Skip to comments.

Don’t blame the Depression on the gold standard – but don’t expect it back either

City A.M. ^

| Feb. 28, 2012

| George Selgin

Posted on 02/29/2012 6:20:32 AM PST by 1rudeboy

TWO of America’s Republican candidates – Newt Gingrich and Ron Paul – have dared to toy with the idea of bringing back the gold standard. Their remarks have in turn triggered a fusillade of indignant replies, from pundits and professional economists alike, the general theme of which is that no one fit to be America’s Commander-in-Chief can possibly have a good word to say about gold.

Of all the reasons usually given for condemning the gold standard, perhaps the most common is the claim that it was to blame for the Great Depression. What responsible politician, gold’s critics ask rhetorically, wants to relive the 1930s?

But the criticism misses its mark. Fans of the gold standard are no more anxious to repeat the 1930s than their critics are. Their nostalgia is instead for the interval of exceptional international monetary stability that prevailed from the mid-1870s until World War I. That was the era of the classical gold standard – a standard policed by the citizens of participating countries, all of whom were able to convert their nations’ paper money into gold.

This classical gold standard can have played no part in the Great Depression for the simple reason that it vanished during World War I, when most participating central banks suspended gold payments. (The US, which entered the war late, settled for a temporary embargo on gold exports.) Having cut their gold anchors, the belligerent nations’ central banks proceeded to run away, so that by the war’s end money stocks and price levels had risen substantially, if not dramatically, throughout the old gold standard zone.

Postwar sentiments ran strongly in favour of restoring gold payments. Countries that had inflated, therefore, faced a stark choice. To make their gold reserves adequate to the task, they could either permanently devalue their currencies relative to gold and start new gold standards on that basis, or they could try to restore their currencies’ pre-war gold values, though doing so would require severe deflation. France and several other countries decided to devalue. America and Great Britain chose the second path.

The decision taken by Winston Churchill, then Britain’s chancellor of the exchequer, to immediately restore the pre-war pound, prompted John Maynard Keynes to ask, “Why did he do such a silly thing?” The answer was two-fold: first, Churchill’s advisers considered a restored pound London’s best hope for regaining its former status – then already all but lost to New York – as the world’s financial capital.

Second, Britain had other cards to play, aimed at making its limited gold holdings go further than usual. Primarily, it would convince other countries to take part in a gold-exchange standard, by using claims against either the Bank of England or the Federal Reserve in place of gold in international settlements. It would also ask the Fed to help improve Great Britain’s trade balance by pursuing an easy monetary policy.

The hitch was that the gold-exchange standard was extremely fragile: if any major participant defected, the British-built house of cards would come tumbling down, turning the world financial system into one big smouldering ruin.

In the event, the fatal huffing and puffing came then, as it has come several times since, from France, which decided in 1927 to cash in its then large pile of sterling chips. The Fed, in turn, decided that pulling back the reins on a runaway stock market was more important than propping-up the pound. Soon other central banks joined what became a mad scramble for gold, in which Britain was the principal loser. At long last, in September of 1931, the pound was devalued. But by then it was too late: the Great Depression, with its self-reinforcing rondos of failure and panic, was well under way.

So the gold standard that failed so catastrophically in the 1930s wasn’t the gold standard that some Republicans admire: it was the cut-rate gold standard that Great Britain managed to cobble together in the 20s – a gold standard designed not to follow the rules of the classical gold standard but to allow Great Britain to break the old rules and get away with it.

So does this mean that those Republican candidates are right to pin America’s hopes on a return to gold? Alas, it doesn’t: the collapse of the gold-exchange standard forever undermined the public’s confidence in governments’ monetary promises; and absent such confidence there can be no question of a credible, government-sponsored gold standard, classical or otherwise. Sometimes with monetary systems, as with life, you can’t go home again.

