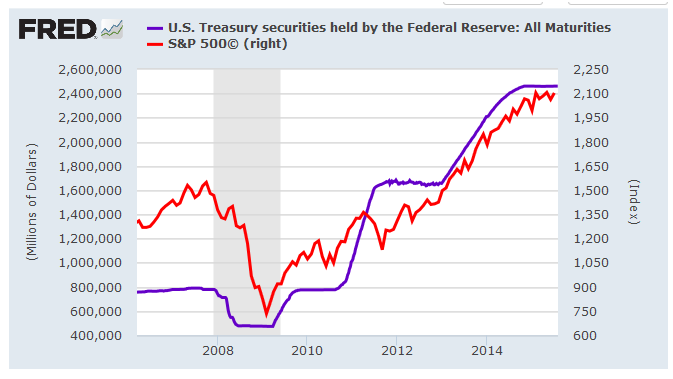

The big buying sprees were '09, '11, and '13. The S&P had already begun its bounce before all three and the big '12-'15 run happened after QE1 and QE2. Fed buying stopped back in Sept. '14 and the S&P continued to climb for half a year. There's more going on w/ stocks than just QE.

If they’ve quit, who’s buying all the bonds?

From '08 to '15 the total Federal debt doubled by selling $9T and of that the Fed bought "only" $2T. There are plenty of other buyers.