|

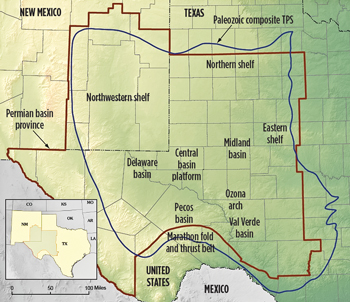

Fig. 1. The Permian basin province is located primarily in West Texas and southeastern New Mexico. Image courtesy of USGS. |

Posted on 07/18/2011 10:57:21 AM PDT by thackney

If oil prices head past $90 per barrel and new oilfield technologies become available, can a boom in the Permian basin be far behind? Active since the 1920s, the basin has produced more than 35 billion bbl and contributes 19% of all US oil. The University of Texas Bureau of Economic Geology believes there are still 30 billion bbl of oil hidden in nooks and crannies that can be recovered through enhanced oil recovery (EOR), accessing deeper formations and the twin techniques of horizontal drilling and multistage fracturing that have proven their worth in the shale plays. Production levels are not likely to reach the peak rate of 665 million bbl per year witnessed in the 1970s, but there are plenty of lucrative opportunities both for majors, such as Chevron, and for more than 1,500 large and small independents. The Permian basin is also benefiting from the independents’ ongoing shift of E&P resources from unconventional gas to the more lucrative liquids-rich plays.

GEOLOGY AND SEISMIC DATA

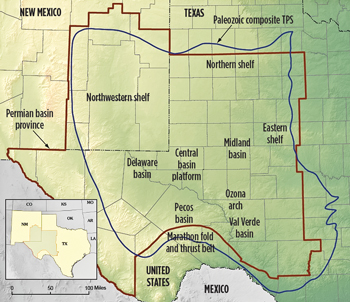

The Permian geologic province is an ovate basin about 800 miles long and 300 miles wide with the hydrocarbon-rich portion primarily in Texas and New Mexico, Fig. 1. Within the province, there are geological features such as the Delaware, Midland, Pecos and Val Verde basins, both the Eastern and the Northwestern shelves and the Central basin platform. Current activity benefits from 90 years of production data and extensive legacy seismic, well logs and core data. The exploration and production focus at this time is in the Bone Spring, Wolfcamp and Spraberry formations of Permian age. Operators have coined the term “Wolfberry” to denote the combined Spraberry and Wolfcamp target intervals of interbedded shales and carbonates encountered at depths ranging from 7,000 to 10,500 ft, Fig. 2.

|

|

|

|

|

|

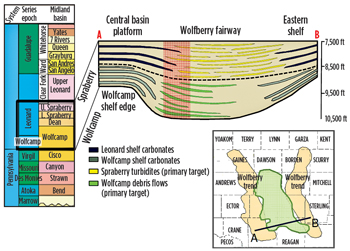

In addition to the legacy data, seismic contractors are offering newly acquired or reprocessed data for the trends with high interest. CGGVeritas offers 266-fold 3D data in the Wolfberry and Bone Spring formations in Tunstill field, located across Loving and Reeves Counties, Texas. Additionally, Echo Geophysical offers 3,259 sq mi of reprocessed 3D data in the Permian basin, including recent data in Eddy County, New Mexico, that was initially acquired for ConocoPhillips. Echo’s processing includes prestack time migration and several proprietary techniques for resolution enhancement and the detection of anisotropy and hydrocarbons, Fig. 3.

|

|

|

RECOVERY STRATEGIES

Operators are employing three specific E&P strategies to increase liquids production in the Permian basin.

CO2 injection. The Permian basin is the most successful example of CO2 -based EOR. According to ExxonMobil, CO2 injection has yielded 1 billion bbl of incremental oil production in the Permian basin and contributes 25% of the current production. The CO2 is available via pipeline from the Sheep Mountain storage facility in Colorado and the Bravo Dome in New Mexico. According to Occidental Petroleum, CO2 recovery adds $11.60/bbl to the cost of oil recovery at a $100/bbl oil price.

