Posted on 04/11/2024 9:14:52 PM PDT by SeekAndFind

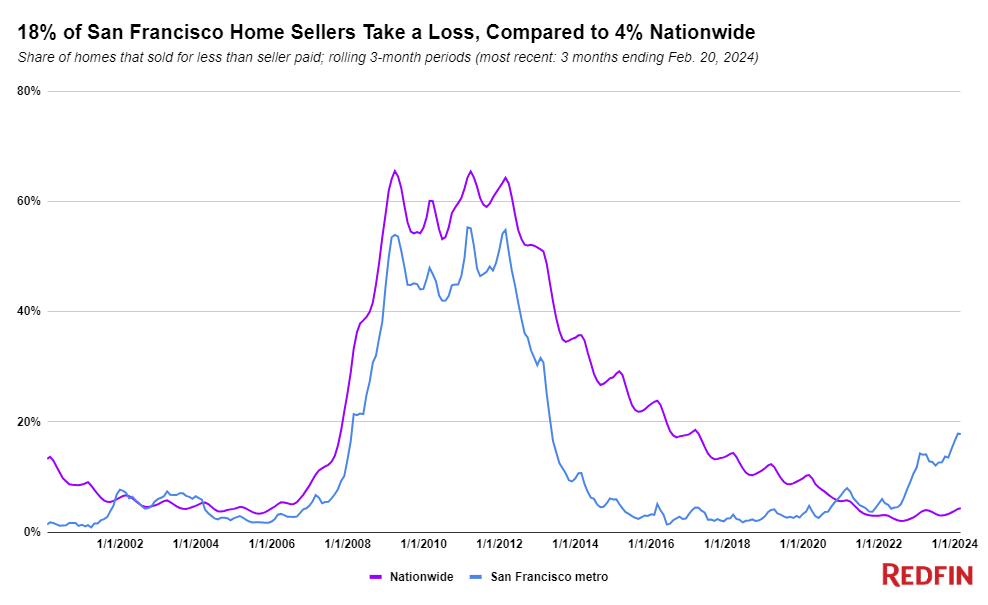

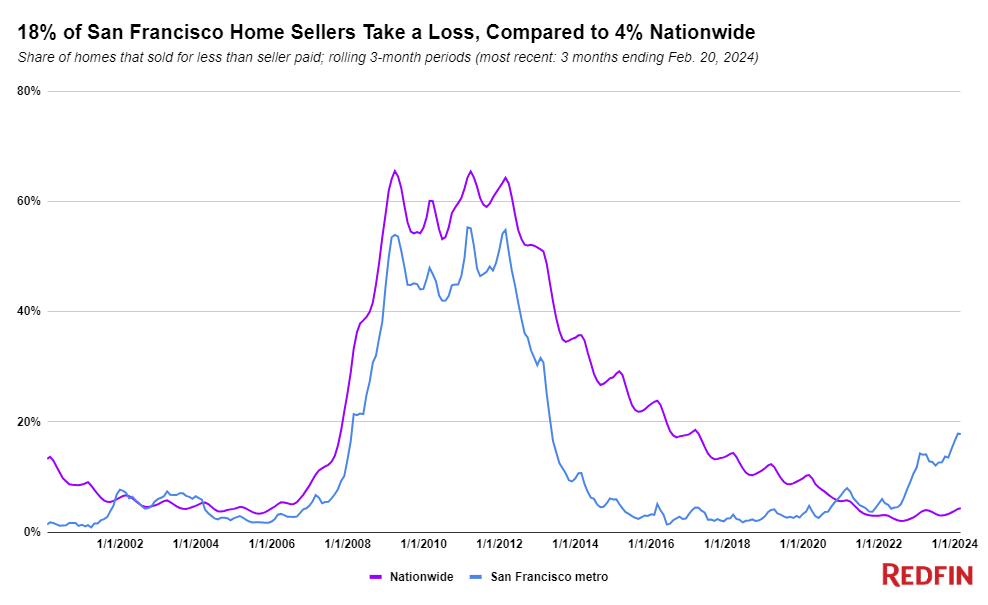

Nearly one of five (17.8%) homes that sold in San Francisco during the three months ending February 29 sold at a loss. That’s comparable with the 17.9% share hit during the three months ending January 31, which was the highest in 11 years.

