Posted on 12/12/2014 6:25:55 AM PST by coloradan

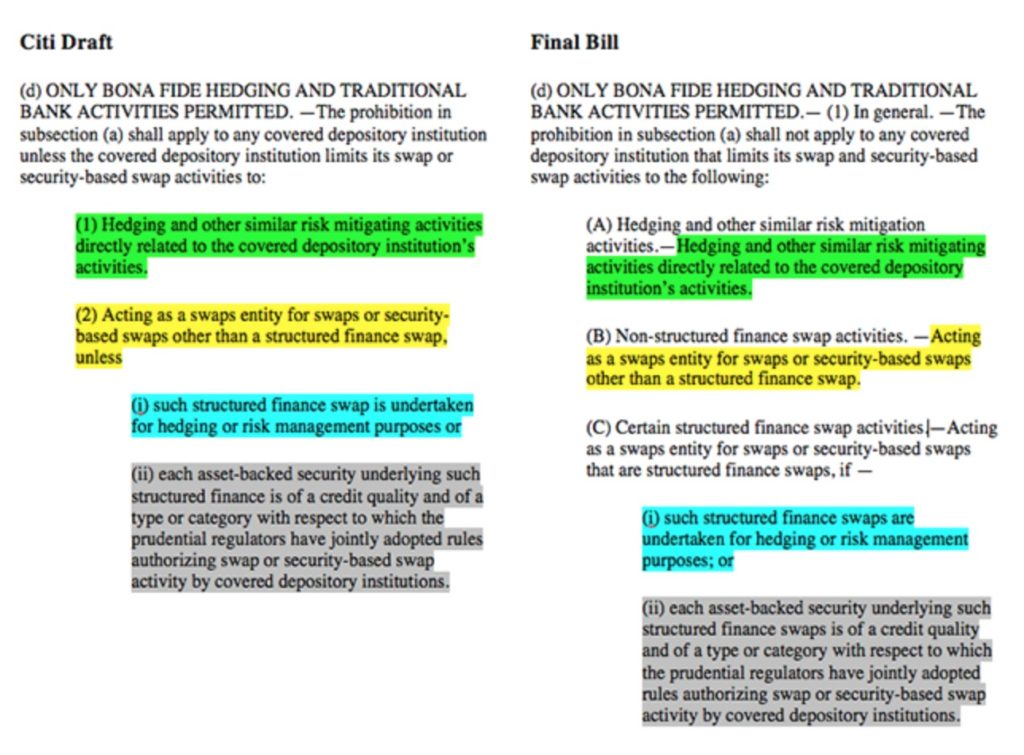

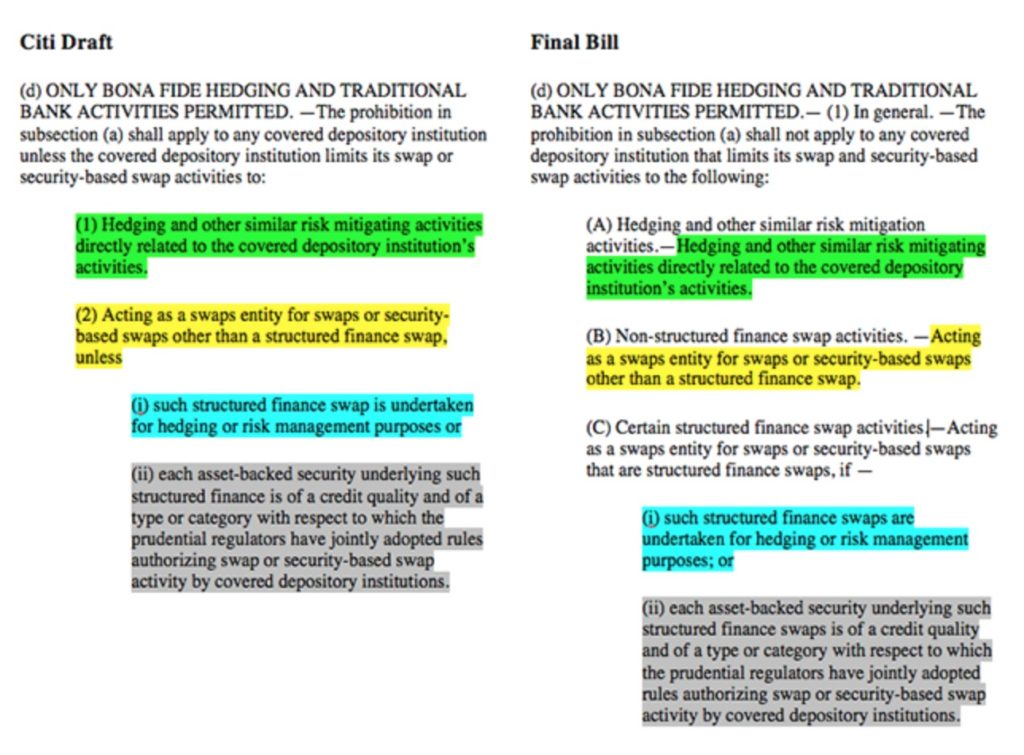

Courtesy of the Cronybus(sic) last minute passage, government was provided a quid-pro-quo $1.1 trillion spending allowance with Wall Street's blessing in exchange for assuring banks that taxpayers would be on the hook for yet another bailout, as a result of the swaps push-out provision, after incorporating explicit Citigroup language that allows financial institutions to trade certain financial derivatives from subsidiaries that are insured by the Federal Deposit Insurance Corp, explicitly putting taxpayers on the hook for losses caused by these contracts. Recall:

(more at link)

(Excerpt) Read more at zerohedge.com ...

very nice

boehner and co. are crying about this no doubt all the way to the bank

why bother to vote at all

One more reason why the next election is going to be won by an anti-banker populist.

Who is John Galt??

If I hand the feds $1M, will they leave me alone?

Just like Obama. All of our rulers are angry about it, too.

At this point, why not. It’s not like it matters. This thing (America) doesn’t last past 2020.

Title should be ‘opens the door to underpinning up to 300 trillion in derivatives’, looks like a title written to be more explosive than reality.

That being said, you can be sure this will cause the US Government to loose over a trillion dollars.

What should have been done, is the banks need broken up. They need to be deregulated but we can never allow banks that are too big to fail again. We need this kind of leader that will take on this task.

Just as soon as they're finished going through your couch cushions and turning you upside down to shake the change out of your pocket.

One can only dream of getting off so easy...

The progressive nanny state is built on the Federal Reserve and their ability to issue fiat currency, monetize debt and control interest rates. No FED means the Federal Government is forced to shrink - drastically.

Of course not...where did you get all that money?

