Skip to comments.

Gingrich Right on Gas Prices, Economy

Yahoo ^

| February 29, 2012

| Radell Smith

Posted on 02/29/2012 6:05:21 PM PST by Red Steel

As a Georgia Super Tuesday voter, the Michigan and Arizona primary results will (and will not) influence my vote to some degree. Let me explain.

While I want to cast my vote for the candidate who shares my views politically and otherwise, the options currently available leave a lot to be desired, and that includes the current president.

But like my fellow voters, I have to decide on one candidate or the other, whether one of them fits the bill perfectly or not.

Of the Republicans, Newt Gingrich is the only one with ties to Georgia. He's also the only presidential primary candidate willing to venture into the northern portion of the state this week in advance of the Super Tuesday primary.

-snip-

However, I really like one thing that Newt said in North Georgia on Tuesday of this week:

"Newt equals $2.50 per gallon."

Who in America couldn't jump for joy if we could see $2.50 per gallon for our vehicle gasoline cost again?

-snip-

Romney, on the other hand, fresh off the Michigan and Arizona victories, appears to be leading. But he barely won his own home state, and that speaks volumes to Southerners like me.

It makes me wonder if he is the leading candidate, not because he is liked (or believed to be a good option for turning things around), but, instead, because he has deep political fundraising pockets.

And I can't help but go back to what Gingrich said on Tuesday, despite Santorum and Romney's "almost tie" in Michigan,

"16 million new jobs were created," Gingrich said, when he and Ronald Reagan worked together. If Gingrich was instrumental in seeing 16 million new jobs created all those years ago,

(Excerpt) Read more at news.yahoo.com ...

TOPICS: Extended News; Politics/Elections

KEYWORDS: gingrich; newt

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-64 next last

To: OHelix

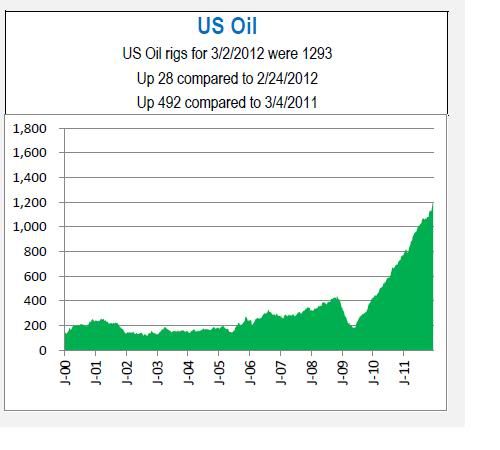

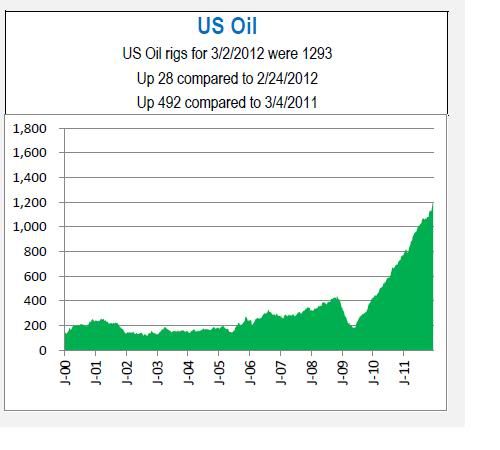

do you disagree is my statement? Let us look at some actual numbers.

The past couple years, we have had a very significant increase in the number of oil wells being drilled, mostly in North Dakota and Texas.

This massive increase in drilling has resulted in a increase of US oil production, not a huge increase, but at least increase after decades of decreases.

Now our importing of crude oil has declined, the increased production with our falling demand shows a significant decrease in imports. But this is still a massive mountain to climb.

Now what many people don't understand, while the production from the Shale fields like the Bakken, Eagle Ford and others has really turned things around for the industry, the decline rates in these very tight formation are very steep. In 5~7 years, the production rate is 1/10th the initial flow rate.

Typical Bakken Well Production rates.