That’s a higher share than any other metro, and it’s more than four times the national share of 4.3%. The national share of sellers taking a loss is the highest it has been since May 2021, but the share has been fairly stable over the past two years, hovering between 2% and 4.5%.

In San Francisco, the typical homeowner who sold at a loss parted with their home for $155,500 less than they bought it for, the largest dollar loss of any major metro. Nationwide, the median loss was $39,912.

This is according to a Redfin analysis of county records and MLS data across the 50 most populous U.S. metros. To be included in this analysis, a home must have been owned by the same party for at least nine months leading up to the sale. When we say “sold at a loss,”, we mean the seller sold the home for less than they bought it for.

San Francisco home sellers are far more likely than sellers in the rest of the country to lose money because home prices there have dropped dramatically since the pandemic homebuying boom. Still, the Bay Area is home to the most expensive real estate market in the U.S.

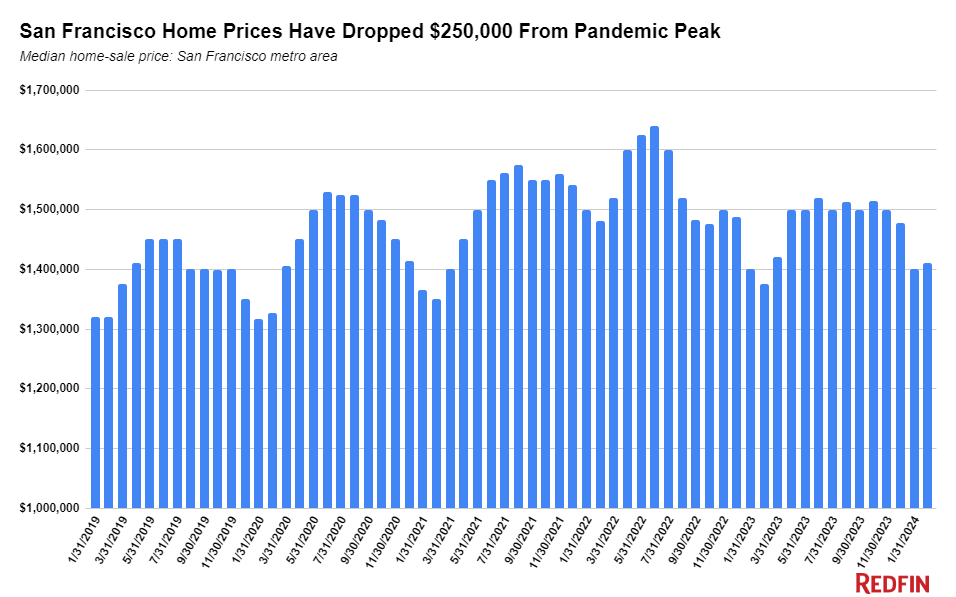

San Francisco’s median sale price peaked at $1.66 million in April 2022, and has since fallen 15% ($250,000) to $1.41 million as of February. The typical person who bought in San Francisco at nearly any point in 2021 or 2022, when the housing market was red hot due to ultra-low mortgage rates, would have taken a loss if they sold during the first few months of this year.

Local Redfin Premier agent Christine Chang said San Francisco’s market is stumbling more than other parts of the Bay Area. “Home prices have fallen from their peak, especially when it comes to condos,” Chang said. “It’s not just because mortgage rates are high. San Francisco has lost some of its appeal post-pandemic. A lot of tech employers and big-name retailers have moved out of the city, and some of my clients have reported they’re leaving the area because they don’t feel as safe as they used to.”

It’s worth noting that most San Francisco homeowners who bought during the last two to three years are hanging onto their home. Some of the homeowners who are selling are likely doing so because a life event such as divorce or job relocation has necessitated it.

It’s also worth noting that San Francisco home prices have swung up after hitting a low point of $1.28 million in January 2023, when prices were declining in the face of elevated mortgage rates and tepid demand. Home sellers would likely fetch a higher price now than they would have a year ago.

After San Francisco, Detroit had the highest share of homes selling at a loss (10.8%) during the three months ending February 29. It’s followed by three other Rust Belt and Midwestern metros: Cleveland (8.2%), St. Louis (8.1%) and Chicago (7.9%).

Sellers in those places are more likely than most to lose money because, like in San Francisco, home prices have fallen quite a bit from their pandemic peak. In Detroit, for instance, the median sale price is down roughly 20% from its pandemic peak.

Additionally, housing markets in Detroit and Chicago have suffered because they’re typically among the U.S. metros homebuyers are most likely to leave.

Homes were least likely to sell at a loss in Providence, RI, where just 1.2% of homeowners who sold during the three months ending February 29 lost money. It’s followed by Boston, Anaheim, CA, Fort Lauderdale, FL, and San Diego; roughly 2% of homes sold for less than the seller originally paid in each of those metros.

In dollar terms, homeowners who sold their home for less than they originally paid lost the least in metros where homes are inexpensive compared to most of the country: Pittsburgh and Kansas City, MO (-$15,000) come first, followed by Detroit (-$16,812), Houston ($-16,990) and Milwaukee (-$18,000).

Even in San Francisco, where roughly 18% of sellers who part ways with their home are losing money, more than four in five (82%) sellers are selling for more than they bought for. The typical San Francisco seller sold for $482,000 more than their purchase price during the three months ending February 29.

Nationwide, about 96% of sellers are earning money on their sale, with a median gain of $196,016. Today’s sellers are likely to sell their home for more than they bought it for because the median U.S. home-sale price is just 5% below the all-time high set in mid-2022. The median U.S. sale price is more than $100,000 higher (+40%) than before the pandemic began.

California home sellers reap larger gains than sellers anywhere else in the country. Following San Francisco, the biggest median gain was another part of the Bay Area. In San Jose, where 5% of sellers lost money on their home sale and the other 95% earned money, the median gain was $695,000. Next comes Anaheim, where just 2% of sellers lost money and 98% earned money; the median gain there was $510,000.

Sellers are gaining the least money on home sales in relatively inexpensive Rust Belt metros, but the median gains are still nearing six figures. The smallest gain was in Cleveland, OH, where sellers gained a median of $70,650, a big chunk of the $175,000 median sale price. Next come Detroit (median gain of $72,000) and St. Louis ($90,000).

| Metro-level summary: 50 most populous U.S. metro areas Stats in table represent the three months ending Feb. 29, 2024 | ||||

| U.S. metro area | Share of homes sold at a loss | Median loss of homeowners who sold at a loss | Median capital gain for all sellers | Median sale price |

| Anaheim, CA | 1.8% | -$56,000 | $510,000 | $1,035,000 |

| Atlanta, GA | 3.4% | -$34,000 | $162,000 | $352,000 |

| Austin, TX | 6.0% | -$45,000 | $196,000 | $455,000 |

| Baltimore, MD | 6.1% | -$27,000 | $130,000 | $315,000 |

| Boston, MA | 1.7% | -$59,050 | $290,000 | $640,000 |

| Charlotte, NC | 2.4% | -$27,418 | $167,000 | $355,000 |

| Chicago, IL | 7.9% | -$30,000 | $110,000 | $300,000 |

| Cincinnati, OH | 3.2% | -$20,000 | $110,000 | $243,000 |

| Cleveland, OH | 8.2% | -$20,765 | $70,650 | $175,000 |

| Columbus, OH | 2.7% | -$22,550 | $129,000 | $280,000 |

| Dallas, TX | 2.8% | -$26,710 | $170,300 | $425,000 |

| Denver, CO | 4.0% | -$35,000 | $230,000 | $540,000 |

| Detroit, MI | 10.8% | -$16,812 | $72,000 | $150,000 |

| Fort Lauderdale, FL | 1.9% | -$30,000 | $215,000 | $400,000 |

| Fort Worth, TX | 3.8% | -$19,550 | $130,000 | $342,000 |

| Houston, TX | 4.3% | -$16,990 | $110,000 | $335,000 |

| Indianapolis, IN | 2.9% | -$19,450 | $109,300 | $259,300 |

| Jacksonville, FL | 5.7% | -$23,000 | $145,000 | $340,000 |

| Kansas City, MO | 2.3% | -$15,000 | $120,000 | $290,000 |

| Las Vegas, NV | 4.0% | -$28,500 | $171,000 | $399,000 |

| Los Angeles, CA | 3.4% | -$92,000 | $395,750 | $845,750 |

| Miami, FL | 3.0% | -$68,500 | $264,000 | $499,000 |

| Milwaukee, WI | 6.1% | -$18,000 | $103,250 | $248,250 |

| Minneapolis, MN | 5.8% | -$29,000 | $114,000 | $325,000 |

| Montgomery County, PA | 2.4% | -$56,845 | $187,650 | $422,650 |

| Nashville, TN | 4.2% | -$37,250 | $174,591 | $413,366 |

| Nassau County, NY | 2.2% | -$127,870 | $297,500 | $662,500 |

| New Brunswick, NJ | 2.8% | -$75,000 | $220,000 | $470,000 |

| New York, NY | 6.9% | -$97,723 | $327,250 | $702,250 |

| Newark, NJ | 3.2% | -$58,500 | $228,000 | $501,000 |

| Oakland, CA | 5.9% | -$55,000 | $355,050 | $806,500 |

| Orlando, FL | 3.5% | -$27,500 | $168,600 | $370,000 |

| Philadelphia, PA | 5.5% | -$20,000 | $117,000 | $240,000 |

| Phoenix, AZ | 4.0% | -$32,000 | $190,100 | $434,000 |

| Pittsburgh, PA | 7.3% | -$15,000 | $99,298 | $208,175 |

| Portland, OR | 5.7% | -$47,050 | $222,500 | $510,000 |

| Providence, RI | 1.2% | -$35,000 | $205,500 | $437,500 |

| Riverside, CA | 3.1% | -$35,000 | $247,750 | $537,750 |

| Sacramento, CA | 4.0% | -$30,250 | $224,500 | $527,000 |

| San Antonio, TX | 5.9% | -$25,500 | $94,110 | $314,000 |

| San Diego, CA | 1.9% | -$110,000 | $390,000 | $825,000 |

| San Francisco, CA | 17.8% | -$155,500 | $482,000 | $1,410,000 |

| San Jose, CA | 4.7% | -$75,000 | $695,000 | $1,325,000 |

| Seattle, WA | 5.1% | -$65,000 | $345,000 | $725,000 |

| St. Louis, MO | 8.1% | -$18,500 | $90,000 | $218,000 |

| Tampa, FL | 3.1% | -$22,808 | $180,000 | $360,000 |

| Virginia Beach, VA | 2.8% | -$27,836 | $97,000 | $312,000 |

| Warren, MI | 3.5% | -$20,366 | $102,000 | $250,000 |

| Washington, DC | 4.0% | -$33,000 | $180,080 | $485,000 |

| West Palm Beach, FL | 2.5% | -$26,250 | $234,300 | $450,000 |

| National | 4.3% | -$39,912 | $196,016 | $442,333 |

It sounds like the plan to drive people out is working.

Who wants to pay a million plus for an average sized house and have bums taking a dump on your front door?

In fairness, the defecating street people aren’t uniformly sprinkled throughout every neighborhood of San Francisco. If you have the misfortune of living in the urban core of S.F. (Tenderloin/Downtown/Civic Center/South of Market), the street people are very likely to be up close and personal with you.

As you move away from the city’s center, you’ll still find street people in public parks and in neighborhood commercial zones, but they thin out to essentially zero as you get into enclaves of single-family homes or duplexes.

People buy a place knowing they'll need to sell it within 10 years when the payments go up. They count on selling at a profit and putting the net $$ towards their next place.

The plan is to just keep buying, selling, moving on. I guess that's one way to live...

Thats been going on in my Upstate NY neck of the woods for a whole now.

But somehow it’s never reflected in the property tax assessments.

Go figure.

Welcome to Bidenzuela

If you didn’t see it coming you are a idiot.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.