To: expat_panama

Good morning. I trust you are well.

Have you read this article at MarketWatch...

The Amazing Portfolio

If you have time, tell me what you think.

5.56mm

56 posted on

03/12/2015 8:51:22 AM PDT by

M Kehoe

To: M Kehoe

Thanks for the heads-up.

For me it was a bit hard to follow but what I got is they're pushing a broad spectrum portfolio with equal weight to small as well as medium and large cap stocks. As an index they talk about the MSCI US (equally weighted) but I can't get the data because that index seems to be proprietary so we can't verify the article's numbers.

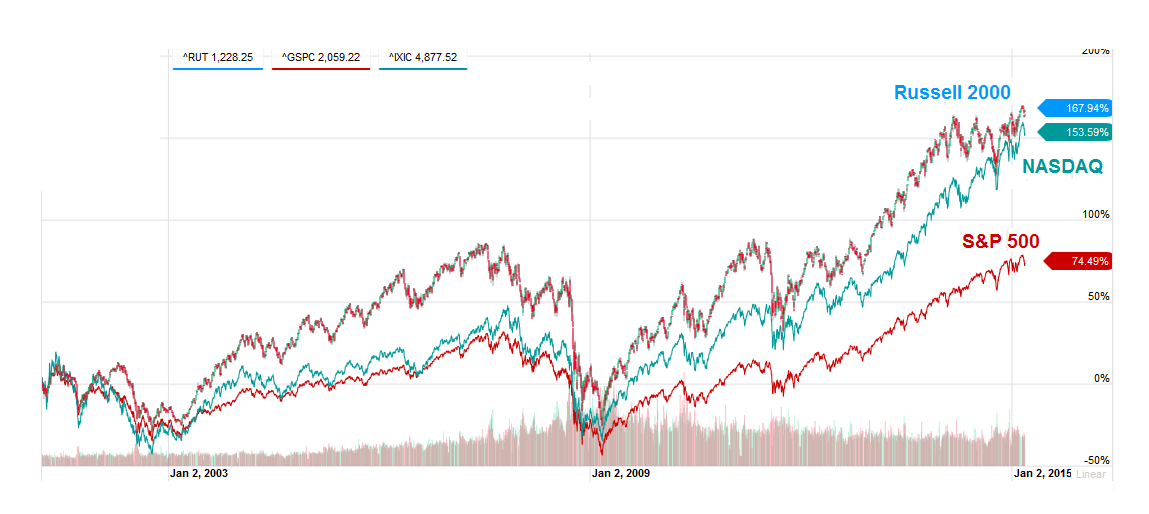

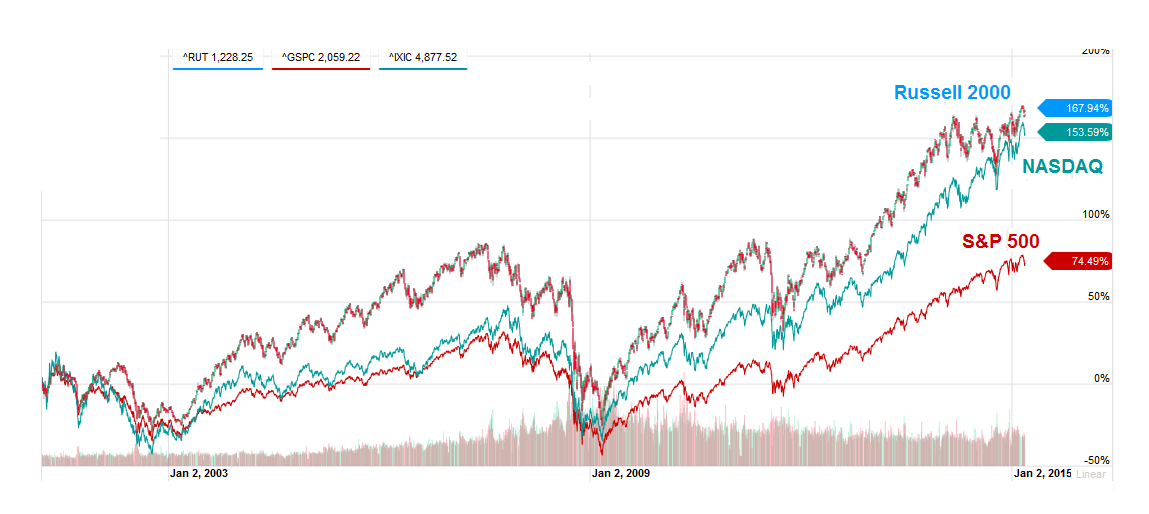

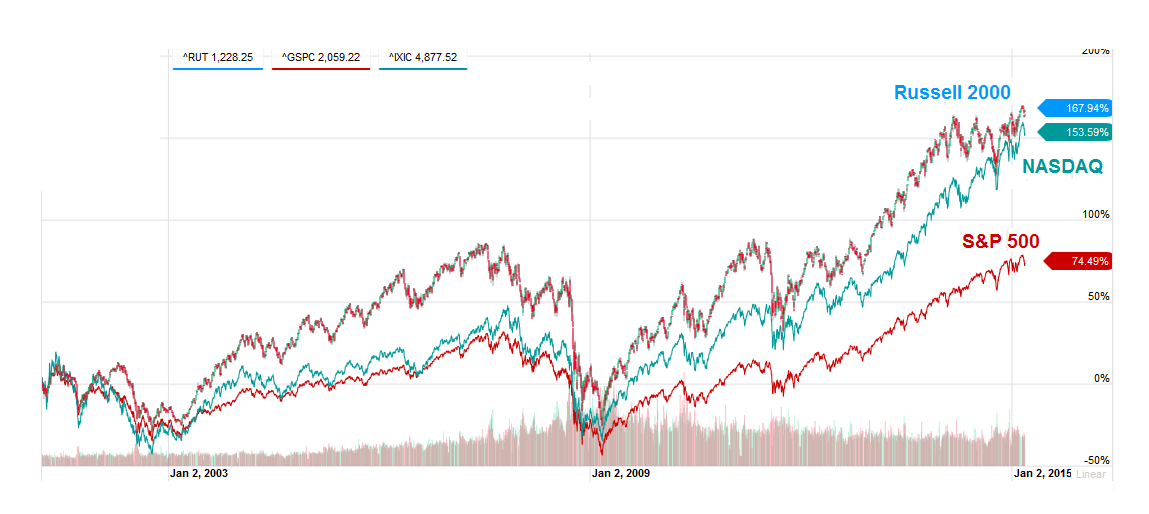

Just the same, there is a good point there that we don't want to narrow ourselves just to large caps, and after reading the piece I'm thinking it's good to compare the S&P500 and NASDAQ to the broader Russell 2,000 over 16 years--

--which makes the R2K look really good. It's not always that way though; looking at just the past year or 2 makes the R2K seem not nearly as hot as the bigger ones, but it's the nature of smaller companies we're talking about. The little guys just can't handle hard times as well but in good times they grow more. At any rate, today I just happened to buy into an R2K exchange traded fund (IWM) and I only paid $10 commission --not the $500 that the article talked about.

To: M Kehoe

Thanks for the heads-up.

For me it was a bit hard to follow but what I got is they're pushing a broad spectrum portfolio with equal weight to small as well as medium and large cap stocks. As an index they talk about the MSCI US (equally weighted) but I can't get the data because that index seems to be proprietary so we can't verify the article's numbers.

Just the same, there is a good point there that we don't want to narrow ourselves just to large caps, and after reading the piece I'm thinking it's good to compare the S&P500 and NASDAQ to the broader Russell 2,000 over 16 years--

--which makes the R2K look really good. It's not always that way though; looking at just the past year or 2 makes the R2K seem not nearly as hot as the bigger ones, but it's the nature of smaller companies we're talking about. The little guys just can't handle hard times as well but in good times they grow more. At any rate, today I just happened to buy into an R2K exchange traded fund (IWM) and I only paid $10 commission --not the $500 that the article talked about.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson