Posted on 12/12/2014 6:25:55 AM PST by coloradan

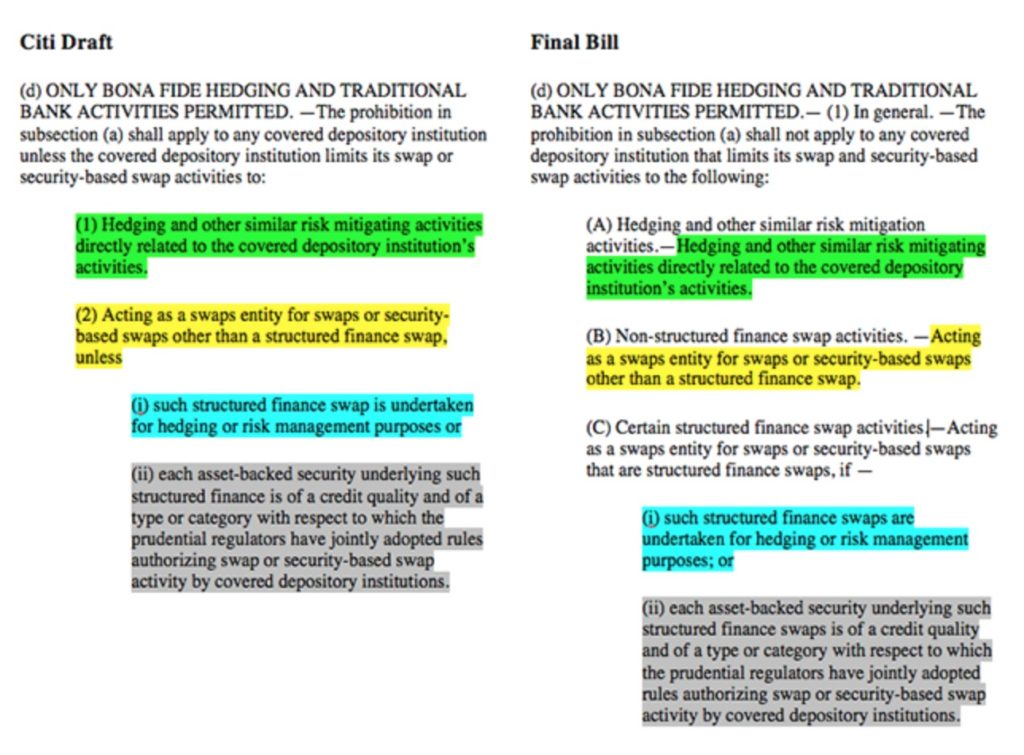

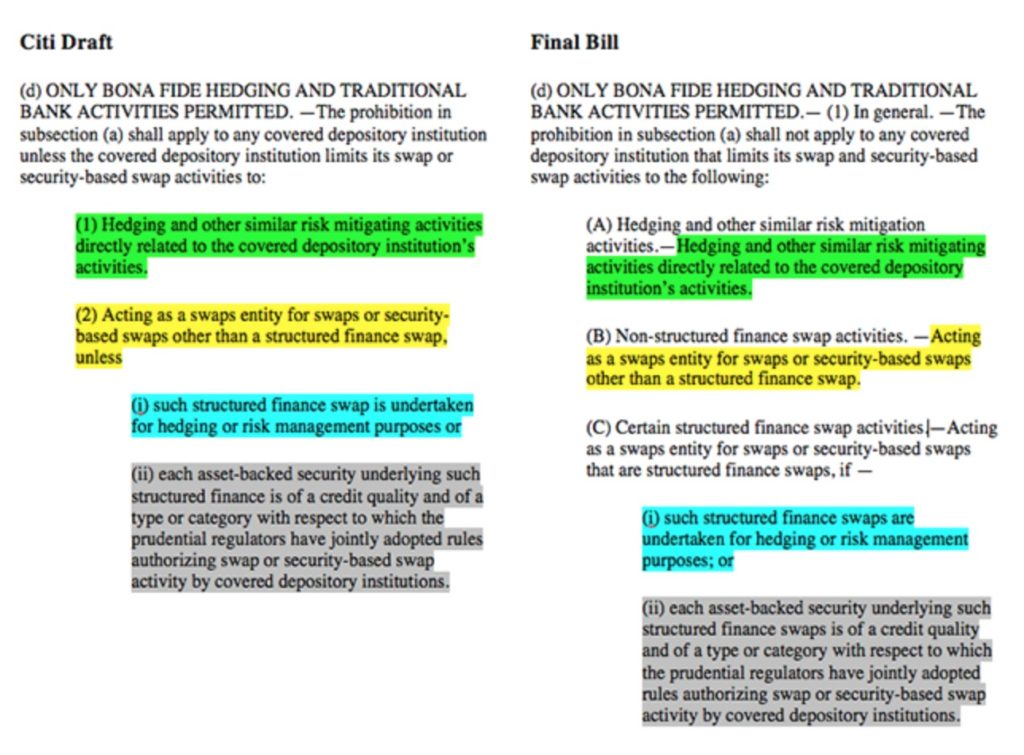

Courtesy of the Cronybus(sic) last minute passage, government was provided a quid-pro-quo $1.1 trillion spending allowance with Wall Street's blessing in exchange for assuring banks that taxpayers would be on the hook for yet another bailout, as a result of the swaps push-out provision, after incorporating explicit Citigroup language that allows financial institutions to trade certain financial derivatives from subsidiaries that are insured by the Federal Deposit Insurance Corp, explicitly putting taxpayers on the hook for losses caused by these contracts. Recall:

(more at link)

(Excerpt) Read more at zerohedge.com ...

The list, Ping

Let me know if you would like to be on or off the ping list

Very well stated.

Yeah, Zerohedge is good at panic mongering.

A legally enforceable netting agreement with a counterparty creates a single legal obligation for all transactions (called a “netting set”) under the agreement. Therefore, when banks have such agreements with their counterparties, contracts with negative values (an amount a bank would pay to its counterparty), can offset contracts with positive values (an amount owed by the counterparty to the bank).

The above, from my prior link, shows part of the reason why the "Net current credit exposure (NCCE) fell 6%, or $19 billion, to $279 billion, the lowest level since the third quarter of 2007".

$279 billion at risk, instead of $230 trillion.

If John lends Bob $1,000,000,...if Sue goes bankrupt, John becomes unhedged and becomes on the hook for the full million.

Yes, John lent $1,000,000 and can lose $1,000,000.

Maybe we should outlaw loans?

One can hope, but the electorate is pretty stupid.

Don’t forget. April 15th is tax day. Now get back to work chumps.

And I agree with virtually everything you said. But to reiterate for the third time, the law as posted in the article deals primarily with HEDGING TRANSACTIONS or transactions that do not accumulate risk.

” It is important to note that the CDS contract is not actually tied to a bond, but instead references it. For this reason, the bond involved in the transaction is called the “reference obligation.” “

This is should not be allowed.