So this means while the industry is booming, lots of drillers working, to continue to raise total production rates year after year, it will take a nearly exponential curve of more and more wells to keep climbing faster and faster.

So back to your question:

as we approach or achieve producing more oil than we consume, that the downward pressure on global prices created by the loss of US demand for imports combined with the addition of any surplus US supply, would far exceed any upward pressure any subsequent global market condition would be able to exert on prices inside the US.

We will not be capable of producing more than we consume in 4 years time. If some magical entity adds over 9 million barrels of oil per day in that same time period, yes, prices will fall significantly.

We are now adding over 2,000 production oil wells a month. The industry is struggling to find enough people with skills and capable of passing drug test. Equipment deliveries are streching out as manufacturing is getting quite busy supplying this industry.

But these are not the cheap easy wells of that were the boom of the early 1980s. These wells average millions of dollars, most require horizontal drilling rigs and stretch a string for miles underground.

41

posted on

03/03/2012 4:29:02 PM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

If the point is that you don't trust Newt why don't you just say so instead of playing BS word games?

There are policies that will push down gas prices. There are also conditions that are only marginally controllable. None of that changes the issue that we need a president that actively works to control what is controllable and push on what is marginal.

You want to advance a different candidate make the argument. I am genuinely interested. You want to split hairs and engage in mental masturbation? go away. You are wasting peoples energy and time to satisfy your own ego.

42

posted on

03/03/2012 7:50:17 PM PST

by

70times7

(Serving Free Republics' warped and obscure humor needs since 1999!)

To: 70times7

If the point is that you don't trust Newt why don't you just say so instead of playing BS word games? I think he proved that with his wives, but that wasn't the topic of discussion.

There are policies that will push down gas prices.

Absolutely, and I believe Newt if elected would implement policies that would lower gasoline prices via lower oil prices. But that wasn't the claim.

There are also conditions that are only marginally controllable.

Absolutely. Claiming complete control is only feeding fodder to the thoses who don't undertand.

we need a president that actively works to control what is controllable and push on what is marginal.

Absolutely. Which one is honest about the desire and ability to do that and which one throws out junk.

You want to advance a different candidate make the argument. I am genuinely interested.

I want people to demand honesty from politicians instead of decaded after decades of false claims and "whoops, I tried" and the people not only accept it, but argue to others that is okay.

You are wasting peoples energy and time to satisfy your own ego.

Please feel free to ignore all my posts.

Cheers.

43

posted on

03/04/2012 5:09:55 AM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

ANNNNNND you continue to split hairs and drone on while offering nothing. Yeah, hackneyed, I’ll ignore your posts.

44

posted on

03/04/2012 5:36:25 PM PST

by

70times7

(Serving Free Republics' warped and obscure humor needs since 1999!)

To: 70times7

Perhaps you think it is nothing to expect truth and honesty, and to make decisions based upon reality.

I don’t understand the concept of accepting deception from any politician, even when it is the deception you wanted to hear.

45

posted on

03/04/2012 6:12:22 PM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

We will not be capable of producing more than we consume in 4 years time. If some magical entity adds over 9 million barrels of oil per day in that same time period, yes, prices will fall significantly.I would agree it's highly unlikely we will be a net exporter in four years, but I do think we could significantly reduce our dependency on the middle east.

With that in mind, if we consider Canadian and Mexican imports stable, and group them with domestic sources, it brings your 9 million barrels a day down to, I believe, less than 5 million. (Please correct me if I've gotten the wrong data).

Newt claims the Gulf could return to 400,000 barrels per day and Alaska could supply 1.7 million barrels per day, chipping away another 2.1 million... and leaving only about 3 million barrels per day to be completely energy independent of everyone other than Mexico and Canada.

I'm not sure how to figure out how much the anticipated 700,000 barrels a day from the Keystone pipeline would further decrease that number since I don't know how much of that would reflect an increase in Canadian production vs just change the transportation method.

This brings me back to my previous question: Also, what do you think would be the effect of a "real push" towards being energy independent and a "real push" to reverse Obama's economic policies on futures speculation? I might ask essentially the same thing by saying, "how much of the current high price of crude is driven my the anticipation of potential interruption of supply due to the political instability of our import suppliers and by the perception that Obama's policies are going to destroy the value of the dollar?"

I would still contend that it is neither implausible nor dishonest to hold up $2.50 gas as a valid campaign platform.

46

posted on

03/06/2012 11:35:56 AM PST

by

OHelix

To: OHelix

but I do think we could significantly reduce our dependency on the middle east. Agreed, but I would look at OPEC imports rather than just focus on Middle East. Venezuela is less a friend than Saudi Arabia. Nigeria is more willing to sell but far more unstable.

With that in mind, if we consider Canadian and Mexican imports stable, and group them with domestic sources, it brings your 9 million barrels a day down to, I believe, less than 5 million.

In my opinion, Canada should be considered long-term stable and expected to grow. Mexico while a past reliable supplier is also a continued falling production and politically unstable. But for the sake of discussion call it a wash at 4 million per day.

Newt claims the Gulf could return to 400,000 barrels per day and Alaska could supply 1.7 million barrels per day, chipping away another 2.1 million...

From the time of new areas released for seismic survey, data analysis, lease auctions, acquiring new drill rigs, exploration, review of exploration results, engineering/design of wells & topside facilities, fabrication, construction, tie-ins and start up...

No way complete in 4 years. I've been involved in very rushed fast-tract projects for oilfield production. I have several years in Alaskan North Slope Engineering and Construction. I don't say that lightly, there are just too many steps and too much work to be done prior to oil flow.

I'm not sure how to figure out how much the anticipated 700,000 barrels a day from the Keystone pipeline would further decrease that number since I don't know how much of that would reflect an increase in Canadian production vs just change the transportation method.

It is mostly increase production, but it will offset some rail traffic. Maybe 600 MPBD? Maybe use 700 for the discussion.

n: Also, what do you think would be the effect of a "real push" towards being energy independent and a "real push" to reverse Obama's economic policies on futures speculation?

It will decrease prices. If all this is done it would decrease prices significantly outside of any other changes.

The catch is, I don't know what else will change in the next 4 years, but I would bet my house that everything else effecting the oil market will NOT stay the same for the next 4 years, especially if the US made these drastic changes. The amount of steel, copper, heavy equipment, yard fabrication etc for your production levels would have a measured increase in demand in several countries around the world.

I would still contend that it is neither implausible nor dishonest to hold up $2.50 gas as a valid campaign platform.

We disagree and that is okay. But understand my viewpoint is based upon decades of related experience. I've been involved in emergency rebuilds from plant explosions, and other very fast track oil field projects. I understand this area fairly well.

47

posted on

03/06/2012 12:56:34 PM PST

by

thackney

(life is fragile, handle with prayer)

To: OHelix

Newt claims the Gulf could return to 400,000 barrels per day and Alaska could supply 1.7 million barrels per day, Wait a minute, I read these as additions, not new totals.

Did you mean additional or totals from these areas?

48

posted on

03/06/2012 1:01:58 PM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

I am writing to apologize. I had made the mistake of considering your posts in the limited context of your replies to me, instead of reading the thread as it progressed. My error caused me to conclude that you do not like Newt and that the $2.50 per gallon quote was a way to advance that argument.

The fact is, I don't like the guy much either and I don't trust him. After reading some of your additional posts it is clear to me that a $2.50 quote is disingenuous, and it is highly likely that he knows it. I ask you to accept my apology and forgive my compounding of ignorance with rudeness.

49

posted on

03/06/2012 2:49:50 PM PST

by

70times7

(Serving Free Republics' warped and obscure humor needs since 1999!)

To: 70times7

Those are very kind words. I humbly accept your apology that you did not need to offer.

I think Newt is brilliant and could be a great president. I plan to vote for him or Rick at the primary. I still don’t really trust him but our choices are quite limited.

I see the $2.50 as false pandering. I hate seeing the conservative voter being mislead.

