I recommended getting out of bitcoin when it was $4.

MA

Posted on 04/19/2025 7:29:10 AM PDT by delta7

According to the latest survey of fund managers by Bank of America, 49% say that gold is the most crowded trade.

This marks the first time in 2 years that the Magnificent 7 tech stocks did not top the “overcrowded” survey.

However, there’s a problem here. The fund managers responding to this survey clearly don’t know much about the gold market. My guess is they have not positioned their clients for the rise in gold, and are lashing out against bullion’s rise.

Gold is by no means a crowded trade, as we will show today. Central banks are driving this bull market in gold. Retail and institutional investors have barely gotten involved (yet).

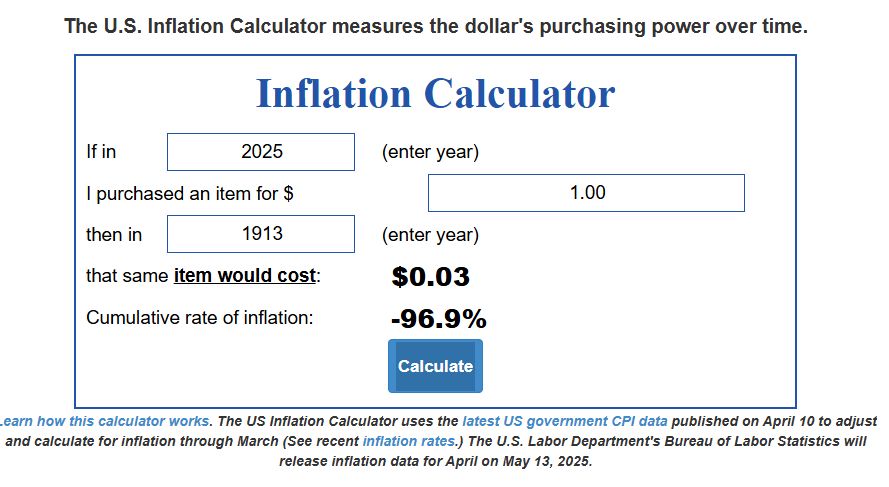

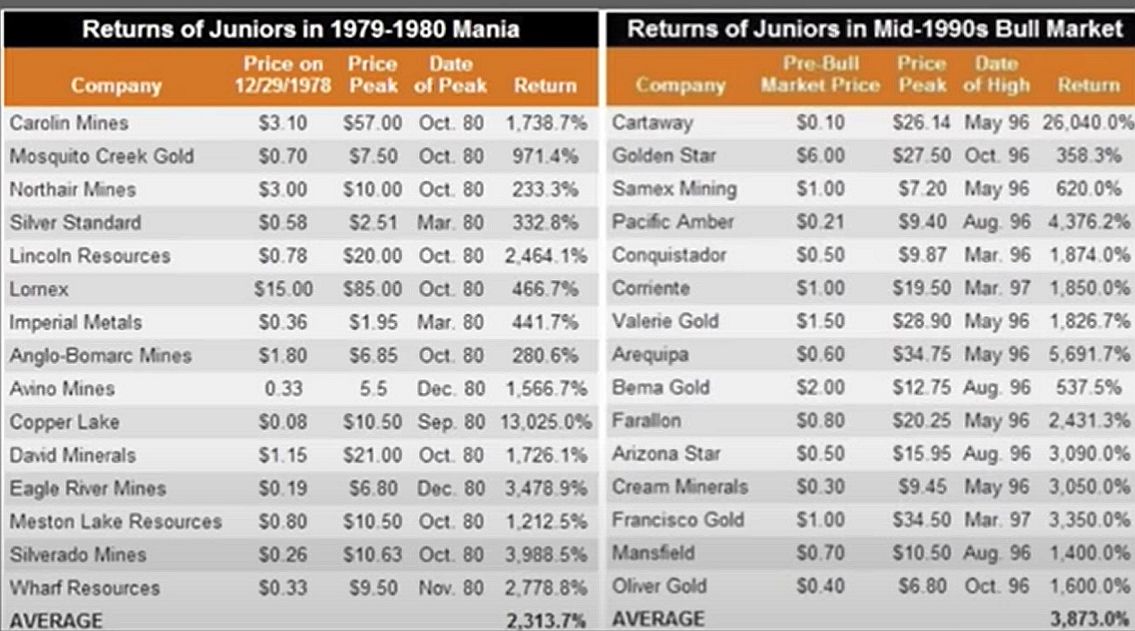

We can tell this in a number of ways. The first is by looking at the chart below, which shows the percentage of all ETF assets which are made up of gold ETFs (like GLD and PHYS).

image 1

Source: Topdown Charts

So only about 2% of ETF assets are currently allocated to gold. And during the last bull market, in 2011, that number got up to over 8%.

Here’s another interesting nugget. Gold miner ETFs are even more under-owned than bullion funds.

Below is another chart which shows the ETF market share of gold miner funds.

image 2

Source: Topdown Charts

As you can see, today gold miner ETFs only make up around a tiny 0.25% of all stock ETFs. Back in 2011 it was nearly 1.5%.

Barely anyone owns gold and silver miners today. It’s a fraction of a rounding error of the total market.

So, no. Gold is not the most crowded trade on Wall Street. The current gold market is not being driven by retail and institutional investors. The vast majority of buying today is being done by central banks (more on that here).

If you’ve already purchased gold (and silver), you’re well ahead of the curve here.

A Different World

We must consider how the market conditions have changed since 2011. The global debt burden is far, far larger.

In 2011, U.S. federal debt was about $14 trillion. Today it’s over $36 trillion and growing much faster.

Meanwhile, China, India, Turkey, and Russia are gobbling up an increasingly large share of global gold production. As we have discussed previously, it is entirely possible China’s gold reserves now exceed America’s by 2 or 3x. And just recently, retail interest in gold in China has absolutely exploded. More on that in a future letter soon.

My point is that it’s an entirely different planet than it was back in 2011. Mainstream asset managers have yet to get the memo. But they will eventually.

For now they simply see gold as a “crowded” trade because the price has increased. They have no idea that central bankers are the ones doing the buying! This is the ultimate insider signal, when the guys who run the fiat printing machines are the ones buying gold.

The fact that central bankers are doing the bulk of gold buying today is important for a few reasons. First of all, they are unlikely to sell it anytime this century. When central banks make a change in their reserve policy, it tends to last at least a few decades. This trend will continue going forward.

When mainstream investors do finally catch onto the precious metal story, and begin to digest the magnitude of our situation, the move in precious metals will be absolutely explosive. They will all rush to buy bullion and miners so they can respond to their clients’ inquiries with, “well of course we own it!”.

Just recently we’ve begun to see a slight uptick in gold and silver miners. I believe it’s truly just the beginning of this move.

A rotation out of traditional stocks, and into precious metals and miners has begun. But it is not anywhere near a “crowded” trade. So feel free to ignore those headlines.

However, in the very near-term, it does seem like gold is due for a break. I could see it pulling back to around $3,000 or a bit lower. Then continuing higher, with $4,000/oz being a reasonable target for the end of this year…

I’m assuming that the rise in the price of gold is good for certain Index Funds. What I’m not so sure of is whether it’s safe to assume that.

> It is no mistake the Basel Agreements take full effect on 1 July, stating banks will have GRA’s ( Gold Revaluation Accounts) and declaring Gold is now a Tier One Asset…..they are preparing.

Sooo... i wonder if we should expect another uptick just before then

I’m assuming that the rise in the price of gold is good…

—————

I am assuming, by your statement, you don’t get it. The amount of dollars needed to buy an ounce is skyrocketing, illustrating the dramatic loss of purchasing power. The purchasing power of ALL paper currencies is rapidly declining.

IBTG

I’m being very specific. Specifically to “certain Index Funds”, so cut the crap!

….I will add the return to real money is good, but the move will have severe consequences for all paper denominated assets.

“so cut the crap!”

Mission Impossible!

It’s ‘severe’ consequences as a result of waiting at least 113 years to fix the problem.

Could have fixed it much earlier, but NOOOO... had to kick the can down the road a few trillion times.

Yup. they are putting themselves in a position to be in the catbird seat when the true value of gold when compared to fiat money becomes apparent. Which they are seeing as sooner rather than later.

If Bitcoin can go from $4 to 83,000, there is nothing too crazy about the rise in the price of gold.

I recommended getting out of bitcoin when it was $4.

MA

“stating banks will have GRA’s ( Gold Revaluation Accounts) “

Central Banks already have GRAMS.

Under III they will have to daily mark to market.

When my father passed in summer of 2020 I inherited a little dime sized gold coin. I don’t remember its actual value, but I remember checking and the price of gold was around $1700. It’s now almost twice that.

Yup, I'm sticking to the safe haven assets, paper money, treasuries, and paper stocks until death do us part. And people would foolish to consider to get in on gold and gold stocks in particular when the price of gold rises. History proves that!

.

“they are preparing.”

They have already “prepared”.

“Meanwhile, China, India, Turkey, and Russia are gobbling up an increasingly large share of global gold production. “

Russia is depleting their gold reserves to pay for their “two-week” waanother year of this and they will be broke.

Index Funds are representative of the market itself. Gold may indeed be at an all-time high but it’s not enough to act as a major hedge against market corrections and/or a major sell-off.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.