No they are not. It's the other way around. Without the tax revenue of the states that you seem to despise, the Federal revenue would be a trickle.

Further, you are advocating Double Taxation - people forced to pay taxes upon the taxes they already are paying. Since 1913, the Federal Tax code has prohibited this, because the original authors deemed it "immoral."

And then there was this:

Rep. Dan Donova (R-NY):

"Since the federal income tax was created in 1913, Washington has never violated the conservative principle that people shouldn’t pay federal taxes on the taxes they already pay to their state and local governments because to do so would be a double tax and would interfere with a state’s ability to raise and spend as it chooses. Former President Ronald Reagan didn’t change it when he had the chance in 1986, and we shouldn’t change it now. We have an opportunity for transformative action to reform the bloated, complex and job-killing tax code for the first time in 30 years. I want nothing more than to vote for a plan that unleashes our country’s full economic potential. The tax proposal released last week has great policies that will make our country’s businesses more competitive, a top priority for President Trump and House Republicans. Unfortunately, the plan would also repeal the state and local tax (SALT) deduction, sending the bill for tax cuts elsewhere in the country straight to (the) middle class......Let’s stop pretending this tax proposal is good for everybody: the middle income people of New York, California, Illinois and New Jersey are footing the bill for a tax break for people elsewhere."

And then comes the typical attack against anyone who does not want to see their individual taxes raised by this crappy bill - we are socialists and we hate capitalism.

Give me a break.

You can pull that one on your weak minded sister at Thanksgiving, but not here.

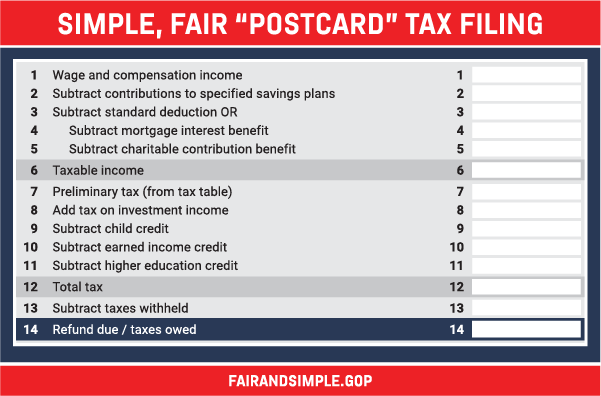

Paul Ryan and his little postcard that his staffer whipped up using Excel and PowerPoint and sent to the printer is propaganda that any thinking person is not going to swallow. Eliminating deductions (forever), while then making even the crumbs of "tax relief" they are promising individuals is worthy of contempt - but you are buying it because it probably benefits you in some way (business, stocks, etc).

Sorry, but I don't want to "subsidize" your tax break. And if you disagree with me, I won't call you a "socialist." That's your game.

/cdn.vox-cdn.com/uploads/chorus_image/image/56238953/ryan_postcard_tax.0.jpg)

http://freerepublic.com/focus/f-bloggers/3603755/posts

Whenever challenged with the reality that their proposal will result in a tax increase on many of their constituents, they exclaim, “Yes, but we are doubling the standard deduction!” Yet, not one of them ever mentions that they are, simultaneously, repealing the personal exemption deduction of $4,150, per person.

In 2018, the standard deduction for single filers will be $6,500, and for married taxpayers filing jointly $13,000, while the personal exemption will be $4,150 (per person). That means a single non-itemizer would already have received $10,650 ($6,500 standard deduction + $4,150 personal exemption) of tax exempt income before the proposal, versus $12,200 after. And, a married couple, without children and not itemizing, would already have received $21,300 of tax exempt income before the proposal, versus $24,400 after.

For single filers, the difference between $12,200 and $10,650 isn’t double, it’s only $1,550. For married couples, the difference between $24,400 and $21,300 is a mere $3,100. This isn’t a doubling of the standard deduction. It is effectively an increase to the standard deduction of $1,550 for single filers and $3,100 for couples without children. So, please stop lying to us.