They're only meaningless to people who don't understand them or don't want to except what they prove. You asked for data on constant dollar wages. I gave it to you. Now you want to light the hoop on fire because you say it's meaningless unless it's placed into context of income levels.

Let's see what conservative economist and founder of the Club for Growth, Stephen Moore has to say about your income levels:

- The Census data from 1967 to 2004 provides the percentage of families that fall within various income ranges, starting at $0 to $5,000, $5,000 to $10,000, and so on, up to over $100,000 (all numbers here are adjusted for inflation). These data show, for example, that in 1967 only one in 25 families earned an income of $100,000 or more in real income, whereas now, one in six do. The percentage of families that have an income of more than $75,000 a year has tripled from 9% to 27%.

But it's not just the rich that are getting richer. Virtually every income group has been lifted by the tide of growth in recent decades. The percentage of families with real incomes between $5,000 and $50,000 has been falling as more families move into higher income categories -- the figure has dropped by 19 percentage points since 1967.

the Census data indicate that the income cutoff to be considered "middle class" has risen steadily. Back in 1967, the income range for the middle class (i.e., the middle-income quintile) was between $28,000 and $39,500 a year (in today's dollars). Now that income range is between $38,000 and $59,000 a year, which is to say that the middle class is now roughly $11,000 a year richer than 25 to 30 years ago.

The upper-middle class is also richer. Those falling within the 60th to 80th percentile in family income have an income range today of between $55,000 and $88,000 a year, which is about $24,000 a year higher than in 1967.

Source (subscription required)

How about wealth? Higher incomes must mean greater wealth accumulation, right? Rather than give you total household net worth and let you complain about how much richer the rich are getting, I'll give you the median numbers so you can see that the tide is lifting all boats. Remember, in 1980 only 25% of all working Americans were invested in the markets. Today it's closer to 60%. Yeah, those people are really going to get angry when government interventionists screw up the economy and cause the equity market to plummet.

the only time "class warfare" raises its ugly head is when regular folks are having a tough time themselves.

LOL! The only time class warfare raises its ugly head is when economically illiterate people treat what the socialists, and their allies in the MSM, are telling them as gospel or when they need to blame something other than the cause for their inability to get what they want. Those of us with a fundamental understanding of economics know better.

No, this is what's worrying me:

Good grief. You link me to an article from The Economist citing the Economic Policy Institute (EPI) to prove that we're in tough shape? Do you know what the EPI is? It's a left wing think tank funded by unions and other socialist causes. Look at their Board here and tell me what you think their agenda might be.

Then you link me to USA Today (LOL again) whining about consumer debt loads. Do you understand that any discussion of debt is meaningless unless assets are included? Our debt to assets ratio is just 18.3%. This is why our net worth (that assets minus debt) continues to rapidly increase.

Tell me what it is about this chart you don't understand. Do you think that people are wise to borrow when interest rates are low? Do you think that record home ownership might increase the our debt to income ratio? Is a .08% increase in our debt to income ratio over the past decade anything to be concerned about? If so, why?

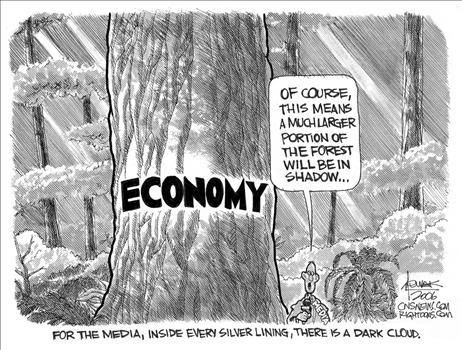

Durasell takes a walk in the woods.