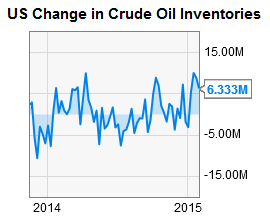

So like the first half of 2014 inventories went up and down while the price of oil just went up, and then inventories went up down and up in the other half of 2014 while the price plunged. What I'm getting is that meaningful price trends in oil take decades to set in, and month/year timeframes are just noise static.