To: 1010RD

...we need currency competition. Let everybody print currency...

...we need currency competition. Let everybody print currency...We already tried that:

For America’s first 70 years, private entities, and not the federal government, issued paper money. Notes printed by state-chartered banks, which could be exchanged for gold and silver, were the most common form of paper currency in circulation. From the founding of the United States to the passage of the National Banking Act, some 8,000 different entities issued currency, which created an unwieldy money supply and facilitated rampant counterfeiting. By establishing a single national currency, the National Banking Act eliminated the overwhelming variety of paper money circulating throughout the country and created a system of banks chartered by the federal government rather than by the states. The law also assisted the federal government in financing the Civil War.

To: expat_panama; 1010RD

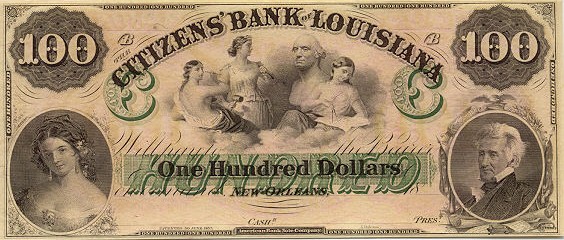

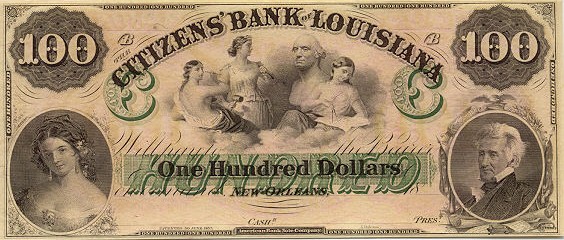

Some history of that bank and its “money.”

http://www.waymarking.com/waymarks/WM99BQ_The_Birthplace_of_Dixie_New_Orleans_LA

The Birthplace of “Dixie”

On this site from 1835 to 1924 stood the Citizens State Bank, originator of the “Dixie.” In its early days, the bank issued its own $10 bank note, with the French word “Dix” for “ten” printed on the note’s face. As this currency became widespread, people referred to its place of origin as “the land of the Dix,” which eventually shortened to “Dixieland.” Through song and legend, the word became synonymous with America’s southland.”

My favorite “money” story.

http://en.wikipedia.org/wiki/Magnetic_ink_character_recognition

Before the mid-1940s, cheques were processed manually using the Sort-A-Matic or Top Tab Key method. The processing and clearance of cheques was very time consuming and was a significant cost in cheque clearance and bank operations. As the number of cheques increased, ways were sought for automating the process. Standards were developed to ensure uniformity in financial institutions. By the mid-1950s, the Stanford Research Institute and General Electric Computer Laboratory had developed the first automated system to process cheques using MICR.[4] The same team also developed the E13B MICR font. “E” refers to the font being the fifth considered, and “B” to the fact that it was the second version. The “13” refers to the 0.013 inch character grid.[5]

In 1958, the American Bankers Association (ABA) adopted E13B font as the MICR standard for negotiable documents in the United States. By the end of 1959, the first cheques had been printed using MICR. The ABA adopted MICR as its standard because machines could read MICR accurately, and MICR could be printed using existing technology. In addition, MICR remained machine readable, even through overstamping, marking, mutilation and more.

35 posted on

02/24/2015 5:48:05 AM PST by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama; 1010RD

Now we get into the history of banking and lending, which demands that we look at this bit of history. Note the most important component of said history: Trust.

http://en.wikipedia.org/wiki/History_of_the_Knights_Templar#Bankers

By 1150, the Order’s original mission of guarding pilgrims had changed into a mission of guarding their valuables through an innovative way of issuing letters of credit, an early precursor of modern banking. Pilgrims would visit a Templar house in their home country, depositing their deeds and valuables. The Templars would then give them a letter which would describe their holdings. Modern scholars have stated that the letters were encrypted with a cipher alphabet based on a Maltese Cross; however there is some disagreement on this, and it is possible that the code system was introduced later, and not something used by the medieval Templars themselves.[6][7][8] While traveling, the pilgrims could present the letter to other Templars along the way, to “withdraw” funds from their accounts. This kept the pilgrims safe since they were not carrying valuables, and further increased the power of the Templars.

Knights Templar playing chess, 1283.

The Knights’ involvement in banking grew over time into a new basis for money, as Templars became increasingly involved in banking activities. One indication of their powerful political connections is that the Templars’ involvement in usury did not lead to more controversy within the Order and the church at large. Officially the idea of lending money in return for interest was forbidden by the church, but the Order sidestepped this with clever loopholes, such as a stipulation that the Templars retained the rights to the production of mortgaged property. Or as one Templar researcher put it, “Since they weren’t allowed to charge interest, they charged rent instead.”[9]

36 posted on

02/24/2015 5:57:44 AM PST by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

unwieldy money supply and facilitated rampant counterfeitingHow are stores of value unwieldy? How are stores of value counterfeited?

Competition works. Bank clearing houses worked as well. Why not try an experiment?

40 posted on

02/24/2015 6:18:26 AM PST by

1010RD

(First, Do No Harm)

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

...we need currency competition. Let everybody print currency...

...we need currency competition. Let everybody print currency...