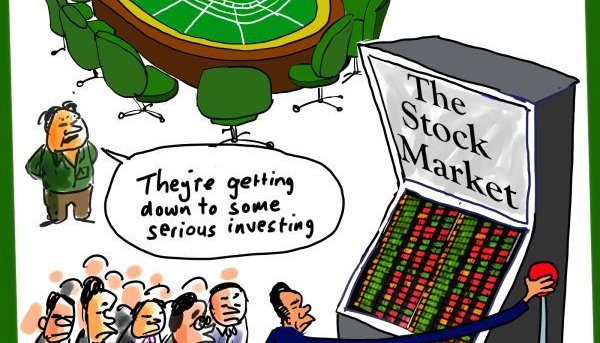

The casino will pay out big - until it doesn't.

"We will massively cut taxes for the middle class, the forgotten people, the forgotten men and women of this country, who built our country....Tax relief will be concentrated on the working and middle class taxpayer. They will receive the biggest benefit and it won't even be close."**

Donald Trump, Scranton PA, Oct 2016

**Except for you middle class in NY, NJ, CA, IL, CT, WA, MA, and other states....and except for you middle class who deduct medical expenses, and except for large families who rely on the Personal Exemption, and except for you young people who deduct student loan interest, and except for you middle class who deduct mortgage interest, and except for you men who have to pay alimony, and except for you school teachers who deduct paying for school supplies out of your own pocket, and except for graduate students, and except for college students who get tuition benefits from parental employment, and...