Either the taxpayers are on the hook if the derivatives blow up, or they aren’t. At the moment the derivatives aren’t blown up, so there is no present bill due. But given oil’s slide and rapid currency revaluations (e.g. the Yen) the odds that derivatives might start blowing up is, well, let me put it this way: likely enough for cronies in Washington to insert language getting them off the hook if/when they do blow up.

This is should not be allowed.

If the text highlighted is representative of what they actually did, I think it is good. It permits them to execute a derivatives/ swaps to offset risks already on their books. It is my understanding that the credit risk derivatives, where big banks and insurance companies essentially took the credit risk off the originating lender’s books and put it on their own (for a fee), were the main problem in the big bank/ insurance company failures/ bailouts. In the end, they took more credit risk than they could cover, and of course should have been allowed to fail and not be bailed out. That doesn’t appear to be what this legislation is addressing or permitting again.

Derivatives and swaps for the purpose of reducing risk exposure ALREADY ON A BANK’S BOOKS from ordinary deposit and lending transactions is a good thing for both the bank AND taxpayer . . . IMHO. As posted here, I am perfectly fine with it. But it has to be done correctly. In my regulator days, I saw a case where a bank claimed to be hedging, whereas they were actually “doubling up to catch up”, and that is VERY, VERY bad.

In other words, bend over taxpayers.

Perhaps Uncle Sugar will be kind enough to give us a voucher for lube in bulk from Sam’s or Costco? Because one day we are all going to need it.

One more reason why the next election is going to be won by an anti-banker populist.

Paul Ryan is all ready to roll out his corporate tax cuts plan. GOP walking right into the Dem populist game plan trap. GOP is gonna get crushed. Bye Bye majority.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.