I don’t expect everyone on Free Republic to agree with me on energy policy. But I would like to see that their opinion is based on reality.

50

posted on

03/06/2012 5:19:26 PM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

In my previous post I treated them both as additions, if I was mistaken, please let me know.

I am fairly certain the 1.7 million figure is from opening up federal lands in Alaska, and is not a total from Alaska.

Also, the 400,000 figure must be additive, since we produce well over a million a day from there now. It may, however, refer to a loss of 400,000 under Obama that would presumably be restored.

From the following, I would conclude the 700k figure regarding the keystone pipeline is also an addition, not a total:

“Keystone has contracts with oil sands producers totalling 495,000 barrels per day with an average contract term of 18 years.”

“ConocoPhillips will use the Keystone Pipeline to deliver raw materials for a production and processing partnership with EnCana to pump raw oil sands bitumen out of Alberta for upgrading and refining in Illinois and Texas.”

“TransCanada hopes to secure oil shipping contracts that will prompt construction of a second, longer leg to take 750,000 barrels daily to Texas refineries clustered east of Houston, around Port Arthur...”

“...On completion the project will increase the total capacity of the Keystone pipeline to 1.1 million bpd.”

(From http://www.hydrocarbons-technology.com/projects/keystone_pipeline/)

51

posted on

03/06/2012 10:45:35 PM PST

by

OHelix

To: OHelix

I am fairly certain the 1.7 million figure is from opening up federal lands in Alaska, and is not a total from Alaska. Okay, we will some some significant increase in the NPRA (west side of oil production facilities) without any new changes. The bridge permit for CD5 (Colville Delta Unit, Drill site #5) has been approved. This area has already had leases bought, seismic and exploration drilling completed and the data analyzed, there are 6 new reservoirs on the map in my office. CD5 is out for engineering bid now, there will be a lot of duplication for the topsides of the other 5 and some significant expansion required at the main processing facility, Alpine, if these were all brought on as fast as possible. As fast as possible from this point in time (about 4 years plus time waiting on permits) could bring several of these on an early (lower flow rate) start with the production to continue to climb over the next 4 years or so. I think they might see as much as 150,000 BPD additional from this area if they go all out, but it would likely keep climbing for years to double or triple, if things went really well.

I'm sending you a FRmail for some other details on NPRA.

There is no way to be producing from ANWR in 4 years, too many years of work prior to getting to the point we are now for Northeastern NPRA.

Also, the 400,000 figure must be additive, since we produce well over a million a day from there now.

That was where I got confused rereading the language versus the current production rates. A massive new platform like Crazy Horse may produce 100,000 barrels per day. 4 years from the start of design to completed start-up is fast track but doable. But you have to have already have flow tested a new reservoir from exploratory drilling and decent analysis of the data in order to now what pressures, flow rates, oil/gas/water ratios to size equipment, size pipeline, etc.

So a couple of these may be at this point now, probably not 4. So maybe 2~300,000 BPD additional. These are not really stopped by regulation now but an overall slowdown has added time to the progress.

A change in regulations and offering areas to lease to speed up additional fields and platforms. But with no governmental or economic delays, new fields from unfound to producing are going to be 7~8 years for anything extensive. Little additions to existing facility may be good for another couple 100,000 at most in that time frame.

“Keystone has contracts with oil sands producers totalling 495,000 barrels per day with an average contract term of 18 years.”

Statements like that are promises to move through the pipeline, does not mean that some of the oil isn't shipping today on rail, but I suspect most of it will be new as the Canadian Oil Sands continues to grow output.

52

posted on

03/07/2012 4:45:32 AM PST

by

thackney

(life is fragile, handle with prayer)

To: OHelix

“TransCanada hopes to secure oil shipping contracts that will prompt construction of a second, longer leg to take 750,000 barrels daily to Texas refineries clustered east of Houston, around Port Arthur...” This section is already being started (engineering, not construction) under a separate project. By breaking out a portion not tied to a border crossing, they no longer need the approval from the State Department.

