Genuflectimus non ad principem sed ad Principem Pacis!

Listen, O isles, unto me; and hearken, ye people, from far; The LORD hath called me from the womb; from the bowels of my mother hath he made mention of my name. (Isaiah 49:1 KJV)

Posted on 09/19/2012 6:55:32 PM PDT by SMGFan

ated: Sep 19, 2012 9:57 AM EDT HEALTHDAY NEWS - New research finds that high cigarette taxes take a heavy toll on low-income smokers, compared to those who are wealthier.

In a study, researchers at RTI International found that poor smokers in New York state -- which has the country's highest state cigarette tax at $4.35 a pack -- spent about 25 percent of their household income on cigarettes. Nationally, the average spending was about 14 percent.

By contrast, the richest smokers nationwide and in New York spent about 2 percent of their household income on cigarettes.

"Excise taxes are effective in changing smokers' behavior," study author Matthew Farrelly, chief scientist and senior director of RTI's public health policy research program, said in an RTI statement. "But not all smokers are able to quit, and low-income smokers are disproportionately burdened by these taxes."

Despite the high taxes in New York state, the study found that the percentage of people with incomes under $25,000 who smoked didn't decline from 2003-2004 to 2009-2010.

"Special efforts are needed to reduce smoking among those with low incomes," Farrelly said. "States, especially New York, generate significant revenue from cigarette taxes, but only a small percentage of that money is used for tobacco control programs. It seems only fair that states with high cigarette taxes should adequately fund cessation interventions for low-income smokers who shoulder a disproportionate share of cigarette taxes."

The researchers relied on surveys of more than 13,000 people.

The study, funded by New York State Health Department, appeared Sept. 12 in the journal PLoS One.

They burden who is ever dumb enough to smoke.

Jonathan Allen

Reuters

5:48 p.m. CDT, September 19, 2012

NEW YORK (Reuters) - Poor smokers in New York State spend about a quarter of their entire income on cigarettes, nearly twice as much as the national average for low-income smokers, according to a new study.

The study, conducted by the non-profit research group RTI on behalf of the state’s health department, found there was no statistically significant decline in the prevalence of smoking among poorer New Yorkers between 2003 and 2010, even as the habit declined by about 20 percent among all income groups.

“Although high cigarette taxes are an effective method for reducing cigarette smoking, they can impose a significant financial burden on low-income smokers,” Matthew Farrelly and his co-authors wrote in the conclusion of their paper, which was published this month in Plos One, an online, peer-reviewed journal.

Using data from the state health department’s New York Adult Tobacco Survey, researchers calculated that smokers in New York earning less than $30,000 a year spent an average of 23.6 percent of their earnings on cigarettes, compared with about 14.2 percent nationally.

The state’s wealthier smokers - those earning over $60,000 - spent an average of 2.2 percent of their income on the habit, about the same as the national figure.

New York has the highest state cigarette tax in the nation, at $4.35 a carton, compared with a national average of $1.46. New York City imposes an additional $1.50 tax. The researchers said they did not have enough data to measure whether city residents were shelling out an even larger portion of their earnings on cigarettes.

The low-income now spend twice as much of their earnings on cigarettes as they did in 2003, when the state imposed a tax of $1.50 on each carton.

http://www.chicagotribune.com/news/sns-rt-us-usa-newyork-smokingbre88i1i6-20120919,0,4412787.story

1% should subsidize cigarettes for poor.

Redistribute wealth and help poor.

While we’re at more income redistribution...

powerball and lottery “taxes” (50% tax, 50% payouts) disproportionately burden the poor as well. EBT cards only go so far every week!

Amazing how we can always find the money for our addictions.

/johnny

Well boo flipping hoo. I quit on 2-27-10. The reasons were many and predictable but one of the biggest ones was that I would not be an idiot paying a growing voluntary tax. If others can’t figure that out...what are we to do?

/johnny

One of my neighbor's daughters is a welare momma. It seems that the higher the tobacco tax, the more she and her pals smoke. Kids from different absent fathers, she's on welfare and does nothing but smoke and drink constantly. Our taxes we involuntarily pay, funds their addictions. High tobacco tax costs don't impact poor people who get redistibuted money from the rest of us.

taxpayers pay for food so you can buy your cigarettes? Give you SNAP to feed the kids,then school feeds them. You can buy your cigarettes.

Watch. You have to understand how the liberal mind works; someone will suggest that the government subsidize poor people’s cigarettes. And that someone will be taken seriously.

Or you could take the cynical approach:

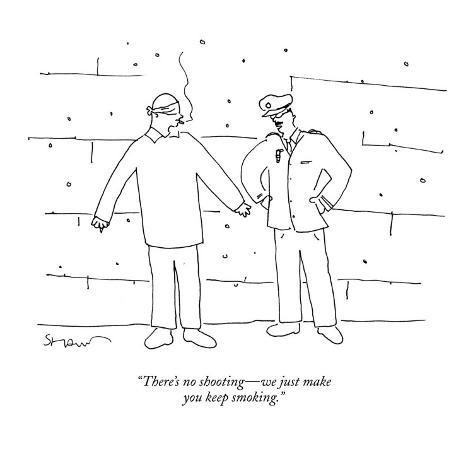

just give them all the cigarettes they want and we will save money on welfare payments and healthcare in the long run. . . .

/johnny

..."Disproportionate"...

Well,

That is "proportionate". . "Disproportionate" is pure liberal hyperemotion-speak!

~~~~~~~~~

” Farrelly said. “States, especially New York, generate significant revenue from cigarette taxes, but only a small percentage of that money is used for tobacco control programs”

Do they actually think the states WANT people to quit?

Too much tax revenue would be lost.

Hypocrites.

.

Imagine if they got addicted to getting good grades in school.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.