Please click the secure server link above or by mail to:

Free Republic - PO Box 9771 - FResno, CA 93794

Make it a monthly if you can.

Keep freedom ALIVE!!

Thank you all very much!!

God bless.

Posted on 04/15/2014 6:04:43 PM PDT by Jim Robinson

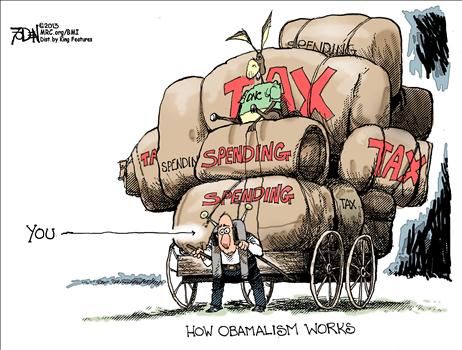

On this April 15, filers and accountants alike are finding a new array of taxes resulting from the president’s health care legislation. These include at least 20 ObamaCare-related tax increases totaling $409 billion over the next ten years, according to the Joint Committee on Taxation.

The new taxes are especially irksome to ObamaCare opponents, because they are imposed by a law that passed on a straight party-line vote and are being enforced by an agency that some accuse of party favoritism.

"I think it's rather unfortunate that the IRS has this huge role in the Affordable Care Act because it's always controversial," said Mark Everson, a former IRS Commissioner. "Then, to tie it up with this very controversial domestic law, it just makes the job tougher," he said.

~~~~~snip~~~~

Among the new taxes:

- A Medicare Tax Increase of .9 percent for individuals earning over $200,000 or married couples earning $250,000

-A net investment income tax of 3.8 percent tax on individuals, estates, and trusts worth more $200,000 or $250,000 for joint filers.

- And an increase in the threshold for itemized deductions for medical expenses from 7.5 percent to 10 percent of gross income.

There are also new taxes on insurance companies, drug makers, and medical device manufacturers. Architects of the Affordable Care Act say those businesses can afford it, given the millions of new customers they'll be serving. "More people will have health insurance and be able to use their product more effectively," said Fontenot.

But one skeptic said the projected 10-year tax increases from ObamaCare are more than twice what the Joint Committee on Taxation forecasts. "It raises the costs of these things,"...

(Excerpt) Read more at foxnews.com ...

The Fox News Taxpayer Calculator breaks down the tax burden over the next 10 years by income level. If you make under $15,000: it's just over $59.00. If you make between $50,000 and $100,000, it's $6,069.90. And if you make between $200,000 and $250,000, it's $38,200.66

Hey? What happened to my family’s promised $2,500.00 savings?

It’s not the taxes. How much will your standard of living decline because of it.

How much freedom are you willing to sacrifice for some pills or an operation.

Learned long ago that there’s no such thing as “free lunch.”

Wait until the idiot Obama voters find out that their healthcare won’t be free.

At least the EXEMPT and their families,

and their EXEMPT Staff and their families

and all Moslems are free of these taxes

and their complications and DeathPANELS.

And of course, felons.

> Hey? What happened to my family’s promised $2,500.00 savings?

Moochie used it for dessert today....

The answer has been in front of our noses for years. Look at the taxation levels in all Old European countries, and then consider their income tax rates AND a 20% VAT rate in addition.

Aside from the taxes on the insurance company that are passed on to my monthly premium that I pay with AFTER-TAX dollars,

My HSA ia now worthless as a tax write-off because Nancy changed the Minimum Deductible for a Single from $1200 (which Congress previously set) to $1250.

And the percentage of AGI before you begin to write off Medical Expenses just went from 7.5% to 10%.

I’m constantly amazed by everyday people who have no idea why gas is so high in Europe compared to here.

Or a vacation!

Powerful stuff. Sounds like something that ought to go in a national political ad.

Wow.

Called to get Obamacare today. Based on my current income of zero, I can sign up for Obamacare for the low price of $9,100/year. Since I can’t afford that right now, I’ll get taxed by the IRS for not having healthcare. I haven’t had healthcare for the last 5 years - so much for covering the uninsured...

I thought it was too late to sign up for this year.

.

Me too.

You didn’t qualify for Medicaid with zero income?

You'll have to cheat. Trust me, I don't feel guilty one bit!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.