Yes, my original link was http://usbudget.blogspot.com/2017/11/the-problems-with-taxpayer-examples_26.html but that post links to a prior post in it's discussion of examples A through J. In fact, you can't sum up all single and married taxpayers with just two examples, whether it be those from the Senate Finance Committee or those that I posted. My plots do give a broader view in that they look at a large range of incomes but they still don't represent ALL taxpayers. You need to look at as wide a variety of taxpayers as possible. As explained at the first link above, it helps if you analyze where the changes in taxes are coming from.

>> The first plot shows higher taxes, especially for lower incomes...

> Over $50,000/per year is considered a lower income? Just exactly how many people in this country making $50,000 per year have been getting away with itemized deductions of over $30,000 per year on their income tax? Talk about cherry picking!

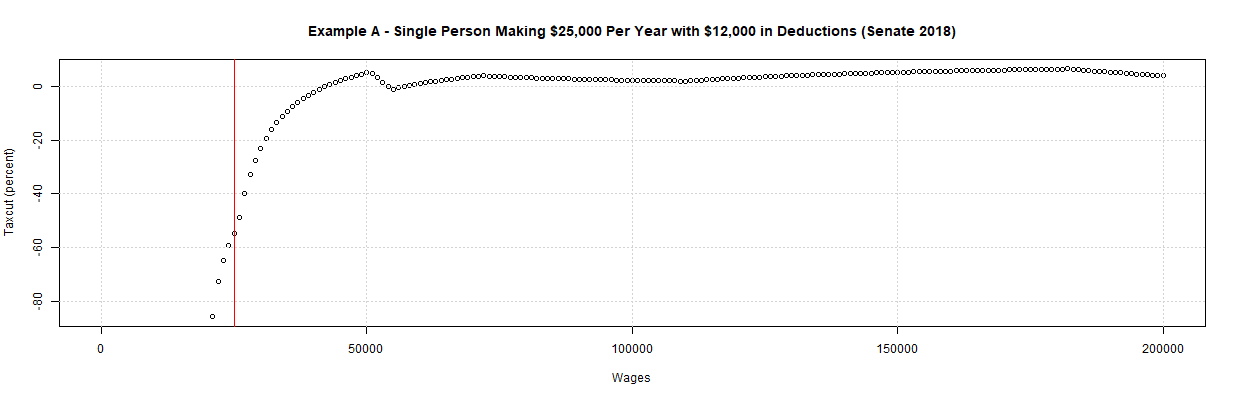

Don't get excited! I meant "lower incomes" as the lower incomes of those displayed. Also, the tax increases below $50,000 are not shown in the plot because they are likely increases of more than 100 percent! Still, we can look at Example A which is only a $12,000 deduction for a single taxpayer making only $25,000:

> The first example, from the Finance Committee was "A family of four with income of around $73,000 (median family income)" - a typical American family with two children with a middle claass family income. Nothing whatsoever, "cherry picked".

It's cherry picked if you take it to be anything more than representing a family of four with an income of $73,000 which has less than $12,000 in deductions. By the way, the House claimed that the median income is $59,000 for a family of four in their Example 1. Hopefully, they can work that disagreement out in reconciliation! Selecting any one or two examples as representing all taxpayers is cherry-picking, whether is be those from the Senate Finance Committee or two of Examples A through J that I posted. You need to look at as wide a range as possible.