Posted on 03/06/2025 9:32:47 AM PST by SeekAndFind

What is going on in the United States Senate? Last week the Senate Republican majority passed a budget blueprint resolution that:

A) Spends MORE MONEY

B) Has NO Trump tax cut

Huh?

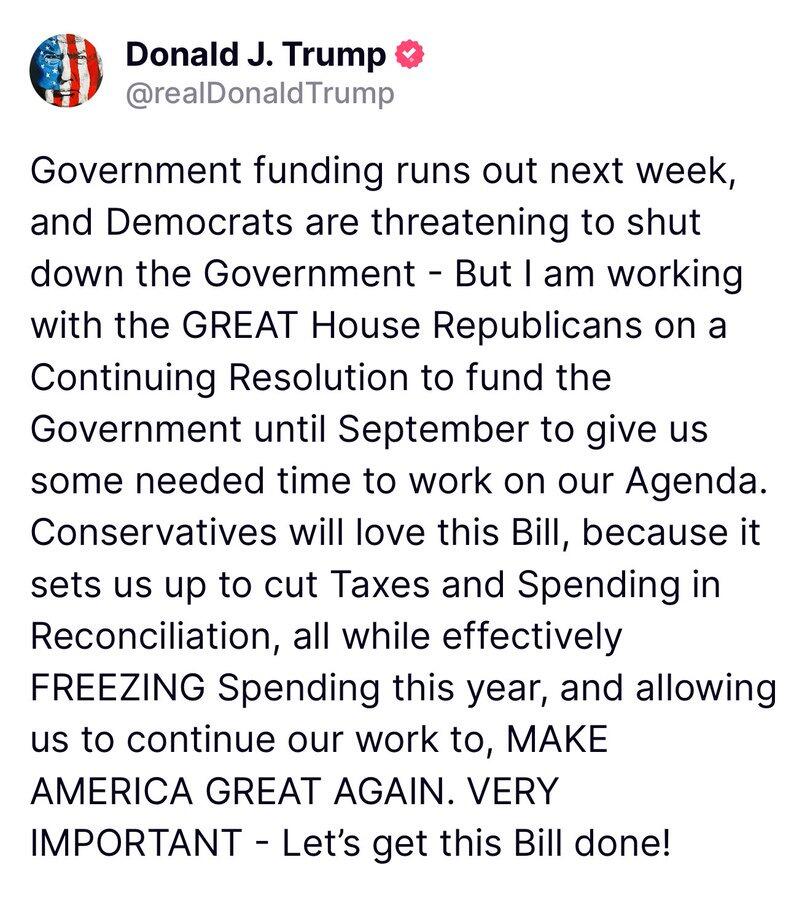

The senators want to push the Trump tax cut off until…later in the summer or maybe into the Fall? The highest priority has become the least urgent priority. Sure. That makes sense!

We can count at least three glaring problems with this strategy:

First, the economy is looking a little wobbly right now. Consumer spending and consumer sentiment are both falling, housing sales are down, and inflation is rising. This is the after-shock of Bidenomics. We need a real tax cut extension economic stimulus ASAP.

Second, waiting only allows the wanderlust Democrats months to regroup. There’s too much that can go wrong with this plan. This reminds us of a James Bond movie where the villain captures 007, dumps him in a shark tank, walks away, and foolishly/naively assumes he’s dead.

Third, and most obviously, the sooner the tax cut is passed, the faster the Trump economic rebound.

Republican senators assure us that as soon as the House passes the tax cut, they will jump aboard. Sure. Like they did on Obamacare repeal?

This is what happens if the Democrats (and pro-SALT Republicans) have their way and the tax cut is not extended (based on a handy summary from the Brookings Institution):

Millions More Americans Will Have to Itemize Deductions: If TCJA expires, the standard deduction for a married couple will be cut to $16,525 in 2026, versus $30,725 if the tax cut remains. This means about four times as many Americans will have to itemize deductions making tax preparation much more complicated.

Individual income tax rates rise: TCJA lowered marginal income tax rates for all tax filers. The highest tax rate will rise from 37% to 39.6%.

State and local tax (SALT) deduction: TCJA imposed a $10,000 cap on the deductibility of state and local taxes (SALT). If this provision of the TCJA expires, all state and local taxes will be deductible, primarily benefiting rich people in high-tax states.

Child Tax Credit Cut In Half: If TCJA is repealed the tax credit for each child under 17 falls from $2,000 to $1,000, penalizing families with kids.

Small business income tax rises by 25%: TCJA provided a 20% deduction for most small businesses. If the bill is not extended the tax on qualified small businesses rises by that amount.

Alternative minimum tax (AMT) Hits Millions More Families: Failure to extend the TCJA would mean roughly seven million more families hit with the unfair AMT.

Twice as Many Families Hit with Death Taxes: The TCJA doubled the estate tax exemption. If this provision expires the exemption in 2026 will be cut from $28.6 million to $14.3 million for married couples.

Same old same old. Republicans have never been comfortable with a majority. It brings problems to the stage of high visibility.

There will be no tax cuts for the people. They will agree to not raise taxes, pay themselves on the back and the great scam will continue.

It is a political ploy; reconciliation.

Pass a blueprint to the house where the hard rk is done.

There will be tax cuts.

There will be spending cuts.

Nope. See #5

“There will be no tax cuts for the people. They will agree to not raise taxes, pay themselves on the back and the great scam will continue.”

Nope. See #5

?????

They will agree not to raise taxes?

The Trump tax cuts from his first term are expiring. If nothing is done, we will all face a tax increase as those tax cuts expire.

So for them to agree not to raise taxes, would mean they have to take positive action to make it happen.

Trump needs to nip this in the bud or it will continue for four more years. As I claimed several months ago, the paint is washing off and showing their spots again. They haven’t changed one bit and they are going to fight against Trump’s agenda every way they can. They are insulting his intelligence. He should absolutely veto this and tell them to go back and try again...

To too many DC pols, the Uni-Party scam is more important than anything else.

Legalized stealing is what and only what they’re about.

CALLING JOHN THUNE!

GET OFF YOU’RE BUTT!

Quit being a tool.

Trump should destroy the GOP. I’ve had enough of these traitors .

An earlier story said the Senate wanted to make the Trump tax cuts permanent. Some House Republican deficit hawks were concerned about long term effects on the deficit due to the loss of revenue, and only wanted short term tax cuts. It may be that the Senate is not the real problem, and that time is needed to hammer out an agreement on the tax cuts.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.