You can imagine that all you want but it is by no means certain.

With a national sales tax every products tax rate will be at the whim of the next Congress. Think about it.

Posted on 10/17/2011 11:08:56 AM PDT by RockyMtnMan

Do you know why candidates for office tend to be reluctant to propose detailed plans? Because they know the plans will be flyspecked and picked apart by just about everyone. Inviting criticism doesn’t help you to get votes.

But fear of criticism prevents you from conceiving solutions to problems. So even if avoidance of criticism helps in propelling you to an election victory, how are you supposed to effectively govern? How are you supposed to fix the problems you told everyone you were going to fix? That’s why I’m happy to see so much criticism of the 9-9-9 plan I’ve proposed. It shows that people are thinking seriously about a substantive idea. When people stop obsessing over “gaffes” and campaign strategy, and start honing in on fixing the country’s economic problems, we are getting somewhere. This is not to say, of course, I’m going to leave poorly founded criticisms of the plan unanswered. Certain objections to the plan are circulating in the usual places, driven by the same kind of thinking that has left us with a stagnant economy, $14 trillion in debt and mounting entitlement obligations. These criticisms deserve responses, and here they are:

Claim 1: The 9 percent sales tax, which is one third of the formula, is regressive and hurts the poor, many of whom pay no federal income taxes now. Response: This claim ignores some important aspects of the plan. One is that we eliminate the 15 percent payroll tax, which allows for no deductions at all – not even for charitable contributions. Some critics have argued that the poor still come out behind because employers pay much of the payroll tax. That demonstrates a basic misunderstanding about how compensation works in the business world. An employer decides to accept a certain cost-of-employment for each employee, and the employer’s share of the payroll tax is part of that cost. It comes out of your compensation whether you realize it or not. Also, a flat tax is not – by definition – a regressive tax. Everyone pays the same rate. And it is not an added tax, but a replacement tax, whose total burden is determined by the consumer’s spending decisions. Finally, the best way to help the poor is by spurring economic growth, which the current tax code will never do, and which the 9-9-9 plan is specifically designed to do.

Claim 2: Creating a new tax is merely setting the stage for higher rates on all taxes, as untrustworthy politicians will surely raise them. Response: First of all, that is not a criticism of the 9-9-9 plan. It is a criticism of politicians. If you don’t want the rates raised, don’t elect politicians who will raise them. Even if we repealed the 16th Amendment and eliminated the income tax, as some demand in return for establishing a consumption tax, politicians could raise that rate too. What’s far more important here is the fact that the very simple, flat-rate structure of the 9-9-9 plan, which allows no deductions, loopholes or exemptions (with the exception of charitable contributions for the income tax), is a far more growth-friendly tax structure than the mangled mess of rates, taxes, exemptions and ill-conceived incentives we have today. It virtually eliminates the massive compliance costs of the current tax code, and it restrains the size of government. By taking away the politicians’ gateway drug of loopholes and deductions, we make it much more difficult for them to mess with the tax code. Having said that, any plan could be criticized for what it would look like if someone messed it up. The plan as I’m proposing it is a huge improvement over the status quo.

Claim 3: The plan redistributes wealth from the poor to the rich. Response: It does no such thing. It is fair and neutral, taxing everything once and nothing twice. What’s more, we are getting ready to propose empowerment zones for economically struggling areas in which the rates will be even lower. That will allow the poor to benefit even more from the plan than they already would.

Claim 4: The plan should have included a pre-bate to offset the sales tax. Response: The last thing we need is to establish another federal entitlement, which the proposed pre-bate would quickly become. And it’s not necessary. The consumption tax replaces ones already embedded in prices. It’s not the prices that would increase, but the visibility of the taxes being paid. Right now, money is deducted from your paycheck and you never see it, so it doesn’t feel like you paid a tax. But you did. With the 9-9-9 plan, you feel it, and I suspect a good many people who clamor for higher taxes will start to feel differently as a result. But they won’t be paying more than before. They’ll just be more aware of it.

Claim 5: The business tax represents a new tax on labor. Response: Paul Krugman of the New York Times makes this claim because we do not allow businesses to deduct the cost of labor from their taxable revenue. But the claim is bogus for several reasons. First, we are reducing the corporate tax rate from 35 percent to 9 percent, so the tradeoff is a much lower rate paid on more of a company’s income. Second, we treat capital and labor the same, both with the corporate tax and with the income tax. That is fair and neutral. What’s more, the current system taxes both capital investment by business and capital gains by individuals. That’s a double tax, and the 9-9-9 plan eliminates it.

Claim 6: The numbers don’t add up. The 9-9-9 tax wouldn’t generate enough revenue. Response: Several groups apparently “ran the numbers” and came to this conclusion, including Bloomberg News and the Center for American Progress. Our report, which they do not appear to have read, demonstrates that it generates the same revenue as the current tax code, and our methodology is visible for anyone to see. Those who are making this claim should release their scoring so their methodology is as visible as ours.

Claim 7: The 9-9-9 plan is a really an 18 percent value-added tax plus a 9 percent income tax. Response: That’s an argument? That some might be able to give it a disagreeable label? What we have done is split the incidence of the tax so it is harder to evade – since you’d have to dodge two taxes, not just one, to save the 18 percent. And by eliminating loopholes we’ve made that virtually impossible to do anyway. I don’t really care what people call it. What matters is how it works.

Claim 8: Some people (like Herman Cain) who may live off capital gains, would pay no income taxes. Is that fair? Response: First, one of the benefits of the 9-9-9 plan is that, even if someone doesn’t pay much or any of one of the taxes, he or she is still likely affected by the other two. More to the point, though, everyone has the same opportunity to work hard, earn capital and put that capital at risk. Whatever I have earned has come from hard work, good decisions (and some bad ones), a willingness to take risks and a constant honing of strategy. Nothing is stopping anyone else from doing the same thing. I realize many are being told there are no opportunities available to them, but that is not true and I wish people – for their own sakes – would stop listening to such doom and gloom and come to understand all the opportunity that truly exists, and learn how to access it.

Claim 9: It won’t pass. Response: Politicians propose things that can pass. Problem-solvers propose things that can work. One of the worst instincts of Washington types is to judge an idea not on its substantive merits, but on their perception of its political viability. I do not underestimate the challenge of getting any good idea through Congress, but I have said all along that if you propose a good idea, and the people understand the idea, they will pressure Congress to pass it. So there. I welcome the robust discussion and the many questions that are being raised about the 9-9-9 plan. Asked and answered. What else do you want to know?

Nice work!

2) If somehow you're able to get around the Constitutional issues, you've got another problem - the "tyranny of the status quo" which takes over about 100 days after the new guy is in office. Why not just get a bill passed immediately after taking office that 1) immediately lowers both income and sales taxes to 9% as proposed and 2) calls for BOTH a complete phase-out of income tax while creating and phasing in a sales tax? Otherwise you risk getting bogged down midstream with a sales tax without having passed a bill abolishing the income tax - a Socialists dream.

That's entirely true, and a far more likely scenario than the company passing the FICA tax savings on to the employee. It is, after all, an expense to the company so it makes sense for the company to use the savings to the best advantage of the company itself. So if we can agree that the odds are heavily against the employee getting the money then can we also agree that it should not be factored into the employee tax bill under the current tax law?

Bttt

>> “REALITY: Corporations are absolutely drowning in cash and NOT hiring today, as it is.” <<

.

Obamacare.

I totally disagree. Making all taxes visible to the public is most desirable. Our current 67,000 page tax code is that large to provide loopholes and wiggle room for the large corporations and political elites. I am guessing the 9-9-9 tax code would be miniscule in comparison. I doubt that it would be anywhere close to 100 pages. We are currently double and triple taxed and its all hidden from public view. You purchase an Item at X dollars and it may have 5 or 6 levels of taxes already added to the price. You pay the last tax and never know about the hidden taxes. The 9-9-9 plan also assures that everyone with income contributes something as apposed to our current situation where 50% of the public pays zero.

You get around the constitutional issues by keeping your eye on the conservative sparrow and electing Tea Party conservatives to the House and Senate in 2012. There are people who need to be removed from both the House and Senate. That is how we do it. Vote them out and elect someone who cares about "We the People". 2010 was a good start. We MUST do the same or better in 2012.

My argument doesn’t particularly address whether a different tax code would eventually be better. I think changes should be made in small increments so people have plenty of time to adjust.

If you could make a tax system that was trivially simple, it would destroy a significant part of the economy, and put a lot of people out of work. If they had time to find new ways to make money, it would be an easier transition.

