Posted on 04/15/2011 5:30:39 AM PDT by thackney

Repealing a decades-old natural gas production tax exemption could either bring in $2.4 billion in revenue to Texas over the next two years or cost the state $3 billion or more, depending on whom you ask.

A proposal by Texas Rep. Lon Burnham (D-Fort Worth) would undo what was supposed to be a temporary tax exemption for “high-cost” gas – essentially natural gas produced from tight sand and shale formations that require what were once the non-traditional (“extraordinary”) techniques of horizontal drilling and hydraulic fracturing.

The exemption – which reduces the standard 7.5 percent tax rate to 2 percent – was put in place temporarily in 1989 and somehow made permanent in 2003.

Burnham notes that the exemption is hardly needed, given the widespread use of the advanced drilling techniques, which were used on wells that accounted for 56 percent of Texas’ natural gas production last year.

“If more than half of the industry qualifies, it is by definition not ‘extraordinary.’ The exemption is no longer an incentive – it’s a handout,” said Burnham. “One Barnett Shale producer got a $114 million tax break last year while raking in $4.6 billion in net earnings.”

Burnham says last year the exemption cost the state $1.2 billion, money that could help save teaching jobs in Texas public schools.

Naturally, the Texas Oil and Gas Association doesn’t see it that way.

The trade group argues that the removal of the tax exemption would not neatly transfer that $1.2 billion to state coffers. Rather, it would lead to a drop in natural gas production because the costs for drillers would go up.

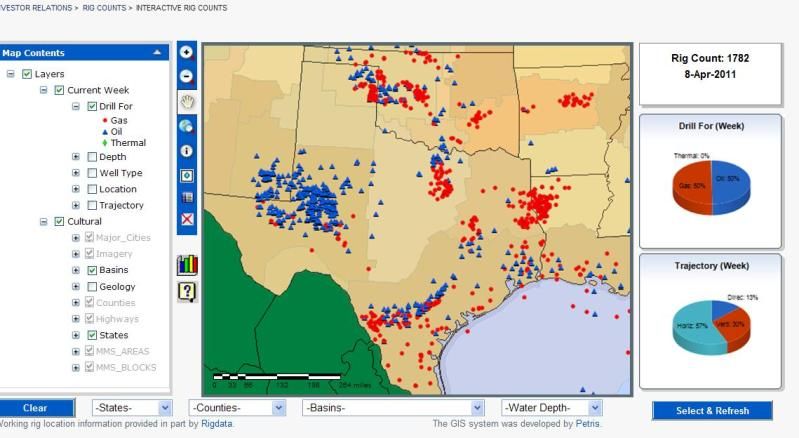

“Drilling rigs are mobile and can leave Texas,” the group said in a statement, meaning other states with lower tax regimes would lure the rigs away. “Taxable values of gas reserves would drop. With those rigs would go the taxes that reserves and drilling activity generate, depriving schools, hospitals, community colleges and first responders of revenue in over half of the counties in the state.”

TXOGA goes on to tout the $3.2 billion the industry paid in local property taxes last year, and circulates a report written for the industry in September by Billy Hamilton Consulting that says discontinuing the tax break would lead to a 4.7 percent loss in drilling activity in 2012 and a $1.5 billion loss to the Texas economy in the first year alone.

Not surprisingly, given the budget shortfalls seen in most states this year, Texas is not the only state having this argument.

Louisiana officials debated (but now seem to have rejected) changing their own exemptions for shale gas drilling. Under a 1994 law, gas drillers get a full exemption from severance taxes on all production for two years, or until the well cost is paid, whichever comes first.

Arkansas has a 5 percent tax, with exemptions that allow companies to cover well costs, but there was some movement to raise it to 7 percent. Oklahoma has a 7 percent tax with no specific shale exemptions.

Pennsylvania is the only major gas producing state without a severance tax. An effort to create one recently was killed.

So would getting rid of the tax exemption really kill more jobs on the gas drilling side than the number that would be saved on the state services (i.e. schools and other government positions) side?

The basic economic theory that raising the cost of a service makes it less likely to occur makes perfect sense.

Then again, it was just a year ago that the only way to get shale gas drillers to slow down was to hogtie them, as companies rushed to lease acreage across the country and start drilling before the leases expired. All that haste led to oversupply and natural gas prices just barely above $4. The migration away from gas drilling to more oily plays is going strong now, as higher oil prices make that the favored strategy.

Maybe the more apt question is how much would paying the full tax rate change individual companies’ per-well drilling costs, and would that push them over the edge to not continue work they’ve got planned in the booming Eagle Ford Shale or the Barnett?

Sounds smart to me, screw the drillers out of taxes, so that they can put the money in the hands of the public school socialists.

We get a lot of jobs and infrastructure built with these competive tax rates.

Giving someone a tax break is a “handout”. I’m so sick of government speak.

Or maybe it does. Maybe he WANTS less gas developed so that hard-pressed families have to pay for for natural gas.

BILLIONS for 0’s stupid wind mills, but not one penny for NG.

see post #5

No tax on corporations, savings or capital.

Only people should pay taxes.

There (sound of hands slapping together as if to wipe off grime) -- solved it.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.