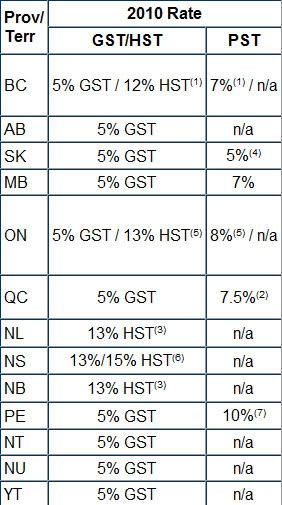

The provincial sales tax is not a national tax.

The GST is a national tax.

The HST is supposed to make it easier

more economical to collect the two taxes.

Provincial sales taxes vary by province.

Indeed in Alberta for example there is no PST.

As well some provinces haven't implemented the HST...

(1) BC will combine the PST with GST for a single value-added tax, 12% HST, effective July 1, 2010.

(2) The sales tax is applied to the total of the selling price plus the GST. The 2009 Québec budget proposes an increase to 8.5% effective January 1, 2011. The 2010 Québec budget proposes an increase to 9.5% effective January 1, 2012.

(3) The GST rate was reduced to 5%, and HST to 13% effective January 1, 2008. They were previously reduced from 7% and 15% to 6% and 14% effective July 1, 2006.

(4) Saskatchewan PST rate reduced from 7% to 5% for all sales made on or after October 28, 2006.

(5) Ontario will combine the retail sales tax with GST for a single value-added tax, 13% HST, effective July 1, 2010.

(6) Nova Scotia announced in their 2010 Budget that their HST rate will increase to 15%, effective July 1, 2010.

(7) The sales tax in PE is applied to the total of the selling price plus the GST.

link