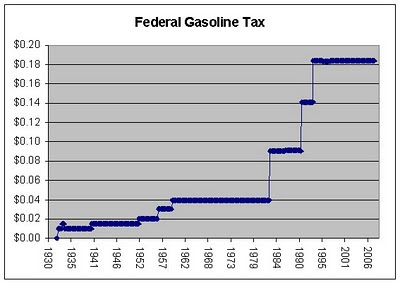

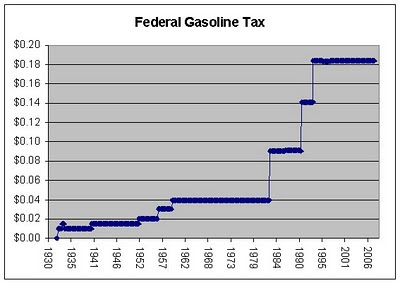

If all the hidden taxes are eliminated and the only tax that is paid is the 9% sales tax when you purchase an item, I can imagine that gasoline would become much cheaper. Gasoline probably has more hidden taxes than any other item. Gasoline prices affect all other prices in a big way. If prices are substantially reduced on gasoline it would be like a shot of adrenaline to the economy.

The more I study and understand the 9-9-9 plan the more I like it.

I apologize, I’m trying not to make assumptions. His plan, at his web site, explicitly states that phase one enhanced is to be “passed” by the supercommittee. What I put in my comment was the quote from his plan.

The rest is conjecture as to why he thinks the supercommittee can pass anything, or why if he really meant “recommend”, he thinks his plan should be built in secret by a 12-member committee and then sent to the house and senate to be passed without debate or amendment. I say THAT because the debt ceiling bill that created the supercommittee mandated that their recommendations be treated that way.

So the Cain proposal calls for his 9-9-9 plan to be passed by the supercommittee, which if he means “recommended” would require a house and senate vote with no amendment or debate.

Now, if I know that, Cain certainly knows that. So why did he say “pass”, and why doesn’t he want debate or amendment?

And since the supercommittee is going to finish their work in the next few weeks, when is Cain going to send his proposal to them in legislative form so they could “pass” it?

Cain SAID it was OK to call it a VAT.

Does 9-9-9 including eliminating gas taxes?

SO, if I understand your comment (pretty lazy of you to just repost a comment to someone else that doesn’t particularly apply to how I addressed you, but I’m sure you are just too busy to bother with decorum), you don’t care how conservative Perry has governed, because in his position as Governor, he spoke at a convention of La Raza held in his state.

That certainly is your right, but it does nothing to support your false claim that Perry can’t be trusted to be conservative.

There are good reasons to oppose Cains plan, as I do, but what you describe here is not one of them. The federal government has no business treating those who choose to remain single, childless or unencumbered by a home mortage any differently than they do those who choose to be married with children with mortgages they can not afford to pay.

What you advocate is a system that chooses winners and losers to buy votes. Same in the corporate world and one of the major problems with a national sales tax is the ability of Congress to tax things they like at lower rates than that which they don't like.

Under the Cain plan, labor costs are taxed (are not deductable for purposes of determining net income). He explains that this is part of how he lowers the tax rate, by taxing a lot more of the money a company gets.

So, a company no longer would avoid taxes by hiring more people, removing that incentive, as opposed to a capital investment in a robot that can take an employee’s job, which I think will be deductable.

Although since Cain actually does NOT have a detailed plan, or even much of a plan at all, I’m not sure what exactly is taxed and not taxed under the Cain tax proposal, except what he tells us from time to time.

You can imagine that all you want but it is by no means certain.

With a national sales tax every products tax rate will be at the whim of the next Congress. Think about it.

...If you could make a tax system that was trivially simple, it would destroy a significant part of the economy, and put a lot of people out of work. If they had time to find new ways to make money, it would be an easier transition....

Yeah we need to keep those non-productive paper pushing jobs and expenses as a brake on the economy so everyone suffers not just the few who need to be retrained to do something productive for a change...we have had more “tax reforms” in my lifetime than I can remember we need to go cold turkey.

I agree that any tax hikes are at the whim of Congress, but isn't that already the case? Herman Cain said it best. Don't elect those who would raise the tax rate. Also there is more tax on gasoline than that graph shows. It represents the final tax you pay as a consumer but doesn't show the taxes paid by the middle men which also increases the price. The refiners pay a tax which they add on to the price, the distributors pay a tax and pass it on, and so do the local jobbers. I remember about 15 years ago the effective tax on gasoline was roughly 53 cents/gallon. I am sure its much higher now.

Ok is it easier to raise a tax on 50% of the voters or 100% of the voters?

The first group might re-elect you, the second group without real proof of the need to raise taxes might tar and feather you as they ride you out of DC on a rail....

Most Fairtax proposals use some sort of pre-bate to try to overcome the problem of re-taxing savings. It complicates things, but at least makes it a little less onerous.

I’m not sure how to handle the transition from income to consumption taxes without punishing savers and rewarding debtors. But since there are a lot more debtors than savers, such a plan can get majority suport.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.