New Keystone plan splits pipeline in parts

http://fuelfix.com/blog/2012/02/27/transcanada-to-move-forward-on-keystone-xls-southern-leg/

February 27, 2012

Trans-Canada Corp. said Monday it would seek to start building the southern segment of its Keystone XL pipeline while it prepares to file a new application for U.S. approval of a cross-border pipeline to import Canadian crude oil.

The company said it would first start building a segment from the storage hub of Cushing, Okla., to Gulf Coast refineries in Texas, citing the need to alleviate an ongoing supply glut at Cushing by providing an outlet for the oil to get to the Gulf.

more at link...

53

posted on

03/07/2012 4:53:58 AM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

There is no way to be producing from ANWR in 4 years...I don't think that is Newt's contention. His claim is that by pushing the policies we are discussing, he believes the price of gas will fall towards what it was when Obama took over, $1.89. He apparently concluded (presumably with advice) that $2.50 was a reasonable place to draw his line in the sand. When asked how long it would take, he suggested as much as a year citing the six months it took prices to collapse when Reagan took over from Carter.

Statements like that are promises to move through the pipeline, does not mean that some of the oil isn't shipping today on rail

I quoted that figure to demonstrate that the 700k figure was in addition to it in terms of the pipeline itself. It also seems to me that it's the anticipation of expanded production that's driving the need for the pipeline.

But I don't think your issue is with the plausibility of $2.50 gas, but with the "honesty" of making it a campaign promise. And that comes down to whether Newt actually believes he will do what he says he will, and if he believes it will have the effect he intends.

54

posted on

03/07/2012 11:50:09 AM PST

by

OHelix

To: OHelix

he believes the price of gas will fall towards what it was when Obama took over, $1.89.

- - - -

If the price falls that low for any length of time, we will see the drilling falling fast as well. Just like last time when the industry had significant layoffs.

What is driving the massive oil drilling into expensive shale formations ia the high price. If oil falls to below $40, we have no chance of gaining significant increases in our domestic production.

55

posted on

03/07/2012 12:25:31 PM PST

by

thackney

(life is fragile, handle with prayer)

To: OHelix

Without ANWR, I don’t understand where the 1.7 MMBPD in Alaska would come from even in 10 to 15 years.

56

posted on

03/07/2012 12:36:40 PM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

If the price falls that low for any length of time, we will see the drilling falling fast as well. Just like last time when the industry had significant layoffs.What is driving the massive oil drilling into expensive shale formations ia the high price. If oil falls to below $40, we have no chance of gaining significant increases in our domestic production.

That makes good sense to me.

Is there a somewhat objective way to determine what crude price would be necessary sustain $2.50/gal gas? Or, what the price of gas would be expected at the break even point of $40 per barrel?

57

posted on

03/07/2012 12:43:16 PM PST

by

OHelix

To: OHelix

$40 is not a break even point. It is a point so low with today expensive production that we would surely have large layoffs in the industry and idle rigs setting around.

Let me look later at the refinery acquisition prices versus gasoline averages to guess at the $2.50 price.

58

posted on

03/07/2012 1:15:16 PM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

$40 is not a break even point. It is a point so low with today expensive production that we would surely have large layoffs in the industry and idle rigs setting around.I misunderstood why you referenced that particular price. My memory was that $40 had been a historic high prior to Katrina.

59

posted on

03/07/2012 1:55:13 PM PST

by

OHelix

To: OHelix

I picked $40 because it was a recent price we dipped below and had significant layoffs even though the price did not stay there long at all. The slow down in the industry started at much higher prices and was brutal by that point.

Look at this chart for comparison.

Link because WTRG.com doesn't like hot linking:

http://wtrg.com/rigs_graphs/rigus.gif

Keep in mind with the linked chart, that the slow down was My memory was that $40 had been a historic high prior to Katrina.

Katrina was in late August 2005. We had been above $40 a barrel for crude oil for over a year by that point.

(click pic for data set)

60

posted on

03/07/2012 2:33:09 PM PST

by

thackney

(life is fragile, handle with prayer)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-64 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson