Posted on 01/15/2026 9:47:27 AM PST by Angelino97

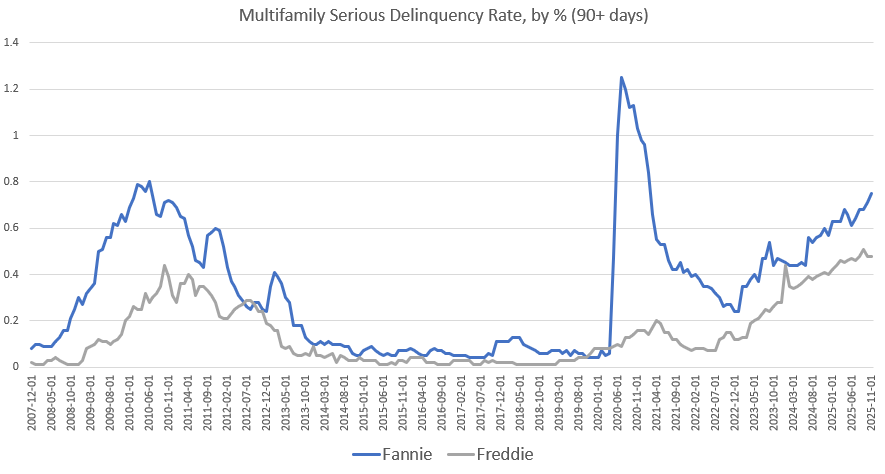

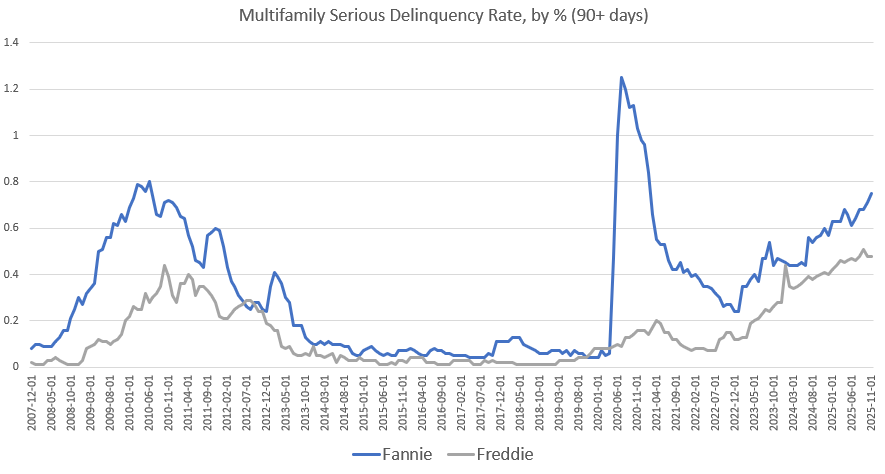

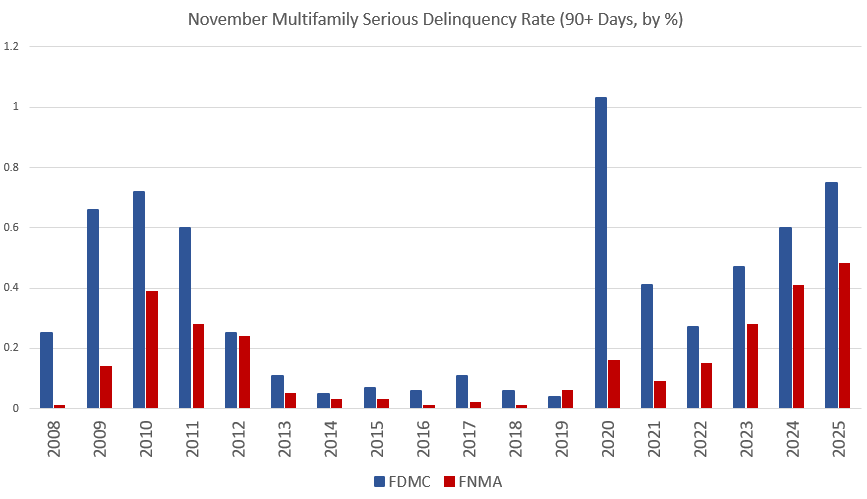

Fannie Mae and Freddie Mac (also known as “GSEs”) have released their November reports on their mortgage portfolios and mortgage delinquencies. Both Fannie and Freddie report that serious delinquencies in multifamily are rising to multiyear highs.

(These numbers reflect the condition of mortgages in each agency’s portfolio, which are a major part of the overall mortgage market. Nearly half of the multifamily mortgage market are part of GSE portfolios.)

For November, seriously delinquent multifamily mortgages (90+ days delinquent) at Fannie Mae rose to 0.75 percent. That’s up from October’s total of 0.71 percent, and it was up from November 2024’s total of 0.60 percent. Fannie’s delinquency rate has risen quickly since December 2022 when the rate was 0.24 percent. Excluding the covid panic, Fannie’s delinquency rate is now the highest since 2010, but remains below the Great-Recession high of 0.80 percent.

Freddie Mac’s delinquency report, on the other hand, shows delinquencies above the Great-Recession peak. During November, Freddie reported multifamily serious delinquency rate was 0.48 percent. That’s unchanged from October 2025, but up from November 2024’s level of 0.41 percent.

Comparing for November of each year, November 2025’s delinquency rate at Fannie exceeds that of November 2011, the previous peak year for delinquencies (ex covid), when November delinquencies reached 0.72 percent. At Freddie, November 2025’s delinquency rate of .48 percent is the highest in decades, and above the previous peak of 0.39 percent.

This trend likely reflects slowing rent growth and waning demand for rentals as employment stagnates and wage growth slows. CNBC reported on Dec 26:

"After years of steep increases, renters are finally seeing sustained price relief, a trend that appears to be carrying into early 2026.

"In November, the median asking rent across the 50 largest U.S. metro areas was $1,693, down about 1% from a year earlier and marking the 28th consecutive month of year-over-year declines, according to Realtor.com listings data. Nationally, the median rent fell to $1,367, down 1.1% from a year earlier, according to Apartment List’s data.

"November is typically the slowest month for rentals, but rents fell more from October to November this year than they did over the same period last year, according to Apartment List.

"With new apartment supply still hitting the market, rents are expected to remain lower into 2026.

“'Barring a major economic shock, 2026 is shaping up to be one of the more renter-friendly periods we’ve seen in a decade,'” says Michelle Griffith, a luxury real estate broker at Douglas Elliman."

The phrase “renter friendly” is anything but friendly for owners of multifamily rentals. Moreover, landlords must continue to contend with rising prices in services and materials necessary for regular maintenance of multifamily units. In other words, we must consider inflation, so real, inflation-adjusted rent growth is even worse than the nominal declines now reported in a number of metro areas. In Denver metro, for example, the median asking rent in November was down 4.8 percent, year over year.

Yet four days previous to this article: Trump Orders $200 Billion Mortgage Bond Purchase To Lower Housing Costs

Does “multifamily” mean multiple generations living in the same house? Or does it mean a building that I grew up calling “duplex”?

Investors buy bonds...freddy mac and fanny mae (tickers FNMA and FMCC) this is to provide funds that those agencies use to underwrite the mortgage loans. This report is commenting on overdue mortgage payments not the interest rates on new mortgages. The reason Trump is having the government buy the bonds is because investors are not interested, I know I’m not. But someone has to buy them because if they go unsold, the taxpayers will have to fund fanny and freddy like they did in 2008-09 during the great recession. Yes, fanny and freddy both collapsed and were a big part of the too big to fail bailout. If you have two cents to rub together both of these bond funds are selling for less than $10 per share right now. Get you some.

Multi Family means 4+ units in a building. It is subdivided into the big corporations financed by investors who want to diversify away from stocks and bonds as one group

and small ma-n-pa operators who only have one building, or one complex and not many.

A major factor is the overhead imposed by EPA and other federal and state and local building code, zoning and harrassent regulations.

Apartment

“Or does it mean a building that I grew up calling “duplex”?

From two units to hundreds on the same land.

The last time this happened (except COVID) was from 2008-2013ish. The opportunities were fantastic. Bought a little foreclosed house in 2012 for $60k that had sold with an FHA loan for $197k in 2007. Spent about $3k on fixup, rented it for $900 a month, sold it in 2016 for $202k. Sweet deal.

Most likely homes sold to illegals as it gets tougher for them, in the US, the ability to pay payments diminishes greatly.

I hope so. Housing my area was pumped to artificial highs like much of the country during Covid and only recently started coming down. People are house poor in my area.

There’s nothing “artificial” about high prices. There’s nothing artificial about low prices. The “proper” price is whatever a buyer and seller agree upon.

From the headline I thought this was going to be a story about juvenile delinquents in high-rise apartments.

Isn't that the same thing?

Trump is buying bonds with taxpayers' money, so taxpayers won't have to fund it?

This is apartment buildings.

The solution?

Close em out.

Every party takes their losses.

Let the market clear.

Don’t prop up the owners.

Don’t bail out the lenders.

Let the Invisible Hand do it’s work.

“Does “multifamily” mean multiple generations living in the same house? Or does it mean a building that I grew up calling “duplex”?”

A duplex is a building with two living units.

Multifamily is a building with multiple living units.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.