Horizontal drilling. Operators such as Apache are applying pad drilling at single sites to access as many as four horizontal laterals in both sandstone and shale formations. By drilling 23 horizontal laterals, the company was able to increase its production by 3,100 bopd.

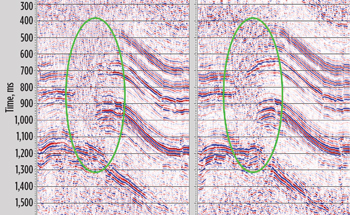

Deeper drilling. Pioneer Natural Resources drilled deeper into the Lower Wolfcamp formation and expects to add 30,000 boe to the EURs of Spraberry wells, Fig. 4. Beyond the Lower Wolfcamp is the deeper Strawn formation, which Pioneer has also tested with horizontal wells, at an incremental cost of $60 million for deeper drilling and the addition of one frac stage. Early results indicate up to a 20% increase in cumulative first-year production.

|

|

|

OPERATOR ACTIVITY

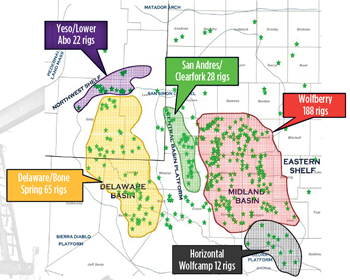

The Permian Basin rig count, which had reached a low of 43 in 1999 when the price of oil was down to $10/bbl, had risen to 412 on June 19, with 343 rigs operating in Texas and 69 rigs in New Mexico, according to the Midland-Reporter Telegram. Figure 5 shows how the rig activity is distributed throughout the province in the plays of current interest. Featured below are activities of some of the leading operators in the Permian basin.

|

|

|

Occidental Petroleum. Oxy is the largest leaseholder and oil producer in the Permian basin, with output of 197,000

boepd at the end of 2010. About 66% of the California-based independent’s production comes from CO2-centered EOR projects. The company has 1.2 billion boe of proved reserves and 2.5 billion boe of probable reserves in the Permian. In 2011, Oxy plans to use 14 rigs to drill 300 wells in the Wolfberry, Delaware/Bone Springs sand and Avalon shale formations.

Apache. Upon acquisition of properties from Exxon, Hess, Anadarko, BP and Mariner, Apache has become the second largest leaseholder in the Permian basin with holdings of 3 million acres. The independent operator has a location inventory of 5,000 wells in all of the basin’s exploration areas. From five rigs in 2010, the company has built up a fleet of 24 rigs, and it is in the process of doubling its number of dedicated fracing crews from three to six.

Apache is a leader in the horizontal redevelopment of the Central basin platform waterfloods. In the Central and North basin platforms, Apache has tested five horizontal wells with 100% success and an average IP rate of 400 boepd. In the Deadwood Wolfcamp area, Apache is drilling horizontal targets in the Wolfcamp, Cline shale and Fusselman formations. The company is operating six producing fields with CO2 injection in Roberts, GMK, Maple Wilson and Round Top fields. Among Apache’s new ventures is Galaxy Penn Reef field, where the company has acquired 3D shear data to test horizontal targets.

Chevron. On Feb. 23, Chevron celebrated the milestone of surpassing one billion barrels of oil and gas production in the Permian basin through its legacy companies. Its current production in the basin is 115,000 boepd from about 11,000 wells. The operator is applying advanced formation evaluation, horizontal drilling and multistage fracturing to extend the life of declining fields such as Lupin in the Wolfcamp area.

Forty years ago, Chevron had pioneered the use of CO2 injection in the Permian basin. The current focus is on applying CO2 recovery in the high-water-saturation transition zone between the oil and water zones in New Mexico’s Vacuum field. The EOR plan was designed on the basis of a 3D reservoir model built from newly reprocessed seismic data, calculated logs from a 2006 formation evaluation program for porosity distribution within the model, and new core data for permeability transforms.

Devon. In 2010, Devon divested its properties in the Gulf of Mexico to concentrate on North American onshore plays, including the Permian basin. The independent operator holds 1 million net acres throughout the basin and is currently producing 44,000 boepd, with proved reserves of 167 million boe. The company is operating 11 rigs and is planning to drill 300 wells in 2011 in the liquids-rich Wolfberry, Avalon shale and Bone Spring areas. In 2010, Devon drilled 20 wells in the Wolfberry play to increase its production by 5,000 boepd.

Anadarko. In the first quarter of 2011, Anadarko produced 4 million bpd of oil, 1 million bpd of NGLs and 52 MMcfd of gas. The independent operator increased its rig count in the basin to six, from four rigs in the fourth quarter of 2010. Those rigs are all operating in the Bone Spring horizontal play, where, in the first quarter, the company spudded 18 wells and completed 14. Anadarko’s gross production from Bone Spring during that period was 15,600 boepd, of which about 75% was liquids. The company spudded one exploration well as it continued to evaluate the Avalon shale, where it has multiple wells testing at rates of 800–1,000 boepd.

Chesapeake. In continuation of its strategy to switch to liquids-rich plays, Chesapeake has acquired 670,000 net acres with 1.7 billion boe of unproved reserves in the Bone Spring, Wolfcamp and Wolfberry plays. The company is producing 99 MMcfd of gas and 4,406 bpd of liquids, and is operating eight rigs to discover additional resources.

ExxonMobil. The energy giant’s participation in the Permian basin comes through its acquisition of XTO. Ironically, it was XTO that bought ExxonMobil’s Permian basin properties in three separate transactions between 2005 and 2009 for a total price of $772 million. Currently, the Permian basin supplies 9% of XTO’s production.

ConocoPhillips. While the major is focusing its attention elsewhere in the world, it continues to explore opportunities in the 1 million net acres it holds in the Permian, which contain about 500 million boe of undeveloped resources. In 2010, ConocoPhillips produced 123 MMcfd of gas and 30 million bpd of liquids and drilled 67 wells in the Permian. It is the largest leaseholder in the San Juan basin, where it is applying advanced drilling and artificial lift technologies to further develop 1.7 billion boe of discovered resources.

Pioneer Natural Resources. Pioneer is the largest operator in Spraberry field, with interests in more than 5,600 active wells. The field produces sweet crude and natural gas from formations ranging in depth from 6,700 ft to 10,000 ft. The company is currently drilling at 40-acre spacing, but is planning to go down to 20-acre spacing using 67 rigs. It is also investigating the potential of shale/silt intervals and conducting a 7,000-acre waterflood. Pioneer has an inventory of 20,000 drilling locations in the Permian basin.

Concho Resources. Midland, Texas-based Concho Resourses has 324,523 net acres in the Permian basin and daily production of 58,100 boe. The company is operating 32 rigs to explore 6,200 well locations in the Delaware basin, Central basin platform and Midland basin.

SandRidge Energy. Oklahoma City-based independent SandRidge has 210,000 net acres in the Permian basin with 7,700 target well locations and daily production of 75 MMcfd of gas and 75,000 bpd of liquids, of which 74% is oil. The company currently operates 16 drilling rigs, primarily in the Central basin platform.

MERGERS AND ACQUISITIONS

The Permian basin is a prime example of how the US operators are shifting their E&P activities from natural gas to more lucrative liquids-rich plays. Mergers and acquisitions are the fastest means to gain access to the desired acreage.

Apache. Beginning in 2004, Apache embarked on a strategic series of acquisitions to steadily increase its presence in the Permian basin. As a result, the independent is now the second leading operator in the region. The acquisitions have come from Exxon in 2004, Hess in 2005, Anadarko in 2006, Marathon in 2009 and both BP and Mariner in 2010. In the aftermath of the Macondo well blowout, BP sold 1.7 million acres to Apache with 141 million boe of proved reserves at a price of $3.1 billion. In the Mariner merger for $2.7 billion, Apache acquired 125,000 acres in the Spraberry, Wolfcamp and Wolfberry areas with little existing production (8,200 boepd) but significant upside potential.

W&T Offshore. An operator in the Gulf of Mexico for 27 years, W&T Offshore entered the onshore business by acquiring 30,900 acres in the Permian basin with proved reserves of 164 Bcf of gas and 27 million bbl of oil from private sellers for $377 million. The company’s Permian production comes from 70 wells in the Wolfberry trend.

Energen. An Alabama-based private operator, Energen acquired properties in the Avalon shale, Wolfberry and Bone Spring plays through four transactions during 2010–2011. The transactions increase Energen’s position to 33,000 acres in the Bone Spring, 40,000 acres in the Avalon and 21,300 in the Wolfberry.

INFRASTRUCTURE

The Permian basin has decades’ worth of existing gathering systems and pipeline networks in place to transport CO2 from the northern storage facilities and gas and oil to the Gulf Coast refineries and the Cushing storage depot in Oklahoma. Nevertheless, pipeline companies are advancing plans to increase capacity and build extensions to access new well locations.

For example, Plains All American Pipeline (PAA) is proceeding with a new construction and expansion project to serve the Bone Spring play in the Delaware basin. The project includes adding six miles of new 6-in. pipe to an existing system and constructing 20 miles of new 12-in. pipe. The project is designed to initially transport up to 65,000 bopd and will provide additional takeaway capacity for production primarily in Ward, Winkler, Reeves and Loving Counties, Texas. The project is expected to be in service by the end of 2011 and is supported by long-term agreements with Anadarko and Chesapeake. PAA owns and operates about 3,500 miles of crude oil gathering and trunk pipelines and 20 million bbl of crude oil storage capacity that service the Permian basin. In 2010, PAA transported about 470,000 bpd of crude oil out of the basin.

TECHNOLOGY ADVANCES

Advanced technologies from the service companies are contributing to exploration successes and drilling and completion efficiencies in the Permian basin.

Formation evaluation. Several of Schlumberger’s petrophysical and geological formation evaluation technologies are being used in the Permian basin. These include the Sonic Scanner acoustic scanning platform, which measures 3D rock mechanical properties that can be applied to develop a superior stimulation design. The Dielectric Scanner multifrequency dielectric dispersion service is being used to target previously bypassed reserves through enhanced petrophysical evaluation. In addition, the PeriScope bed-boundary mapper is a geosteering tool that enables long laterals in thin formations to be drilled in zone using azimuthal resistivity bed-boundary mapping.

Drilling efficiency. A Halliburton 7⅞-in. FX65RM bit, featuring X3-series cutter technology, drilled 7,331 ft at a record penetration rate of 108.6 ft/hr in Glasscock County, Texas, reaching a total depth of 10,378 ft in less than 68 hours and establishing a benchmark depth for the operator.

Drill pipe conveyance. Weatherford used drill pipe conveyance to acquire openhole data using its Compact cross-dipole sonic tool for a limestone formation in the Permian. The company was able to obtain a comprehensive suite of log measurements, including rock mechanical properties, in an openhole well where previous attempts to reach TD were unsuccessful.

Artificial lift performance monitoring. Following a chemical treatment program, field personnel for an independent Permian basin operator inadvertently restarted the well with the tubing and casing valves closed. The well immediately began to cycle, putting the electrical submersible pump (ESP) system at risk of failure. A Baker Hughes artificial lift engineer was remotely monitoring the ESP system and the well using the WellLink XPVision monitoring and production optimization system. Less than 16 hours after the well was restarted, exception reports generated by the WellLink system identified a rise in the ESP motor temperature and a correspondingly high motor current. This critical information was immediately given to the operator.

A pumper sent to the field by the operator discovered the closed valves. Without the information from the monitoring system, it would have been at least another eight hours before the closed valves were found. The operator avoided an ESP failure, prevented more than eight hours of well downtime and saved about $80,000 in intervention costs.

ENVIRONMENTAL ISSUES

Issues of environmental concern in the Permian basin include shortage of water, increased regulatory interest in fracturing, and the campaign to place the sand dune lizard on the endangered species list.

Water shortage. The Permian basin is experiencing a water shortage due to the increase in demand for water in fracturing operations and a severe drought across the Southwest region of the US. The cities of Midland and Odessa, Texas, both exceeded the Colorado River Municipal Water District’s allotment of water usage for the month of May. The situation has forced the district to approve another 10% reduction in the water allotment effective July 1. Furthermore, produced water from the Permian contains high levels of salinity that require onsite treatment prior to recycling or disposal.

Fracturing chemicals disclosure. In anticipation of more restrictive federal requirements, the Texas Legislature passed House Bill 3328, which requires operators to post the list of chemical ingredients that are subject to Occupation Safety and Health Administration requirements for material safety data sheets (MSDSs) on a website maintained by the nonprofit Ground Water Protection Council and the Interstate Oil and Gas Compact Commission.

The new law also requires companies to file the list of chemicals with the Texas Railroad Commission (which regulates oil and gas activity in the state) along with the well completion report. Additionally, the total volume of water used to hydraulically fracture a well must be posted and filed with the Railroad Commission. Non-MSDS chemical ingredients that were intentionally included and used for the purpose of hydraulic fracturing must also be provided to the Railroad Commission, to be made available on a public website. Ingredients that are not purposely added, occur incidentally, or, in the case of the well operator, are not disclosed by the service company or supplier do not need to be disclosed.

Significantly, the legislation does not require disclosure of the specific quantities of the hydraulic fracturing chemicals, nor does it require information about the techniques or staging of chemicals used in a frac treatment. Also under the new law, hydraulic fracturing chemicals may be claimed as a trade secret, and if so claimed, would be subject to the existing information disclosure process set up by the Texas Public Information Act. Only landowners where the well is located, landowners of adjacent property, or state departments and agencies with jurisdiction may challenge a trade secret claim. The law does require the disclosure of chemical information, including the trade secret information, to a health professional or emergency responder who needs the information for medical treatment.

Sand dune lizard. A rare species found only in the shinnery oak habitats of West Texas and southeastern New Mexico, the sand dune lizard, also known as the sagebrush lizard, is listed as endangered by the New Mexico Department of Game and Fish, and has been a candidate species for listing under the federal Endangered Species Act by the US Fish and Wildlife Service since 2001, Fig. 6. The federal listing would make oil and gas activity difficult by prohibiting surface occupancy within 200 m of designated habitats, requiring rerouting of seismic exploration, drilling and pipelines construction. A decision regarding the designation is expected in mid-December. US Sen. John Cornyn of Texas has filed an amendment to the Economic Development Revitalization Act of 2011 to block the Fish and Wildlife Service from listing the lizard as endangered.

|

|

|

GOOD TO THE LAST DROP

Permian basin oil production peaked in 1973 at 2.085 million bpd and leveled off in 2007 at about 800,000 bpd. It is now moving in the other direction, nearing 900,000 bopd. Since 2007, Permian basin production has exceeded that of Alaska. If oil prices continue to exceed $90/bbl and the E&P activities are not excessively impacted by fracturing disclosure rules or endangered species, our grandchildren may well live through yet another Permian basin boom. ![]()

No! Evil! Fire BAD!

These dumbasses still don’t get it, do they? Obama and his Envirofascists will never, ever, EVER allow domestic drilling again until the cities go dark.

Perhaps you don’t get it. This is drilling going on right now.

There are numerous shallow fields where as I don't think people have bothered to look deeper.

