Posted on 11/15/2017 4:51:41 PM PST by SkyPilot

Sen. Ron Johnson (R., Wis.) said he opposes the Senate Republican tax package, becoming the first GOP voice of dissent that, if it gains momentum, could force significant changes or jeopardize the party’s goal to pass the bill before the end of the year.

“If they can pass it without me, let them,” Mr. Johnson said in an interview Wednesday, adding that the plan unfairly benefits corporations more than other types of businesses. “I’m not going to vote for this tax package.”

Any Republican opposition is significant because GOP leaders are counting on near universal support from within the party to pass a bill on party line votes. With 52 seats in the Senate, Republicans can lose no more than two votes unless they can somehow find a way to win votes from Democrats.

Other Senate Republicans have expressed concerns. Jeff Flake of Arizona, for example, has worried about deficits and Susan Collins of Maine has worried about Republican plans to repeal the insurance coverage mandate in the Affordable Care Act as part of a tax overhaul.

Until now, no Senate Republican has come out definitively against the GOP tax plan. The risk for GOP leaders is that other Republicans get behind Mr. Johnson’s opposition, and either stop the bill or slow its passage, depriving Republicans of the chance to boost after-tax income household income next year, during the elections.

Still, in a statement issued in the late afternoon, Mr. Johnson said he hoped that Republicans could address the disparity so he could support the final version of the tax bill. Such changes could be expensive and might force tax writers to make other changes. .

(Excerpt) Read more at wsj.com ...

SPOT ON AND YOU’RE NOT ALONE!

100% true - because the only ones getting a real cut are the corporations (35% to 20%). That's all they care about.

Also, did you see this?

The Moment Gary Cohn Realized His Entire Economic Policy Is A Disaster

During an event for the Wall Street Journal's CEO Council, an editor at The Wall Street Journal asked the room: "If the tax reform bill goes through, do you plan to increase investment — your company's investment, capital investment?" He asked for a show of hands. Alas, as the camera revealed, virtually nobody raised their hand. Responding to this "unexpected" lack of enthusiasm to invest in growth, Cohn had one question: "Why aren't the other hands up?"

The assumption that corporate tax cuts are going result in higher worker wages and investment is flawed.

The companies are going to use the extra cash to repurchase more of their own shares.

Ron Johnson also supports the NFL and their disrespect for our country.

This is a tax increase bill, it’s the biggest tax increase for California in state history. Calling it a tax cut is a lie.

No conservative should support this tax increase bill.

Oh, and the evil SALT deductions you hate so much? Both the House and Senate bills allow the corporations to keep those full deductions. The "math" works out that in order to give away the store to the GOP donors and corporations, we screw the middle class.

Got it. Gee, thanks a lot.

Preach it Cali. Amen.

Because corporate income, unlike partnership or LLC income, is subject to two levels of taxation, once at the corporate level and then again at the individual level. Under current law a dollar of income earned by a corporation and paid as a dividend to a shareholder paying tax at the 33% rate is subject to an effective tax of almost 57% (.35 + (.33 x .65)). Further, there could be no more effective boost for our economy than a reduction of our non-competitive tax on corporate income. We already have the advantages of comparatively unregulated labor markets and low energy prices. We would be inundated by capital if we had a competitive corporate tax regime.

Broken clock syndrome.

A "TAX CUT" is supposed to be for EVERYONE; not a selective few and that is exactly what this POS is and getting worse.

In one way or another, everyone who pays taxes, "subsidizes" others.

I bet that you have a mortgage and probably other things to deduct, or make lower middle class to lower middle middle wages so as long as YOU "get yours"...you don't give a damn about anyone else. You're no better than the ILLEGALS ALIENS, people who get MY tax money back as a refund, who paid almost nothing in, and the others who don't understand what's going on.

Are you aware that small businesses do NOT get a break in the Senate Bill...only the BIG corporations?

“Moreover, most of the high tax states are subsidizing the low tax states - not the other way around.”

That is the way it ought to be since they are the ones sending the big spenders to Congress.

Rush Limbaugh nailed it exactly right today when he said any tax reform bill that doesn't flat out cut rates ACROSS THE BOARD for EVERYONE isn't tax reform at all.

This nonsense that the Government picks winners and losers by giving one "class" a tax break while "offsetting" those dollars by taking them away from someone else is absolutely ridiculous.

I want REAL TAX REFORM - like Ronald Reagan did when he cut rates ACROSS THE BOARD.