TOPICS: Business/Economy; Editorial; Foreign Affairs; Government; United Kingdom

KEYWORDS: europeanunion; gold; goldbugs; johnmaynardkeynes; unitedkingdom; winstonchurchill

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-46 next last

1

posted on

02/29/2012 6:20:36 AM PST

by

1rudeboy

To: Toddsterpatriot; Mase; expat_panama

2

posted on

02/29/2012 6:27:14 AM PST

by

1rudeboy

To: 1rudeboy

TWO of America’s Republican candidates – Newt Gingrich and Ron Paul – have dared to toy with the idea of bringing back the gold standard. That would create a new stone age in North America. We'd be rubbing sticks together to make fire.

To: 1rudeboy

The gold standard isn't coming back for the simple reason that there isn't enough gold. There is about one ounce of gold in the US for every person. So the standard of exchange would be a dust mote sized piece of gold. Simply too small to be workable.

This doesn't mean I don't support a backed currency. But gold alone is insufficient in quantity to do the job given the size of the US and our limited gold reserves. Gold + Silver + Copper could work. Or just place a valuation on the land held by the Federal government. Any time they want to issue more currency, they have to sell off some assets. Kills two birds with one stone. Keeps the currency strong, and gets land locked up by the Fed and the EPA back into productive use.

4

posted on

02/29/2012 6:38:51 AM PST

by

GonzoGOP

(There are millions of paranoid people in the world and they are all out to get me.)

To: GonzoGOP

I agree with you on this. Whatever we do, allowing the Government to declare the value of money by “fiat” is the worst answer. It could not have piled up this mountain of Democrat debt any other way.

5

posted on

02/29/2012 6:44:44 AM PST

by

DiogenesLamp

(Partus Sequitur Patrem)

To: DiogenesLamp

It could not have piled up this mountain of Democrat debt any other way.

Exactly. With a backed currency there is a clear knowledge of how much "Money" there is. So there is a limit to how much you can borrow. This is a real debt limit as opposed to something that congress can just increase every time they want to.

The national debt becomes a mortgage rather than credit card. The net assets of the nation are known and nobody will lend you more than the repo value. On the down side if Obama were to default under such a system you would have to learn Mandarin to visit the Grand Canyon or Yellowstone.

6

posted on

02/29/2012 6:53:42 AM PST

by

GonzoGOP

(There are millions of paranoid people in the world and they are all out to get me.)

To: GonzoGOP

The gold standard isn't coming back for the simple reason that there isn't enough gold. A gold standard can be implemented on any quantity of gold. We could, for example, set the dollar equal to 1/1700 oz. of gold. We would continue using dollars for everyday transactions, but if the Fed were printing too many dollars (lowering their purchasing power,) we could go to the bank and exchange 1700 paper dollars for an ounce of gold.

That would lower gold reserves and require the Fed to withdraw dollars from circulation restoring its value.

This is just an explanation of the mechanism; I understand the political unlikeliness of its ever happening. Though, I'd be all in favor of it.

7

posted on

02/29/2012 7:07:43 AM PST

by

BfloGuy

(The final outcome of the credit expansion is general impoverishment.)

To: varmintman

That would create a new stone age in North America. We'd be rubbing sticks together to make fire.Why?

8

posted on

02/29/2012 7:08:52 AM PST

by

BfloGuy

(The final outcome of the credit expansion is general impoverishment.)

To: DiogenesLamp

"Whatever we do, allowing the Government to declare the value of money by “fiat” is the worst answer. It could not have piled up this mountain of Democrat debt any other way."Sure it could. England piled up a higher debt to GNP ratio while they were on the gold standard. Congress can promise that your children will pay in gold just as easy as they can promise that your children will pay in fiat dollars.

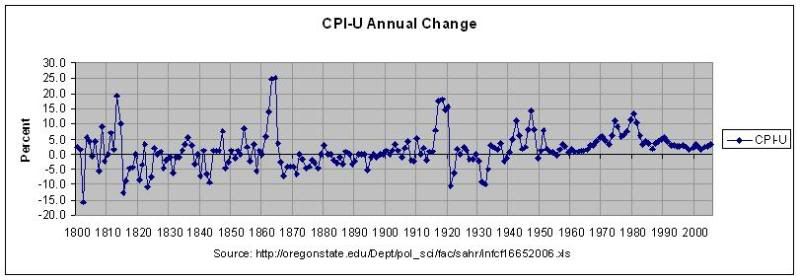

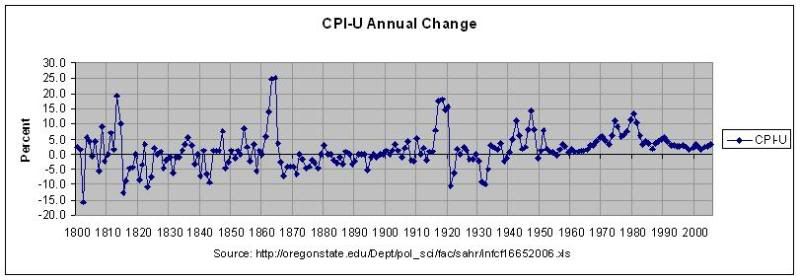

Fiat money is actually the best answer. The dollar has been more stable on a year to year basis than it was under the gold standard. Not only is it more stable, but deflation has almost been eliminated, along with the depressions they cause, which is actually a very good thing.

But those who think the dollar should be a long term store of value (it shouldn't) get really scared when you see a 60 year chart of the cummulative effect of 2% inflation a year.

9

posted on

02/29/2012 7:23:42 AM PST

by

DannyTN

To: GonzoGOP

The national debt becomes a mortgage rather than credit card. The net assets of the nation are known and nobody will lend you more than the repo value. On the down side if Obama were to default under such a system you would have to learn Mandarin to visit the Grand Canyon or Yellowstone. This is a postulation in absence of contemplation of the deterrence effect. I would suggest that if the consequences were known and obvious, the will to behave improves dramatically.

Something I have learned about people is that they respond very well to negative feedback. The problem with our current system is that we have politically disconnected the negative feedback system that improved stability.

The 24th amendment made it possible for non-taxpayers to vote, and they have no incentive whatsoever to vote for anybody but those who promise them federal dollars. The 26th amendment also made it possible for a new group of non-taxpayers to become attached to the "give away party" before they had much real experience in paying taxes. Both amendments removed an aspect of financial stability from the system, and it is no accident that the worst excesses were subsequent to these two amendments.

People have since been "kicking the can" down the road, content in the belief that by the time the sh*t hits the fan, they will have gotten theirs. It reminds me of John Maynard Kenyes' fallacy. "In the long run we are all dead anyway."

It discounts the notion that the social compact that is our government is not meant to be mortal, and is intended to live beyond the life of any individual. What they have done is created an Achilles heel through which they have been bleeding it to death.

Restore "pain" for behaving financially irresponsible, and you will likely prevent the occurrence of it.

10

posted on

02/29/2012 7:24:31 AM PST

by

DiogenesLamp

(Partus Sequitur Patrem)

To: BfloGuy

A gold standard can be implemented on any quantity of gold. We could, for example, set the dollar equal to 1/1700 oz. of gold.

You would however have to set some form of minimum exchange amount. You would have to exchange currency for gold an ounce at a time. With a rate that high you just can't make change. Throw silver into the mix and you can still have a backed currency, but the minimum exchange gets much more reasonable. A dime sized silver coin (about as small as you want to make a coin that won't get lost) would be worth just under $3. A similar sized gold coin would be worth close to $145 at this mornings spot price.

11

posted on

02/29/2012 7:25:16 AM PST

by

GonzoGOP

(There are millions of paranoid people in the world and they are all out to get me.)

To: DiogenesLamp

This is a postulation in absence of contemplation of the deterrence effect. I would suggest that if the consequences were known and obvious, the will to behave improves dramatically.

+1. I was just pointing out what the deterrence would be. When your money represents real things the consequences of bad monetary policy become real as well. Inflating your way out of debt is no longer an option. You pay your bills and if you get in over your head austerity becomes the only option.

