To: shortstop

RE: SHOULD WE RETIRE RETIREMENT?

The problem is not really retirement, the problem is AGEISM.

A large number of businesses and companies will FORCE you to retire vias layoffs, replacement, or some other means when you reach a certain age.

And very few businesses will hire you even if you are strong enough and willing to continue working.

To: SeekAndFind

True. There is age discrimination in the workplace.

Though such discrimination is illegal, if one job applicant is 60 and appears to be overweight or have less than robust health, and another applicant is 35 with ten years of experience in whatever job field is being recruited for, guess which one gets the job offer.

Age is only some advantage in the job market, when they are seeking senior level management. In such case, someone age 55 who has 30 years of increasingly responsible management experience will be a strong job candidate. Otherwise, the bias is towards younger workers for just about any job you can think of.

To: SeekAndFind

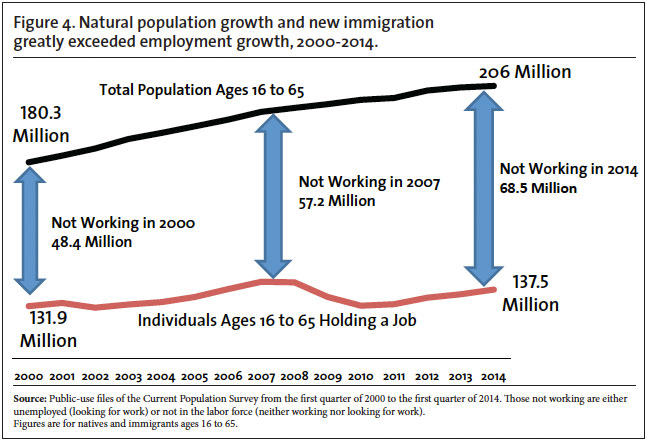

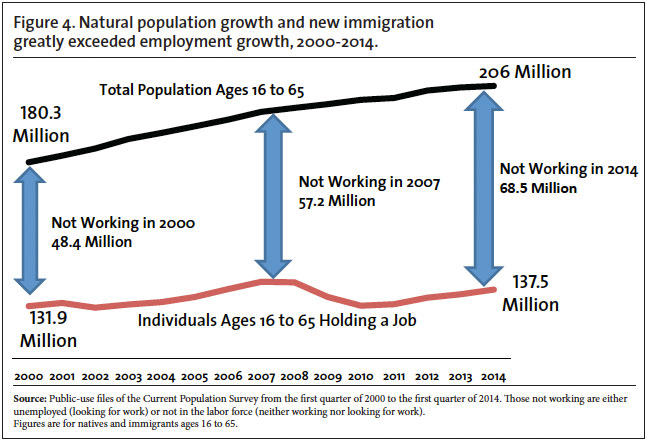

We have the lowest labor participation rates in 38 years for those 16 to 65. The percentage of those over 65 working has increased, which is more a function of economic necessity than anything else.

Most Americans still stop working by the time they hit 65. But about 18.5 percent of Americans age 65 and over were working in 2012, according to the Bureau of Labor Statistics. That's a nearly 8 percentage point increase from a low in 1985, when just 10.8 percent of Americans over age 65 were still at work.

A new GAO analysis finds that among households with members aged 55 or older, nearly 29 percent have neither retirement savings nor a traditional pension plan. Even among those who do have retirement savings, their nest eggs are small. The agency found the median amount of those savings is about $104,000 for households with members between 55 and 64 years old and $148,000 for households with members 65 to 74 years old. That's equivalent to an inflation-protected annuity of $310 and $649 per month, respectively, according to the GAO.

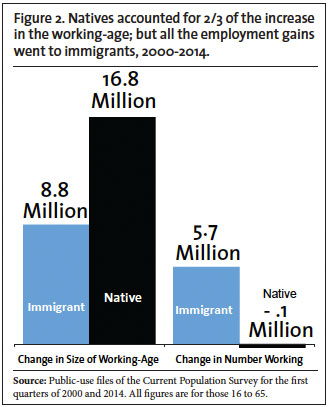

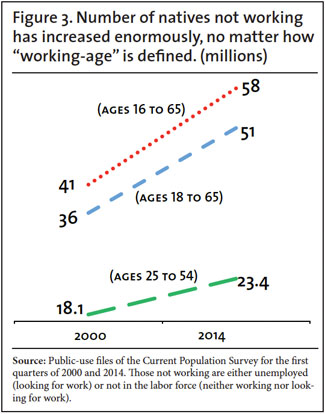

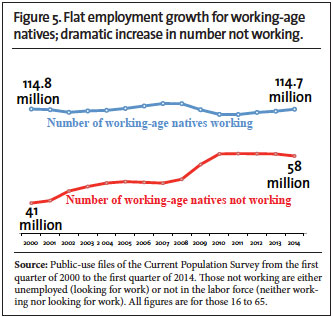

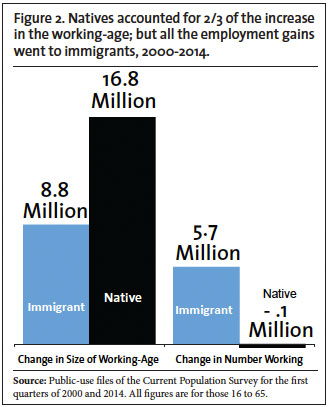

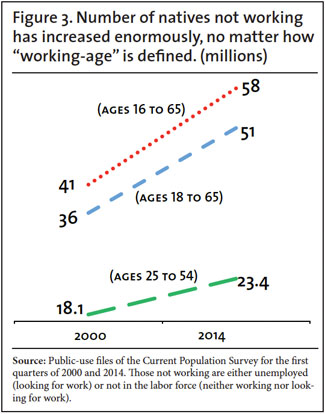

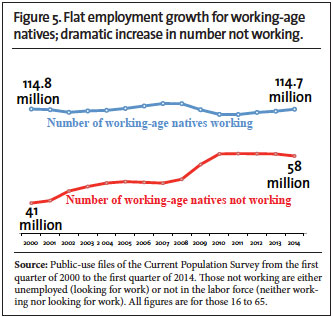

While some may consider the numbers working over 65 to be a good thing, it does have an impact on younger workers who will find it more difficult to find jobs and promotions. There are fewer native born Americans working now than in 2000 despite an increase in the working age population of 25.6 million. And add in the impact of automation and you have some real problems, economically and culturally.

42 posted on

06/10/2015 8:28:17 AM PDT by

kabar

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson