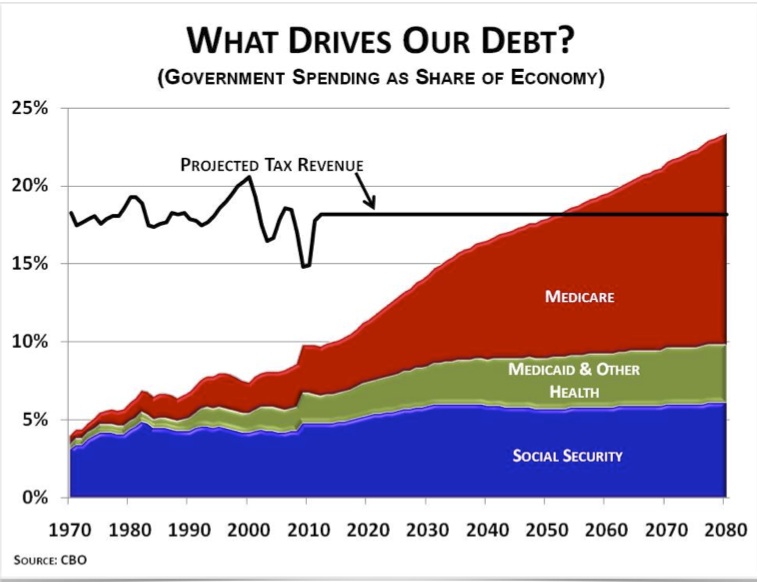

Too simplistic. Sounds good until you get into the details. Our entitlement programs will continue to increase due to our aging population. They will go up much more than 1% a year. And now we have added Obamacare, which will not be cost neutral by any metric. Medicare costs nine times what it was projected to cost. Obamacare will be the same if not worse.

What impact will inflation have? Do you take 1% a year in inflation adjusted dollars? And what percentage of GDP do you expect in terms of revenue?

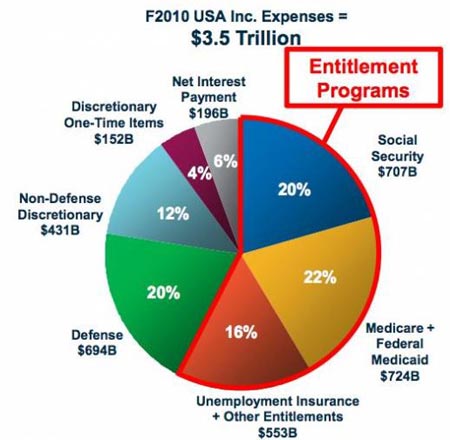

When almost two thirds of the budget is on automatic pilot, much of it going up due to COLAs, inflation, a aging population, and interest rates, can you really make 1% annual cuts across the board?

The sad reality is that Americans want the benefits of the welfare state, but don't want to pay the taxes to pay for it. Mark Steyn said this:

A few months ago, I dined with a (pardon my English) French intellectual who, apropos Mitt Romney's stump-speech warnings that we were on a one-way ticket to Continental-sized dependency, chortled to me, "Americans love Big Government as much as Europeans. The only difference is that Americans refuse to admit it."

My Gallic charmer is on to something. According to the most recent (2009) OECD statistics: Government expenditures per person in France, $18,866.00; in the United States, $19,266.00. That's adjusted for purchasing-power parity, and, yes, no comparison is perfect, but did you ever think the difference between America and the cheese-eating surrender monkeys would come down to quibbling over the fine print? In that sense, the federal debt might be better understood as an American Self-Delusion Index, measuring the ever-widening gap between the national mythology (a republic of limited government and self-reliant citizens) and the reality (a 21st century cradle-to-grave nanny state in which, as the Democrats' Convention boasted, "government is the only thing we do together.").

Generally speaking, functioning societies make good-faith efforts to raise what they spend, subject to fluctuations in economic fortune: Government spending in Australia is 33.1 percent of GDP, and tax revenues are 27.1 percent. Likewise, government spending in Norway is 46.4 percent, and revenues are 41 percent – a shortfall but in the ballpark. Government spending in the United States is 42.2 percent, but revenues are 24 percent – the widest spending/taxing gulf in any major economy.

So all the agonizing over our annual trillion-plus deficits overlooks the obvious solution: Given that we're spending like Norwegians, why don't we just pay Norwegian tax rates?

No danger of that. If (in Milton Himmelfarb's famous formulation) Jews earn like Episcopalians but vote like Puerto Ricans, Americans are taxed like Puerto Ricans but vote like Scandinavians. We already have a more severely redistributive taxation system than Europe, in which the wealthiest 20 percent of Americans pay 70 percent of income tax while the poorest 20 percent shoulder just three-fifths of 1 percent. By comparison, the Norwegian tax burden is relatively equitably distributed. Yet Obama now wishes "the rich" to pay their "fair share" – presumably 80 percent or 90 percent. After all, as Warren Buffett pointed out in The New York Times this week, the Forbes 400 richest Americans have a combined wealth of $1.7 trillion. That sounds like a lot, and once upon a time it was. But today, if you confiscated every penny the Forbes 400 have, it would be enough to cover just over one year's federal deficit. And after that you're back to square one.

It's not that "the rich" aren't paying their "fair share," it's that America isn't. A majority of the electorate has voted itself a size of government it's not willing to pay for.