**********************************

That is how the bankers insured their CDO’s on mortgage trusts 10-30X over... it is criminal... and we are all paying them off to this day on the miniscule losses (relatively speaking) on the “reference obligation”.

AMERICATHON!

Don’t get me started, but it’s TOTAL KRAP!

It will if the bankers decide they need a "beard" - someone to publicly rail against them while privately giving them whatever they want. Obama got two terms that way.

But ... but ... but you said that only the net matters, and the net was zero in this case. Now you're saying that the gross amount is what is important (if another party goes bankrupt)? The gross of derivatives is $300 trillion, not $279 billion.

Now you’re saying that the gross amount is what is important (if another party goes bankrupt)? The gross of derivatives is $300 trillion, not $279 billion.

*******************************

The numbers are so obscene that if the banksters attempt to use the FDIC rules to confiscate all our deposits it will collapse the currency... collapse EVERYTHING .... I do see them however using this ploy to “bail in” (like Cypress?) when hedge funds (many of them under their control) either fail or are ordered to fail by their controlling banks ... easily done by telling them to take their place as counterparty to whatever position the squid is working to collapse...

END THE FED

The net in this case is not zero.

So a bank orders a hedge fund to fail, why do we care?

So a bank orders a hedge fund to fail, why do we care?

************************

Because with this change in the rules the FDIC is on the hook,, and we are the FDIC.

What could possibly go wrong ,, if they win they win , if they lose WE pay them... surely GS won’t take advantage of us..

The FDIC is not on the hook because one bank ordered (funny idea by the way) one hedge fund to fail.

and we are the FDIC.

Banks are the FDIC.

What could possibly go wrong ,, if they win they win , if they lose WE pay them...

What could go wrong with your silly scenario? LOL!

You need to re-read what the changes inserted in the budget bill mean.. if you didn’t understand the original here’s a follow up.. http://www.zerohedge.com/news/2014-12-14/fed-vice-chairman-shocked-wall-street-influence-after-jamie-dimon-whips-cromnibus-vo

Thanks for the link. It wasn’t very helpful.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.