Posted on 09/03/2025 12:34:17 PM PDT by Angelino97

Homebuyers are backing out of property purchases last-minute at a higher rate than ever recorded due to fears that a financial crash is imminent.

Just four years ago, homebuyers were bidding up house prices and waiving inspections in order to quickly secure fast-selling properties.

Today's buyers are moving slowly through the process — negotiating lower prices and obsessing over property details.

And they are increasingly getting cold feet and backing out, even after signing contracts. In fact, 58,000 home-purchase agreements were canceled in July alone, according to data collected by Redfin.

That's 15.3 percent of all homes that went under contract that month -— the highest July cancellation rate on record since Redfin began tracking in 2017.

The spike — up from lows of 11.6 percent in 2020 and 2021 — reflects how tough today's market is...

Some experts expect a crash. 'I'm waiting on the market to cycle as it did in 2008,' said Joel Efosa, who runs a company buying and selling homes...

Buyers also have more homes to choose from now compared to the past, which gives them more negotiating power and means they aren't in a rush to secure the deal.

Many buyers also depend on selling their own house before closing on a new one, so if they struggle to offload their old property, they may not be able to move forward with the deal.

Home purchases are most likely to fall through in Texas and Florida, with 22.7 percent of contracts in San Antonio being canceled in July and 21.3 percent of property sales in Fort Lauderdale falling through.

Florida and Texas are building more homes than anywhere else in the country, leading some buyers to back out of deals because they're sure they will be able to find a better property elsewhere.

(Excerpt) Read more at dailymail.co.uk ...

In the Daily Mail’s home nation there is no panic because the government is buying up new houses for what are quaintly known as ‘asylum seekers’.

My question is will local governments respond by decreasing valuations? Of course, I know the answer to that one.