The example was the Carlsbad Field (Tom Green county) in the early 80's. It was producing at 8K ft since the 50's until a independent came in 30 years latter and found another zone below at 10K ft of the same size and reserve.

About 60 completions were achieved and drilling moved elsewhere with out anyone looking for what was below that second zone.

The old Ranger Field has been worked to death at the 4-5K ft depth with little information of what's below that zone. Every few years one might see a lone thumper truck working a small lease but nothing on a larger scale.

The permian basin is pretty mature and probably a good place for small operators that can use poor boy type solutions. They can get by with used tubing courtesy of the majors and probably the operations folks get a percent which means they work 360 days a year for a big payout. More effecient that a big company with armies of technical experts that go around and around the bush and never make decisions.

I dont know what kind of flowrates they have from wells, but you got to have a good rate to pay for all that cutting edge Schlumberger logging. And a Baker centrilift will probably cost you 500K. Nice to see that they can justify those costs there based on deliverability.

Words are too limited to describe the one-track ignorance in some around here.

It reminds me of the Marcellus Shale and the flack we are getting from our very vital Fracking agenda.

I think a small lizard is going to hold this up.

The costs have come down dramatically because of it.

Permian Basin is seeing development into Woodford and Wolfcamp shale fields similar to the Bakken and Eagle Ford. The game is changing.

There are several of the bigger companies putting money into the Permian Basin at this time.

US Permian Basin hosts new rush for black gold

http://www.ft.com/cms/s/0/69c8c4c0-9db9-11e0-b30c-00144feabdc0.html#axzz1SU7EXCW1

PERMIAN BASIN DRILLING REPORT: WEEK OF JULY 17, 2011

http://www.oaoa.com/news/approved-68710-number-commission.html

I certainly hope so. I'm not an expert, nor claim to be. I was under the impression PB had played out years ago, but I am sure I am wrong about that. It's just costing more to get the stuff out of the ground.

US oil recovery: Permian Basin sees reversal of fortune

http://www.ft.com/intl/cms/s/0/0cdabaf6-a053-11e0-a115-00144feabdc0.html#axzz1SU7EXCW1

From the article;

[Operators have coined the term “Wolfberry” to denote the combined Spraberry and Wolfcamp target intervals of interbedded shales and carbonates encountered at depths ranging from 7,000 to 10,500 ft, Fig. 2.]

Is this close to the Ranger field you describe?

my son started work in the Permian Basin this spring, so drill baby drill!

Active Permian Basin Rig count as of about a week ago = 421

http://fuelfix.com/blog/2011/07/10/permian-basin-rig-count-710/

I the last year alone, I have seen and been a part of several new methods or procedures that have doubled our success and production/recovery rates.

A friend of mine was mentioning some movie his neighbor got at the library, and had a party to watch it. All about the evils of fracking and the “witches brew” of chemicals. And how Cheney got the EPA rules lifted for the chemicals. Interviews with sickly people from their now tainted water wells, etc.

It sounded like some liberal crap linked together with some stories. I really don’t have the time to pursue it, but any two-cent comments? When I worked in the oil field for a couple of summers in college, it was a big deal if you parked your truck outside the designated parking area for fear of environmental damage. Hard to believe that the rules would be relaxed so far as the movie claims.

Debunking GasLand (the movie)

http://www.energyindepth.org/2010/06/debunking-gasland/

This link cite specific false statements, where they occur in the movie, and documents how they are false.

Cornyn amendment would halt Permian Basin lizard listing

http://fuelfix.com/blog/2011/06/07/cornyn-amendment-would-halt-lizard-listing/

Jun 7, 2011

New Fish and Wildlife director agrees to review sand dune lizard listing

http://www.mywesttexas.com/local_newsroom/article_a96c66fb-0e39-5da3-84d5-a43f5e05be70.html

July 1, 2011

Thanks a bunch for the link - will send it along to my friend.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.