Posted on 03/10/2009 10:40:28 AM PDT by Lorianne

We are now at a point where the world is awashed with U.S. Dollars and the Dollar has become the largest bubble the world has ever seen.

It's a real shame that those who lost most of their money in the stock market and Real Estate bubbles, and are now finally selling out after these markets have already collapsed, are positioning themselves to get wiped out all over again through massive inflation.

We believe both the U.S. stock and housing markets are likely to fall another 30% nominally from these levels. However, priced in Gold, which is real money, they will likely fall 80% or more in the years ahead.

As the inflation being created today starts to work its way through the system, U.S. stocks and Real Estate will eventually start rising in value again, but Gold will rise at a significantly faster rate. Silver, we believe, could eventually start rising at an even faster rate than Gold.

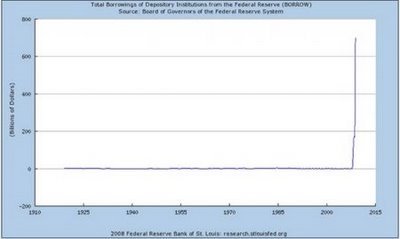

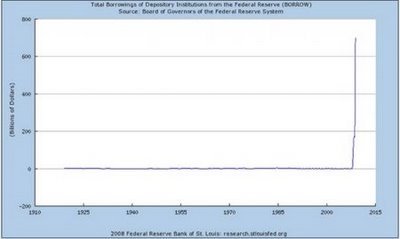

Most of the money that is presently being created by the Federal Reserve is being hoarded during this temporary deflationary phase. As the government continues to bailout every bank in existence and pass larger stimulus's, all of the Dollars being squirreled away around the world will soon come out all at once.

With many retail stores in the U.S. liquidating their inventories and going out of business, there will be a lot less products available for purchase and combined with the storm of Dollars, prices of everything from food to clothing will go through the roof. The government, instead of dealing with the cause of rising prices, will likely institute price controls. This will only exacerbate the problem and lead to empty shelves.

We cannot solve problems that were created by getting into too much debt, by multiplying our deficits and getting into much larger amounts of new debt. It will be impossible to all of the sudden "mop up" the massive amount of Dollars being printed. We are practically guaranteed to see substantially higher interest rates in the future, that will raise the annual interest on our national debt to trillions of Dollars. The United States will have a choice to either default on its debt or create Hyperinflation.

The wealthiest countries in the future will be those who control all of the world's Gold production. The world's largest creditor nations, mostly Asian countries, will have the best chance of accomplishing this. There are some Gold and Silver stocks that could gain by thousands of percent in the years ahead. With GE, formerly the world's largest company, headed towards bankruptcy, companies like Newmont Mining and Barrick Gold could be on their way towards becoming the world's new largest companies of the future.

The only good thing that will come out of the upcoming inflationary crisis for our country: students that were conned into investing hundreds of thousands of Dollars for worthless college degrees will be able to easily pay off their debts. Hopefully they will learn how to become a Gold miner or a farmer, and produce real things for our country, instead of destroying wealth like those on Wall Street and in Congress have done.

Anyone have some secret maps they want to sell me?

Yeah, whenever I see articles like this, you can usually figure on it being someone promoting gold or silver or related things...

Sure enough...

“an opportunity for a small percentage of Americans to become wealthy by investing into companies that we believe will prosper in an inflationary environment, such as Gold and Silver miners. “

... stated in their “about us” section...

[ can you say “paid by these ‘investment opportunities’ ...” LOL... ]

This is some interesting stuff. I was wondering about buying a bag of silver coins — cheapest I’ve found is that monex operation — $1k per bag. I’m not so sure about buying into these companies listed on this article — looks too much like a setup.

Don’t worry, the money supply will be reduced through massive, confiscatory taxation.

The USD will crash at some point. However, that isn’t what’s currently happening. It’s never a good idea to assume facts about the market that are not yet in evidence. Wait until the trend has clearly changed, but don’t wait so long that the new trend is mostly over!

Trading rule #1: Cut your losses short, let your winners run!

How many people are going to see their home values increase speedily and think the world is alright again, not realizing when it zips on by and the salary doesn’t equal the rent increases or property tax increases or cost of living increases?

I don’t trust these people that Glenn Beck pushes like buying gold and letting them store it for me?

I’m not so trusting, LOL!

Is it too late to buy gold now? The price is already very high. I got burned buying gold before Y2K and had to liquidate it in 2002 at a loss of $50 per ounce. I don’t want to do that again but the inflation monster is headed our way and growing larger every day.

The Dollar is way too big to fail.

Monex is for speculating on “paper gold” with lots of leverage and fees. They are pushy; be very wary of dealing with them.

You can find old 90% silver coins at any coin shop or APMEX. To figure out the value of the silver content, check out coinflation.com.

More than anywhere on earth the US is still seen as a safe haven and that means the dollar i,s too.

Since currency is valued relatively, I think the dollar will continue on as a storehouse of value. Gold is a play, but the goldbugs (I am not using it as an insult, just a description) are usually wrong. That said, I am not endorsing fiat currency as the best store of value.

bull.... inflation ain’t coming back anytime soon and when it does it will not be as hyper inflation. Hyper inflations are very rare

I might be wrong though, my inflation hedge is au, which did well in 1930s deflation too

Since currency is valued relatively, I think the dollar will continue on as a storehouse of value. Gold is a play, but the goldbugs (I am not using it as an insult, just a description) are usually wrong. That said, I am not endorsing fiat currency as the best store of value

_________________________

USD was strong in the 1930s last time we had deflation

I give it until 2012.

Utterly contradicts the headline. If dollars are confetti, houses which have some real value must be worth wheelbarrows full of said confetti.

Doom mongers never worry about the intellectual coherence of their allegations.

The housing crisis is demonstrative proof that nominal debts in dollars can be worth more than the real assets they are written against, which cannot happen if dollars are so oversupplied they have no value.

In fact, demand for dollars is nearly infinite at the present time, but only for safe investment purposes. Monetary velocity is non-existent, and therefore so is any pricing pressure. Large increases in free reserves in the banking system due to Fed actions have not been accompanied by large increases in total dollars outstanding (just the usual moderate ones), and money turnover has remained basically flat.

What the quantity theorist types never admit is that the value of anything depends on demand for it as well as supply, and the demand for money is not a constant.

There is a reason rates for riskless debts are very low and the dollar is strong against all currencies, and it isn't because hyperinflation is occurring.

It is a deflation. But men ideologically committed to slandering the Fed and the financial system cannot accept the existence of deflation in a fiat money system.

But I will only act on that belief when the chart patterns say there is a high-probability entry point to go long. Not there yet. And if my entry point isn't right, I will exit before taking very much of a loss, and wait for another opportunity to get in. I may have to do that several times. But the strategy will work, as long as the total loss on failed trades is much less than the total gain on successful ones. You need a trading system that makes such a result highly probable over any sufficiently large number of trades—and "cutting your losses short" (quickly exiting losing trades) is absolutely essential in that regard.

Recommended reading: Trade Your Way To Financial Freedom (Van Tharp)

Get a gov job with a inflation guaranteed pension. It’s better than a gold mine, the taxman will do all the work for you.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.