Posted on 07/25/2024 9:12:44 PM PDT by SeekAndFind

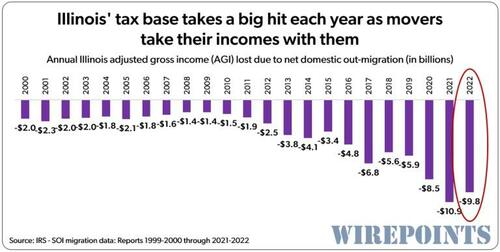

One of the most damaging impacts of Illinois’ people loss to other states is the destruction of Illinois’ tax base. When people leave in a given year, they take their incomes (adjusted gross incomes, or AGI) with them, and that means the state’s tax base suffers.

A smaller tax base, everything else equal, means less tax revenues for safety, education, road repair and every other core government service – or, as is typically the case in Illinois, more debts and more tax hikes.

Unfortunately, Illinois’ out-migration problem is much bigger than just a one year loss: the state has lost people and AGI every single year since at least 2000, the first year of Wirepoints’ out-migration analysis. The AGI losses pile up on top of each other year after year, slashing Illinois’ tax revenue growth and destroying Illinois’ overall prosperity.

In all, the cumulative impact of out-migration for the last 23 years means the state budget lost out on about $3.6 billion in income tax revenue in 2022 alone. (Said another way, had Illinois not lost all those people over the last 23 years, the state would have had $3.6 billion more in income tax revenues in 2022 alone.)

The revenue losses for 2022 are even bigger when you take into account all the other revenues foregone – sales taxes, gas taxes, fees, etc. – due to the loss of taxpayers.

Thanks to the state’s failed spending and pension policies, Illinoisans are paying the price.

The latest 2021-2022 migration data from the IRS shows Illinois reported $9.8 billion in lost adjusted gross income as a result of losing a net 87,000 residents to other states. Read our full report here.

That $9.8 billion in AGI, after taking into account exemptions of $1.6 billion*, could have become $400 million in income taxes for the state (calculated at 4.95%). That in itself is a significant amount of lost income tax revenues.

But the cumulative impact of the AGI losses are much more dramatic. Let’s build out how state’s 2022’s income tax revenues were impacted by the cumulative AGI losses since 2000.

In 2000, Illinois suffered a net loss of $2 billion in AGI as a result of outmigration, meaning the state lost out on being able to tax $2 billion that year.

The next year, 2001, Illinois lost another $2.3 billion in AGI due to outmigration. Pile on top of that the $2 billion in AGI lost in 2000 and, overall, the state lost out on being able to tax a cumulative $4.3 billion in AGI in 2001.

In 2003, Illinois lost another $2 billion in AGI, putting the cumulative AGI losses for that year at $6.3 billion.

You get the picture. When Illinois loses a taxpayer, his income isn’t just lost for tax that year. It’s lost for every subsequent year, as well.

So when you carry the above exercise all the way through to 2022, it totals nearly $88 billion in AGI that the state couldn’t tax in 2022 because of all the cumulative losses. Subtract exemptions*, and it results in about $74 billion in net income. Multiply that by Illinois’ 4.95% flat tax and you get $3.6 billion in income tax revenues the state could have had in 2022 alone if Illinois had not bled residents for 23 years.

The same tax-revenue-loss calculations can be done for all prior years.

In all, Illinois has lost – counting every single year’s cumulative loss – $700 billion in AGI, that it could have taxed over the entire 2000-202 period. It’s one of the big reasons Illinois is in such a fiscal mess and why it has the worst credit rating of any state in the country.

The opposite of what’s happened to Illinois is true for the nation’s big winner of people and their incomes: Florida.

Gains in people and income pile on top of each other each year, building an ever-growing tax base. In 2022 alone, the state’s tax base was some $272 billion higher compared to 2000 because of the state’s 23 straight years of net in-migration.

And while the state of Florida doesn’t directly take advantage of that income because it doesn’t have an income tax, it’s understandable why the government is swimming in cash when you take into account all the other tax revenues – sales, gas, fees, etc. – that the state’s growing number of taxpayers pay.

In all, Florida has gained– counting every single year’s cumulative gain – $2.14 trillion in AGI, that it could have taxed over the entire 2000-2022 period.

More than anything, Illinois’ lost revenues represent the fundamental crisis this state faces because of chronic out-migration.

Illinois is stuck in a vicious downward spiral it can’t hope to escape from without fundamentally changing how it governs.

The problem is even worse when you consider that a lot of the people leaving are also government retirees with fat pensions.

It does not matter

They will always be bailed out and have their finances topped-up by Fed.gov during the next "stimulus" program

That's how governments use printed, fiat currency and massive debt for their own political purposes.

Wherever people sense that their government and institutions are hopelessly corrupt, be it Illinois, California, New York or Africa , they leave to move elsewhere if they can.

Governor Pritzker should be proud of seeing the outflow. He’s responsible for a good part of it. Perhaps he could figure out a way to call back for the people who departed for other states. That would be the very democratic thing that drives the Democrats to doing stupid things. They are vicious and vindictive.

Such an infelicitous formulation to have in the opening sentence!

One major flaw of the article is that it examines only the loss of tax revenue attributable to outmigration.

The article should tally up namely not just the lost tax revenues, but also the lower tax expenditures resulting from the outmigration.

Fewer people need fewer jails, less state aid, etc.

Regards,

Has he tried shaming tactics? Calling them "ray-cists?"

That always works!

Regards,

“Fewer people need fewer jails, less state aid, etc.”

Not necessarily as the people leaving were less likely to be “customers” for those services.

I know that - but the article is nonetheless severely flawed in this regard.

Regards,

Play stupid games, win stupid prizes.

Love to see these charts for Kalifornia. Probably much worse seeing as we have more billionaires and people save a lot more on housing when they exit. Then again IL residents have some incentive to flee the snow. Nobody leaves CA for better weather.

Plea to Chicago residents fleeing to other states:

Please donate your Kevlar vest to someone in Chicago too poor to afford one. Saving a life is more important than letting the vest gather dust on a closet floor.

Talking to people in Las Vegas about the growth of the city. Seems that the majority of people coming to Las Vegas are unhappy RATs from RAT run cities. Problem is they bring the same stupidity with them that caused the dumpster fire they just left. Can’t fix stupid.

“Taxation is theft”

-Frederic Bastiat, 1843

https://en.wikipedia.org/wiki/Taxation_as_theft

“...They forget that the state lives at the expense of everyone”

Illinois doesn't tax retirement accounts, at least not yet. Illinois had meaningful pension reform about a dozen years ago, but any benefit from that will be some years away..

The criminals aren’t leaving.

they lost some heavy hitters, 19B/87K = 222,725.73 taxes for each on average.

As I’ve urged everyone for several years....if you are in Illinois, move! Get out while you still can before the taxes are jacked to the stratosphere in the final stages to try to maintain the clearly unsustainable pension promises to public sector labor unions followed by the inevitable crash after the state has been sucked dry.

The crash will take down private businesses and see home values plummet. It will be like what happened to Detroit only on a state wide scale.

I realize you may have homes and a business and it may not be easy to leave but I urge you to do so if you possibly can. If you cannot, then at least try to move as much of your wealth beyond the reach of the state’s tax authorities as you possibly can. They will come for your money...even more than they already are.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.