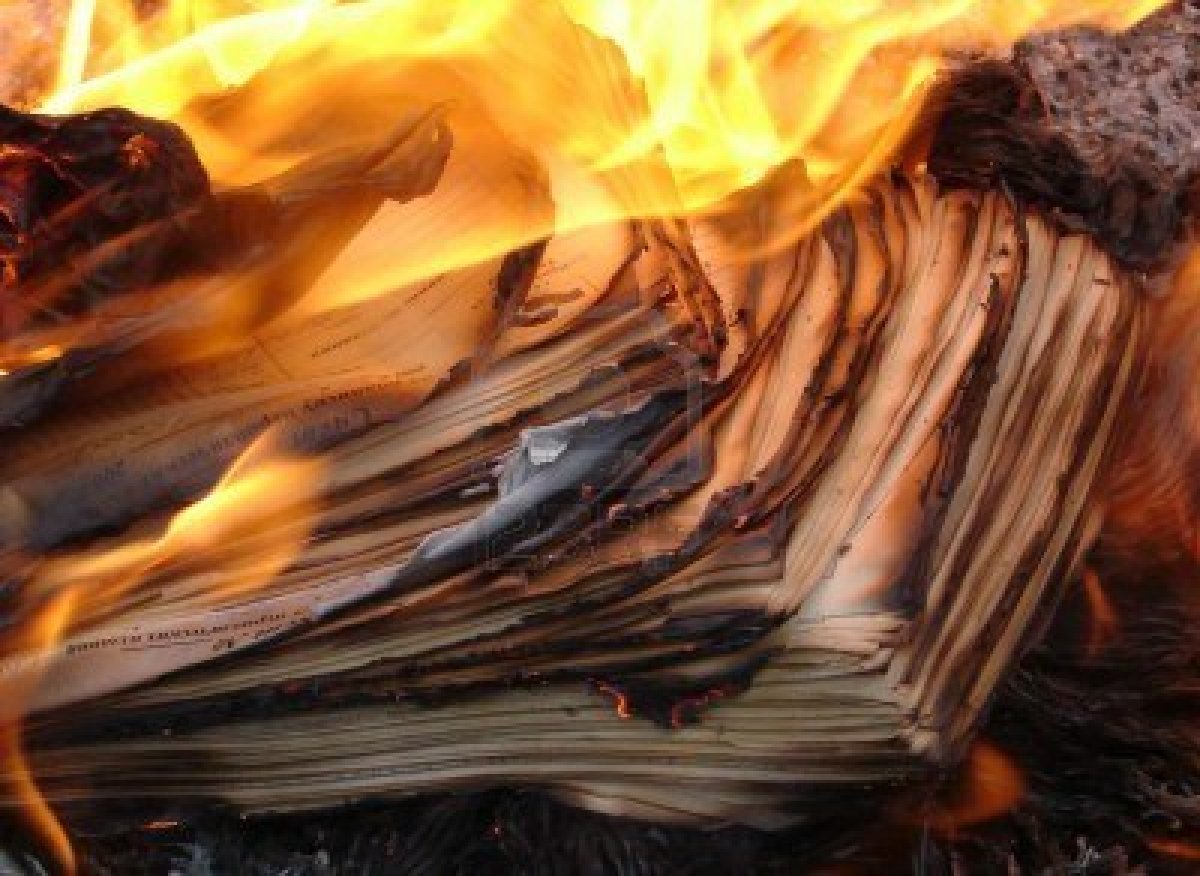

Trump's "tax reform" isn't reform at all, it's more socialism on steroids. It needs to go down in FLAMES.

Tax reform should be passed after there are massive cuts in spending.

I am hoping and praying this bill burns to the ground.

I have contacted my Representative on several occasions, and his staff has given me and several others the cold shoulder (even though they said they would be in contact).

The folks on the Hill know we are ticked, but they are hoping they can jam this through before the revolt gains traction.

Low wage earners get the misnamed "earned income tax rebate".

"HIGH" wage earners, in todays's proposed Bills, get NAILED TO A CROSS, with pilfered pockets.

And it's NOT just them...it's also lots and lots and LOTS of middle class people who live all over this nation; not only high state tax ones.

Agreed. I wish Trump would get out and lead, but he is sitting back, waiting for a bill (any bill) to reach his desk.

I wonder if he really even knows what's in the bill itself.

This isn't what he promised or ran on. Not by a longshot.

I love Trump, but I hate where this is all going.

If this bill comes to pass and Trump signs it, it will be the death of the Republican Party and I personally will sit out the 2018 & 2020 elections. (Can't bring myself to vote Democrat so that's the best I can do.)

It does not raise taxes on anyone.

I say that we should "punish" low tax states then, since THEY get far more back from the Fed Gov., than they send in. How'd ya like dem apples? LOL

I really wish I could disagree with you.

But unfortunately I can’t because what you said makes perfect sense.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.