I personally like the system, but then again I'm a conservative who doesn't carry credit card, student loan, car or mortgage debt. And hasn't done so since I was 30. I like strong currency to protect my savings. I have taken responsibility for my own life and would appreciate a system where other people's irresponsibility doesn't ruin my life.

12

posted on

02/29/2012 7:35:59 AM PST

by

GonzoGOP

(There are millions of paranoid people in the world and they are all out to get me.)

To: BfloGuy

Mainly because the supply of gold in the universe is limited and cannot expand to meet the needs of expanding economies but, in particular, the combination of a gold standard and fractional reserve banking was toxic all during the 1700s and 1800s after the initial infusion of new world gold into Europe petered out. There were cycles of expansion of fractionally gold-backed dollars and then collapse as bankers called everything back with higher rates and what came back was homes, farms, and capital assets; there wasn’t any new gold being produced to come back to pay interest on loans based on any sort of a 10% reserve.

To: DannyTN

Sure it could. England piled up a higher debt to GNP ratio while they were on the gold standard. Congress can promise that your children will pay in gold just as easy as they can promise that your children will pay in fiat dollars. I think that more than one reform is needed to resolve this problem. I mentioned a couple of other causes in the message I posted above. I suspect if money was convertible back and forth, it might cause a little better scrutiny on those who spend it in the public name.

Fiat money is actually the best answer. The dollar has been more stable on a year to year basis than it was under the gold standard. Not only is it more stable, but deflation has almost been eliminated, along with the depressions they cause, which is actually a very good thing.

Gasoline was $0.25 in the 1970s. It is now ~ $3.50. I don't think inflation is under control at all. I am not an economic theoretician, but I suspect the economic bumps of which you speak might be better regulated in a larger economy. I *DO* know something about the effects of positive feedback. (that is what causes oscillations in a system.) The best way to deal with it is to introduce characteristics which promote negative feedback.

Fiat money is how we got 100 trillion in debt. (if you count Social Security commitments as part of the debt, which I do. ) I cannot comprehend how any other system could be worse than this, economic bumps included. I note that Roosevelt made the ownership of Gold illegal. Can you tell me that Roosevelt was right about anything?

But those who think the dollar should be a long term store of value (it shouldn't) get really scared when you see a 60 year chart of the cummulative effect of 2% inflation a year.

You do not need to tell me. Using the dollar as a store of value is a horrible idea right now, unfortunately there are many people who are in positions such that they have no alternative as of yet. It is the distorted economic theories of John Maynard Keynes which has led us to this fast approaching economic meltdown. (I say distorted theories, because not even John Maynard Keynes would have regard such folly as a consequence of his ideas.)

14

posted on

02/29/2012 7:40:34 AM PST

by

DiogenesLamp

(Partus Sequitur Patrem)

To: GonzoGOP

I personally like the system, but then again I'm a conservative who doesn't carry credit card, student loan, car or mortgage debt. And hasn't done so since I was 30. I like strong currency to protect my savings. I have taken responsibility for my own life and would appreciate a system where other people's irresponsibility doesn't ruin my life. You and me both. I have lately been telling my kids repeatedly, "the Democrats are STEALING our money." They give me weird looks, and I try to explain that because Democrats have been raising government spending, and routing it through their friends, associates and supporters as much as possible, it has a devaluation effect on existing money, meaning money loses value every year this insanity continues. (Overly simple, I know, but they wouldn't understand the more complex aspects of what is occurring. :) )

I have been quite aggravated in looking for alternatives. I see the stock market as a "no mans land" and real property holds no appeal for me. (If we have a financial collapse, your paper deed will not secure your property anyway.) Gold was a good idea several years ago, but buying it now is locking in loses already suffered.

