Let us look at some actual numbers.

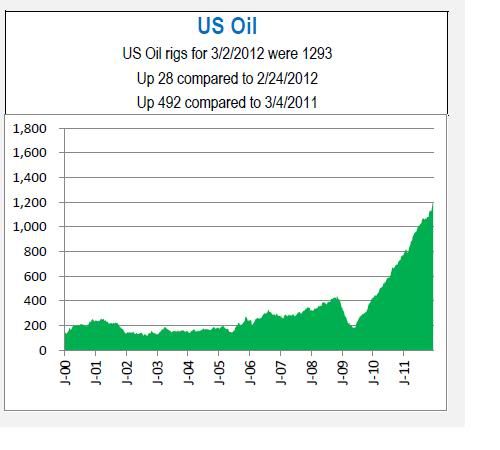

The past couple years, we have had a very significant increase in the number of oil wells being drilled, mostly in North Dakota and Texas.

This massive increase in drilling has resulted in a increase of US oil production, not a huge increase, but at least increase after decades of decreases.

Now our importing of crude oil has declined, the increased production with our falling demand shows a significant decrease in imports. But this is still a massive mountain to climb.

Now what many people don't understand, while the production from the Shale fields like the Bakken, Eagle Ford and others has really turned things around for the industry, the decline rates in these very tight formation are very steep. In 5~7 years, the production rate is 1/10th the initial flow rate.

Typical Bakken Well Production rates.

So this means while the industry is booming, lots of drillers working, to continue to raise total production rates year after year, it will take a nearly exponential curve of more and more wells to keep climbing faster and faster.

So back to your question:

as we approach or achieve producing more oil than we consume, that the downward pressure on global prices created by the loss of US demand for imports combined with the addition of any surplus US supply, would far exceed any upward pressure any subsequent global market condition would be able to exert on prices inside the US.

We will not be capable of producing more than we consume in 4 years time. If some magical entity adds over 9 million barrels of oil per day in that same time period, yes, prices will fall significantly.

We are now adding over 2,000 production oil wells a month. The industry is struggling to find enough people with skills and capable of passing drug test. Equipment deliveries are streching out as manufacturing is getting quite busy supplying this industry.

But these are not the cheap easy wells of that were the boom of the early 1980s. These wells average millions of dollars, most require horizontal drilling rigs and stretch a string for miles underground.