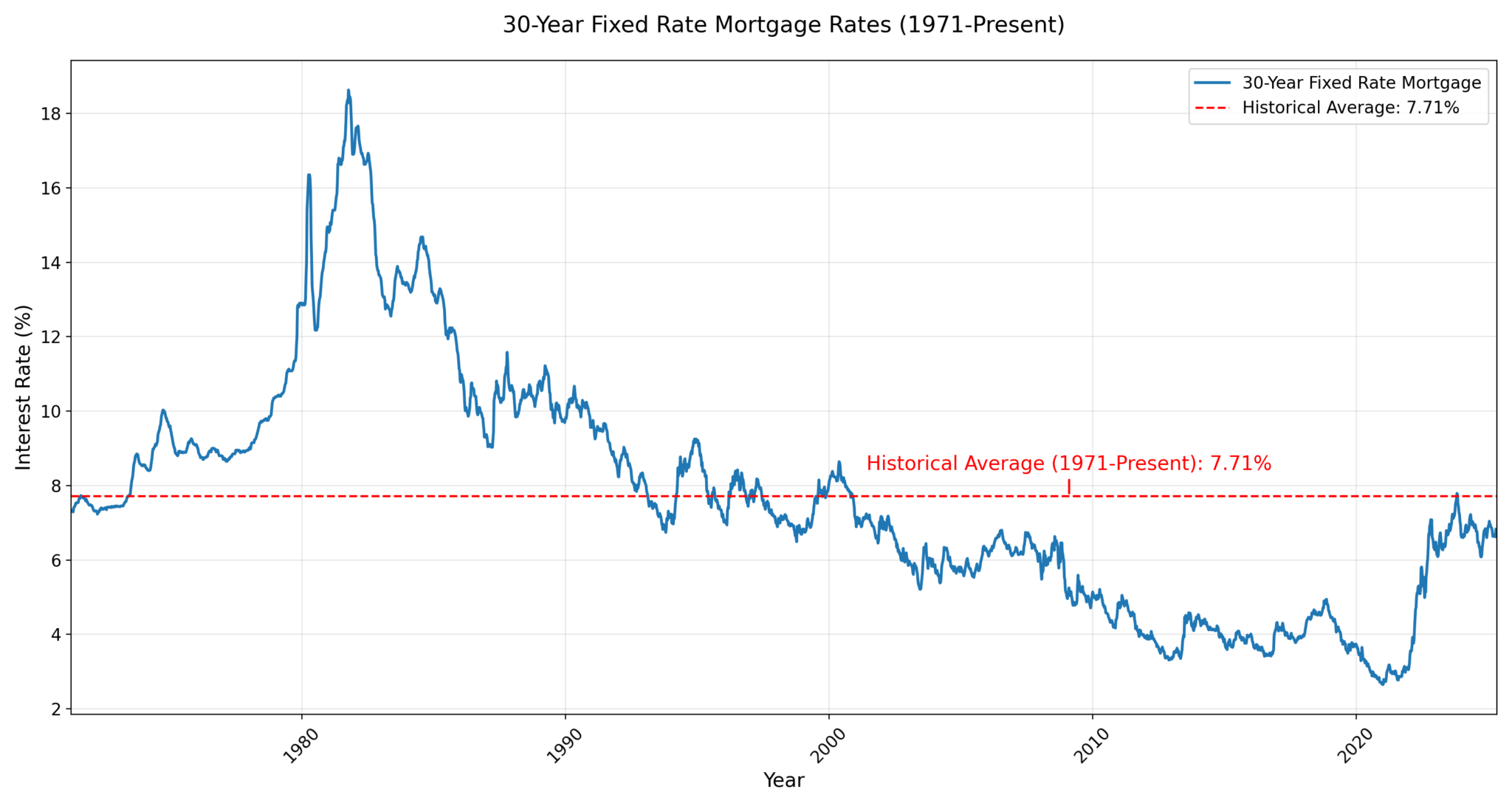

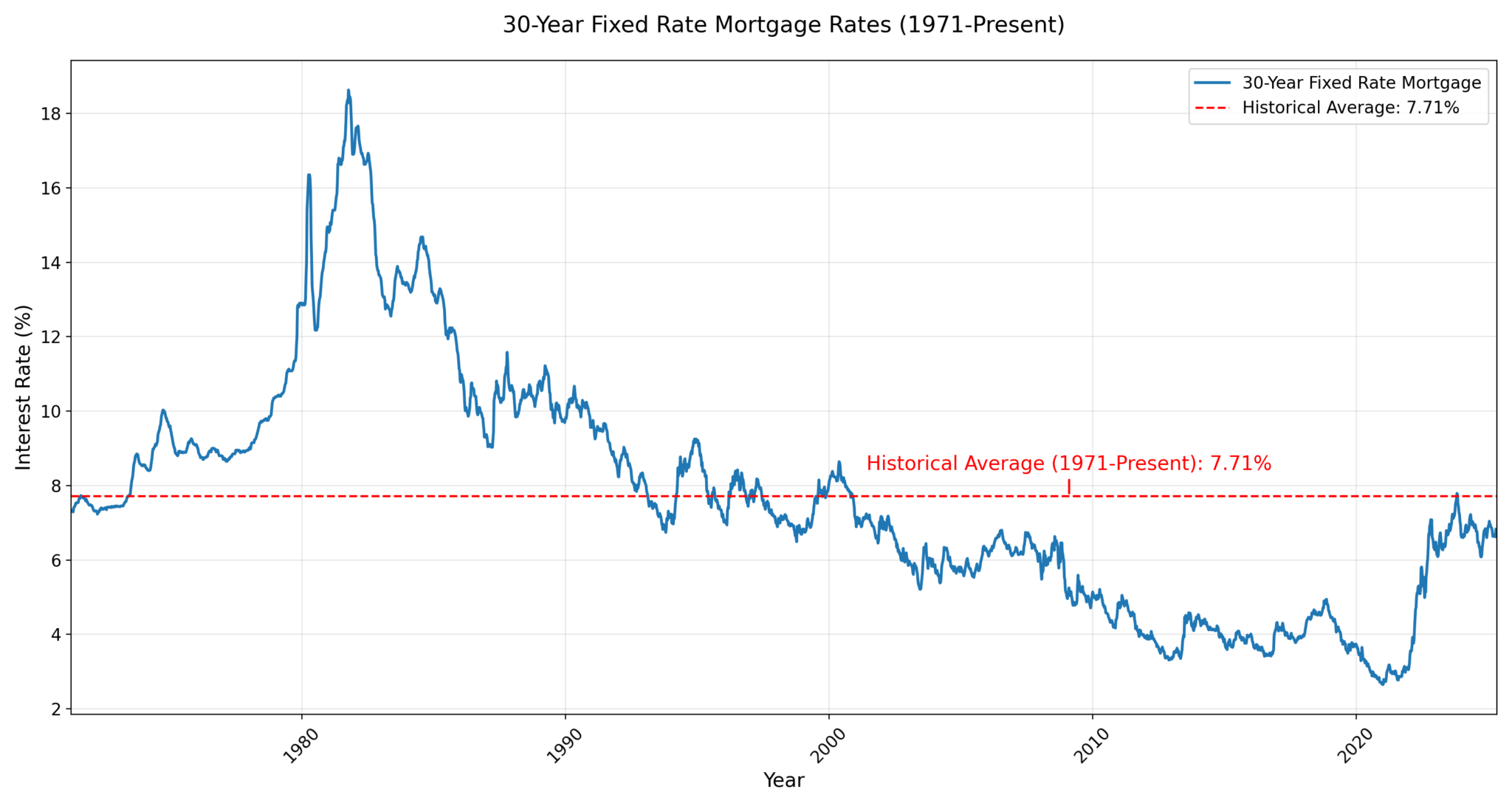

I remember when we bought a house on that chart in 1988. We were grateful for 9 7/8’s.

I’ve been looking at a second house.

Interest rates and prices have the monthlies very high, even with VA.

I’m not sure if there’s a steal out there right now.

Jimmy Carter heavily skewed that average, but then to be fair, the push for near-zero rates in the 2000’s skewed it in the opposite direction as well. So, that historical average may not be so far off.

It’s not like it wasn’t predicted.

Look at any curve of home prices from 2015 to 2024. Skyrockets in 2021-2022 as all the remote workers bolt the big cities and FJB caused mass inflation with oil flow constriction.

What comes up...gotta go down.

It’s a good thing, notta bad.

And how does she know? Who keeps track?

Interest rates were high but prices were not off the charts.

And there are 10s of millions of people who simply cannot afford to buy a house and who have just resigned themselves to be renters forever.

They dare not dream the American dream.

My city taxes went up $150 from last year and I live in the hood. There is no way I could sell my house now for what they say it is worth.

Economics is all about psychology. An expectation that prices could crash will cause a self-fulfilling prophecy of falling home prices.

For me the biggest isssue is in a lot places of country now half the home owners are running around thinking they “rich” because they have so much paper equity in thier homes. The rise in home values since the Covid scam is staggering. The next crash is going to be even harder than 2008, IMO.

While looking for a temporary, furnished apartment or condo to possibly rent when my son will go into his residency there, I found whole housing developments where a company that owns all the houses rents them, detached with their own yards and driveways. Never seen that before. That could explain some of this.

People will always have cold-feet about big purchases, including homes and vehicle, and even business transactions.

With home prices being so high now, it’s expected that people will have second =thoughts about such a high commitment.

The 2008 kind of panic is not what’s concerning pep[;e today, since the government is not making things as easy as it was back then with no down=payments and easy qualification for purchases.

Also the huge infux of illegals.

We bought our house in Valley Ranch (North Irving TX) nearly 30 years ago. A neighbor offered a cautionary note, saying he was underwater for about ten years. I don’t plan on selling anytime soon, my kids and grandkids live within a 30 minute drive.

Wow...

I get 5 offers to buy my house every WEEK. Half the houses in my area have been bought up and are now rentals for insanely high rent. Getting hard to even be a renter nowadays also.

I used to make fun of men who didn’t move out of the house right away, but who can afford it now?

LOL!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.