REFINERS IN NORTH AMERICA AND WORLDWIDE

file:///C:/Users/GT%20Engineering/Downloads/797317%20Implications%20of%20Light%20Tight%20Oil%20Growth.pdf

January 2014

Tim Fitzgibbon, Matt Rogers

The production of light tight oil (LTO) – or unconventional oil – in North America has grown dramatically, rising from almost nothing in 2010 to over 2 million barrels per day (bpd) in 2013. This growth shows no sign of slowing, with production currently increasing by about 75,000 bpd each month.

The application of production techniques that were first applied to shale gas – horizontal drilling in combination with hydraulic fracturing—has been driving this trend. These techniques have allowed producers to tap a vast resource that, while well known for many decades, has until now been uneconomic to produce. Most of this growth has come from two basins, the Bakken in North Dakota and the Eagle Ford in South Texas. However, the techniques are increasingly being applied in a number of other areas. While these newer plays are typically smaller -in acreage and resource size than the Bakken and Eagle Ford, several of these developing plays are reporting similar well sizes, and showing attractive economic returns and growth.

The volume, quality, and location of LTO supply growth pose both challenges and opportunities for the refining industry in North America, and the resulting changes could have important consequences for refiners worldwide.

LTO QUALITY AND ITS RAMIFICATIONS

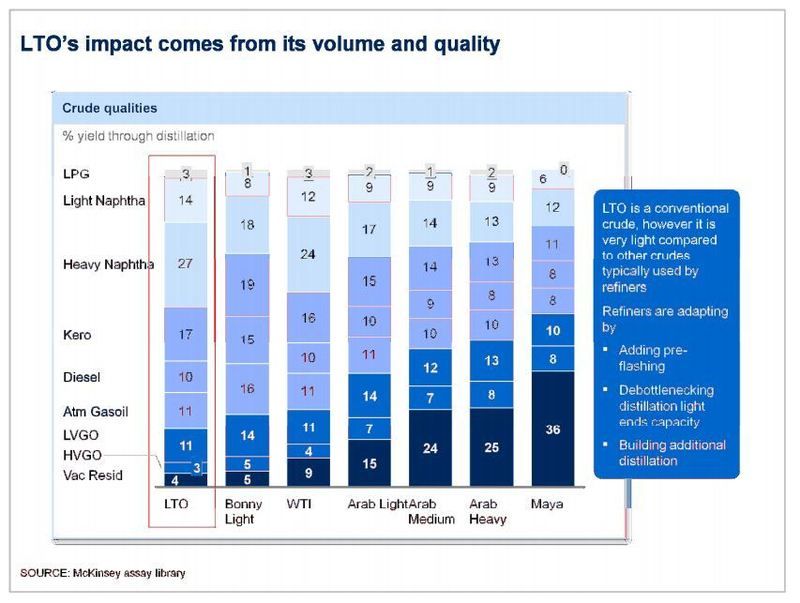

LTO from all resource areas is consistently lighter and sweeter than typical crude oils processed by North American refiners. LTO has almost twice as much naphtha and half as much bottoms material as Arab Light (Exhibit 1). Even relative to other light-sweet grades, such as West African Bonny -Light or West Texas Intermediate (WTI), LTO is noticeably lighter.

US refiners have invested heavily over the last two decades to process medium- to heavy-crude slates, especially on the US Gulf Coast. To process greater quantities of LTO, most refiners will have to either debottleneck the light-ends part of their distillation, or add new distillation that is specifically suited to LTO. Longer term, as LTO displaces medium and heavy crudes, refiners will struggle to keep their highvalue conversion units (FCC, hydrocracking, and coking) full. They will either need to reduce utilization of these units or find ways to backfill, perhaps through importing feedstock.