Anyway, I have a few ideas which I am implementing currently, but beyond that I wish there were some way to jettison dollars from my assets. I do not trust that they will be worth much of anything in the near future. As a matter of fact, the notion just occurred to me that we may very well have another meltdown just prior to the election just as we did in 2008, and it is my belief that *THAT* meltdown was intentional and contrived by those seeking to boost Obama into the Presidency. (McCain was leading decisively till this occurred.)

I think if such a thing occurs again, I would not want to be holding very many dollars after the late part of summer.

15

posted on

02/29/2012 7:58:22 AM PST

by

DiogenesLamp

(Partus Sequitur Patrem)

To: DannyTN

“But those who think the dollar should be a long term store of value (it shouldn’t) get really scared when you see a 60 year chart of the cummulative effect of 2% inflation a year.”

Then why don’t they put warning labels on Dollar bills they way they do cigrattes.

It is the intention of the Federal Reserve to cause inflation which will dilute the value of this dollar. A 3% inflation rate will reduce the purchasing power of this dollar bill by 1/3 over 20 years. etc.

They only get away with this system because most people don’t have a clue what inflation is or what its effects are. I showed a pretty smart guy at work an inflation calculator. He was shocked at how much value the dollar has lost since 1990.

The FR isn’t going away anytime soon, so maybe the next best answer is to educate people so they can better protect themselves. Take the profit out of the game...

To: desertfreedom765

"Take the profit out of the game..."You don't understand. The profit isn't the 2% inflation a year.

The real profit is a stable productive growing economy. A slight amount of inflation facilitates that.

Second, you seem to be under the impression that the government is just printing up and walking away with the 2% each year. It doesn't work like that. Money is created through banks creating loans. The Fed influences the rate of that money creation.

If credit expands faster than the supply of goods, then we get inflation. If credit expands slower than the supply of goods, we get deflation. It's not the government that usually benefits from the 2%, it's the borrowers, because the dollars they pay back with have a lower purchasing value.

To the extent that government is a large borrower, they do benefit, but it's indirect, and certainly not the entire 2%. Government benefits far more from a good economy, than from the inflation effects. So do banks. So do we the people.

17

posted on

02/29/2012 8:39:52 AM PST

by

DannyTN

To: desertfreedom765

And really, the borrowers, don’t benefit, because once the market begins to recognize that we have consistent 2% they price that in to the interest rate.

18

posted on

02/29/2012 8:46:54 AM PST

by

DannyTN

To: desertfreedom765

It is the intention of the Federal Reserve to cause inflation which will dilute the value of this dollar. It's a good thing the Federal Reserve doesn't have the intention of causing deflation, which is much worse for the economy than mild inflation.

A 3% inflation rate will reduce the purchasing power of this dollar bill by 1/3 over 20 years. etc.

Good thing our incomes have exceeded the rate of inflation since we left the gold standard. That's why we own more stuff today than we did back then.

They only get away with this system because most people don’t have a clue what inflation is or what its effects are.

The reason they "get away with this system" is because most people don't have a clue what it was like living in an economic environment that delivered 5% inflation one year followed by 5% deflation the next. Those swings put a lot of people (especially farmers) out of business. Most people don't have a clue about deflation so they find themselves defending a gold standard that never delivered stable prices.

19

posted on

02/29/2012 8:49:54 AM PST

by

Mase

(Save me from the people who would save me from myself!)

To: desertfreedom765

So in the end, the market rationalizes the inflation rate, as long as it is stable and neither borrower nor lender profits from it.

A steady inflation rate only affects the cash hoarders who don’t even invest in a savings account to receive interest and thus loose purchasing power. The market as a whole receives the offset from the loss in purchasing power, but that boost is spread out over the entire economy and all goods, so it’s negligible.

The real game, the real profit is keeping the economy performing.

Go back and look at what happened on the gold standard. We had severe swings of inflation and deflation sometimes back to back years of double digit swings.

Avoidance of deflation, which means a small inflation rate, is what businesses need, and it’s what the FED has been able to achieve in most years.

20

posted on

02/29/2012 9:29:04 AM PST

by

DannyTN

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-46 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson